The CATL effect: Can a battery giant power Hong Kong’s stock market revival?

Battery giant CATL’s record-breaking secondary listing in Hong Kong marks a turning point for the city’s capital markets. Will Hong Kong be able to re-establish itself as an international financial centre? Lianhe Zaobao’s China Desk finds out more.

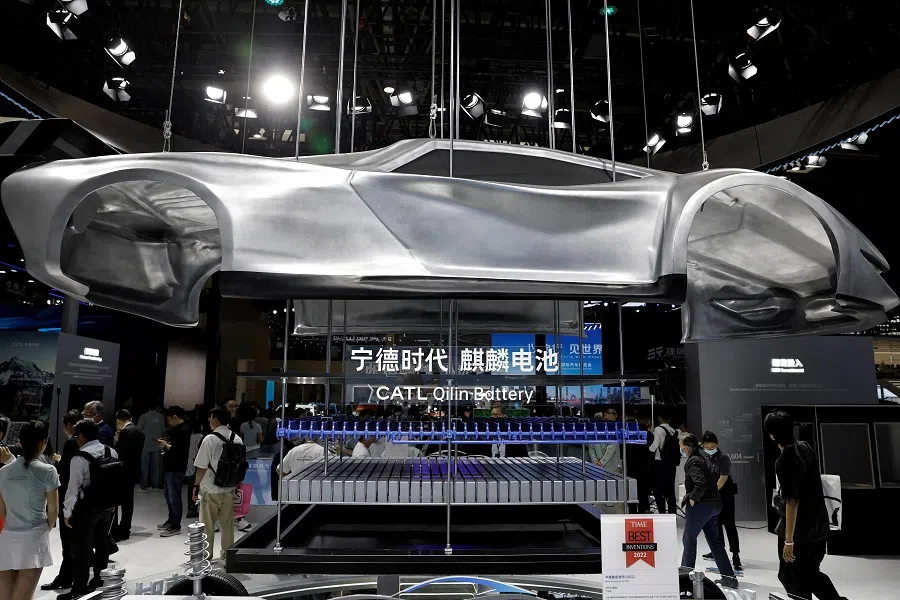

China’s new energy battery bigwig, CATL, saw a significant surge on its first day of trading in Hong Kong, with intraday gains rising to as much as 18.4%.

On 20 May, CATL issued new shares in Hong Kong at HK$263 per share (US$29.8). After listing, the stock price rose to HK$311.4 at one point, closing the day up 16.4% at HK$306.2. The momentum continued into 21 May, with the stock rising further to HK$341.6 at midday.

According to Reuters, CATL issued over 135 million shares, raising a total net amount of HK$35.331 billion. This marked the largest initial public offering (IPO) globally this year and the largest IPO in Hong Kong in the past four years.

CATL is one of the main battery suppliers for electric vehicle giant Tesla. Last year, it held a 38% share of the global power battery market, and its shipments of power and energy storage batteries have ranked first globally for eight consecutive years, earning it the market nickname “King Ning” (CATL is Ningde Shidai in Chinese).

... the purpose of the IPO fundraising is to actively expand its overseas business, with 90% of the funds raised intended for the construction of its Hungarian plant. The new factory is expected to become the largest electric vehicle battery factory in Europe upon completion.

Why Hong Kong for a secondary listing?

CATL is perceived by the market as a company that is not short on funds.

Founded in 2011, CATL was listed on Shenzhen Stock Exchange’s ChiNext market in 2018. Last year, the group’s net profit reached 50.745 billion RMB — a year-on-year increase of 15% — with dividends exceeding a whopping 25 billion RMB. Some social media commentators have joked that the dividends are not much less than the amount raised from the Hong Kong IPO.

In reality, CATL’s listing in Hong Kong is more about serving its overseas expansion strategy. At its previous roadshows, the company repeatedly mentioned that the purpose of the IPO fundraising is to actively expand its overseas business, with 90% of the funds raised intended for the construction of its Hungarian plant. The new factory is expected to become the largest electric vehicle battery factory in Europe upon completion.

In its annual report released in March this year, CATL also stated that the company is at a critical stage of rapid overseas expansion and layout. The Thuringia plant in Germany is currently ramping up production capacity, while the Hungarian plant, the joint venture plant in Spain with Stellantis and the Indonesian battery industry chain project are still under construction or in the planning stages — all of which require significant overseas funding.

Forbes reported that CATL’s revenue fell by 9.7% year-on-year last year, marking the first revenue decline in a decade. These figures indicate a saturated domestic market, in turn making overseas expansion a key growth driver. The report also noted that after listing on the Hong Kong Stock Exchange, CATL will be able to attract more long-term overseas capital; by leveraging its production capacity in Europe, it could also avoid trade barriers.

More than 40 A-share firms are currently actively considering listing in Hong Kong, as these enterprises hope to utilise Hong Kong as an offshore fundraising platform to bolster their overseas expansion plans.

Hong Kong IPOs rising in popularity

Against the backdrop of intensifying competition in China’s domestic new energy industry chain and the consensus for companies to go global, CATL is not the only company that chose “A+H” dual listings on both the A-share and Hong Kong markets.

