China’s beauty brands shine online as foreign rivals falter

China’s beauty upstarts are seizing the spotlight as foreign brands stumble in a fiercely competitive market. With digital savvy, localisation strategies and “self-developed” formulas, they are rewriting the rules of China’s cosmetics game. Will China’s cosmetics market become a battlefield foreign brands can no longer win?

(By Caixin journalists Feng Yiming and Wang Xintong)

Foreign beauty brands have long dominated China’s cosmetics market. European luxury labels filled department store counters, South Korean imports set trends and multinational companies controlled the science behind skincare. But that landscape has shifted.

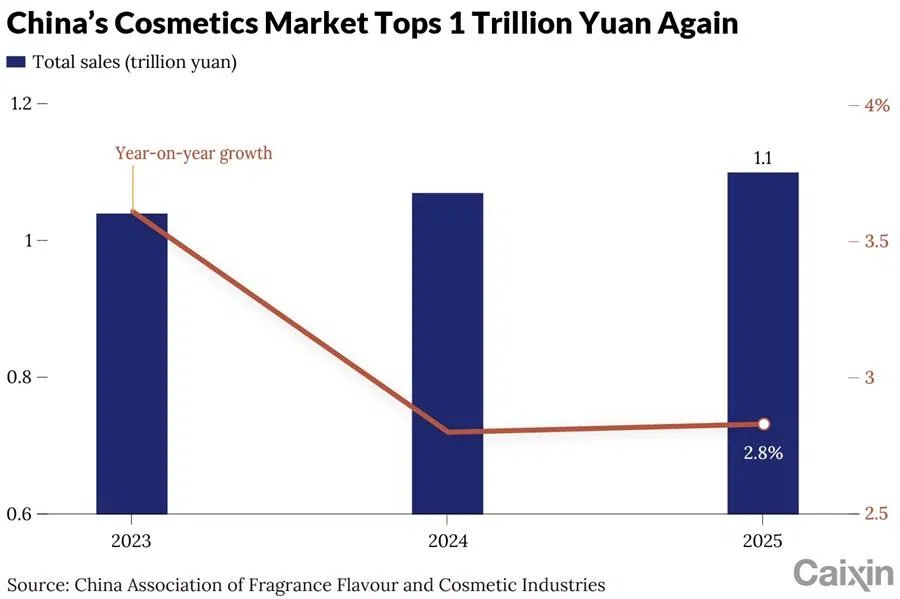

In 2025, China’s cosmetics market grew 2.8% to more than 1.1 trillion RMB (US$159 billion) in sales, according to the China Association of Fragrance Flavour and Cosmetic Industries (CAFFCI). Domestic brands accounted for 57.4% of the market, outpacing foreign competitors for the fourth straight year.

The momentum has extended to the capital markets. Since 2024, the cosmetics industry has seen a rise in IPO activity as domestic players fund their expansions. Mao Geping Cosmetics Co. Ltd. kicked off the wave with a Hong Kong IPO in late 2024, followed by Shanghai Forest Cabin Cosmetics Group Co. Ltd. last year. Others, including Chando Group Corp., Proya Cosmetics Co. Ltd., Guangdong Marubi Biotechnology Co. Ltd. and Shenzhen HBN Technology (Group) Co. Ltd., are pursuing primary or secondary listings. In 2025 alone, more than 40 Chinese beauty firms set IPOs in motion, with Hong Kong overtaking Chinese mainland exchanges as the preferred venue, CAFFCI data showed.

Behind the rise of domestic firms is a playbook built on dominating online channels, keen insight into local trends, and rapid decision-making and product development. Foreign rivals have been forced to adapt, scaling back in China or investing in local startups to stay relevant. Some analysts expect larger homegrown players to further consolidate their lead as the industry undergoes rapid reshuffling.

