China's property crisis contagion spreads to state-backed developers

With sluggish sales, a growing list of unfinished projects and mounting debt repayments, China's property crisis, which is stretching into its third year, is now spreading to state-owned developers.

(By Caixin journalists Chen Bo, Wang Juanjuan, Ding Feng and Denise Jia)

Despite China's government throwing just about everything in its policy basket at the real estate crisis, the sector continues to deteriorate, with sluggish sales, a growing list of unfinished projects and mounting debt repayments. Consequently, more developers than ever are on the edge of defaulting on their maturing bonds estimated to be worth over 2 trillion RMB (US$357 billion).

Major developers at risk

Recent revelations indicate that the crisis, which is stretching into its third year, has now spread to state-owned developers, whose deep pockets had largely insulated them from the chaos, as well as some of the largest private developers.

These include some of the biggest names. For instance, earlier this month, state-backed Sino-Ocean Group Holding Ltd. told creditors that it's been working with two major shareholders on its debt load. The nation's second largest developer by sales, China Vanke Co., said that the home market is "worse than expected".

Meanwhile, a key unit of Dalian Wanda Group Co. warned creditors of a funding shortfall of at least US$200 million for bonds coming due. And to cap things off, Country Garden Holdings Co. Ltd., China's largest developer, reported its first annual loss since its Hong Kong IPO in 2007.

These behemoth developers had until recently been viewed by investors as among the few capable of weathering the industrywide debt crisis. More than one institutional investor told Caixin that a default by Country Garden could have repercussions across the nation similar to patient zero China Evergrande Group and completely tank whatever confidence the market has left in the sector.

"It's not just an industry issue now. Other external economic factors have had a strong negative impact on home demand and consumer confidence," said Lin Bo, general manager of research at Shanghai-based property data and analysis provider China Real Estate Information Corp. (CRIC).

"If you want people to buy homes on mortgage, they must establish a relatively strong expectation on future employment and income," Lin said.

Confidence is already hard to come by, for good reason.

Boosting homebuyer confidence

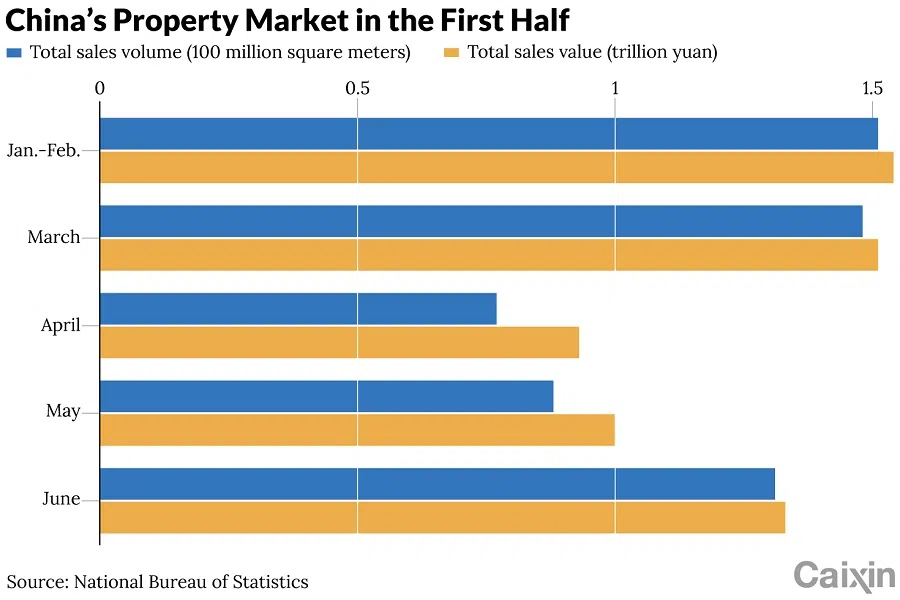

New property sales by China's 100 biggest real estate developers fell 28.1% in June to 526.74 billion RMB, and that was against a low base for comparison a year earlier when pandemic restrictions curbed buying, according to data from CRIC. The data include both new residential housing and commercial properties.

... visits to new projects are about one-third of the average level, and only half of those visits result in sales...

Among the 100 biggest developers, less than 30% - most of them state-owned - reported year-on-year growth in new property sales in June. Twenty-seven companies, mostly private developers, reported declines of more than 50%, the data showed.