Since the beginning of this year, several A-share companies in the lithium battery and photovoltaic sectors — such as Wuxi Lead Intelligent, CNGR Advanced Material Co Ltd, Shenzhen Senior Technology Material Co Ltd, Zhejiang Narada Power Source and Hainan Drinda New Energy Technology Co Ltd — have all announced plans to list in Hong Kong. Last month, Seres, a new energy manufacturer that collaborated with Huawei, also applied to list on the Hong Kong Stock Exchange.

In her speech at CATL’s listing ceremony, Bonnie Chan, CEO of Hong Kong Exchanges and Clearing Limited (HKEX), stated that more than 40 A-share firms are currently actively considering listing in Hong Kong, as these enterprises hope to utilise Hong Kong as an offshore fundraising platform to bolster their overseas expansion plans.

In addition to A-share companies, industry newcomers like Mixue Bingcheng, which have not previously been listed, are also making high-profile moves to list in Hong Kong, attracting the attention of international investors.

Buoyed by multiple streams, the enthusiasm and trading activity for IPOs in Hong Kong have increased significantly. HKEX data showed that IPO fundraising in the first four months of 2025 amounted to HK$21.3 billion, up 170% year-on-year from HK$7.9 billion. In terms of trading volume, the average daily turnover in April 2025 was HK$274.7 billion, up 145% from the same period last year.

Caijing (《财经》) reported on 19 May that, catapulted by major IPOs such as CATL’s, Hong Kong’s IPO fundraising has exceeded HK$60 billion so far this year, currently ranking first globally.

Can Hong Kong regain its status as an international financial centre?

In recent years, Hong Kong has been said to be losing its lustre as an international financial centre due to a scarcity of IPOs and sluggish trading.

Between 2009 and 2021, the Hong Kong Stock Exchange led global IPO fundraising rankings for seven consecutive years. However, starting in 2022 Hong Kong’s IPO fundraising slipped out of the top five due to a combination of factors including the Covid-19 pandemic and geopolitical tensions, barely climbing back to fourth place last year.

Hong Kong has emerged as a crucial platform for Chinese companies to access international financing and expand, and the Hong Kong stock market has regained its vibrancy thanks to these listings.

This year, several leading mainland Chinese companies have successively listed in Hong Kong, injecting vitality into the market and prompting investors to reassess the role of the Hong Kong stock market as a capital platform amid China-US rivalry.

While going public overseas has become a consensus among Chinese companies, the risks of listing in the US continue to rise. Hong Kong has emerged as a crucial platform for Chinese companies to access international financing and expand, and the Hong Kong stock market has regained its vibrancy thanks to these listings.

A turning point

Hong Kong Financial Secretary Paul Chan Mo-po said on 20 May that CATL’s listing reflects the confidence of companies and investors in the Hong Kong stock market, as well as how mainland companies are leveraging Hong Kong to accelerate their global strategic expansion.

Chan pointed out that it is an opportune time for companies from mainland China and other regions to utilise Hong Kong’s listing platform to raise capital and grow bigger, amid a complex geopolitical landscape and the trend of global capital diversification.

On the other hand, a growing number of US-listed China concept stocks are proactively returning to list closer to home to circumvent geopolitical risks and the potential threat of delisting — a trend that is poised to invigorate Hong Kong’s IPO market. Chan stated in a blog post on 13 April that he had instructed Hong Kong’s financial authorities to actively attract China concept stocks to list in Hong Kong following significant market fluctuations caused by the US’s announcement of reciprocal tariffs.

Chinese authorities are also encouraging enterprises to choose Hong Kong as their overseas IPO venue. On 7 May, China Securities Regulatory Commission Chairman Wu Qing said that they will safeguard the legitimate interests of Chinese companies listed overseas, and create conditions to support the return of high-quality US-listed Chinese firms to the A-share market and the Hong Kong market, while also protecting the legitimate rights and interests of investors.

Challenges abound

For Hong Kong, regaining its status as a financing hub amid China-US competition presents both opportunities and challenges.

CATL issued its shares through a “Regulation S” offering, meaning the securities were not offered to investors within the US, thus bypassing the need to register with the US Securities and Exchange Commission. While this helps circumvent US regulatory scrutiny and potential political risks, it also limits the participation of US institutions.

... further restricting US investment will inevitably reduce the overall capital supply to the Hong Kong market, leading to an oversupply of shares

Given that the Hong Kong stock market is already smaller than the US market, market participants worry that if trade tensions between China and the US spill over to affect more stocks, further restricting US investment will inevitably reduce the overall capital supply to the Hong Kong market, leading to an oversupply of shares.

The Securities Times quoted Lawrence Lau, Greater China Financial Accounting Advisory Services Leader at Ernst & Young, as pointing out that insufficient trading activity for some stocks and even a short-term oversupply situation could result from a large-scale influx of newly listed companies to the Hong Kong stock market without a corresponding significant increase in market funds, impacting company valuations and share price performance.

In the long run, the key to whether Hong Kong stocks can continue to attract and accommodate more heavyweights such as “King Ning” lies in whether it can maintain sufficient capital inflows.

This article was first published in Lianhe Zaobao as “宁王上市 香港重回金融中心宝座?”.

![[Video] George Yeo: America’s deep pain — and why China won’t colonise](https://cassette.sphdigital.com.sg/image/thinkchina/15083e45d96c12390bdea6af2daf19fd9fcd875aa44a0f92796f34e3dad561cc)