Can Trump’s tariffs on Mexico save the US auto industry?

Considering the significant gains Mexico has made with its domestically produced cars and the growing trade imbalance with its northern neighbour, it is unsurprising that US President Donald Trump is imposing strict tariffs on Mexico, according to academic Liu Xuedong. How can Mexico navigate these challenges, and will the tariffs be effective?

In his inauguration speech, US President Donald Trump announced his policies on the auto industry: “With my actions today, we will end the Green New Deal and we will revoke the electric vehicle mandate, saving our auto industry and keeping my sacred pledge to our great American auto workers.” He later also followed through on his threat to impose 25% tariffs on Mexican imported products, although this is now under a 30-day pause.

‘America First’

Promoting the auto industry and imposing a 25% tariff on Mexican imported products implies the consistency of Trump’s ideas, that is, the auto industry in the US should be the emphasis of national interest and security, in other words, “America First”. The reversal of the green plan promoted by his predecessor Biden and the shifting of financial resources away from electric vehicles towards promoting the overall auto industry are two sides of the same coin.

Both planned and potential investments in Mexico, a favoured nearshoring destination, are expected to decrease.

Faced with persistent and potential tariff threats, the Mexican economy is facing increasing pressures over time. According to estimates released by Moody’s and the world’s most important financial institutions, the Mexican economy may have a contraction by 2025, with a growth rate of only 0.6%, and a decline of up to a percentage point. In fact, statistics from national statistics agency INEGI showed on 30 January that the Mexican economy shrank more than expected in the fourth quarter of 2024 on a sequential basis, marking its first quarter-on-quarter contraction in over three years.

Mexican auto industry on Trump’s radar

In particular, the tariff announcements targeting Mexican products may have a negative impact on the Mexican auto industry, which may not be the most severely affected activity, but should be at least one of them. Both planned and potential investments in Mexico, a favoured nearshoring destination, are expected to decrease. This is due to investors adopting preventive measures and a cautious stance in response to the increasingly uncertain environment.

In the past five to six years, one of the fastest growing sectors for growth and export expansion in Mexico has been the auto industry and its parts and accessories. According to recently released data by INEGI, in 2024, the production and export of light vehicles in Mexico has reached 3.99 and 3.48 million units respectively, both figures surpassing their historical records observed in 2017 and 2018 respectively.

It must be pointed out that the auto bilateral trade between Mexico and the US has made significant contributions to Mexico’s total sales to its northern neighbour country, especially since 2021 when the Mexican economy began to recover from the decline caused by the 2020 pandemic.

Mexican-produced cars shipped to the US market have increased their share in the total exports to its northern neighbour during the past four years, with a net increase of 2.4 percentage points.

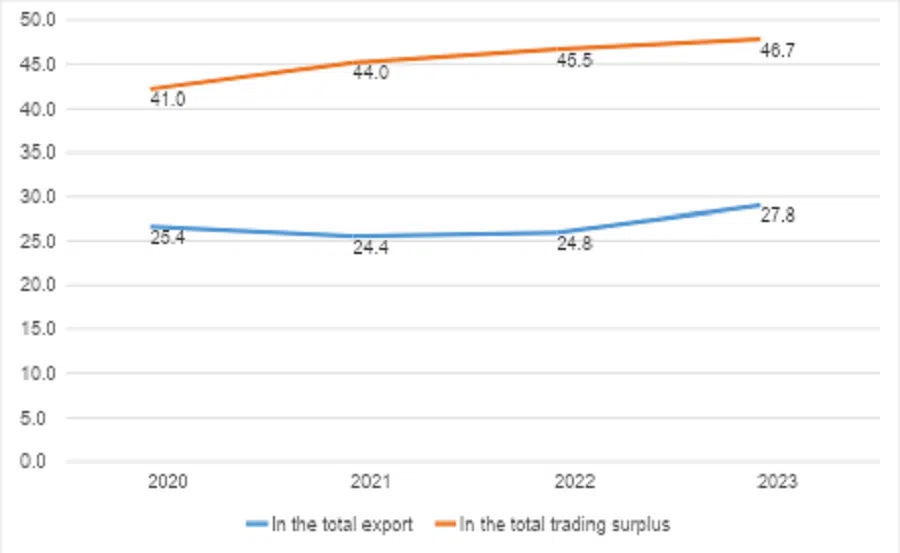

In 2020, the export of the merchandise included in Section XVII (Transportation materials) accounted for 25.4% of Mexico’s total exports to the US; by 2023, the same indicator had reached 27.8%, which was only lower than that shown by Section XVI (Machinery and equipment, electrical materials and their parts) in both cases. With respect to the importance of a trading surplus for the Mexican economy, they were 41.0% and 46.7% respectively in 2020 and 2023 (Figure 1).

This indicates that Mexican-produced cars shipped to the US market have increased their share in the total exports to its northern neighbour during the past four years, with a net increase of 2.4 percentage points. At the same time, the contribution of the same sector to the trading surplus increased by 4.3 percentage points.

Therefore, it is unsurprising that the US government, under Donald Trump’s leadership, would both threaten and impose a 25% tariff on Mexican products, particularly targeting the Mexican auto industry, which now faces a future filled with challenges and uncertainties.

What can Mexico do?

Before the tariff threats of the new US administration, the Mexican government did their best to resolve the bilateral trade differences within the framework of the United States-Mexico-Canada Agreement (USMCA). But as expected, Trump´s aims extend beyond trade itself, covering immigration, frontier security and illegal fentanyl entry into US territory. Therefore, as can be seen with Mexican President Claudia Sheinbaum’s pledge to send 10,000 troops to the border, the Mexican authorities would be required to cooperate with the Trump administration in areas unrelated to the economy and bilateral trade.

However, cooperating with the Trump administration may often lead to conflicts with Mexican national sovereignty interests, potentially causing challenges for Sheinbaum with her supporters. All policy responses would require great talent and clever manoeuvres to convince both the US president and the Mexican public to accept, in order to save the Mexican auto industry.

The tariff increases would be insufficient to offset the lower prices in Mexico, making it difficult for US-made final products to compete with similar imported ones.

Can Trump achieve what he planned?

Despite the high tariffs imposed, it would be very difficult for auto manufacturing to be repatriated to the US for at least two reasons.

First, the costs of labour, inputs, intermediate goods and equipment for manufacturing cars are more expensive in the US compared to its trading partners, especially Mexico. The tariff increases would be insufficient to offset the lower prices in Mexico, making it difficult for US-made final products to compete with similar imported ones.

Second, estimates by the US Department of Commerce indicate that Mexican auto parts account for over 42% of total US imports annually. As such, imposing high tariffs could lead to an increase in US car production costs, ultimately driving up prices for consumers. As the Mexican Secretary of Economy Marcelo Ebrard has said, American auto companies depend on Mexico, and the auto plant in Edomex is “one of the best of the world”, and it would be a “strategic mistake” for Trump to follow through on the tariffs.

![[Big read] When the Arctic opens, what happens to Singapore?](https://cassette.sphdigital.com.sg/image/thinkchina/da65edebca34645c711c55e83e9877109b3c53847ebb1305573974651df1d13a)

![[Video] George Yeo: America’s deep pain — and why China won’t colonise](https://cassette.sphdigital.com.sg/image/thinkchina/15083e45d96c12390bdea6af2daf19fd9fcd875aa44a0f92796f34e3dad561cc)