China’s BRI problem: From builder to debt collector

China has embarked on very rapid and massive overseas lending since 2013, when it launched the Belt and Road Initiative (BRI). But it has now become the world’s largest debt collector for developing countries’ debt repayments. EAI senior research fellow Yu Hong assesses whether China’s shifting role in global lending will undercut the BRI.

The Belt and Road Initiative (BRI), launched in 2013, has positioned China as a central player in global infrastructure financing and development. According to a 2022 report by the World Economic Forum, Chinese enterprises and banking institutions have announced their participation in about 3,800 overseas projects under the BRI since 2013, involving a total investment of US$4.3 trillion towards building roads, railroads, seaports, energy plants and other critical infrastructure sectors.

The Laos–China Railway, the Jakarta–Bandung High-Speed Rail in Indonesia, the Mombasa–Nairobi Standard Gauge Railway in Kenya, the upgrading of Piraeus Port in Greece, and the Lahore Rail Transit Line in Pakistan represent just a few among the hundreds of infrastructure projects completed and now operational under the BRI framework, which gives a glimpse of the initiative’s geopolitical and geoeconomic impact across the world. China’s influence in the region and the world has rapidly increased to accompany its push for BRI implementation.

China’s overseas lending boom under BRI

Since its implementation in 2013, the BRI has formed a key part of China’s global engagement strategy, as assessed in my book Understanding China’s Belt and Road Initiative. As of May 2025, a total of 152 countries have signed up for the initiative. The BRI is critical to China’s foreign trade, outward investment and economic ties with the world.

China’s experience stresses the importance of infrastructure as the foundation for industrial take-off and economic development. If you want to get rich, build roads first, as a Chinese saying goes.

Studies from many multilateral development banks suggest that large infrastructure investment gaps exist in many developing countries. For example, according to the Asian Development Bank’s 2017 forecast of infrastructure investment needs for the Asia-Pacific region, in order to realise their economic growth potential by 2030, the Asia-Pacific countries will need a total investment of US$22.5 trillion in infrastructure development.

With its push for the BRI, China has risen to become the largest bilateral sovereign creditor for developing countries, accounting for over 25% of external bilateral debt in the developing world and more than 50% of external bilateral debt in the world’s poorest and most vulnerable countries as of 2023...

China has embarked on very rapid and massive overseas lending since 2013 when it launched the BRI. It has emerged as a major lender and provided hundreds of billions in loans and credit to the developing world.

The hard truth is that infrastructure financing and development are long-term and costly. For many poor and developing countries, mobilising domestic capital to support the acceleration in infrastructure investment would be challenging given limited fiscal buffers, shallow domestic financial sectors and often a lack of surplus savings. Those BRI countries facing the largest infrastructure gaps also have twin deficits in their fiscal and external accounts and hence will most likely need to import capital to finance significant additional spending.

With its push for the BRI, China has risen to become the largest bilateral sovereign creditor for developing countries, accounting for over 25% of external bilateral debt in the developing world and more than 50% of external bilateral debt in the world’s poorest and most vulnerable countries as of 2023, particularly to the countries in Africa, South Asia, Central Asia and Southeast Asia.

Debt repayments for geostrategic leverage?

For the world’s poorest and most vulnerable nations, China is the largest holder of their external debt. Laos is such a case in point. Laos’ rapid increase in external debt is attributed to the BRI projects such as the Laos–China Railway. According to the China’s Overseas Development Finance Database managed by Boston University’s Global Development Policy Center, China is by far its largest sovereign creditor, with Laos’ debt to China accounting for 50% of its total debts.

This allows China to exert immense influence over these countries’ debt sustainability outlook. Beijing could also use the debt repayments for geostrategic leverage amid the changing global geopolitical environment. The critics argue that there is a significant risk that developing countries may not be able to repay their BRI-related debts. Given their debt obligation to China, these countries must align their foreign policy with Beijing by taking a pro-China stance.

In May 2025, the Lowy Institute, an Australia-based foreign policy think tank, published an analytical report entitled “Peak Repayment: China’s Global Lending”. The report revealed that amid a tidal wave of debt repayments and interest costs to China deriving from bills coming due from its BRI lending boom in the 2010s, China, once the largest source of new finance for the developing world, now becomes the world’s largest debt collector for developing countries’ debt repayments. This transition raises a critical question: will China’s shifting role in global lending undercut the BRI?

According to the report, in 2025, 75 of the world’s poorest and most vulnerable countries will make record high debt repayments to China amounting to US$22 billion.

According to the report, in 2025, 75 of the world’s poorest and most vulnerable countries will make record high debt repayments to China amounting to US$22 billion. The report found that China is expected to be more debt collector than banker to the developing countries for the rest of this decade, as debt servicing costs (repayments and interest) on the BRI-affiliated projects from the 2010s now far outstrip new loan disbursements. It warned that the high debt burden facing the developing countries will slow down their development and hamper poverty reduction while stoking political and social instability risks.

