Alibaba renews strategy reset to revive growth momentum

Alibaba has been grappling with sluggish growth in the face of a cooling Chinese economy and rising competition from upstarts such as PDD Holdings and ByteDance's short-video app Douyin. How is the e-commerce giant responding to these challenges?

(By Caixin journalists Bao Yunhong, Sun Yanran, Qu Yunxu and Han Wei)

It has been a turbulent year for Alibaba Group Holding Ltd. since it began a sweeping reorganisation aimed at revitalising growth. Yet, internal reshuffling and business adjustments persist as the e-commerce giant ramps up efforts to realign its strategy and regain momentum in an increasingly competitive market.

Attention has focused on the Hangzhou, China-based company after Jack Ma, its billionaire co-founder, wrote a lengthy memo on 10 April aimed at boosting morale of the more than 200,000 employees. He praised the new leadership's efforts to refine Alibaba's businesses over the past year and urged them to stay the course.

"Not only must we have the courage to admit and correct yesterday's mistakes in a timely manner, but we must also reform for the future," Ma, who has stepped outside the spotlight in the past few years, wrote in his message posted to an internal forum. The priority this year, he said, would be to "know ourselves and go back to the track focusing on consumers".

Alibaba has been grappling with sluggish growth in the face of a cooling Chinese economy and rising competition from upstarts such as PDD Holdings and ByteDance's short-video app Douyin.

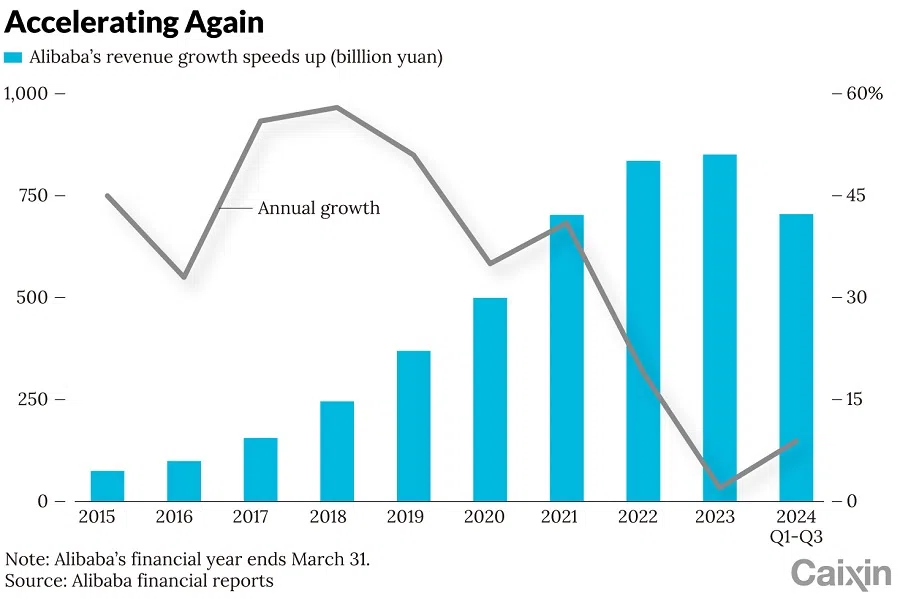

Revenue rose 5% to US$36.6 billion in the fourth quarter compared with a year earlier, representing a slowdown from previous quarters as growth in e-commerce and cloud computing divisions declined. Net income in the three months ended 31 December fell 69%.

Ma's remarks echoed comments earlier this month by chairman Joseph Tsai, the company's other co-founder, who attributed lagging performance to the neglect of user experience and said that a restructuring was needed.

The pandemic, competition and regulatory scrutiny have delivered a devastating blow to morale, Tsai said in an interview with Nicolai Tangen, the CEO of Norway's Norges Bank Investment Management, an Alibaba shareholder. "The most important thing is that employees are looking for a direction, and if you can clearly communicate what that direction is, then they will regain morale," Tsai said.

