Why Chinese youths are travelling across cities to deposit money

In China, some people - mostly young people - are choosing to deposit their money in out-of-town banks, making long journeys to take advantage of varying interest rates between cities. Is this another whim and fancy of the younger generation or a measure done out of desperation to generate more savings? Zaobao's China Desk looks into the phenomenon.

On a sleepy weekend morning, some people wake up early and take a high-speed train to a different city to deposit money at the bank, only to find dozens of other people already in line to make deposits, including those from other cities.

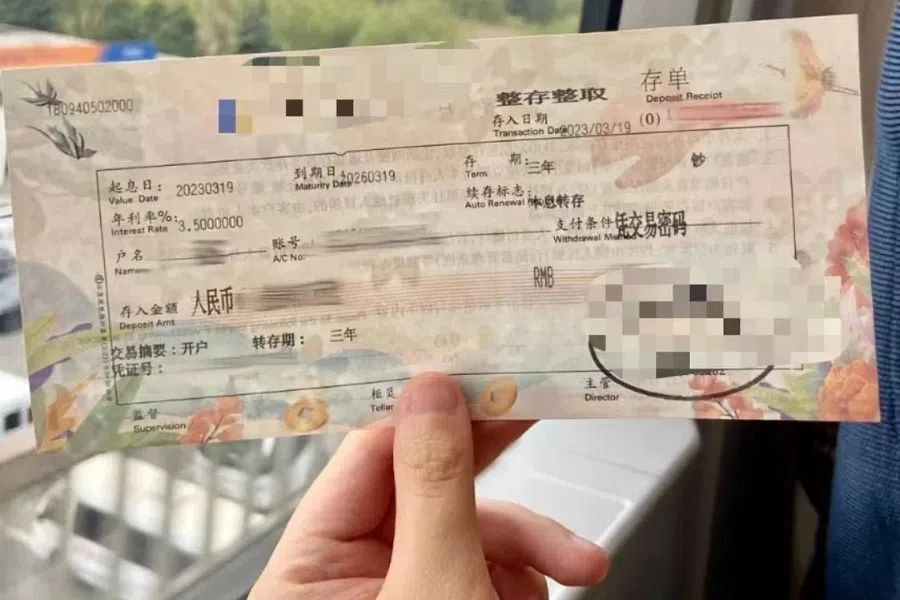

Recently, in many parts of China, there has been a trend of people travelling long distances to deposit money in other cities. These individuals are jokingly referred to as "special forces depositors".

Like the "special forces travellers" previously popular on social media, most of these "special forces depositors" are young people. They travel to other cities, not to visit as many tourist attractions as possible in the shortest time and at the lowest cost, but to deposit money in banks away from where they live.

Travelling across cities for hours just to deposit money

A young woman surnamed Hai - aged below 30 and who lives in Shaoxing, Zhejiang - woke up at 5am on 3 June. Despite it being a Saturday and not a regular workday, she left home at 6 am to catch the earliest high-speed train from Shaoxing to Shanghai in order to deposit money at a bank there.

The Economic Observer reported that when Hai arrived just before 9:30 am, the bank was already crowded with depositors waiting to conduct their transactions. While waiting, she spoke with people around her and found that several of them were also depositing money from other cities.

Private sector worker Xiang Linran, 28, drove from Taizhou, Jiangsu, to Shanghai early in the morning on 12 May to deposit money in a bank with a high interest rate before the deadline.

... she counted about 50 people waiting in line. Among them were young people who, like her, had rushed there from other cities over the weekend.

Xiang told The Paper that she and her husband didn't immediately go to the bank upon arriving in Shanghai because it was already evening and the bank was closed. "So, on the morning of the 13th, around 9 am, we took a taxi to the bank. When we arrived, there were already many people in line, mostly young people... Later, when the bank opened, several more young people arrived. It was only when I asked them that I found they were also from out of town."

According to an article in Qianjiang Evening News, in late April, a young woman in her twenties surnamed Xu and her best friend departed from Suzhou, Jiangsu, at around 6 am. They took the high-speed train, subway, and bus, and arrived at a bank in Shanghai at 9:30 am. However, upon reaching the branch, Xu was shocked by the endless queue in front of her - she counted about 50 people waiting in line. Among them were young people who, like her, had rushed there from other cities over the weekend.

