Can Malaysia’s solar industry survive Trump’s tariffs?

In the face of possible new solar tariffs imposed on some Southeast Asia countries under Trump 2.0, the best way forward is to increase local content in the existing host economies rather than constantly relocating to stay one step ahead of the tariffs, says Malaysian academic Tham Siew Yean.

Malaysia offers generous fiscal and non-fiscal incentives to attract foreign direct investment (FDI) in the solar industry.

In 2008, four well-known solar companies, First Solar and Sunpower from the US, Q-Cells, founded in Germany and headquartered in South Korea, and Tokuyama from Japan invested in Malaysia due to these incentives and the relatively low-cost advantage.

Subsequently, Chinese solar companies entered Malaysia to circumvent the anti-dumping tariffs on Chinese solar panels, imposed by the Obama administration in 2012. Penang in Malaysia, for example, hosted JA Solar and Jinko Solar from China in 2015.

Tariffs under Trump 1.0

Under Donald Trump’s first administration, blanket safeguards, or temporary tariffs to protect an industry from imports, were imposed at 30% in February 2018. The tariffs were scheduled to decline yearly, bottoming out at 15% by 2022.

The products covered by the safeguard tariffs were broadly defined and included solar cells, whether or not assembled into modules, as well as parts of solar cells. However, these tariffs have various exclusions, thereby enabling some companies to sidestep them.

... in June 2022, Biden allowed a 24-month moratorium, allowing duty-free importation of certain solar cells and modules to support the development of solar manufacturing in the US.

Investigation and moratorium under Biden

Cambodia, Malaysia, Thailand and Vietnam were investigated by the US Department of Commerce (DOC) for anti-circumvention practices in the solar industry on 28 March 2022. The practices referred to mean that China was manufacturing, with only minor processing, in the four countries in order to circumvent paying anti-dumping and countervailing duties.

After investigation, in August 2023, it was announced that Hanwha Q CELLS and Jinko Solar were not circumventing in their manufacturing activities in Malaysia. But companies in Malaysia that did not respond to the US Commerce’s request for information in this investigation, were found to be circumventing.

Notwithstanding, the final decisions on tariffs for circumventing would be imposed only after June 2024 because, in June 2022, Biden allowed a 24-month moratorium, allowing duty-free importation of certain solar cells and modules to support the development of solar manufacturing in the US.

Subsequently, the Biden administration announced the imposition of countervailing and anti-dumping duties on solar panel imports from Cambodia, Malaysia, Thailand, and Vietnam. The four countries were targeted because they constituted the four largest import sources of photovoltaic modules to the US in 2023.

Countervailing and anti-dumping duties

Countervailing duties are used to resolve or neutralise the impact of excessive subsidies provided by a foreign government to the producers or sellers of a product. On the other hand, anti-dumping duties are import duties imposed on imported goods to compensate for the difference between the export price and the normal value of a product. Both are used to protect a country’s domestic producers and to ensure that domestic businesses can compete fairly.

The companies listed under the preliminary investigation for countervailing duties included included one Korean company (Hanwha Q CELLS Malaysia Sdn. Bhd), a Chinese company, Jinko Solar Technology Sdn. Bhd and its strategic partner from Malaysia (Omega Solar Sdn. Bhd) and three other companies which the DOC found to be cross-owned with Jinko Solar Technology Sdn. Bhd and Omega Solar Sdn. Bhd. Final determination is scheduled for 7 March 2025 while the issuance of orders is set for 3 April 2025.

The solar tariffs under Trump’s first administration and Biden’s moratorium did not appear to deter China’s solar investments in Malaysia.

As for the anti-dumping duties, preliminary investigations reported Jinko being investigated with its associated company Baojia New Energy Manufacturing Sdn.Bhd. Another company that was investigated is Lynter Enterprise, which is headquartered in Hong Kong. Hanwha Q Cells Malaysia Sdn.Bhd. was also investigated but was cleared while the two other companies named in the list are non-Chinese, namely CRC Solar Cell Joint Stock Company and Mega PP Sdn.Bhd. Final determination is scheduled for 2 June 2025, while the issuance of orders will be on 9 June 2025.

The preliminary investigations have not discussed whether there will be any “sunset” reviews for the final countervailing and anti-dumping duties in 2025. Hence the duration of the tariffs is not known.

Apart from these investigations, the US has reportedly imposed a general duty of 9.13% on solar imports from Malaysia.

Firms and government’s response

Firms do have recourse to file their comments which Jinko did with the DOC to identify a clerical error in the calculation of certain exempted import duties and sales taxes. Jinko alleged that its “free trade zones” benefits were double-counted, and that the rate for this benefits programme should be reduced from 0.42% to 0.21%.

