[Big read] Young women are the driving force in China's consumer market

With the rise of e-commerce, traditional department stores are having a hard time attracting customers, especially following three years of the pandemic. While some stores have managed to re-style themselves to tap into the younger generation, others have struggled to move past the fashion of 20 or 30 years ago and are closing their doors as a result.

On a weekday afternoon in August, the Pacific Department Store in Shanghai is unusually crowded, with hordes of customers lugging their shopping haul and moving between counters plastered with promotional signs. A store employee told Lianhe Zaobao that in her three years of employment, this was the first time seeing so many customers, "but it's also the last time."

Retail moving online

The Pacific Department Store, which has stood in Xuhui district's Xujiahui business area for 30 years, announced on 31 July that it would close in a month's time as its cooperation with its investment partner expires. Its other two locations in Shanghai were closed in 2016 and 2020 respectively.

According to incomplete statistics, at least 13 department stores across China, including the Xuhui branch of the Pacific Department Store, have announced closures this year. There were even more closures last year, with at least 42 department stores shutting down, including 27 well-established ones that had been operating for over a decade.

"The past three years of the pandemic forced us older people to learn how to shop online. I'm used to buying things on Taobao now, and I rarely visit department stores any more." - Retiree Mr Wu

Challenged by new shopping malls popping up and the rapid rise of e-commerce, the pressure on traditional department stores with outdated business models continues to increase. Meanwhile, the strict pandemic measures over the past three years have further aggravated the plight of poorly performing department store operators.

Seventy-year-old retiree and Xuhui resident Mr Wu recalled buying items such as televisions and washing machines from the Pacific Department Store. However, with the rapid development of e-commerce in recent years, the appeal of traditional department stores has gradually declined. He said, "The past three years of the pandemic forced us older people to learn how to shop online. I'm used to buying things on Taobao now, and I rarely visit department stores any more."

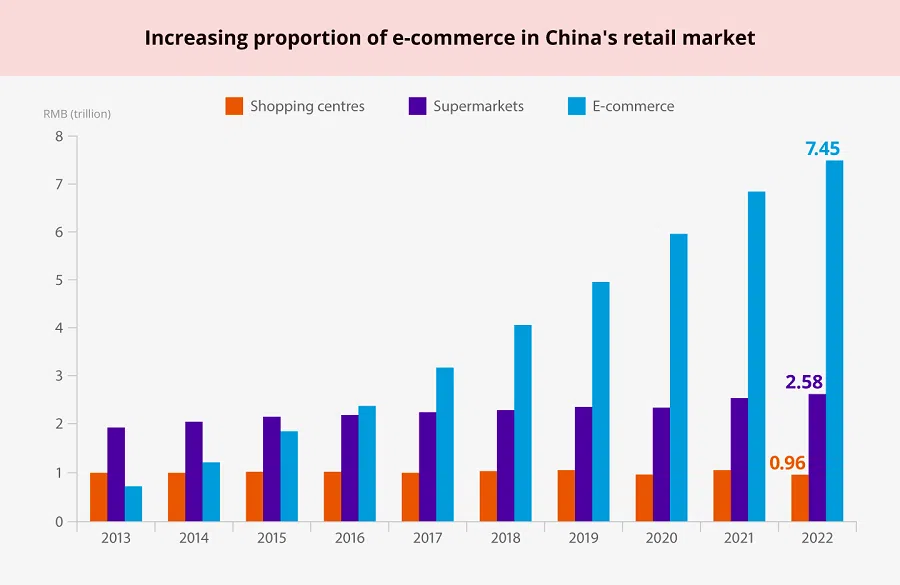

Data from market research firm Euromonitor show that from 2008 to 2022, the e-commerce market in China grew from 23.8 billion RMB (US$3.29 billion) to 7.5 trillion RMB, becoming the most significant retail channel in China, accounting for nearly 70% of the overall market. In contrast, the department store market grew by only 68% over 15 years, with its market share dropping from 32% to less than 9%.

A survey conducted by the China Commerce Association For General Merchandise (CCAGM), which has over 1,000 members, showed that 85.9% of surveyed businesses saw a decline in sales in 2022, with nearly 30% experiencing a decline of over 20%.