Fine-tuning plans

In March 2023, the e-commerce pioneer and former darling of investors announced a reorganisation plan that would split its sprawling empire into six independently run companies - the largest restructuring in its 24-year history. This sweeping overhaul was launched as Alibaba sought to recover from three years of pandemic-induced turmoil and a bruising regulatory crackdown that resulted in an 18.2 billion RMB (US$2.6 billion) fine.

The structural changes were accompanied by a series of management shakeups, affecting most of the company's major divisions and seeing the return of several founding members and long-term associates of Ma. In September, Daniel Zhang, who became CEO of Alibaba Group in 2015 and took over as chairman from Ma in 2019, stepped down. He was succeeded by Tsai as chairman and Eddie Wu as CEO.

Since taking office, Tsai and Wu have intended to integrate some separate parts while shedding marginal assets to focus on core businesses. Under the strategy of "user first" and "AI-driven" proposed by Wu, Alibaba is focusing on e-commerce and cloud business. Non-core businesses are left to themselves to make their decisions on fundraising and asset sales while taking responsibility for their own profits and losses.

Caixin learned that there are complaints among Alibaba employees that management's strategy has been inconsistent over the past year.

At the recent earnings conference, Tsai said Alibaba has established a specialised team to carry out capital market sales. In the last nine months of 2023, the company divested US$1.7 billion of non-core assets, while setting plans to exit the traditional brick-and-mortar retail business.

Speculation has swirled that grocery business Freshippo, supermarket chain RT-Mart and the loss-producing food delivery service Ele.me are slated for sale.

However, multiple sources told Caixin that, internally, there is no urgency for asset sales. "Given the current market conditions, selling assets is quite challenging," a person close to management said.

Alibaba has fine-tuned its restructuring plan, scaling back some of its original proposals. Plans to list Freshippo and logistics arm Cainiao, as well as a cloud-computing business spinoff are on hold.

Tsai said in March that Alibaba's primary goal is to regain market share and drive business growth, to strengthen its presence in the e-commerce sector. "The best approach right now is to focus on fostering synergies among the different businesses within the group," he said.

Caixin learned that there are complaints among Alibaba employees that management's strategy has been inconsistent over the past year. Replying to an employee on the company's internal forum, Ma wrote: "If making decisions last year were easy, then it wouldn't count as reform. Each decision impacts the interests and efforts of hundreds to thousands of employees and hundreds of thousands of customers... True reform demands determination, accountability, and reverence."

Investors appeared to welcome Ma's 10 April message. Alibaba's Hong Kong-traded shares jumped 4.9% that day, compared with a 1.9% rise in the Hang Seng Index. However, the stock still hovers at a low level after a short lived rebound last year, having lost nearly 80% of its value from its peak of US$319.32 in October 2020.

"The market is weary of their constant discussions about future plans," said a securities analyst who tracks the company. "It wants to see Alibaba compete overseas like PDD's Temu and SHEIN, establishing a foothold and regaining high growth."

Refining the core

Alibaba is refocusing on its core e-commerce and cloud computing businesses in its strategy reset.

