China’s booming nuclear sector lobbies for green vouchers to ensure profits

Nuclear power is making an aggressive comeback in China, as the State Council greenlights the construction of 11 new nuclear power reactors, spread across five nuclear power stations in several of China’s coastal provinces recently.

(By Caixin journalists Zhao Xuan, Fan Ruohong and Joyce Qin)

Nuclear power is making an aggressive comeback in China, after a long lull precipitated by the 2011 Fukushima nuclear disaster in neighbouring Japan.

The meltdown, which followed a deadly earthquake and a tsunami that knocked out the plant’s power supply, led to mass evacuations and environmental contamination, and sent a chill through the global nuclear energy industry.

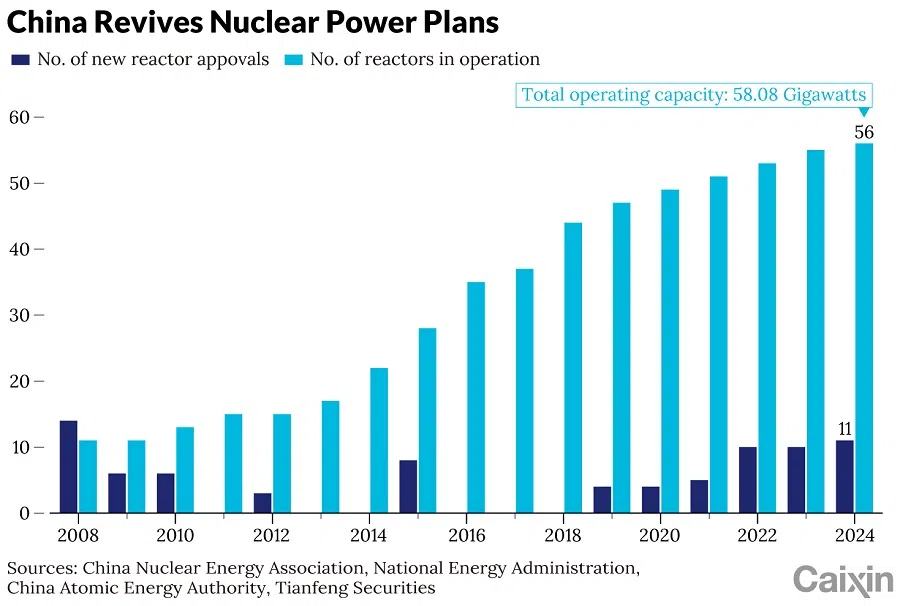

It was a reminder that while nuclear reactors are a rich source of electricity that produce few carbon emissions, when things go wrong, they can go really wrong. China dramatically curbed new reactor approvals, with only a handful in 2012 and then again in 2015, followed by a three-year freeze from 2016 to 2018.

A decade later, amid pressure to transition away from carbon-intensive sources of fuel in order to meet green targets, the Chinese government began to rapidly reverse that stance.