According to a report on the development of China's department store retail industry published by the CCAGM in March this year, 76.9% of respondents believe that insufficient consumption and weak growth were the main challenges facing the department store retail industry.

Soochow Securities analyst Wu Jincao said that the advantages of online consumption lie in the quick response, broad reach and competitive prices, which makes e-commerce suitable for mass consumer goods. High-end goods and experiential services still have significant growth potential, representing an important direction for the future development of offline commerce. He believes that China's department stores will experience industry recovery and reform after the pandemic.

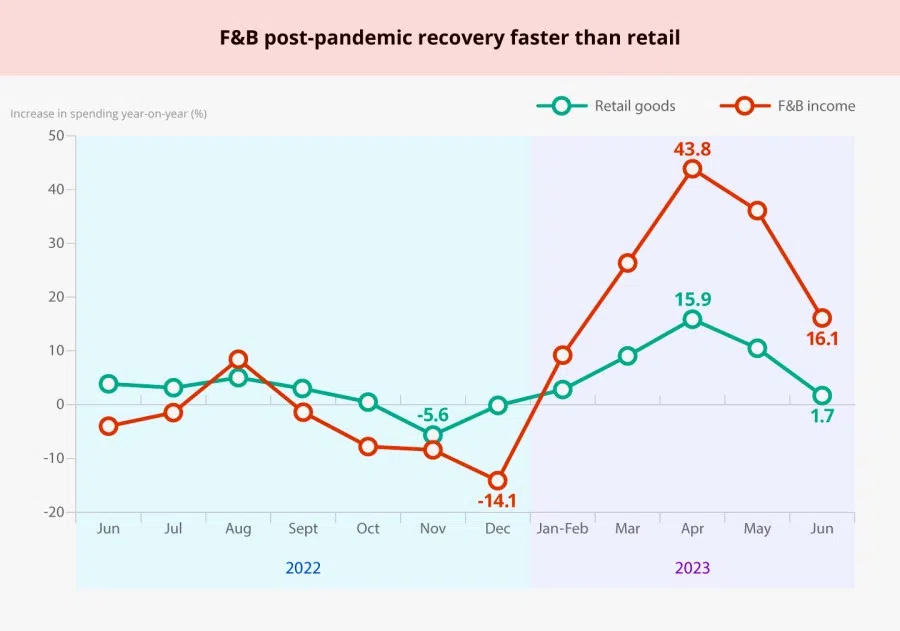

... after a substantial growth of 18.4% in April, the national total retail sales of consumer goods saw an increase of only 3.1% in June, the lowest growth rate this year.

Weak recovery in consumption momentum

Just a week before the announcement of the closure of the Pacific Department Store, Chen Yong, the director of the Xuhui District Business Committee, said at a press conference that they would ramp up the development of the Xujiahui Centre and the transformation of Pacific Department Store and Shanghai 600 mall. However, spring did not come in time for the time-honoured department store.

As China dropped its zero-Covid policy at the end of last year, private consumption experienced a "revenge" rebound early this year. However, amid generally weak economic recovery, the momentum of consumption recovery has been weakening. The latest data from China's National Bureau of Statistics show that after a substantial growth of 18.4% in April, the national total retail sales of consumer goods saw an increase of only 3.1% in June, the lowest growth rate this year.

Among the different types of consumption, the food and beverage (F&B) sector saw the most growth in total retail sales, at 16.1% year-on-year in June, while retail sales of consumer goods increased by only 1.7%. The strong recovery of dining consumption has stabilised vacancy rates and rents in shopping centres, but tenants are still difficult to secure due to the slow growth of retail sales.

According to data from Cushman & Wakefield, the vacancy rate in Guangzhou shopping centres in the first half of the year fell to 7%, bucking the trend of continuous increase over the previous four quarters. Data from Jones Lang LaSalle show that the vacancy rates of shopping centres in both core and non-core business districts of Shanghai decreased slightly in the second quarter to 13.4% and 12.1% respectively. However, this is still higher than the same period last year, while rental levels decreased both on a quarter-on-quarter and year-on-year basis.

... high-end fashion and other categories have even seen a continuous decline in leasing demand.

Government efforts to boost consumption

Chinese media Caixin quoted industry insiders as saying that among the various types of businesses taking up leases in shopping centres this year, the F&B industry has shown the most significant rebound, while other types have not seen significant recovery. For example, high-end fashion and other categories have even seen a continuous decline in leasing demand.

