Chinese AI app makers look overseas for their big break

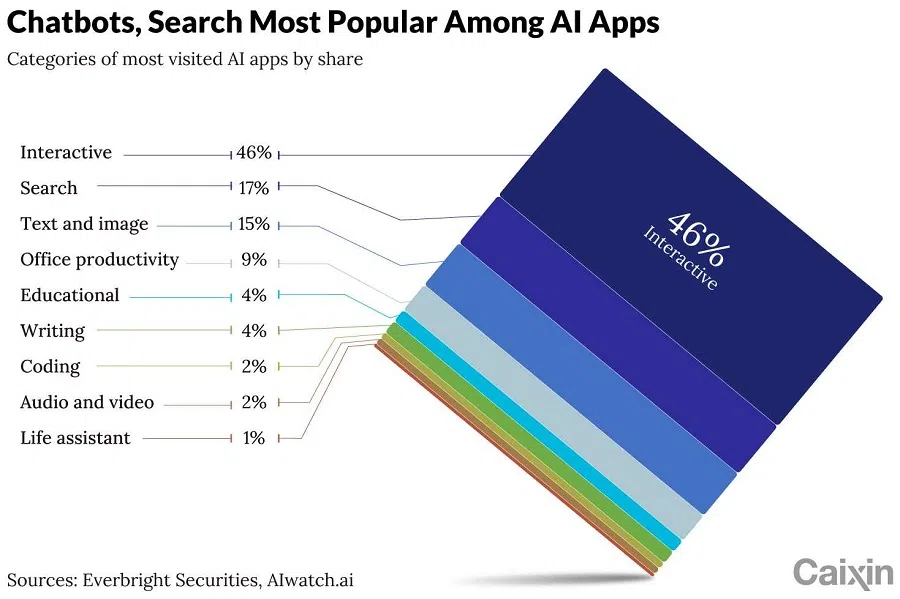

The AI generative application market is buzzier than ever, with the sector seeing a 192% increase last year in new photo editing apps featuring “AI” in their names.

(By Caixin journalists Du Zhihang, Liu Peilin, Guan Cong and Wu Peiyue)

Instead of following the well-worn TikTok and Temu playbook of dominating the domestic market before venturing overseas, Chinese artificial intelligence (AI) ventures have been taking the opposite approach.

The strategy, driven mostly by fierce competition and strict regulations on generative AI apps at home, has allowed the companies to capitalise on mature markets where subscription-based Software as a Service (SaaS) models are well-established and where there is a readiness to pay for AI-driven services.

The AI generative application market is buzzier than ever, at least based on the number of apps that now claim to include AI technology. According to mobile data research firm data.ai, the sector saw a 192% increase last year in new photo editing apps featuring “AI” in their names. Moreover, 70% of the top 20 globally downloaded photo editing apps now prominently include “AI” in their titles or descriptions. In the generative text field, the competition is fierce between Chinese firms such as AIWavesInc’s siuuu.ai, 01.AI’s WanZhi, Pai Tech’s ChatDOC, and the US startups such as Copy.ai and Writesonic, along with Microsoft’s Copilot. These companies are actively competing for market share in both the US and China.

Kai-Fu Lee, chairman and CEO of Sinovation Ventures, has been instrumental in this approach through his incubation of 01.AI, which focused initially on generating revenue overseas. By May, following its September 2023 launch, 01.AI’s office productivity tool had garnered tens of millions of users internationally, with overseas revenues projected to reach 100 million RMB (US$14.2 million) this year.

After this successful international rollout, 01.AI launched the domestic version Wanzhi in May. Wanzhi offers features similar to Microsoft Corp.’s Office 365 Copilot but is available through a more accessible mini-programme and web version, rather than a full app.

“We first validated our product and market demand overseas. By the time we launched domestically, our overseas product already had tens of millions of users and revenue exceeding 100 million RMB, giving us the confidence to replicate this model in China,” Lee explained at a press conference.

... while promotions in China might reduce a monthly subscription cost from 29 RMB to as low as 9 RMB (from around US$4 to US$1), overseas prices can range from US$50 to US$60... — Wan Lei, Co-Founder, AIWavesInc.

Chinese AI startup MiniMax first introduced its AI role-play chatbot Talkie overseas before launching its Chinese version Xingye along with other applications like Conch AI, a productivity tool that can interpret financial statements and long texts.

Revenue from overseas customers can be equivalent to ten times that from domestic clients, Wan Lei, co-founder of Hangzhou-based AI firm AIWavesInc., told Caixin. Wan said that while promotions in China might reduce a monthly subscription cost from 29 RMB to as low as 9 RMB (from around US$4 to US$1), overseas prices can range from US$50 to US$60, attracting even individual creators.

Wu Shichun, founding partner of venture capital firm Plum Ventures, told Caixin that the cost required for AI research and development needs to be distributed across broader markets. He said due to the intense AI competition between China and the US, other regions such as the Middle East and Southeast Asia offer more untapped opportunities.

Big tech’s overseas bet

Among the predominantly younger userbase of TikTok and Instagram, the computer-assisted video editing app CapCut is a household name.

The app, developed by TikTok creator ByteDance Ltd., has helped the tech giant emerge as a leader in integrating AI-generated content (AIGC) across its global product lines. CapCut has gained substantial traction through its AI-driven features like templates and special effects. It has clocked more than 600 million global downloads annually and generated nearly $130 million in revenue, dominating the video editing app market in 2023.