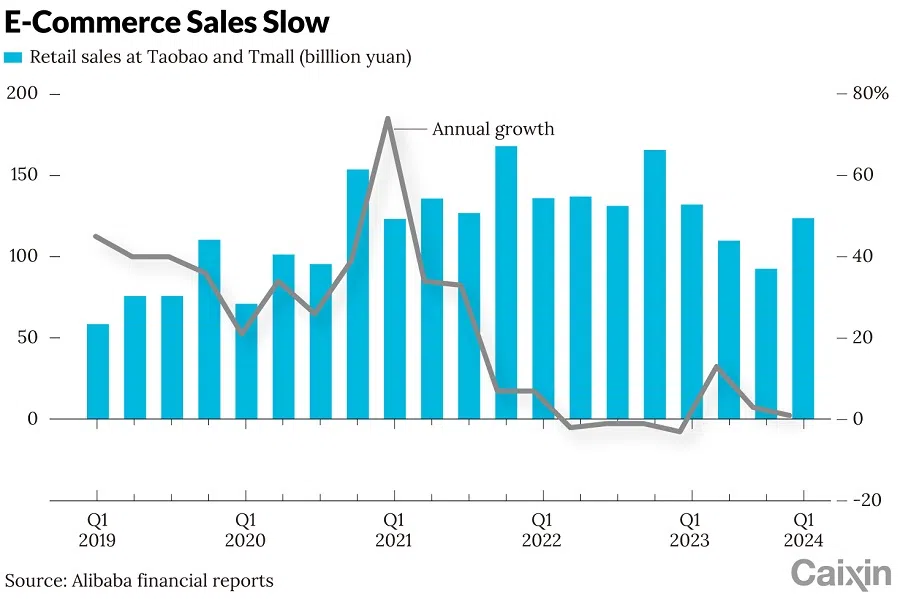

The domestically focused e-commerce marketplaces Taobao and Tmall have been the foundation of Alibaba's business empire but are experiencing slower growth amid weak domestic consumption and rising competition, losing market share to rivals such as PDD and ByteDance.

In the October through December period, Alibaba's e-commerce sales, including domestic and international commerce, totalled about 157.6 billion RMB, compared with 88.9 billion RMB of PDD.

But rivals are catching up quickly. In the fourth quarter, the Taobao Tmall Commerce Group recorded 2% revenue growth, down from a 4% increase in the third three-month period and a 12% jump in the second quarter. At PDD, revenue surged 123% in the final three months of the year, following a 93.9% increase in the third quarter and a 66% gain in the second.

In a letter to employees early this year, Wu disclosed that Alibaba's domestic commerce business has fallen to second place nationwide in terms of transaction user count and package volume. "We are no longer the leaders in product experience and business models in China's e-commerce market," he said.

In December, Wu replaced Trudy Dai as CEO of the Taobao Tmall Commerce Group, doubling down on efforts initiated by Dai to improve user experiences and benefits.

The measures signal a shift of Alibaba's service focus from vendors to customers, an e-commerce industry insider said.

This reflects the company's response to PDD's low-price strategy, which has become especially effective in the post-pandemic era as consumers have grown more careful with spending.

In his letter, Wu noted that while Taobao's product variety remains unmatched, it ranks near the bottom in price competitiveness. "This is a key reason for Taobao's struggles to attract new users and retain existing ones in recent years."

Since last year, both Taobao and Tmall sites have directed more traffic to low-price products. Starting this year, the group has accelerated the integration of its low-cost supply chain, moved the bargain product platform Taote to the main site and opened stores for Alibaba's online wholesale marketplace 1688 to try to woo new users.

According to a 1688 employee, Taobao is set to establish a comprehensive price category supply combination, with Taote offering mid-to-low-end generic brands, 1688 supplying mid-to-high-end generic brands, and Tmall continuing to focus on branded goods. However, all categories aim to address the demand for "consumption downgrade".