The difficulty in securing tenants in shopping malls is evident from the vacant buildings on Nanjing Road Pedestrian Street, a commercial street in Shanghai. Shanghai Landmark Department Store, a traditional monument on Nanjing Road, closed its doors at the end of January after nearly 26 years of operation, leaving the building mostly empty except for a few stores selling jewellery and gold on the upper levels.

After fashion brand Metersbonwe, a major tenant of Sendnes Shopping Center, closed its five-story flagship store last year, only a hotel and a restaurant remain open in the building, which is located next to Shanghai Landmark. Meanwhile, Seventh Heaven Building (七重天大厦), also in a prime location on Nanjing Road, has been vacant since its main tenant Giordano closed in 2021.

The pace of consumption recovery not only affects the vitality of department stores but also influences China's economic growth. In the first half of this year, final consumption expenditure contributed to 77.2% of China's economic growth. In July, the government implemented several policies to boost domestic demand, including the introduction of 20 measures on 21 July to revive and expand consumption.

The 20 measures released by China's National Development and Reform Commission focus on various aspects of consumption, such as improving consumption for automobiles, housing, F&B and cultural tourism. It advises against restricting car purchases, and calls for promoting the transformation of old residential areas and urban villages, implementing paid leave systems, and improving rural e-commerce and express logistics systems. However, there was no mention of the much-anticipated stimulus of cash and consumption vouchers.

Dependent on central government efforts

A research team led by Zhang Ming, deputy director of the Institute of Finance at the Chinese Academy of Social Sciences, conducted a survey in a coastal province in eastern China in June this year. The team found that the distribution of 40 million RMB worth of consumption vouchers in an underdeveloped area last year led to approximately 450 million RMB in consumption, demonstrating significant multiplier and leverage effects.

... local governments are burdened by heavy financial responsibilities, and driving consumption is mainly dependent on the central government's efforts...

However, the issuance of consumption vouchers is mainly financed by local governments. The disadvantage of closed marketplaces between regions is another drawback, in addition to its limited scale and reach.

Zhang proposed issuing consumption vouchers using funds raised from special government bonds, thereby resolving financial pressure and increasing distribution. In addition, while the scope of usage for the vouchers should not be limited, they should not be issued in cash terms. This prevents residents from saving it up and rendering the measure less effective.

Economist Chen Bo mentioned that local governments are burdened by heavy financial responsibilities, and driving consumption is mainly dependent on the central government's efforts, including further relaxing real estate controls, increasing subsidies for new energy vehicles, and promoting home appliance purchases in rural areas. By stimulating bulk consumption, the overall market can be revitalised.

Chen said that the 20 measures, which were put forward in response to the unusual economic situation, are not like the policies planned at the beginning of the year, which can be implemented quickly. Its large-scale implementation will take some time. However, considering the urgency of boosting consumption, it is expected that relevant supporting policies will be introduced within a month or so.

According to data from the People's Bank of China, household deposits in the country increased by a record 17.84 trillion RMB last year, nearly double the previous year. Chen analysed that people do not lack money but confidence, which makes them hesitant to invest or spend.

He said, "Promoting consumption is not just about consumption itself, but also about using downstream consumption as a lever to drive overall industry recovery, boost market confidence, and create a positive cycle."

Embracing anime, comics and games sector

On the first day of her trip to Shanghai, 13-year-old Xiao Xiao (pseudonym) from Anhui made a beeline for the Bailian ZX complex on Nanjing Road Pedestrian Street with her mother, and bought three figurines of virtual singer Hatsune Miku.

This first-year middle school student told Lianhe Zaobao that the 800 RMB models were "sponsored" by her parents. There are no specialty toy stores in her hometown, and since she hardly ever comes to Shanghai, she considered the costly purchase "an occasional indulgence".

As those born after 1995, or Gen Z, become a new force in the consumer market, several department stores on Nanjing Road have started transitioning to anime, comics and games (ACG) products.

With the support of young consumers like Xiao Xiao, the Bailian ZX complex, which specialises in anime, comics and games (ACG) products, has become one of the most popular shopping malls on Nanjing Road.

