[Big read] Invest or leave: Foreign firms adjusting to China's changing investment climate

Lianhe Zaobao correspondent Chen Jing notes that as China's economic and business policies shift and change, foreign companies are finding it difficult to decide whether to stay in China or pull out, given the challenges in meeting new regulations and requirements. But there are others who see opportunities.

After three years, the China International Import Expo returned in early November as a fully in-person event. Alas, this expo that represents China's determination to open up to the world was upstaged by other news at the same time.

First, there were media reports of three major US firms announcing their withdrawal from the Chinese market, including fund management giant Vanguard, consultancy bigwig Gallup, and Cloud Software Group, the mother company of software firm Citrix.

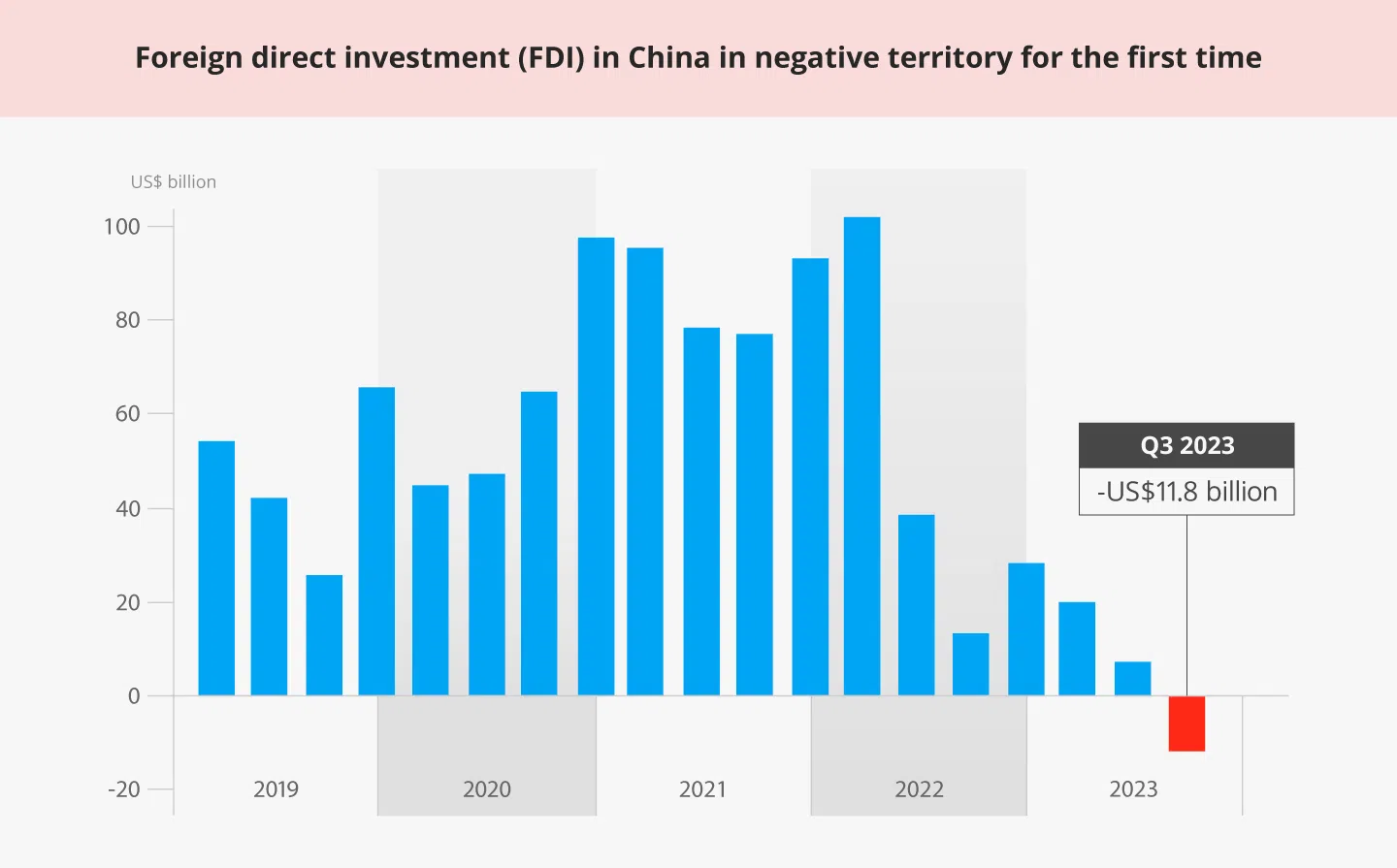

Second, statistics released on 3 November by China's State Administration of Foreign Exchange showed that balance of payments data on foreign direct investment (FDI), which is reflective of the investment situation in China, registered a deficit in Q3 of US$11.8 billion, the first such occurence since data was collected in 1998, showing that foreign capital was flowing out of China more than it was coming in.

Statistics announced by China's Ministry of Commerce in October showed that in the first three quarters of 2023, China's actualised foreign investment fell 8.4% year on year. Statistics from Wall Street Journal showed that as of end September, foreign firms have been pulling earnings out of China for six consecutive quarters, with a total value of more than US$160 billion. Statistics from China's State Administration of Foreign Exchange were even more worrisome; is this the beginning of an exodus of foreign firms from China?

... 40% of multinational companies planned to move their production out of China in the next few years.

