[Big read] Chinese stocks to delist in US amid trade war market rout?

Amid the China-US trade and tariff war, there have been signs that Chinese stocks might have to delist from US stock markets, whether on their own accord or as a result of government decisions. What effect would this have on global trade? Lianhe Zaobao senior correspondent Chen Jing speaks to experts to find out more.

With the China-US tariff war caught in an impasse, the more than 200 Chinese companies listed in the US face delisting risk once more. Will this result in another wave of delisting among such Chinese companies? Which stocks will be more affected? Which financial centre stands to benefit from the potential delisting?

On 17 April, Chinese tea chain Chagee made history by debuting on the Nasdaq as the first US-listed Chinese tea beverage company. As this milestone unfolds, analysts are abuzz with a pressing question: which Chinese stock will be the last remaining on US exchanges?

During an interview with Fox News on 9 April, US Treasury Secretary Scott Bessent talked about the tariff war. Responding to a question on the delisting of Chinese stocks from US exchanges, he said “everything’s on the table” and that US President Donald Trump would decide.

While Bessent did not delve into whether the US would take such action, his words worsened investors’ fears over the prospects of Chinese concept stocks. Subsequently, financial institutions such as J.P. Morgan, Morgan Stanley, and Jefferies Financial Group issued notes on the delisting risk of the more than 200 Chinese companies listed in the US.

According to a report by the US-China Economic and Security Review Commission of the US Congress, there were 286 Chinese companies listed on US exchanges with a total market capitalisation of US$1.1 trillion as of 7 March 2025.

Aside from Chinese stocks lacking dual listings, those linked to China’s military also face elevated delisting risks... — James Ooi, Market Strategist, Tiger Brokers

Analysts feel the Trump administration has various means to make Chinese stocks leave. For instance, the US Securities and Exchange Commission (SEC) can order the exchanges to delist the Chinese companies, or cancel their (trading) registration in the US. It can also invoke emergency powers to order trading suspensions, or prohibit the usage of Variable Interest Entities (VIE), a framework where Chinese companies set up a company abroad for foreign investors to buy its shares before listing overseas.

Dual listing crucial

A Goldman Sachs report highlighted that in the last few months, Chinese stocks without a dual or secondary listing in Hong Kong performed much poorer than their peers that do, indicating that investors are once again focusing on the risk of delisting.

There are 27 Chinese stocks, including industry titans like Pinduoduo, Full Truck Alliance, Futu Securities, Legend Biotech, and Vipshop, which qualify for but are without a dual or secondary listing in Hong Kong. If they are forced to exit the US, their investors will incur losses as they are unable to convert their US-traded shares (ADRs) into Hong Kong shares.

Tiger Brokers market strategist, James Ooi, told Lianhe Zaobao that aside from Chinese stocks lacking dual listings, those linked to China’s military also face elevated delisting risks — similar to the New York Stock Exchange (NYSE)’s 2021 removal of three Chinese telecom giants.

James Wang, who heads China investment strategy research for UBS Investment Bank, added that heavily indebted, cash-burning firms like electric vehicle (EV) and data centre operators could see stronger delisting risks. He warned that small-cap stocks with low float are particularly vulnerable to policy tightening.

Three waves of Chinese delistings from US markets

Prior to this, there were at least three waves of Chinese stocks delisting from US exchanges. In 2010, Chinese companies Orient Paper and Rino International were ordered by the US regulatory authorities to delist over financial fraud, triggering a crisis of confidence in Chinese stocks. In 2011 alone, over 45 Chinese companies were targeted by short-selling organisations, causing their share prices to plummet.

The second wave occurred in 2015 when the stock market in mainland China boomed. Consequently, Chinese stocks like Focus Media, Jiayuan.com International, and Qihoo 360 Technology exited the US market to list domestically for higher market valuations. In that year alone, over 30 Chinese companies exited the US, exceeding the total for the previous four years.

In 2020, the Luckin Coffee accounting fraud sparked another crisis of confidence in Chinese stocks as auditing and regulatory differences between China and the US deepened. The US ordered foreign companies listed in its exchanges to be audited by its Public Company Accounting Oversight Board (PCAOB) or face delisting. At the same time, China conducted stricter data security audits on its companies heading abroad to list their shares.