These three cases share several commonalities: first, those involved travelled long distances and spent a considerable amount of time going from a place of residence to another city for the sole purpose of making a deposit; second, they were all under 30 years old; and third, based on their observations, many young people are among those who travel to other cities to make deposits.

"Although the interest rates may not differ much at first glance, over time, it can accumulate significantly." - China netizen

On Weibo, under the topic "special forces depositors cross cities to for higher interest rates", some bemused netizens wrote: "How much money are they depositing? Can the time wasted, transportation expenses, accommodation and food expenses in another city compensate for the difference in interest rates between local and out-of-town deposits?"

However, some netizens believe that as bank interest rates continue to drop, travelling to another city to deposit money is not without its rewards. "Although the interest rates may not differ much at first glance, over time, it can accumulate significantly."

"When money is easy to earn, no one will care about this petty increase in interest, but when money is hard to come by, one earns as one saves. What's more, this additional income comes from nothing."

Why 'special forces deposits' are popular

Jiang Guangxiang, who works in fund management, explains this phenomenon in an article: depositors are simply seeking the interest rate differential offered by different regions.

He wrote in Chinese: "Even for the same bank, interest rates may vary across its branches in different regions. They each have to consider their own business development. Factors such as the upper limits of deposit interest rates or the supply and demand relationship of a bank could lead to 'involution' (or over-the-top competition) among the different branches."

... for a deposit of 100,000 RMB (US$13,967), the interest over three years would be 9,000 RMB in Shaoxing, while a certain bank in Shanghai would offer an interest of 10,650 RMB, a difference of 1,650 RMB.

An article in The Economic Observer also quoted an analysis from Dong Ximiao, chief researcher with mucfc.com. First, the floating range and upper limit of deposit rates agreed upon by the market's self-regulation pricing mechanism may differ in different regions. Second, supply and demand in deposit markets vary across regions, affecting deposit rates based on customers' investment preferences and savings habits. Lastly, different branches of the same bank may vary in terms of assets and liabilities and market competition strategies, so that demand and rates for deposits are not consistent.

Depositor Ms Hai said for a deposit of 100,000 RMB (US$13,967), the interest over three years would be 9,000 RMB in Shaoxing, while a certain bank in Shanghai would offer an interest of 10,650 RMB, a difference of 1,650 RMB.

The trend of depositing money across cities is closely related to the continuous decline in interest rates in Chinese banks since the second half of last year.

Chinese banks lower interest rates on deposits

Recently, major Chinese banks have once again seen a wave of interest rate cuts. On 8 June, six major state-owned banks - Industrial & Commercial Bank of China, China Construction Bank, Agricultural Bank of China, Bank of China, Bank of Communications, and Postal Savings Bank of China - collectively announced a reduction in RMB deposit interest rates.

According to the announcements made by the six banks on that day, effective from 8 June, the interest rate for demand deposits was lowered by five basis points to 0.2%. For fixed-term deposits, the interest rate for two-year deposits was reduced by ten basis points to 2.05%, for three-year deposits to 2.45%, and for five-year deposits to 2.5%, with a reduction of 15 basis points for all. The benchmark interest rates for three-month, six-month, and one-year deposits remained unchanged.

The last time the major state-owned banks in China lowered deposit interest rates was in September 2022, less than a year ago.

According to yicai.com, several national joint-stock banks in China have also followed suit by lowering deposit interest rates starting from 12 June, including China Merchants Bank, Ping An Bank, and CITIC Bank.

Why do interest rates keep going down?

On 7 June, Mo Kaiwei, a researcher with the China Academy of Regional Finance, published an article in Chinese titled "Why Banks Keep Lowering Interest Rates" (银行再次降低存款利率,降息不断原因到底为何) on chengdu.cn.

The article said banks have frequently lowered deposit interest rates since the second half of last year as a follow-up remedial action for the delayed adjustment of deposit interest rates in the past, and as an effort to alleviate the increasingly shrinking net interest margin between deposits and loans.

Mo added three deeper reasons.

First, in the current economic situation, it is not easy for small and medium-sized banks to survive and grow; they have to manage their liability costs in order to survive.

Second, the days of making easy profits solely based on the interest spread between deposits and loans are over. Banks, especially small and medium-sized banks, have to implement strategic changes in their operations.