In an interview with Lianhe Zaobao, Chen Long, a partner at consultancy firm Plenum, analysed that China's interest rate is currently lower than many regions globally, and multinational firms would transfer their earnings from China to other countries so as to earn higher interest, adding that "this is a normal financial move".

Chen pointed out that besides financial considerations, pandemic restrictions in the past two years have caused some multinational firms to refrain from embarking on new investment projects, and this is reflected in this year's investment figures. Also, in a bid to mitigate geopolitical risks, businesses have shifted part of their investments in China to other countries. These are all possible reasons for the decline in investments.

The American Chamber of Commerce in China (AmCham China) in March released the China Business Climate Survey Report which showed that 24% of US businesses interviewed are considering or have already begun to move their supply chain out of China, which is 14% more than last year. The European Central Bank released a report on 6 November which stated that 40% of multinational companies planned to move their production out of China in the next few years.

The most direct impact of FDIs flowing out of China is the further depreciation of the already weak renminbi. With a decline in interest in Chinese stocks, bonds and other assets from investors, the Chinese RMB traded in the onshore market continued its depreciation against the US dollar this year. In early September, at one point it fell to its lowest rate since the global financial crisis in 2007.

If foreign investment continues to flow out, it would have an even longer term impact on China's economy. Official statistics show that while foreign companies account for less than 3% of businesses in China, they account for 40% of foreign trade, 16% of tax income and nearly 10% of urban employment. Chinese state media Xinhua commented: "Multinational firms have brought investments, techniques and management experience to China, and are a key driving force of China's economic development...it has become a key component of China's open economy."