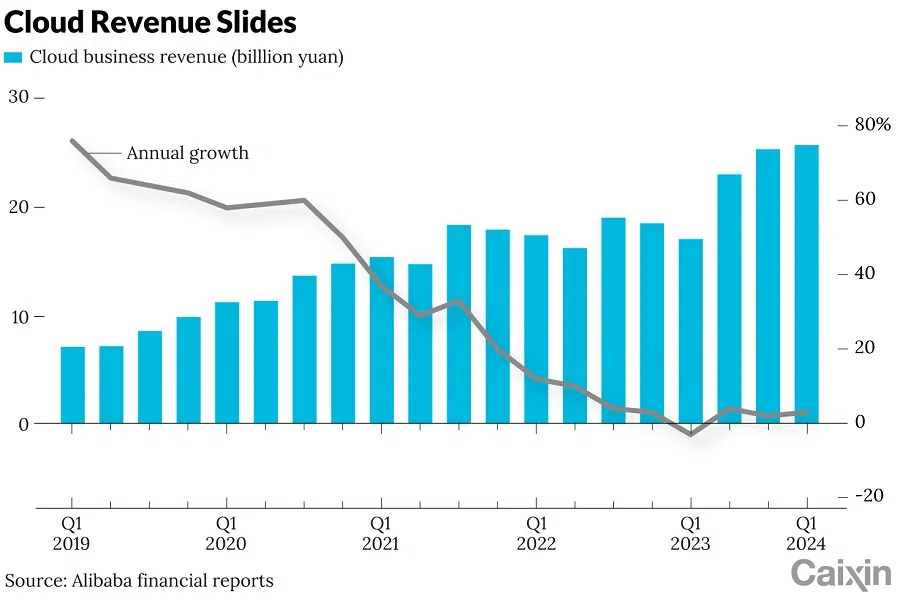

To reclaim its competitive position, Alibaba Cloud initiated a price war in the public cloud market in April 2023, slashing prices for its core products by 15% to 50% and offering developers free trials of 50 cloud products for up to three months.

Another key division, Alibaba Cloud, needed to reverse losses. Wu emphasised the need to make selective choices among all cloud products and business models to improve performance. After cutting some money losing businesses, Alibaba Cloud's profitability started improving. Fourth quarter net income jumped 86% from a year earlier to 2.4 billion RMB. Revenue rose just 3%, however.

The slackening in revenue growth has coincided with a drop in market share. The Internet Data Center (IDC) mid-year 2023 report shows that among the top five providers of internet-based computing in China, Alibaba Cloud's share dropped from 37.8% in early 2021 to 29.9%, while Tencent Cloud fell by 1.9 percentage points to 9%. In contrast, Huawei Cloud, China Telecom Cloud and AWS gained market share.

To reclaim its competitive position, Alibaba Cloud initiated a price war in the public cloud market in April 2023, slashing prices for its core products by 15% to 50% and offering developers free trials of 50 cloud products for up to three months. The price cuts were followed by rivals including JD.com.

By the end of February, Alibaba Cloud escalated the battle, extending price reductions of 20% to 55% on more than 100 products and 500 specifications on its website.

The previous price reductions "failed to meet expectations", Liu Weiguang, president of Alibaba Cloud's public cloud services, said in an interview with Caixin. He said he is optimistic about the future prospects for the business as the lack of uptake in traditional sectors and the artificial intelligence frenzy present rich demand pools.

"A great many traditional enterprises are still in the early stage of using cloud services" to streamline their operations, which presents a large number of business opportunities, Liu said.

Diverting strategy

During a February earnings call, Tsai categorised traditional brick-and-mortar retail operations as non-core and said exiting these was "very reasonable", though the process may be delayed by market conditions. Investors quickly interpreted his statement as Alibaba's intention to divest from the "New Retail" strategy begun by former chair Zhang that featured investments in RT-Mart, Freshippo and department store Intime.

As Alibaba's flagship new retail experiment, Freshippo opened its first store in Shanghai in January 2016. Featuring mobile-only payments and 30-minute delivery within 3 kilometres, it set a new standard for retail by integrating online and offline shopping experiences.

Alibaba announced an IPO plan for Freshippo in May 2023 shortly after its annual sales exceeded 50 billion RMB. But in November 2023, the plan was suspended. Tsai said at the time that due to market conditions, an IPO could not truly reflect the value of the unit.

RT-Mart has been less successful. In 2017, Alibaba spent HK$22.4 billion (US$2.9 billion) to acquire 36.16% of Sun Art Retail Group Ltd., the operator of the RT-Mart supermarket chain. As part of the deal, Alibaba said at the time it would use its "new retail" ecosystem to help Sun Art expedite its digitalisation, integrate its online and offline operations, and improve its order fulfillment efficiency.

In 2020, Alibaba raised its stake in Sun Art to about 72% in a US$3.6 billion deal that would consolidate the supermarket operator into its financial statements.

However, the big bet on Sun Art did not meet expectations. Sun Art's store count has dropped from a 2020 peak of 602 outlets to 505 as of September. Its market value has plunged more than 90% to HK$15 billion from over HK$100 billion before the 2020 acquisition.

Rumours have been circulating that Alibaba is negotiating the sale of its offline retail assets. The parties involved have denied these claims to Caixin.