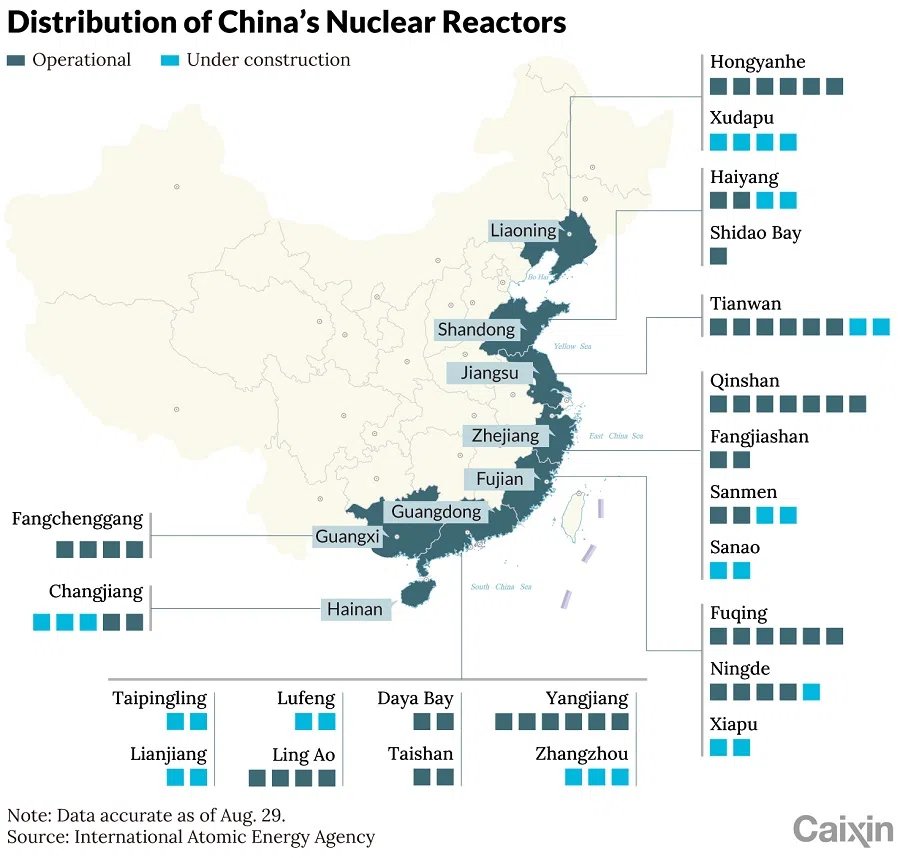

Following ten new reactors in each of the last two years, the State Council on 19 August greenlighted the construction of 11 new nuclear power reactors, spread across five nuclear power stations in several of China’s coastal provinces, including Jiangsu, Shandong, Guangdong, Zhejiang and Guangxi.

The total cost of the reactors is expected to exceed 200 billion RMB (US$28 billion).

But reforms aimed at marketising the distribution of power will create new challenges for China’s nuclear sector, which has long benefited from fixed pricing, and has little inclination to sell power at market rates. Those gained momentum after 2021’s power crunch chaos and should be well underway by the time this new batch of plants comes online.

The question is now whether they will be able to access the kind of premiums that are being talked about to incentivise the purchasing of renewable energy like solar and wind on trading markets over cheaper sources like coal.

“In the past, our focus was solely on electricity generation [and expanding capacity], but now we must also consider how to navigate the electricity market,” said a nuclear power industry insider from South China’s Guangxi Zhuang autonomous region.

Getting more nuclear power into the mix will mean working out how it fits into a changing electricity market framework more focused on intermittent production, observers say.

Market rates

China currently has 56 nuclear reactors in operation, with a total capacity of 58.08 gigawatts (GW), according to latest statistics from the National Energy Administration. That ranked it second, on par with France, after the US with 94 reactors in operation, according to the International Atomic Energy Agency.

Nuclear power only makes up about 5% of China’s generated electricity mix, however. Compare that with one tenth of global electricity generation, and about one fifth in the EU and US.

China’s 14th Five-Year Plan, set in 2021, targeted installed nuclear power capacity of 70 GW by the end of 2025. And the China Nuclear Energy Association predicted last year that China would be the world’s leading producer of nuclear energy by 2030.

Based on the current progress, China may fall short of its 2025 goal, according to a report this month by the Global Energy Monitor (GEM). GEM’s expected start date data would see China having 63 GW online by the end of 2025. But 2026 would then see a further 8 GW added, putting China at 71 GW, overtaking France’s 66 GW by operating nuclear capacity.

Getting more nuclear power into the mix will mean working out how it fits into a changing electricity market framework more focused on intermittent production, observers say.

In 2023, the national electricity market trading volume increased 7.9% year-on-year, with over 60% of consumed electricity traded on the market, according to data from the China Electricity Council.

Regions including Guangdong, Jiangsu, Shandong, Guangxi and Fujian have already introduced nuclear power contracts into their markets and are exploring the rules for competition.

China General Nuclear Power Corp. (CGN), a state-run nuclear giant that operates 27 reactors, said that in 2023 it sold 57.3% of the energy it produced on the market, up from 33.5% in 2020.

Since November, northern China’s Shandong province has included nuclear power in its electricity spot market, according to a notice from China’s energy administration. The province first included 30% of the electricity from two units of the Haiyang Nuclear Power Plant, operated by State Power Investment Corp. Ltd. (SPIC).

“Nuclear power was once considered ‘elite’. But the electricity market is fiercely competitive. For nuclear power enterprises, it is now necessary to enter the market as soon as possible, study the market and plan pricing strategies in order to gain a foothold,” said Huang Shaozhong, a director of a sub-committee of the China Energy Research Society, who is also the former director of the Northwest China Energy Regulatory Bureau of the National Energy Administration.