ByteDance continues to expand its AI portfolio with products such as the chatbot Cici AI, the study tool Gauth, and the photo editor PicPic. Meanwhile, Kuaishou Technology said its Kling video generation model can generate high-definition videos of up to two minutes long from text prompts.

Tencent Holdings Ltd.’s large model Yuan Bao app has introduced a new feature that can generate 3D characters from an image and even allow users to 3D print their creations.

Meitu Inc., ranking third after ByteDance and Joyy Inc. in data.ai’s January 2024 overseas revenue rankings for the non-gaming sector, has seen success with Wink, an AI-powered video editing app.

Since its launch, Wink has topped Apple Inc.’s App Store download charts in Japan, Indonesia, Kenya and Thailand. Including its earlier photo editing tools, BeautyPlus and MeituPic, Meitu has expanded its presence to 195 countries, boasting nearly 76.7 million monthly active users overseas.

Empowered startups

The launch of ChatGPT by American firm OpenAI has been transformative for tech startups in giving them the tools to launch a rash of new products in fields like photo editing, video editing, office and collaboration assistants, and even “companion AI”, a euphemism for chatbots that simulate everything from friendships to intimate encounters. These companies, typically only a few years old and just scaling up, are actively seeking financing around their Series A with big overseas market hopes.

Wang Qin, founder of HelloBoss, a recruitment app, told Caixin that his company integrated ChatGPT to launch features for AI-generated resumes and recruitment information, including registrations, job posting, and company verification, to be completed in five minutes, with services priced at a fraction of comparable products in Japan. Wang said the use of GPT quickly expanded the app’s user base and visibility, propelling HelloBoss through two funding rounds in 2023, with more discussions underway for additional funding.

Startups see an opportunity to challenge traditional giants.

AI has transformed the workflow for user-generated documents — eliminating the need to open a blank canvas, write an outline, align text and find matching images... — Zhao Chong, Founder and CEO, iSheji.com

Zhao Chong, founder and CEO of iSheji.com & its overseas version AiPPT.com, told Caixin that AI has transformed the workflow for user-generated documents — eliminating the need to open a blank canvas, write an outline, align text and find matching images, thus disrupting the traditional advantage of major office software companies having extensive and comprehensive features.

“The global office software market is a huge market worth 400 billion RMB,” said Zhao. “Our strategy is to carve out our own market share through differentiated positioning.”

Some companies aim to identify more niche markets. In February 2023, Wondershare Technology Group Co. Ltd. announced that its video editing software, Wondershare Filmora, designed for the global market, integrated OpenAI services. Wondershare Filmora, which launched overseas in September 2010, caters to consumer markets and supports multiple languages including English, German, Russian, Japanese and Arabic. Prior to integrating with OpenAI, the software already included AI-driven features such as quick text editing, voice separation and masking. Post-integration, it added advanced functions such as a Copilot creative assistant, text-to-video capabilities and a music generator.

Zhu Wenwen, the company’s vice-president, told Caixin that unlike ByteDance’s CapCut, which targets novice users abroad, Wondershare Filmora is aimed at video editing enthusiasts and semi-professionals.

“We don’t view apps from big tech companies as competitors,” Zhu said. “The video creative software market is an expanding sector with broad demand.”

Cross-border data controls bite

But for the Chinese app entrepreneurs that rely on it, using an American generative AI engine is a blessing and a curse. They are increasingly being forced to navigate a complex landscape of cross-border data regulations, which has significantly increased costs.

As both China and the European Union mandate local data storage, companies must establish separate servers and data centres across multiple jurisdictions, including China, the EU and other regions. This fragmentation necessitates launching AI applications separately for domestic and international markets — connecting to China’s local large models and to models like OpenAI developed in the US — further complicating operations and increasing expenses.

... the US is actively considering imposing restrictions on AI investments related to China, prompting some companies that serve both Chinese and the US markets to consider registering in Singapore in the hopes of mitigating them.

Then there’s the pushback from OpenAI itself. Since it launched in November 2022, the firm has strategically avoided servicing Chinese customers. It does not support use on the Chinese mainland, nor does it support API services for the mainland. Some users circumvent these restrictions by registering or purchasing foreign accounts.

In June 2024, OpenAI announced that starting 9 July, it would take further steps to block API traffic from unsupported countries and regions. Similarly, Google’s Gemini and Anthropic’s Claude are not available on the mainland.

Amid these technological and regulatory challenges, the US is actively considering imposing restrictions on AI investments related to China, prompting some companies that serve both Chinese and the US markets to consider registering in Singapore in the hopes of mitigating them.

“The challenges TikTok faced in the US have made it difficult to advance AI model-related work, making the US the slowest region globally in this aspect,” a TikTok staff member told Caixin. The person said that AI applications need frequent model adjustments, and although TikTok rolls out over 700 updates and launches globally each month, only about 100 of these occur in the US.

For investors, this challenging regulatory landscape implies that AI companies desiring to expand internationally must swiftly address their “identity issues”.

Some should give up their IPO dreams — and sell sooner rather than later, said Wu of Plum Ventures, whose portfolio companies include Chinese electric scooter-maker Niu Technologies and EV-maker Li Auto Inc.

“I now advise our invested startups to sell when they are performing well and the timing is right,” he said. “Enduring until an IPO isn’t always necessary. Supporting a company for five years before transitioning it to a larger entity could sometimes prove to be the best strategy.”

This article was first published by Caixin Global as “In Depth: Chinese AI-App Makers Look Overseas for Their Big Break”. Caixin Global is one of the most respected sources for macroeconomic, financial and business news and information about China.