In July, the decline accelerated, with almost all developers' monthly sales reaching record lows. A sales executive at a state-owned developer said that the company's sales in July so far were about 40% of the level in April.

Now, visits to new projects are about one-third of the average level, and only half of those visits result in sales, Caixin has learned from industry participants.

Unsurprisingly, the real estate sector declined 1.2% in the second quarter from a year ago, according to a breakdown of the GDP data released by the National Bureau of Statistics (NBS) earlier this month. Slumping property investment was a major drag on China's GDP in the first three months, which grew 6.3% from a year ago - weaker than economists' average forecast of 7%.

The real estate industry, together with its related sectors, account for about 13% to 14% of the economy, according to Kang Yi, director of the NBS.

If the real estate sector risk is not properly resolved, local governments, whose fiscal revenues rely on land sales to developers, could face a sharp decline in revenue and increasing default risks of local government financial vehicles (LGFVs), according to a bond regulator who spoke to Caixin.

More policies and measures have been called for to revive the ailing sector. Governments have repeatedly introduced supportive policies for the housing market since late 2022, including a 10-basis-points rate cut by the central bank in June, but they have failed to stem the bleeding.

Top leaders at a Politburo meeting last week suggested an "adjustment" of property sector policies. The meeting's language on property was a clear shift from the tone previously set for the sector since 2016: houses are for living in, not for speculation.

In a recent meeting with property developers and builders, Minister of Housing and Urban-Rural Development Ni Hong called for more measures to support home purchases, such as relaxing down-payment rules, reducing mortgage rates for first-home buyers, and tax and fee relief for housing upgrades and replacement.

However, many developers and financial industry participants are worried that the demand for housing may be difficult to revive even with further easing policies. Only when the economy improves significantly will confidence in the sector among potential homebuyers return, they said.

Survival of the fittest

Now the market is worried that some of the largest developers may not survive the crisis. Major builders such as Yango Group Co. Ltd., Shanghai Shimao Co. Ltd. and Jinke Property Group Co. Ltd. are among more than ten real estate companies trading on the Shenzhen or Shanghai stock exchanges that are trying to stave off delisting.

Sunac China Holdings Ltd., the country's 11th largest developer by sales value in 2022, along with China Evergrande Group and Yango were the three biggest defaulters for onshore debt in 2022, analysts at GF Securities Co. Ltd. said in a January report. In the offshore market, Sunac and Evergrande were also at the top of the defaulters list.

... this year Chinese developers have defaulted on 212.4 billion RMB of bonds as of June, including deferrals. Meanwhile, they have a total of 2.54 trillion RMB in domestic and offshore debt due within this year...

Restructuring is a potential route out of this mess. But even while bond restructuring by distressed Chinese property developers can buy them some room to normalise operations, most will continue to face repayment difficulties if home sales do not recover for a sustained period, said Fitch Ratings in a report published last week.

"The majority of Chinese developers that defaulted on capital-market debt since [the fourth quarter of 2021] have completed or made material progress on restructuring as of end-May 2023," said Fitch. "However, those workout plans are essentially deferrals of debt repayment rather sustainable and permanent debt restructuring, as the current property market downcycle, which is more severe and enduring than before, has limited developers' options."

According to financial data provider Wind Information Co. Ltd, this year Chinese developers have defaulted on 212.4 billion RMB of bonds as of June, including deferrals. Meanwhile, they have a total of 2.54 trillion RMB in domestic and offshore debt due within this year, according to data from Tianfeng Securities Co. Ltd.

Shifting strategies

The most worrisome is Country Garden. The Foshan-based developer logged a net loss of close to 6.1 billion RMB in 2022, a stark contrast to the previous year's profit of 27 billion RMB.

The developer has so far benefited from efforts by regulators to prop up the property sector. It was among the private developers that have taken advantage of the financing facilities from state-owned lenders, raising nearly 10 billion RMB through direct financing and obtaining credit lines totalling over 300 billion RMB from more than ten banks.

But between 21 and 28 July, Country Garden's domestic and offshore bonds plunged. Some have worried that the developer's cash flow may not be enough to keep it afloat through the summer.

Country Garden rose to be the nation's top developer through its bets on third-and-fourth-tier cities, which contribute about two-thirds of its sales. In March, the developer announced it would shift its investment focus to first-and-second-tier cities as the market in smaller cities has suffered a bigger hit in the downturn.