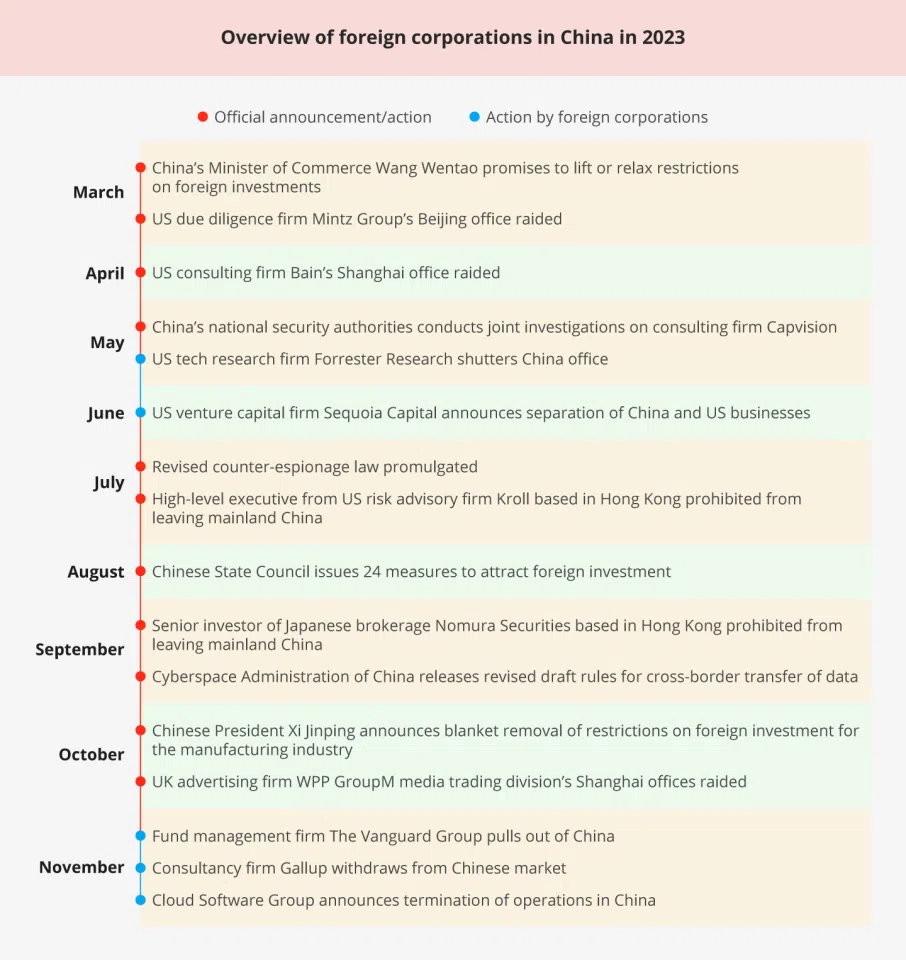

When economic growth last year was far below official expectations, Beijing once again extended an olive branch towards foreign firms this year. The Politburo meeting in April 2023 placed greater emphasis on attracting foreign investment, and to stabilise foreign trade and investment; in August, China's State Council introduced 24 measures to attract foreign capital; and at the opening ceremony of the Belt and Road Forum for International Cooperation in October, Chinese President Xi Jinping announced that China will remove all restrictions on foreign investment access in the manufacturing sector.

Counter-espionage law dampens confidence

However, other policies and actions announced by the authorities at the same time have led the market to doubt the above promises to open up, and foreign corporations with businesses in China to worry that the emphasis on national security by the CCP decision makers outstrips the need to attract foreign investment.

The revised counter-espionage law promulgated in July 2023 expanded the scope of what constitutes espionage activities, without a clear definition of what is meant by "documents, data, materials and items related to national security and interests". This is concerning for high-level executives of foreign firms, as their business activities and conversations in China could all potentially cross the line.

Proof that the market has cause to worry stems from cases since March of several foreign firms that were subjected to raids, and employees who had their movement restricted. Due diligence firm Mintz Group, management consulting companies Bain and Capvision, advertising firm WPP GroupM as well as other foreign firms with offices in China have been raided by the authorities, with several employees arrested. Senior executives from US risk advisory firm Kroll and Japanese brokerage Nomura Securities who were based in Hong Kong were also prohibited from leaving mainland China.

These moves mainly targeted American firms, and the bulk of companies announcing their withdrawal from the Chinese market this year were likewise American companies.

These moves mainly targeted American firms, and the bulk of companies announcing their withdrawal from the Chinese market this year were likewise American companies. The tense relations between the world's top two largest economies have become the biggest risk for US firms in China. In April, a survey by AmCham China showed that 27% of respondents had re-prioritised investments in other countries, a huge leap from last year's 6%.

AmCham China president Michael Hart stated plainly when interviewed that members are here for the long term and are committed to the China market, and in most situations still see business opportunities in China, but "members continue to be concerned about US-China relations". He added that with international travel currently restricted, this might cause employees from US headquarters who are unable to come to China to be less optimistic about China's prospects.