To borrow or not to borrow: BRI’s debt dilemma

China’s outbound investment in BRI countries showed a steady upward trend from 2013 to 2016. However, since 2017, Chinese outward investment has declined overall. This decline is partly attributed to tighter regulations introduced by China’s Ministry of Finance, aimed at addressing debt sustainability concerns in borrowing countries and their ability to repay loans linked to BRI projects.

At the same time, the Chinese economy has experienced a significant slowdown in recent years, which has likely constrained the country’s capacity to maintain the previous pace of overseas lending. The challenging and long-standing structural issues, such as an ageing population, the collapse of the property sector and regional development disparity, mean that China’s economy is now facing significant headwinds.

The Lowy Institute’s study is not the first one to cover the debt issue. In June 2019, a report entitled “China’s Overseas Lending” published by the Kiel Institute for the World Economy found that the low-income countries that have encountered huge debt burdens associated with China’s BRI investment include Laos, Pakistan, Mongolia, Kyrgyzstan and Djibouti. They are struggling to repay external loans and the interest associated with borrowing for infrastructure construction, partially deriving from BRI projects financed by Chinese firms and banks. In 2017, after failing to pay back its debt to China, Sri Lanka had no choice but to relinquish control over its Hambantota Port to the Chinese firms on a 99-year lease. This was widely reported in international media and serves as a cautionary example for other BRI countries aiming to avoid similar outcomes during domestic economic crises.

Given China’s rise as the world’s second largest economy and one of the largest merchandise trading nations, many heavily indebted countries do not want to rock the boat and risk losing access to future Chinese loans, trade and investment promotion opportunities.

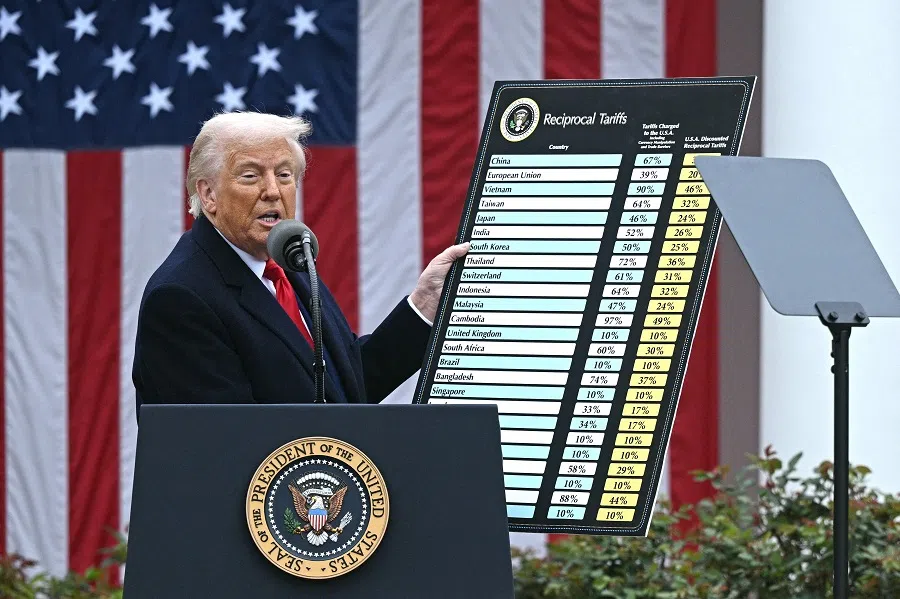

The developing countries also grapple with the impacts of the Russia-Ukraine war, the US’s punitive tariffs, as well as the US’s sharp cuts in its foreign aid budget and development assistance under President Donald Trump. The world’s poorest and most vulnerable countries are caught in a difficult position — turning to Chinese loans for development financing, even as US foreign aid budgets continue to shrink.

Given China’s rise as the world’s second largest economy and one of the largest merchandise trading nations, many heavily indebted countries do not want to rock the boat and risk losing access to future Chinese loans, trade and investment promotion opportunities.

China defends BRI lending practices

In contrast, the Chinese authority argues that multilateral financial institutions and commercial creditors of developed countries are the main sources of debt-servicing stress for developing countries. On 27 May, Chinese foreign ministry spokesperson Mao Ning accused a few countries of spreading the “theory of China’s debt responsibility” and avoiding the mention of multilateral financial institutions and commercial creditors of developed countries, which are the main creditors of developing countries and the source of pressure on debt repayment.

From the Chinese perspective, the BRI is not a charitable programme, and its project financing is based on interest-bearing loans.

She added, “China’s investment and financing cooperation with developing countries follows international practices, market rules and the principle of debt sustainability.” From the Chinese perspective, the BRI is not a charitable programme, and its project financing is based on interest-bearing loans.

Connectivity based on infrastructure financing and development is the central pillar to the BRI. The initiative may have a favorable long-term impact on infrastructure development, industrialisation and economic growth in the BRI countries. According to a 2019 World Bank study entitled “Belt and Road Economics: Opportunities and Risks of Transport Corridors”, BRI transport projects can expand trade, increase foreign investment and reduce poverty by reducing trade costs. If fully implemented, BRI transport projects could increase global trade by 1.7%-6.2% and global real income by 0.7%-2.9%.