Selling off the offline retail assets will not be an easy decision for Alibaba as it would mean abandoning its exploration of new retail that integrates online and offline channels, a company staffer said. As the retail market evolves and new competitors join, it will be difficult for Alibaba to re-enter the market in the future if it gives up now, the person said.

AIDC, which includes Alibaba's overseas platforms like AliExpress, Lazada, Daraz and Trendyol, is considered Alibaba's most promising business.

Doubling down overseas

While reshuffling its domestic businesses, Alibaba is also doubling down on its overseas e-commerce platform AliExpress to spur its growth momentum.

The splashing advertising campaign by PDD's Temu during the Super Bowl in 2023 had prompted Alibaba to discuss whether to conduct large-scale marketing overseas, a person close to the Alibaba International Digital Commerce Group (AIDC).

Over the past two months, AliExpress launched a series of marketing projects including securing the official sponsorship of the UEFA Euro 2024 soccer tournament to enhance its brand image.

AIDC, which includes Alibaba's overseas platforms like AliExpress, Lazada, Daraz and Trendyol, is considered Alibaba's most promising business.

Jiang Fan, CEO of AIDC, said the business is entering a phase of substantial investment, focusing primarily on scaling up. To complement its high-value product offerings, AliExpress rolled out the "Ten Billion Subsidy for Brands Going Global" initiative, aimed at brand merchants and major Amazon sellers.

In September, Alibaba transferred 5% of its shares in Cainiao to AIDC, a move to strengthen the coordination between the overseas e-commerce business and the logistics service.

Last year, AliExpress partnered with Cainiao to launch an express delivery service that guarantees global delivery within five days, now spanning ten countries and regions, including Europe, America, the Middle East and South Korea.

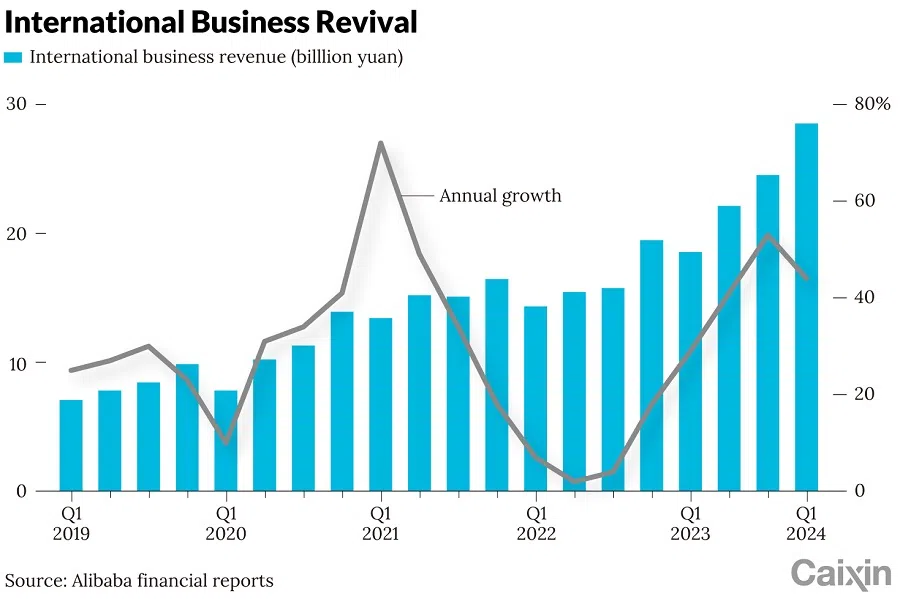

AIDC has become the fastest-growing segment of Alibaba, with growth exceeding 40% for three straight quarters in 2023. Its contribution to the group's total revenue has risen steadily to 11% in the fourth quarter.

The competition for AIDC will intensify as it faces rivals like Temu and SHEIN. An industry expert said that PDD is bolstering Temu with significant human and financial resources, making it a challenge for AIDC to attract popular merchants.

This article was first published by Caixin Global as "Cover Story: Alibaba Renews Strategy Reset to Revive Growth Momentum". Caixin Global is one of the most respected sources for macroeconomic, financial and business news and information about China.