Stricter data controls increase risks and costs

Along with the revised counter-espionage law, stricter data controls have been implemented. The Standard Contract Measures for the Export of Personal Information, which came into effect on 1 June, requires that for the processing of personal information for less than 1 million people, a standard contract must be signed between the sender and the overseas receiver, the purpose and potential risks among other factors of the personal information to be sent overseas must be evaluated, and the sender must file the requisite materials with the local provincial-level cybersecurity office.

According to investigations conducted by the European Union Chamber of Commerce in China (European Chamber) in October, a third of the members interviewed pointed out that if their outbound data did not pass the safety assessment by the Central Cyberspace Affairs Commision (CCAC), they would have to spend several million euros to have their data stored in China. Also, 11% of the businesses felt that it might cost them hundreds of millions of euros.

The data-dependent service sector has borne the brunt of the new regulations. Statistics from China's commerce ministry showed that the actual use of foreign direct investment in the service sector decreased 15% year-on-year to 630.23 billion RMB (US$87.79 billion) in the first three quarters of the year, the largest decline across various sectors.

Companies are not seeking to exit but are building operational resilience by increasingly looking to localise and decouple their China operations from their global ones through shifting investments overseas. - Jens Eskelund, President, European Union Chamber of Commerce

But it is not only the service sector that has been affected. When interviewed, Miller Wang, vice-chair of the Fashion and Leather Desk of the European Chamber, said the leather goods company he works at has set up data centres in China and Europe to meet the requirements of cross-border data transfer. On top of bearing the resultant infrastructure costs, the company also had to switch suppliers and systems, and spent a lot of time training employees. "This is a massive project, and a heavy burden on everyone," he noted.

Chen pointed out that while strengthening data regulation is in line with global trends, there are many definitions that remain unclear in the new regulations, such as what constitutes important data, and what kind of data is at risk of violating the law. He said, "Enterprises hope that the regulations will be clarified and refined as soon as possible to reduce uncertainty."

European Chamber President Jens Eskelund said when interviewed that growing risks and a more volatile operating environment have prompted European companies to re-evaluate their investment and operational strategies in China. Companies are not seeking to exit but are building operational resilience by increasingly looking to localise and decouple their China operations from their global ones through shifting investments overseas.

He said bluntly, "Overall confidence in China as an investment destination has fallen to the lowest levels on record, with an increasing number of members looking to make future investments in other markets that can offer more predictability and reliability."

Building investor confidence

With the growing talk of capital flight out of China, Chinese officials have been quick to adjust relevant policies. On 28 September, the Cyberspace Administration of China released for public feedback a draft version of provisions on regulating and promoting cross-border data flows (《规范和促进数据跨境流动规定(征求意见稿)》), detailing when it is not necessary to make data export security assessment declarations, such as when these are not categorised as "important" data by authorities.

The European Chamber sees the draft as a positive sign that the Chinese government is listening to enterprises' concerns and is willing to take measures to address the issue. It called for the further refinement of some parts of the draft provisions and hopes that it will be implemented soon.

"Our members ask: 'Are we welcome? Will we be treated fairly? Will we be able to compete for all clients (including SOEs and government contracts)? Is the media environment friendly to us and our country?'..." - Michael Hart, President, AmCham China

Also, the much-anticipated meeting between the Chinese and American heads of state took place on 15 November local time in San Francisco, where both leaders agreed to promote and strengthen dialogue and cooperation between both countries in various areas. This meeting, described by Biden as "some of the most constructive and productive discussions" both leaders have had, made foreign companies in China more confident that China-US ties are warming up again.

Hart stressed that confidence is important for both the economy and investment. He noted, "Our members ask: 'Are we welcome? Will we be treated fairly? Will we be able to compete for all clients (including SOEs and government contracts)? Is the media environment friendly to us and our country?' If the answer is yes, investments are more likely to come. If the answer to any of those is no, then investment will fall and potentially companies will exit the market."

Many post-Covid uncertainties

"To all the entrepreneurs who have come today, take a good look at Shandong and speak whatever comes to mind. We will give you the best services."