The shift in pricing poses a challenge to the willingness of nuclear power companies — which have long benefited from fixed pricing — to embrace change.

Not ready for change

The shift in pricing poses a challenge to the willingness of nuclear power companies — which have long benefited from fixed pricing — to embrace change.

“To introduce nuclear power into the market means the selling price will fluctuate, yet nuclear power companies seek stability,” said an insider from China Southern Power Grid Co. Ltd.

China’s nuclear power plants are operated by four central state-owned enterprises: CGN, SPIC, China National Nuclear Corp. (CNNC) and China Huaneng Group Co. Ltd. (CHNG).

Since 2013, the on-grid price of their electricity for new plants has been anchored at 0.43 RMB per kilowatt-hour (kWh), with adjustments allowed according to the local price of thermal power in the province where the plant is located, according to a document from China’s National Development and Reform Commission.

“Nuclear power suppliers really aren’t that keen to enter the market. They’ll only do so if they don’t have a choice,” said a nuclear power industry insider from Shandong.

Higher costs

Compared with thermal power plants, nuclear ones have operational limits in terms of their ability to adjust their power output to match fluctuations in electricity demand, according to Huang. As a result, they often have to shoulder additional costs for ancillary services to maintain grid stability.

“The ancillary service fees for 2.5 GW of nuclear power units in Shandong can reach tens of millions of RMB per month, which is unaffordable for the businesses,” said the industry insider from Shandong.

The high safety standards are also reflected in higher construction costs, which are unlikely to come down anytime soon, compared with other forms of energy, which are seeing faster declining costs, said Peng Chengyao, director of Greater China power and renewables research and analysis at S&P Global Commodities Insights.

With the introduction of new Generation IV reactors boasting enhanced safety features, the cost of Generation IV nuclear power generation is currently predicted to be around 0.6 RMB/kWh, more than double the cost of third-generation units, which stands at around 0.25 RMB/kWh, one investor in the energy sector told Caixin.

The push is now on from the sector and its political backers to get nuclear energy generated by their plants access to a nascent system of green certificates...

Coal serves as a pivotal reference point for pricing in the electricity market, influencing the pricing of medium and long-term trading contracts for nuclear power.

“If coal prices remain above 800 RMB per ton, nuclear power will be able to maintain its profitability,” said a nuclear power industry insider.

But as China’s electricity market expands and more suppliers and customers engage in trading, the entry of nuclear power into the market is inevitable, the energy sector investor said.

Fingers on the scales

The push is now on from the sector and its political backers to get nuclear energy generated by their plants access to a nascent system of green certificates, incentivising companies to use it and making marketisation more palatable.

Chen Zhen, founder of Sunshine Law Firm, which has long focused on energy and environmental law practice, says that nuclear power should be included in China’s green power system, and take the lead in awarding green power consumption vouchers to nuclear power users and green energy certificates to nuclear energy power generators.

CNNC said in a recent investor briefing that they are actively promoting the bundling of nuclear power with green certificates.

One target is China’s non-ferrous metals sector, a significant polluter. In November 2022, China developed a plan to decarbonise the industry and curb the expansion of energy-intensive metals, advance low-carbon technologies, and promote the use of clean energy alternatives.

The plan states that during the period between 2026 and 2030, more than 30% of total aluminium production will be powered by renewable energy.

Nuclear power has the feature of stably providing large amounts of low-carbon emission electricity, matching the needs of some specific users, like the electrolytic aluminum factories in Guangxi, said S&P’s Peng.

“When thermal power cost rises, nuclear power can ensure these users a longer period of supply agreements [with steady price],” she added.

In Guangxi — China’s sixth largest aluminum-producing province — the local government has said it will further promote the marketisation of electricity trading while also fostering cooperation between nuclear power and electrolytic aluminium plants, Suo Shenjing, deputy director of the Department of Industry and Information Technology of the region said in a report published in November.

Wang Jing contributed to this story.

This article was first published by Caixin Global as “In Depth: China’s Booming Nuclear Sector Lobbies for Green Vouchers to Ensure Profits”. Caixin Global is one of the most respected sources for macroeconomic, financial and business news and information about China.