The Ministry of Investment, Trade, and Industry (MITI) in Malaysia is working with the US side to facilitate a verification visit in December 2024. The ministry is also seeking an exemption for companies with at least 40% local content.

Impact on trade and investments of Malaysia

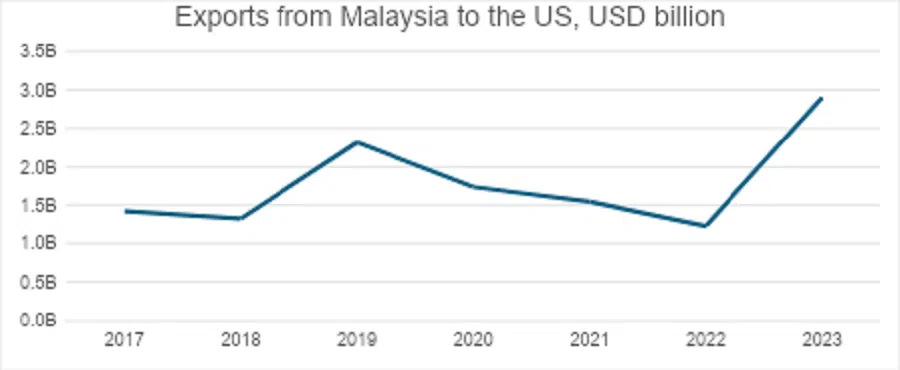

Malaysia’s exports to the US increased from 2018 to 2019 despite the imposition of the blanket solar tariffs (Figure 1). This is possibly due to high demand in the US and domestic installers there had lobbied for exemptions. However, it did subsequently drop due to the advent of the Covid pandemic and the ensuing disruptions in logistics. It continued to drop post-pandemic until 2022. Biden’s moratorium caused a surge in exports from 2022 to 2023.

In October 2023, LONGi Green Energy Technology Co Ltd, China’s largest listed solar panel manufacturer, is reportedly investing RM1.8 billion (US$ 385 million) to build its Serendah Module Plant in Selangor, which is meant to be its Asia-Pacific headquarters.

The solar tariffs under Trump’s first administration and Biden’s moratorium did not appear to deter China’s solar investments in Malaysia. In fact, Chinese solar energy company Risen Energy Co Ltd invested in Malaysia in June 2021. Risen Energy announced a 15-year investment of 42.2 billion ringgit (US$ 13.35 billion) to build a solar PV cell and module manufacturing centre in Malaysia. The new facility was built in Kulim Hi-Tech Park, Kedah, the first in Southeast Asia. It started operating in 2022, just in time for the tariff moratorium during Biden’s administration.

In October 2023, LONGi Green Energy Technology Co Ltd, China’s largest listed solar panel manufacturer, is reportedly investing RM1.8 billion (US$ 385 million) to build its Serendah Module Plant in Selangor, which is meant to be its Asia-Pacific headquarters. This plan was also made during the tariff moratorium period.

More relocation with solar tariffs?

It is expected that Trump 2.0 will expand the scope of solar tariffs to include possible components and to target new regions besides Southeast Asia.

Jinko Solar in Penang has shut down in 2024, while Longyi is reorganising its production and production plans across its global base factories. Jinko is reportedly starting a new manufacturing facility in Saudi Arabia.

It is unlikely that new solar investments will enter Malaysia until the quantum and duration of final tariffs are revealed in 2025.

One solution is to diversify export markets and reduce the dependency on the US market.

Relocating to other Southeast Asian countries like Indonesia and Laos, may allow these companies to sidestep the US tariffs for a while. But it is equally unlikely that these countries will remain outside the long arm of the US solar tariffs for long since the US will, in all likelihood, shift its focus towards new exporting countries, be it in Southeast Asia or other regions.

One solution is to diversify export markets and reduce the dependency on the US market. If MITI succeeds in obtaining an exemption for companies with high local content, then the best way forward is to increase local content in the existing host economies rather than constantly relocating just to stay one step ahead of the US solar tariffs.

Using local companies can affect the cost competitiveness of Chinese companies in Malaysia since China is the cheapest country for producing solar panels. Suppliers from China are inevitably more cost competitive than local companies. However, relocating and re-investing in other third countries to export to the US is also not a sustainable solution, given the current trend towards using tariffs to reduce China or other countries’ indirect exports to the US, via third countries.

![[Big read] When the Arctic opens, what happens to Singapore?](https://cassette.sphdigital.com.sg/image/thinkchina/da65edebca34645c711c55e83e9877109b3c53847ebb1305573974651df1d13a)