At the Singapore-Shandong Business Council meeting held on 11 November, Shandong governor Zhou Naixiang stressed that the local government at all levels will offer tailor-made and customised solutions to Singaporean companies investing in the region. A participating Singaporean company representative told Lianhe Zaobao that the Jinan, Yantai and Qingdao local governments have invited enterprises to visit them and even arranged for professionals to follow up on them, being "much more proactive than in previous years".

China's commerce ministry also launched the "Year of Investing in China" programme this year to accelerate the investment attraction process that was slowed down during the three-year pandemic. Various local governments, including Shandong, are also inviting foreign investors to the country through various local promotion activities, even as they venture overseas to attract investments.

Statistics from the State Administration for Market Regulation showed that in the first three quarters of the year, South Korea, the US and Japan were high on the list of newly established foreign-funded enterprises in China, while the developed southeastern coastal provinces remained hot spots for foreign investment. New foreign-invested companies in Zhejiang, Guangdong and Fujian increased by 112.5%, 41.4% and 29.3% year-on-year respectively.

... to foreign companies that have been isolated from the Chinese market for three years, the uncertain economic outlook has made them more hesitant to make investment decisions. - Representative from a Singaporean investment bank

Under the impact of anti-Covid measures and the property slump, local governments are faced with fiscal stress and soaring debt, and attracting investment has become an important tool to boost local investment. But to foreign companies that have been isolated from the Chinese market for three years, the uncertain economic outlook has made them more hesitant to make investment decisions.

The first in-person International Business Leaders' Advisory Council for the Mayor of Shanghai following the pandemic was held in Shanghai in October, and saw the participation of 30 international business leaders from 12 countries. A senior executive from a Middle Eastern company told Lianhe Zaobao that although the organisers worked hard to invite the company's president to the meeting, the higher-ups decided to "wait another year" as they lacked the confidence to invest in China.

A representative from a Singaporean investment bank said that the three-year pandemic has disrupted China's economic structure and growth, and made foreign enterprises who have not set foot in China for a long time unclear about the situation. It will take some time for companies to find the bright spots of the post-pandemic Chinese market before making investment decisions.

Hart pointed out that although the impact of the pandemic has eased, there are still some concerns about the slowing Chinese economy, and companies are also being cautious about new investments. A number of small and medium-sized enterprises have shuttered, and those that have survived are still trying to rebuild their savings; most are not yet ready to expand.

Much potential

Tommy Xie, head of Greater China Research & Strategy at OCBC Bank, said when interviewed that China's unstable post-pandemic economic recovery has affected market confidence to a certain extent. But compared with short-term statistics, foreign investors are more concerned with long term prospects. The Chinese market still has significant advantages in the manufacturing and new energy sectors, and "if growth can be stabilised, China will be able to continue attracting investments".

"Although the country's demographic dividend is diminishing, it will still lead the world in infrastructure and education over the next 20 years. This gives us huge long-term opportunities." - Kelvin Pooh, CEO, EagleRE

Singapore's Eagle Renewable Energy (EagleRE) was one of the few enterprises that expanded rapidly into China during the pandemic. When interviewed, EagleRE CEO Kelvin Pooh said the company's business in China achieved an average annual growth rate of 500-1,000% over the past three years thanks to the Chinese government's strong support for new energy.

Having entered the Chinese market in 2020, over 90% of EagleRE's business is currently in China. Pooh said that although there is increasing uncertainty about doing business in China, this huge market remains attractive to foreign firms. "Otherwise, why would big companies like BASF, Bayer and even Micron, which came under China's cybersecurity review, continue to expand their investments in China?"

Pooh estimated that the company's number of employees in China will double within the next three years to around 200. He is also optimistic about the development potential of this market. He said, "Over the past 20 years, I haven't seen another country develop as rapidly as China. Although the country's demographic dividend is diminishing, it will still lead the world in infrastructure and education over the next 20 years. This gives us huge long-term opportunities."

This article was first published in Lianhe Zaobao as "中国政策摇摆 外企等待定心丸".

![[Big read] When the Arctic opens, what happens to Singapore?](https://cassette.sphdigital.com.sg/image/thinkchina/da65edebca34645c711c55e83e9877109b3c53847ebb1305573974651df1d13a)