In April 2019, after the second BRI Forum for International Cooperation, China’s Ministry of Finance issued the “Debt Sustainability Framework for Participating Countries of the Belt and Road Initiative”, to promote sustainable financing for the socio-economic development of the BRI countries while ensuring debt sustainability. To further outline China’s open position on debt sustainability, the finance ministry issued the “Debt Sustainability Framework for Market Access Countries of the Belt and Road Initiative” in October 2023, after the third BRI forum.

A shift to ‘small but beautiful’ projects

China faces pressure to deepen coordination with multilateral efforts on debt relief. Given its stance as a major sovereign creditor to the developing world, China has to play a part in any multilateral debt coordination and debt and interest relief for the developing countries. Its engagement with the G20 Common Framework and its issuance of debt sustainability guidelines are welcome steps, but a more cooperative approach will be essential for China if it is to remain a credible and important force in global infrastructure financing and development.

China will be emphasising the construction of “small but beautiful” projects in the developing countries as the BRI enters the second decade...

China has committed to providing another 780 billion RMB (or roughly US$107 billion) to fund the BRI for the next five years. China is likely to continue to offer infrastructure development finance to the developing world. China will be emphasising the construction of “small but beautiful” projects in the developing countries as the BRI enters the second decade, in contrast to its focus on building mega infrastructure projects in the first decade. In October 2023, President Xi Jinping’s speech in the third BRI forum emphasised that China will carry out 1,000 small-scale livelihood assistance projects, and enhance vocational education cooperation through Luban Workshops and other initiatives.

The new BRI projects are expected to be more targeted and smaller in scale, with China focusing on quality rather than quantity of BRI projects in its decisions on outbound investment and lending. The next decade of the BRI may look very different from the previous one.

Transparency and multilateral coordination

External development financing is required for cash-strapped countries with underdeveloped infrastructure. The salient question is how to balance infrastructure development needs and domestic financial sustainability in light of the lack of appropriate fiscal frameworks in the poor and developing countries.

Debt sustainability risk is a primary concern for participating countries. According to recent debt sustainability analyses by the World Bank and International Monetary Fund, one-third of low-income developing countries participating in the initiative face a high risk of debt distress. Nearly two-thirds of emerging market economies that have embraced the initiative face rising debt vulnerabilities, which calls for critical scrutiny of countries whose debt exceeds the indicative threshold of 50% of GDP or whose total financing needs exceed 15% of GDP.

It is very difficult to provide a fully comprehensive picture of Chinese overseas lending, largely due to its less-than-transparent practices...

Excessive borrowing could pose a threat to financial sustainability for the borrowing countries. China has yet to publish country or loan-specific data on its foreign lending, in contrast to the practices of the OECD countries. It is very difficult to provide a fully comprehensive picture of Chinese overseas lending, largely due to its less-than-transparent practices, the prevalence of confidentiality clauses built into the loan contracts by the Export-Import Bank of China and the State Development Bank, as well as the hidden debts stemming from Chinese commercial banks.

In order to effectively address the issue of debt sustainability in relation to BRI infrastructure projects, China should address the issues of transparency and lending management. The lack of transparency surrounding the terms and scale of financing for the BRI poses serious risks to borrowing and creditor countries. Debt transparency is essential for borrowers and creditors to make informed decisions, ensure the efficient use of available financing and safeguard debt sustainability, as well as citizens’ ability to hold governments accountable.

Strengthening regulatory enforcement by Chinese authorities could enhance the transparency of overseas lending and improve debt sustainability under the BRI. Adhering to the Belt and Road Debt Sustainability Framework is essential. To ensure the viability of the BRI, China must prioritise sustainable financing for developing countries along BRI routes and mitigate the long-term financial burden of infrastructure-related loans.

Evolving for success

The Chinese lending under the BRI is long term and economic growth-oriented. China does not want to damage its reputation as a reliable development partner for the developing countries. Between 2000 and 2019, China cancelled US$3.4 billion of debt in Africa and further restructured US$15 billion of debt in Africa, with no assets confiscated, according to a 2020 study by the Johns Hopkins China-Africa Studies Initiative.

Nevertheless, there are domestic financial constraints on China’s flexibility in debt reduction. The debt renegotiation and debt reduction associated with the BRI projects could pose a threat to China’s domestic financial stability in terms of the domestic economic slowdown and capital flight.

... the success of the BRI will depend on China’s ability to adapt and readjust by enhancing project transparency, emphasising debt sustainability and embracing multilateral coordination.

In conclusion, China’s shifting role in global lending poses challenges for the BRI. Yet, the initiative remains a vital platform for international infrastructure financing and China’s global outreach. The BRI is also an adaptive policy that requires constant recalibration.

Amid the increasingly geopolitically divided and geoeconomically fragmented world, the success of the BRI will depend on China’s ability to adapt and readjust by enhancing project transparency, emphasising debt sustainability and embracing multilateral coordination.