Can China rewrite the rules of global sustainability?

China is emerging as a formidable competitor in the race to establish global environmental, social and governance (ESG) dominance. Researchers Lawrence Loh and Wang Zihan from NUS Business School explain how China can take the lead in the current Western-led ESG system and sustainable development.

In the global wave of sustainable development, the environmental, social and governance (ESG) framework is becoming an important measure of a country’s soft power and global competitiveness.

Over the past decade, the United States has struggled with ESG advancement due to uncertainties arising from policy changes. China, on the other hand, has rapidly risen in this field due to policy continuity and industrial transformation. Now, a key question faces the world: Can China break through the current system in which the West sets the agenda, and become a global leader in ESG?

US politics stalls ESG.

The alternations of political parties in power have influenced America’s ESG policy development. During the first term of the Trump administration (2017 to 2021), the US withdrew from the Paris Agreement and loosened environmental regulations, triggering doubts about its commitment to climate governance.

This drastic policy fluctuation not only weakened long-term corporate investment confidence but also affected the country’s leadership position in the global ESG system.

According to the International Energy Agency (IEA), US carbon emissions fell by 3%, while the European Union’s (EU) emissions fell by 18.4% during the same period. Policy uncertainty also affected capital markets. Data from Morningstar shows that net inflows into ESG funds fell by 47% year-on-year in 2024, and large energy companies openly resisted the ESG investing concept.

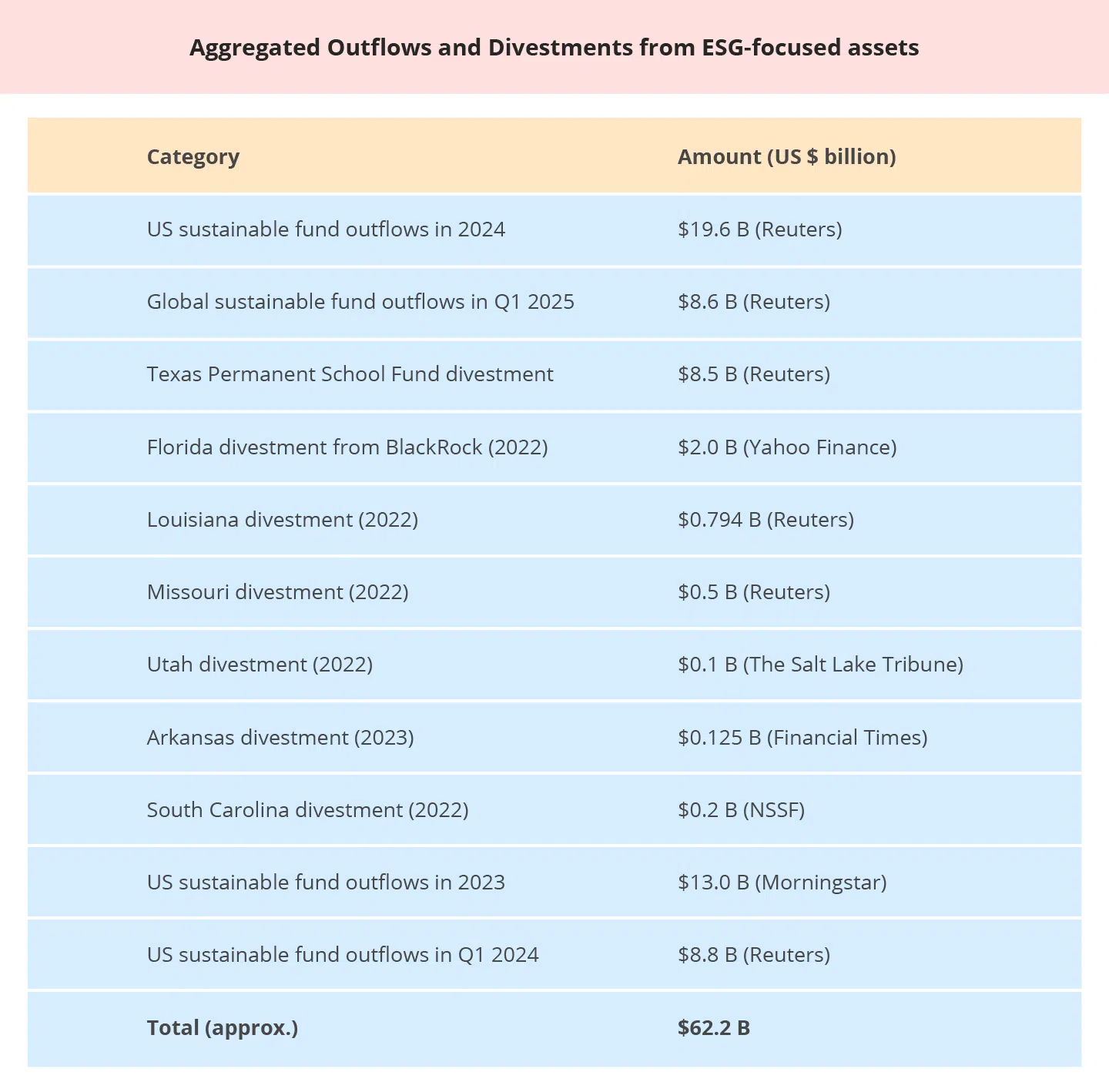

Although the Biden administration tried to revive clean energy through measures such as the Inflation Reduction Act, political polarisation in the country intensified. Republican-led states successively enacted anti-ESG legislation, leading to the withdrawal of more than US$60 billion from sustainable assets.

