China's rich are getting richer

In 2021, more Chinese families became either rich or richer, with Guangdong overtaking Beijing as the region with the most high-net-worth families in the country. These high-net-worth households largely made up of entrepreneurs, real estate investors and professional financial investors, are expected to transfer an estimated 18 trillion RMB of wealth to the next generation over the next decade.

(By Caixin journalist Zhang Ziyu)

In China, more families got rich in 2021, and the ones who were already rich got a fair bit richer.

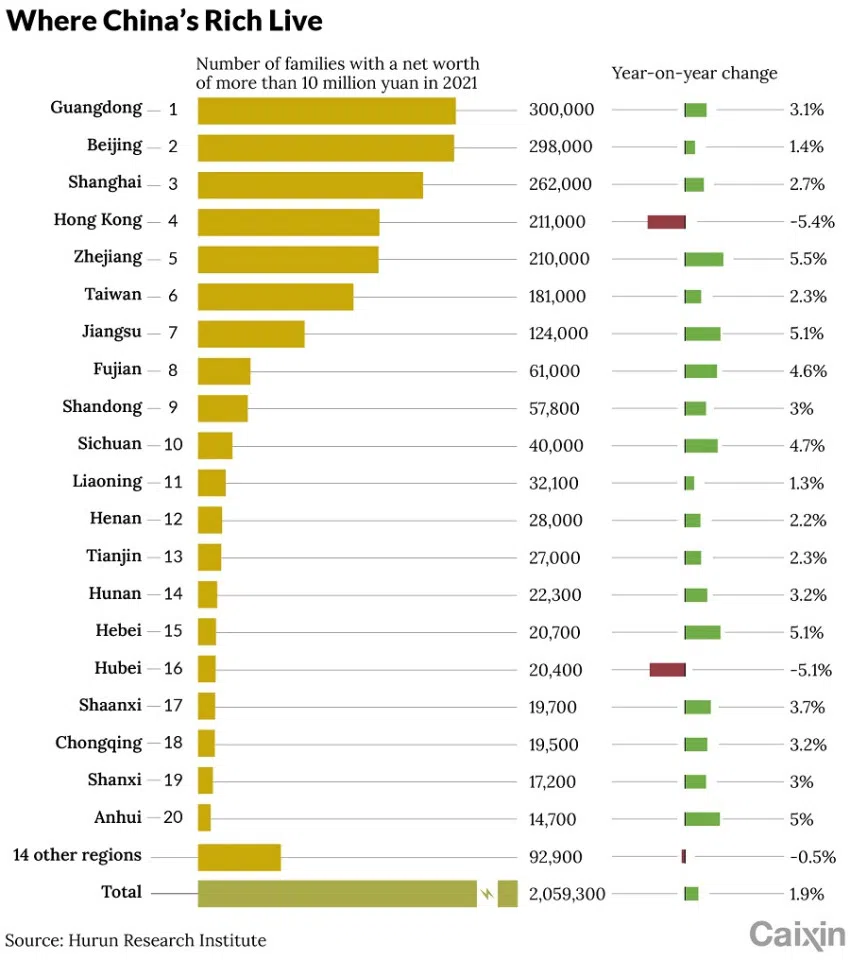

The number of Chinese households that entered the ranks of "high-net-worth families" last year rose 1.9% to nearly 2.1 million, with their aggregate wealth growing 27% to 160 trillion RMB (US$22.4 trillion), according to a report released earlier this month by the Hurun Research Institute and Citic-Prudential Life Insurance Co. Ltd.

More than half of those two million-plus families lived in the top five Chinese provincial-level regions with the most high-net-worth households, defined as those with more than ten million RMB in net worth, the report showed. The regions were Guangdong, Beijing, Shanghai, Hong Kong and Zhejiang.

The booming private economies in Guangdong and Zhejiang provinces, each made up of multiple cities, were behind the growth of their high-net-worth populations.

Guangdong overtook Beijing as the region with the most high-net-worth families in China. The southern province is home to about 300,000 such households, followed by Beijing with 298,000 and Shanghai with 262,000, according to the report.

The booming private economies in Guangdong and Zhejiang provinces, each made up of multiple cities, were behind the growth of their high-net-worth populations. Meanwhile, the cities of Beijing, Shanghai and Hong Kong are key financial hubs and destinations for multinationals.

Notably, the number of high-net-worth families calling Hong Kong home slumped 5.4% to 211,000, the biggest decline of any region in China. The Asian financial centre has suffered an exodus of talent amid Covid-19 restrictions in recent years.

The proportion of entrepreneurs among China's high-net-worth families plunged ten percentage points to 50% in 2021 amid a continued impact of the pandemic on the private economy, while the share of so-called "gold collar" executives - mostly at big corporations and international companies, which can better withstand risks - grew ten percentage points to 30%, according to the report.

Meanwhile, real estate investors and professional financial investors each accounted for 10% of the total.

China's high-net-worth investors earned an average annualised return of 11.8% on their investments from 2019 to 2021, down from 12.8% for the 2018-2020 period, according to the report, which is based on a survey conducted in June and July.

As China's wealthy get older, they are paying a lot more attention to inheritance and tax policy as they look to pass down their fortunes to their next of kin.

Still, these wealthy investors were aiming to earn an average annualised return of 21.4% from 2022 to 2024. Wealth management products, money market funds, stocks, and real estate topped the list of investments that they planned to sink more money into over the next year.

As China's wealthy get older, they are paying a lot more attention to inheritance and tax policy as they look to pass down their fortunes to their next of kin.

High-net-worth families in China will transfer an estimated 18 trillion RMB of wealth to the next generation over the next decade, the report said, a figure that is expected to grow to 92 trillion RMB in three decades.

This article was first published by Caixin Global as "Chart of the Day: China's Rich Are Getting Richer". Caixin Global is one of the most respected sources for macroeconomic, financial and business news and information about China.

Related: China's richest man Zhong Shanshan sells pure spring water, but can Nongfu Spring stay clean and green? | Singapore, Hong Kong vie for wallets of rich Chinese in tech sector | Taishan Club: The rise and fall of a secretive roundtable of China's richest | How increased wealth affects Chinese foreign buyers' housing consumption in Singapore | Wealthy Chinese setting up family offices in Singapore see it as springboard to ASEAN | Hong Kong struggles to stop brain drain

![[Big read] When the Arctic opens, what happens to Singapore?](https://cassette.sphdigital.com.sg/image/thinkchina/da65edebca34645c711c55e83e9877109b3c53847ebb1305573974651df1d13a)

![[Video] George Yeo: America’s deep pain — and why China won’t colonise](https://cassette.sphdigital.com.sg/image/thinkchina/15083e45d96c12390bdea6af2daf19fd9fcd875aa44a0f92796f34e3dad561cc)