Against this backdrop, many Chinese concept stocks like KE Holdings and Zhihu Inc were included in the US SEC provisional list of companies that faced possible delisting, while Didi delisted from the NYSE within a year of its IPO.

Unlike the previous three waves of delistings, analysts believe that any new delisting wave would have a more manageable impact.

Even though Chinese and American regulatory authorities reached a consensus on the matter by the end of 2022 to avert the risk of Chinese stocks delisting, the phased agreement may break down due to the current tariff war, putting Chinese stocks under delisting pressure once more.

Fallout from any delisting wave more manageable

Unlike the previous three waves of delistings, analysts believe that any new delisting wave would have a more manageable impact. This is because many companies have since obtained dual listings on the Hong Kong or Chinese stock exchanges, reducing their risk exposure.

Wang from UBS noted that such delisting fears resulted in an average drawdown of 22% for these Chinese stocks in 2021 and 2022, but many of the large-cap Chinese stocks now have dual listings and their proportion of Hong Kong holdings have also increased by an average of 30 percentage points in the past three years to around 60% of their combined market capitalisation.

Analysts, including Kelly Shi from Jefferies, reported that Chinese companies within their coverage generally consider the likelihood of delisting under current regulations to be low. For instance, Hutchmed, part of Hong Kong tycoon Li Ka-shing’s empire, completed a secondary listing in Hong Kong in 2021. The company noted that even if affected by a new wave of delistings, the impact would be significantly less severe than it was three years ago.

Following China’s strong response to the excessive additional tariffs imposed by the US, Trump eased off and said on 22 April that tariffs on China would “come down substantially” and urged Beijing to negotiate with Washington.

The average amount raised per IPO was only $50 million, way lower than the more than $300 million in 2021.

Overseas financing tougher for Chinese firms

While any potential delisting wave would be manageable, UBS’s Wang warned that uncertainty in Sino-US relations would continue to pressurise Chinese stocks in the near term.

As the decoupling of US and Chinese capital markets intensifies, Chinese companies may face a greater challenge than the current delisting risk: increased difficulty in securing financing abroad.

In 1992, Brilliance China Automotive Holdings listed on the NYSE, paving the way for Chinese companies to list in the US. Thirty years on, Chinese ride-hailing giant Didi, delisted from the US market as regulatory authorities from both countries tussled.

The incident has since been recognised as a sign of financial decoupling between China and the US. According to GreenPro Capital, the number of Chinese stocks listed on the US stock market fell sharply from 41 in 2021 to 12 in 2022, and the total amount raised from IPOs that year dropped drastically by 97% year-on-year to $400 million.

Even though the number of Chinese concept stock IPOs rebounded to 61 in 2024, the average amount raised per IPO was only $50 million, way lower than the more than $300 million in 2021.

Even as the US tightens restrictions on Chinese investments, China is also auditing its companies seeking overseas listings more closely, especially those in domains with national security concerns like artificial intelligence (AI) and big data. The authorities encourage companies to list in Hong Kong or on the mainland as A-shares.

Ooi from Tiger Brokers said that a greater chance of economic downturn in China and rising geopolitical risk over the last two years have made investors more wary of companies that derive their earnings mainly from mainland China. At the same time, Chinese companies are also concerned about lacklustre market valuations in the US.

Nonetheless, he anticipates the US market to still be the top choice for Chinese companies seeking overseas listings. “Especially for tech companies, since they often receive higher valuations in the US. Besides, it is beneficial for their brand influence and awareness. The maturity, liquidity, and vibrancy of the US market make it difficult to replace.”

Hong Kong and London ready for Chinese companies

Even though Chinese stocks have yet to delist from the US, other financial centres in the world are already preparing for the potential exodus, with Hong Kong — which has mainland China as its hinterland — the quickest to react.

It would encourage more Chinese stocks to seek listings in Hong Kong, and should benefit the Hong Kong exchange. — Lorraine Tan, Director of Equity Research, Morningstar

On 13 April, Hong Kong’s Financial Secretary Paul Chan Mo-po wrote in his blog that he had instructed the Securities and Futures Commission and the Hong Kong Exchanges and Clearing Limited to be “fully prepared for the potential return of Chinese Concept Stocks listed abroad”.