The east end of this century-old commercial street once featured South Korean cosmetics brand Innisfree, but is now fronted by "blind box" toy brand Pop Mart. At the west end, New World City has given its largest exterior wall advertisement space, which spans several floors, to the theme restaurant based on the anime series Detective Conan.

As those born after 1995, or Gen Z, become a new force in the consumer market, several department stores on Nanjing Road have started transitioning to ACG products. New World City has converted the fourth floor, which used to carry youth fashion, into an ACG specialty area. Meanwhile, Shanghai No.1 Department Store has created a "Glamour ACG Street", catered towards female ACG fans. And since Hualian Commercial Building became the Bailian ZX complex in January this year, it features seven floors of popular ACG products.

These new efforts by traditional department stores are starting to show results. According to Liberation Daily, customer traffic at New World City increased by 22.34% compared with the same period in 2021 in July, driving an overall sales increase of 7.5%. Store sales on the fourth floor increased by 258.9% compared with the same period in 2021, making it the floor with the highest growth, while customer traffic and sales at the Bailian ZX complex hit a new high in July since its opening.

When a sector lacks attention and favour of young people, it will eventually fade out. - Professor Xu Jian, School of Media and Communication, Shanghai Jiao Tong University

Spending trend led by young women

The ACG economy, long considered a niche market, is now developing into a blue ocean market with hundreds of millions of consumers. A report from iResearch Consulting shows that in 2020, China's ACG market hit 100 billion RMB, a growth of 32.7% year-on-year; the consumer base of the broader ACG market in 2020 was 420 million people and is expected to reach 500 million this year.

As early as 2018, a survey by China UnionPay showed that customer traffic in East Nanjing Road was becoming younger. Customers from the post-1990s and post-2000s generations accounted for more than 60% of the total.

Xu Jian, professor at the School of Media and Communication at Shanghai Jiao Tong University, said that the logic behind the rise of ACG consumption and the decline of the Pacific Department Store is the same: When a sector lacks attention and favour of young people, it will eventually fade out.

Xu cited how the iconic background music of the Pacific Department Store was the Grasshopper's song "Baby, I'm Sorry". He said, "Two or three decades ago, that song was a popular hit among young people. That generation no longer visits department stores."

He added, "But the young people today who have grown up with anime now visit department stores to experience something that online consumption cannot replace - meeting and spending money with fellow enthusiasts who share the same interests. They are willing to pay higher prices for these experiences."

According to a survey report from JD's Consumer and Industry Development Institute in the first half of this year, post-2000s consumers tend to look into the different options before making their purchase, and their spending decisions are also more likely to be influenced by their emotions.

A research report on Gen Z consumption trends in China shows that the average per capita annual expenditure on figurines among Gen Z in 2020 was 2,022 RMB, driving the market size to 3.7 billion RMB that year, and it is expected to exceed 9.1 billion RMB this year.

"Future spending trends will certainly be led by women." - Xu Jian

However, with intensifying competition, ACG is no longer a guaranteed recipe for success. The 2,000-square-metre X11 flagship store on Huaihai Road attracted 50,000 visitors on its opening day in 2021, but with the shift of ACG spending to Nanjing Road, the standalone space of the trendy toy retail brand closed last month.

Besides buying figurines in malls, attending anime conventions is also a popular social activity for Gen Z. In the past month, Shanghai has hosted several large-scale anime exhibitions, including the China International Animation and Game Expo, BilibiliWorld and ChinaJoy, attracting over 500,000 attendees in total.

Xu Jian believes that if Shanghai wants to become an international spending hub, it needs to capture the younger generation, especially young women. He said, "Young women have stronger and more diversified spending awareness than men, covering several areas such as clothing, film and television, and exhibitions. Future spending trends will certainly be led by women."

This article was first published in Lianhe Zaobao as "老牌商场等不到春天 疫后"百货"萧条 伤心"太平洋"".

Related: China's e-commerce sector emerging from dark times | Chinese internet giants gear up for global e-commerce push | China's new measures to attract foreign capital may not be enough to boost confidence | Crisis of trust underlies Chinese private sector's unwillingness to invest | China needs a new model of economic development to revive the economy

![[Big read] When the Arctic opens, what happens to Singapore?](https://cassette.sphdigital.com.sg/image/thinkchina/da65edebca34645c711c55e83e9877109b3c53847ebb1305573974651df1d13a)