In January 2025, Trump was re-elected president. He announced America’s withdrawal from the Paris Agreement for the second time and restarted the “Drill, Baby, Drill” agenda, increasing fossil fuel extraction and dependence. At the same time, the weakening of diversity, equity and inclusion (DEI) programmes and the loosening of the Securities and Exchange Commission’s (SEC) climate disclosure rules further undermined the institutional foundation of America’s ESG policies.

This drastic policy fluctuation not only weakened long-term corporate investment confidence but also affected the country’s leadership position in the global ESG system.

... the ESG information disclosure rate of central state-owned enterprises reached 100%, and the overall disclosure rate of A-share companies rose from 26% in 2020 to 45% in 2025.

China’s green regulations

In contrast, China relies on its “dual carbon” strategic goals (peak carbon emissions before 2030 and carbon neutrality before 2060) to build a relatively systematic ESG policy framework. The latest data released by the People’s Bank of China shows that as of the end of the first quarter of 2025, the balance of green loans in renminbi and foreign currencies in China has exceeded 40 trillion RMB.

In terms of regulation, the ESG information disclosure rate of central state-owned enterprises reached 100%, and the overall disclosure rate of A-share companies rose from 26% in 2020 to 45% in 2025. The stability of institutional implementation has become the core advantage driving the formation of the ESG system.

China also continues to make strides in aligning its regulatory frameworks with international best practices. Its “Product Carbon Footprint Quantification Guide”, released in 2023, makes clear the accounting method for product carbon emissions. In 2024, its Ministry of Ecology and Environment issued the “Carbon Footprint Management System Implementation Plan” for establishing a unified, transparent and internationally compatible carbon footprint system by early 2027. In addition, the Ministry of Finance’s “Green Sovereign Bond Framework” released in 2025 marks a key step in building a system for China’s green financing tools.

China’s green tech dominance

At the industrial level, China’s green transition has achieved remarkable results. The IEA’s “2023 Renewable Energy Market Report” pointed out that China supplies 80% of the world’s photovoltaic modules and 60% of wind power equipment. In 2024, China’s new energy vehicle sales exceeded 12.86 million, accounting for 70% of the global market. In the battery field, companies such as CATL and BYD not only control core technologies but also occupy firm positions in the international market.

China is gradually challenging the Western-dominated system through initiatives such as the “Belt and Road” green investment principles and the “Multilateral Sustainable Finance Common Taxonomy”.

At the same time, China continues to advance in setting standards in ESG subfields. In 2025, the China Green Supply Chain Alliance released a white paper on photovoltaic recycling. This lays out the technical paths and policy directions to form a full life cycle management system for photovoltaic modules, from production to recycling. The introduction of new power battery certification standards is also expected to improve the ESG performance and global influence of the entire new energy industry chain.

Who determine the system and rules

The key to leading global ESG development lies in competing for the right to determine the system and rules. China is gradually challenging the Western-dominated system through initiatives such as the “Belt and Road” green investment principles and the “Multilateral Sustainable Finance Common Taxonomy”. The release of the taxonomy in November 2024 marks a substantial step towards the mutual recognition of green finance standards.

However, challenges remain for China in achieving ESG leadership, particularly in data transparency and alignment with global standards. ESG ratings for Chinese A-share listed companies continue to lag behind developed markets, with persistent gaps in addressing social issues such as labour rights and supply chain human rights. Furthermore, 90% of global ESG rating agencies are concentrated in Europe and the US, and Chinese standards have not been widely adopted.

To truly achieve global leadership in ESG, China must make breakthroughs in several key dimensions.

... only about 20% of A-share environmental data is third-party-verified, far below the 60% level in Europe and the US.

Making breakthroughs

China’s first objective is to significantly improve the transparency and credibility of ESG data. Currently, according to data from the Green Finance Committee of the China Society for Finance and Banking, only about 20% of A-share environmental data is third-party-verified, far below the 60% level in Europe and the US. Promoting standardised information disclosure and strengthening third-party verification mechanisms are key to enhancing international investor confidence.

Secondly, China has to accelerate the improvement of internationally aligned standards and strengthen multilateral rules-based participation. Building on the foundation that China and Europe already have, in the form of 72 mutually recognised green standards, China should further address its system gaps in human rights and labour issues.

China could promote the building of ESG frameworks in emerging markets through multilateral platforms such as the G20 and the Asian Infrastructure Investment Bank, thereby garnering greater influence in setting international regulations and systems.

Finally, China must build a globally competitive green financial ecosystem. Since China already accounts for nearly 40% of global green bond issuance (according to data from Climate Bonds Initiative), it can further promote carbon finance innovation and increase international investor participation and holding ratios.

Although improvements are still needed in social governance and corporate transparency, China’s overall leap in the ESG field cannot be overlooked.

Looking ahead

The competition for ESG leadership is essentially a contest of national governance models and development paths. Problems with the American system have been repeatedly exposed and contrasted with development advantages in China, centred on policy stability and strategic foresight. Although improvements are still needed in social governance and corporate transparency, China’s overall leap in the ESG field cannot be overlooked.

In the next ten years, the global sustainable development landscape may be reshaped. China could gradually transition from implementing policies to setting international regulations, becoming a key force leading the ESG paradigm.

This is an updated version of an article first published in Lianhe Zaobao as “中国如何引领全球ESG新时代”.

![[Big read] When the Arctic opens, what happens to Singapore?](https://cassette.sphdigital.com.sg/image/thinkchina/da65edebca34645c711c55e83e9877109b3c53847ebb1305573974651df1d13a)

![[Video] George Yeo: America’s deep pain — and why China won’t colonise](https://cassette.sphdigital.com.sg/image/thinkchina/15083e45d96c12390bdea6af2daf19fd9fcd875aa44a0f92796f34e3dad561cc)