Statistics indicate that from 2018 to April 2025, 31 US-listed Chinese companies have pursued secondary listings in Hong Kong, achieving dual listings in both markets. This group includes major internet giants like Alibaba, Baidu, and JD.com. Among Chinese stocks that are not yet listed in Hong Kong, there is no lack of heavyweights with market valuations above US$5 billion. For instance, PDD Holdings alone has a market valuation of US$140 billion.

Lorraine Tan, Morningstar’s director of equity research, said that Bessent’s comments on the delisting of Chinese stocks will cause more Chinese companies to consider listing elsewhere rather than in the US. At the same time, it would encourage more Chinese stocks to seek listings in Hong Kong, and should benefit the Hong Kong exchange.

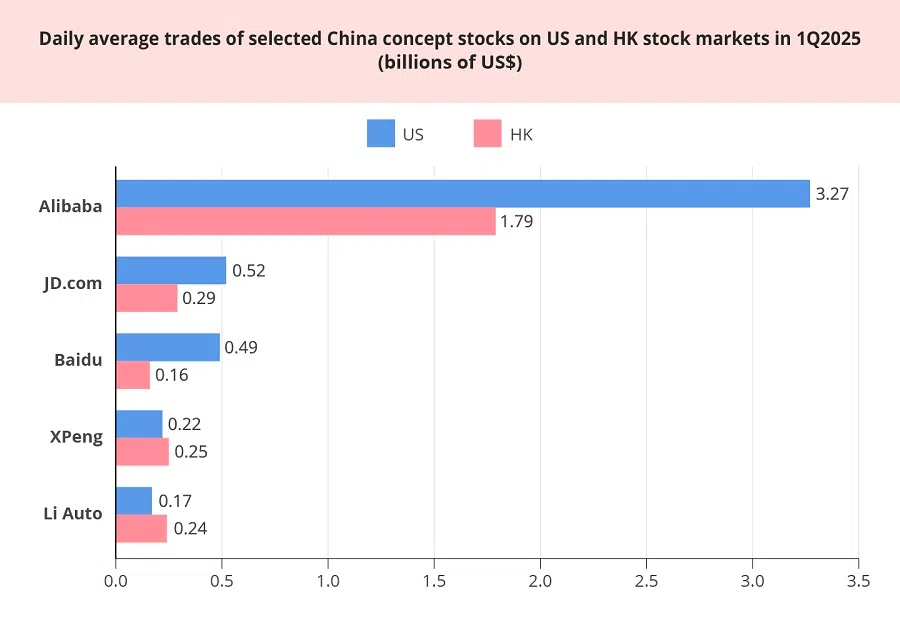

For Chinese stocks, moving to the Hong Kong market presents downsides, such as lower market valuation and trading volume. According to Bloomberg data, in the first quarter of this year, the average daily trading volume for Alibaba, JD.com and Baidu’s US-traded shares significantly exceeded their Hong Kong stock activity. For instance, Baidu’s average daily traded value in the US was three times higher than in Hong Kong.

However, the shares of Chinese new energy vehicles (NEV) companies like XPeng and Li Auto enjoy higher trading volumes on the Hong Kong exchange, so their average daily traded value in Hong Kong is higher than in the US.

British Finance Minister Rachel Reeves expressed her support for Shein to list in the UK and said that the government is working hard to make the UK a livelier place to list.

Morningstar’s Tan noted that a company’s industry can influence its popularity with investors in different markets. For example, Chinese companies like Shein may prefer to list in London or the US because apparel companies enjoy premium valuations in these markets as compared to Hong Kong.

The US’s decision to end duty-free treatment for low-value packages from China and Hong Kong starting from May scuppered Shein’s plan to list in the US. There are reports that it is now seeking a London listing instead and has received approval from UK regulators to do so while awaiting the go-ahead from Chinese regulators.

In an interview with The Telegraph, British Finance Minister Rachel Reeves expressed her support for Shein to list in the UK and said that the government is working hard to make the UK a livelier place to list.

... factors like a lack of market depth, lower liquidity and strict regulatory demands on publicly-listed companies have always discouraged foreign companies from listing in Singapore.

Singapore market less attractive for Chinese companies

To mitigate geopolitical risks from greater decoupling between China and the US, a number of Chinese companies have re-registered or set up their headquarters in Singapore over the last few years. A number of them have also listed in Singapore, such as EV maker NIO in 2022.