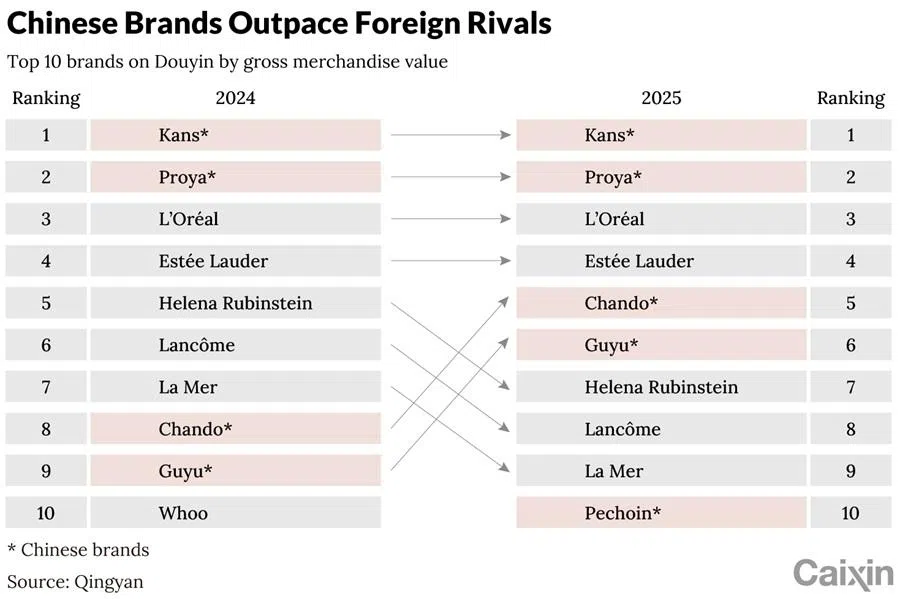

Domestic brands held half of the top ten spots in Douyin’s cosmetics gross merchandise value (GMV) ranking in 2025, according to Qingyan, a market data provider.

Digital dominance

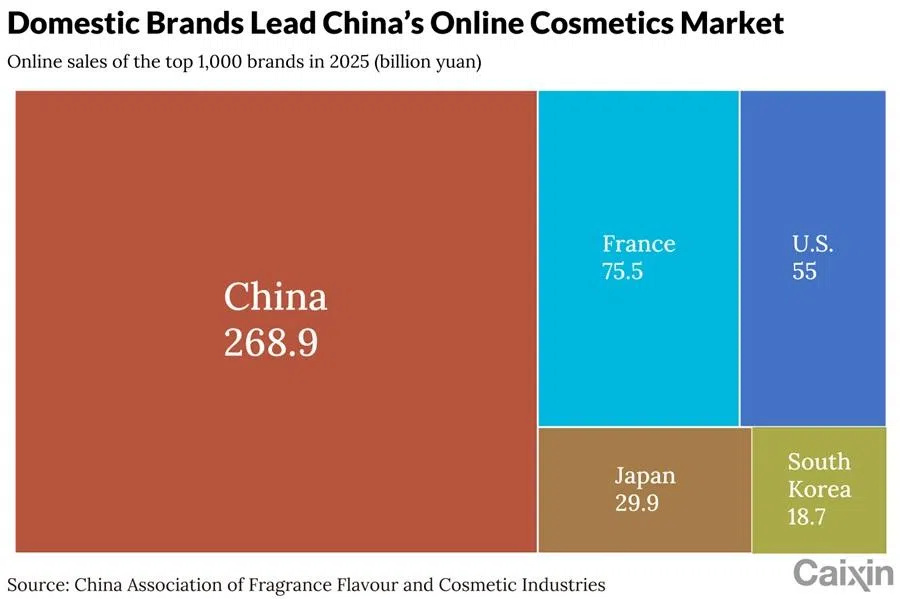

Unlike foreign brands that focus on prime placement in high-end department stores, domestic contenders have prioritised digital storefronts — a shift that became evident during the Covid-19 pandemic. In 2022, China’s online cosmetics sales surpassed offline sales for the first time, according to consulting firm Frost & Sullivan Inc. In 2025, online sales of domestic cosmetics approached 721.8 billion RMB, accounting for 65.4% of the overall market, according to CAFFCI.

“The online playbook of Chinese brands resembles that of internet companies,” said an employee at a foreign cosmetics company. “They move fast, face fewer internal constraints and make decisions quickly. Employees at foreign beauty companies might still be busy writing emails and going through approval processes.”

The Chinese companies use proprietary apps to collect first-hand consumer data, allowing them to develop products targeting unmet needs and deliver them precisely to specific audiences on Douyin... foreign competitors... cannot replicate this model.

E-commerce platforms such as ByteDance Ltd.’s Douyin and Alibaba Group Holding Ltd.’s Tmall have emerged as the main battleground. Domestic brands held half of the top ten spots in Douyin’s cosmetics gross merchandise value (GMV) ranking in 2025, according to Qingyan, a market data provider. Leading the list was Kans, owned by Hong Kong-listed Shanghai Chicmax Cosmetic Co. Ltd., with GMV exceeding 8 billion RMB. Proya ranked second with more than 3 billion RMB, followed by global giants L’Oréal and Estée Lauder.

A report by research firm Bernstein noted that leading Chinese cosmetics companies derive about 70% of their sales from Douyin — TikTok’s Chinese cousin — compared with just 40% for their foreign rivals.

The Chinese companies use proprietary apps to collect first-hand consumer data, allowing them to develop products targeting unmet needs and deliver them precisely to specific audiences on Douyin, the report said, adding that foreign competitors, constrained by global brand guidelines and slower creative cycles, cannot replicate this model.

Proya topped Tmall skincare sales in 2025 with more than 4 billion RMB in revenue, surpassing foreign brands including L’Oréal, Lancôme and Estée Lauder. Its success was fuelled by the viral “morning C, night A” skincare trend — a regimen combining vitamin C for daytime “brightening” and vitamin A for nighttime “anti-ageing”.