Third, the current trend towards regular deposits and people's preference to invest in deposits have created conditions for banks to lower interest rates, and have given them more confidence to do so.

...in the first quarter of this year, RMB deposits increased by 15.39 trillion RMB. Household deposits increased by 9.9 trillion RMB, an increase of 2.08 trillion RMB compared to the same period last year, accounting for 64% of total deposit growth.

Mo noted that with the impact of the three-year pandemic, Chinese consumers have become more conservative in their spending and tend to deposit their surplus funds in banks. This has led to a significant increase in bank deposits, especially in the trend towards regular deposits, with a growing proportion of long-term deposits.

The latest financial statistics released by the People's Bank of China show that in the first quarter of this year, RMB deposits increased by 15.39 trillion RMB. Household deposits increased by 9.9 trillion RMB, an increase of 2.08 trillion RMB compared to the same period last year, accounting for 64% of total deposit growth. In 2022, household deposits surged by 17.84 trillion RMB to a record high.

Lowering interest rates to encourage consumption?

The continuous decrease in bank interest rates is also related to the Chinese economy.

According to data released by China's National Bureau of Statistics on 9 June, the year-on-year growth of the Consumer Price Index (CPI) in May was only 0.2%, slightly higher than the 0.1% in April. Meanwhile, the Producer Price Index (PPI) for industrial producers decreased by 4.6% year-on-year, the lowest since March 2016. This has raised concerns that the Chinese economy is facing a significant risk of deflation.

Some have suggested that lowering deposit interest rates can encourage consumers to spend money rather than save it, thereby boosting the Chinese economy.

However, this may not be the case. Xing Zhaopeng, a senior China economist with ANZ Bank, said in a report released in May that the impact of lowering deposit interest rates on consumption is limited because households' interest income has also declined. He also believes that people may decide to use cash to repay debts instead of using it for consumption.

Depositor Ms Hai said the mentality of young people has changed to some extent following three years of the pandemic, layoffs and unemployment.

"It is clear that more and more young people around us are getting into making money and saving it, switching from luxury cosmetic brands to more affordable ones, and shopping on Pinduoduo rather than Taobao."

The Wall Street Journal quoted economics professor Chen Zhiwu of the University of Hong Kong's School of Business and Economics, who said that confidence of individuals and businesses in China has gone down over the past year, noting that when people feel uncertain about the future, their initial reaction is to save money.

Is saving money a last resort?

In his article in May, Jiang Guangxiang said in the minds of most people, whether it's fixed deposits or certificates of deposit, the target group is mostly elderly depositors. This is because those who go for these options are generally risk-averse individuals who are willing to sacrifice liquidity for the sake of absolute capital safety and a certain rate of return.

He said: "These options are not to the taste of most younger customers. But now they are willing to join this market, which shows they haven't achieved the desired results in other investment areas."

Amid a sluggish Chinese economy and a weak job market, young people are less assured about the future.

This also reflects the struggle of young people in China between reality and ideals. On the one hand, they want their money to grow, especially given the current uncertain economic prospects. On the other hand, they worry about putting their money into platforms with high returns, but also high risks. The wave of P2P online lending scandals a few years ago, as well as the run on Henan's rural banks in May and June last year, have left many people traumatised and intensified these concerns.

Going through the hassle of crossing cities to deposit money is clearly not done for fun. Amid a sluggish Chinese economy and a weak job market, young people are less assured about the future. Their risk tolerance has decreased, and with a lack of high-quality investment channels, crossing cities for that difference in interest rates, ranging from a few hundred to several thousand RMB, means additional income. For these "special forces depositors", this may be a safe choice borne of helplessness.

This article was first published in Lianhe Zaobao as ""存款特种兵"跨城存钱为哪般?".

![[Video] George Yeo: America’s deep pain — and why China won’t colonise](https://cassette.sphdigital.com.sg/image/thinkchina/15083e45d96c12390bdea6af2daf19fd9fcd875aa44a0f92796f34e3dad561cc)

![[Big read] When the Arctic opens, what happens to Singapore?](https://cassette.sphdigital.com.sg/image/thinkchina/da65edebca34645c711c55e83e9877109b3c53847ebb1305573974651df1d13a)