However, factors like a lack of market depth, lower liquidity and strict regulatory demands on publicly-listed companies have always discouraged foreign companies from listing in Singapore.

To revitalise its stock market, Singapore set up an Equities Market Review Group last August. At the start of this year, a S$5 billion Equity Market Development Programme was rolled out together with other improvement measures like five years of corporate income tax rebate for new primary and secondary listings, and streamlining prospectus requirements and listing processes.

Tiger Brokers’ Ooi pointed out that while these measures would make the local stock market more attractive, it is undeniable that it is still far smaller than the US market and does not enjoy the proximity advantage of Hong Kong. “From a geopolitical perspective, the Chinese government encourages companies to list in Hong Kong.”

Morningstar’s Tan feels that while the Singapore government is trying to improve stock market trading liquidity through a multi-pronged approach, it may take some time for the activity levels to rise. “Hence, we do not think the Singapore exchange is attractive to list on for Chinese companies compared to Hong Kong, Shenzhen and Shanghai.”

Can A-shares recover lost ground?

The escalation of the China-US tariff war at the start of April wiped out overnight the gains made by the Chinese stock market in the previous three months, and nullified the various government measures implemented in 2025 to revitalise it.

Following “Black Monday” on 7 April, the state-backed “national team” acted quickly to provide market support and Chinese regulators redoubled efforts to boost market confidence. A succession of state-backed companies like Central Huijin Investment, China Reform Holdings, and China Chengtong Holdings Group announced plans to increase their holdings of Chinese equity assets. The Chinese central bank also pledged to provide Central Huijin Investment with sufficient refinancing support when necessary to keep capital markets stable. At the same time, a group of publicly-listed state-owned-companies announced plans to increase share holdings or buy back shares to shore up investors’ confidence.

On 25 April, the CSI 300 index closed at 3,786.99. Even though it made steady gains in the previous three weeks, it has not recovered from the loss suffered on 7 April.

With the tariff war stuck in a rut, the State Council executive meeting on 18 April discussed the need to maintain stock market stability, and to keep promoting the stable and healthy development of the property market. Since 2023, this is the third occasion that the meeting has been used to chart the development of capital markets. For the first time, “steadying the stock market” was mentioned before “steadying the property market”, which has been interpreted as a political signal of greater strategic importance of capital markets.

A trade war not only wounds market sentiments but also adversely affects the performance and prospects of some publicly-listed companies. This damage to the economic environment is difficult to undo through confidence-boosting talk, or the efforts of the state-backed “national team”. — Shen Meng, Executive Director, Chanson & Co

The Financial News under the Chinese central bank quoted Huaxi Securities’ deputy research director and chief strategist Li Lifeng as saying that amid the uncertainties of the trade war, timely remarks and fund injections by the Chinese authorities to protect the stock market can mitigate the propagation of external shocks through capital markets, preventing overreaction and irrational selling, and this show of determination and strength will boost confidence.

Expert: reduce trade friction by going for quality over quantity

Shen Meng, executive director at Chanson & Co, said a trade war not only wounds market sentiments but also adversely affects the performance and prospects of some publicly-listed companies. This damage to the economic environment is difficult to undo through confidence-boosting talk, or the efforts of the state-backed “national team”.

On 22 April, the International Monetary Fund (IMF) released its Global Financial Stability Report and warned of the growing threat to global financial stability. With high economic policy uncertainty and some macro indicators performing poorer than forecasted, it is highly likely that market assets like stocks could see falling prices.

Shen noted that even before the trade war with the US, China’s trade disputes with economic entities like the EU were also escalating. He feels it would be difficult for the country to continue its overreliance on an export-based economic structure. To reduce trade friction, China should advocate high value-added goods in order to go for quality over quantity.

Given the massive Chinese economy, transformation and upgrading would take a long time, but Shen feels its market fundamentals would not improve without resolving the fundamental problems. “Even if the authorities lower interest rates or negotiations begin between China and the US, that would only bring short-term benefits to the stock market, but does not create healthy, long-term economic growth.”

This article was first published in Lianhe Zaobao as “贸易战火殃及股民 中概股或打包离美”.