In 2021, Proya packaged its two serums into a dedicated “morning C, night A” set and raised prices shortly after. According to Minsheng Securities Co. Ltd., the firm’s average prices on Tmall doubled from 2017 levels, driving a 76% jump in sales that year. In 2024, Proya became the first domestic cosmetics company to surpass 10 billion RMB in annual revenue.

Kans took a different approach. In 2023, it promoted an anti-ageing kit through a 15-episode short drama on Douyin, featuring the products throughout. The series drew over 200 million views in three weeks. By March 2024, Kans had backed 22 short dramas that received 7 billion views in total. The strategy paid off: Kans’s revenue jumped 143.8% in 2023, while parent Shanghai Chicmax’s revenue grew 56.6%.

Bet on ingredients

A deeper shift is underway in how Chinese consumers evaluate skincare products.

Consumers increasingly scrutinise ingredient lists, research key components such as niacinamide and hyaluronic acid, and prioritise efficacy over brand heritage. A 2024 survey by consulting firm iResearch found that 58.8% of consumers ranked ingredients as their top consideration when buying skincare products.

Domestic brands have leaned into this trend, promoting proprietary research and “self-developed” formulas. Average research and development (R&D) spending among China’s listed beauty-related companies rose from 2.4% of revenue in 2020 to 3.2% in the first half of 2025, CAFFCI data showed.

“Now, they care about whether key ingredients have patents, exclusive supply and stories that can create blockbuster products.” — a worker at a midsize cosmetics factory

Hong Kong-listed Shanghai Forest Cabin promotes camellia oil and the concept of “nourishing skin with oil”, while IPO-hopeful Shenzhen HBN Technology centres its branding on retinol, claiming its proprietary compound enhances DNA repair and collagen production.

The shift has rippled through supply chains. Before 2021, brands mainly wanted basic moisturising products, said a worker at a midsize cosmetics factory. “Now, they care about whether key ingredients have patents, exclusive supply and stories that can create blockbuster products.”

But ingredient trends can turn quickly. Bloomage Biotechnology Corp. Ltd. saw skincare revenue fall more than 30% in both 2024 and the first half of 2025 after interest in hyaluronic acid waned. Meanwhile, Hong Kong-listed rival Giant Biogene Holding Co. Ltd. grew its revenue from 1.55 billion RMB in 2021 to 5.54 billion RMB in 2024 due largely to its focus on recombinant collagen.

A capital market analyst noted the fickleness of consumer trends: “Whether it’s hyaluronic acid or recombinant collagen, investors worry about preference shifts. Recombinant collagen has been hot for nearly four years. We can clearly sense concerns about its growth and competition intensifying since 2024.”

Bloomage Biotechnology and Giant Biogene clashed over the ingredients in a public spat last year. The former accused brokerages of unfairly promoting recombinant collagen and backed a beauty blogger who questioned the authenticity of one of Giant Biogene’s flagship products. Giant Biogene defended its product and denounced Bloomage’s claims as “malicious allegations”. The dispute dragged down both companies’ share prices.

Foreign strategies

In January, Filorga, a French skincare brand owned by Colgate-Palmolive Co., and Hince, a makeup brand owned by South Korea’s LG H&H Co. Ltd., shut down their Tmall stores. The pair follow 25 other foreign beauty brands that either scaled back operations in China or exited the market entirely last year, according to Chinese outlet Cosmetic Newspaper.

Meanwhile, others are fighting back with heavy discounts. Estée Lauder Companies Inc.’s sales on the mainland rose 13% year-on-year in the fourth quarter of 2025, up from 9% in the previous three months, driven in part by strong performance during the annual “Double 11” online shopping festival around 11 November.

Some global groups are also looking to learn from Chinese upstarts. In November, L’Oréal SA’s venture capital fund took a minority stake in Chinese skincare brand Lan — its first investment in a local skincare startup.

“One reason foreign giants invest in Chinese companies is to learn from startups and feed that experience back into their own organisations, sharpening their decision-making and market instincts,” said the employee at a foreign cosmetics company.

But local brands are often short-lived. Some 27,000 domestic cosmetics brands exited the market in 2025, accounting for more than 40% of local marques, while 17,000 were launched, CAFFCI data showed.

Industry analysts said newcomers face an uphill battle. In such a crowded market, there is little room for new cosmetics brands to scale, the capital market analyst said. The analyst also expected market share to continue shifting toward domestic players, with the larger homegrown firms further consolidating their lead.

Goldman Sachs said in a report that “branding will become the most effective strategy in 2026” for consumer engagement or new product and ingredient launches. Companies with products featuring high repurchase rates and cost-efficient, multiple-channel sales strategies are better positioned, according to the report.

This article was first published by Caixin Global as “In Depth: China’s Beauty Brands Shine Online as Foreign Rivals Falter”. Caixin Global is one of the most respected sources for macroeconomic, financial and business news and information about China.

![[Big read] When the Arctic opens, what happens to Singapore?](https://cassette.sphdigital.com.sg/image/thinkchina/da65edebca34645c711c55e83e9877109b3c53847ebb1305573974651df1d13a)