But the shift won't be easy. Country Garden is facing great pressure to deliver its unfinished projects, mainly because homes in third-and-fourth-tier cities are hard to sell, said an executive at a fixed-income investment fund.

The company was one of the few private developers with a positive cash flow in 2022. As of the end of 2022, Country Garden had 147.55 billion RMB of cash, seemly enough to cover its debt due within a year. It has 3.9 billion RMB of domestic bonds and US$4 billion dollar bonds due this year, according to its annual report.

China has to face the reality that as demographic changes and urbanisation have reached a certain level, housing demand among much of the population in lower-tier cities has been met. - Lu Ting, Chief China economist, Nomura Holdings Inc.

But industry participants said that the company is still coming up short, as most of its cash flow has to be used to deliver unfinished projects. By the end of 2022, Country Garden had total liabilities of 1.23 trillion RMB, according to its annual report.

Country Garden is not the only developer shifting strategy. A marketing executive at a state-owned firm told Caixin that his company has decided to exit from the land parcels it had purchased but yet to pay for in third-and-fourth-tier cities, and redeployed its resources to first-tier cities such as Guangzhou and Shenzhen. Projects in third-and-fourth-tier cities are hard to sell even with deep discounts, according to numerous developers.

Longfor Group Holdings Ltd., one of the private developers in better shape, held an emergency marketing meeting last week and decided to sharply reduce prices and prioritise earning cash, Caixin learned from sources close to the company.

But even with lower prices, homebuyers are keeping their purse strings pulled tight.

China has to face the reality that as demographic changes and urbanisation have reached a certain level, housing demand among much of the population in lower-tier cities has been met, said Lu Ting, chief China economist at Nomura Holdings Inc.

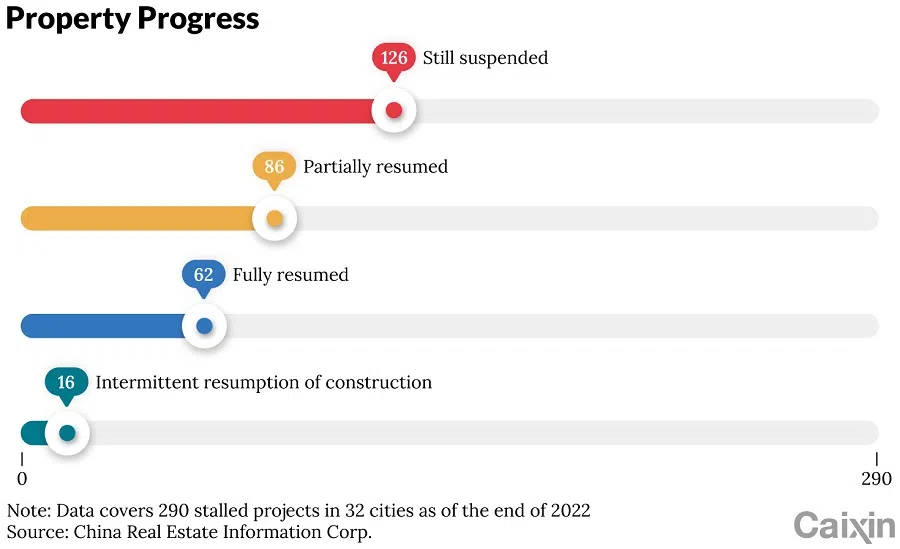

Stalled projects

One of the key supports is helping developers finish stalled pre-sold housing projects, which had sparked mortgage payment boycotts by angry homebuyers last year. The spreading mortgage strike has sparked fears that the crisis will further squeeze Chinese banks, which are already grappling with liquidity stress among developers. The strike also poses a risk to the broader housing market by keeping homebuyers on the sidelines.

In November 2022, the central bank offered 200 billion RMB in special loans from policy banks to help developers complete the construction of unfinished projects. The central government provides interest subsidies of 1% on loans to the policy banks.

The programme, which was originally set to expire at the end of March, will be extended to the end of May next year, Zou Lan, head of the monetary policy department of the People's Bank of China, said at a press conference on 14 July.

Developers across the country delivered 34% of these stalled projects in May, according to a survey of over 1,000 unfinished projects conducted by industry information provider 100njz.com between March and May.

As of June, about 180 billion RMB of the 200 billion-RMB special loans have been issued to developers, with authorities directing policy banks to deploy an additional 150 billion RMB, Caixin has learned.

But these loans are not enough to complete all the unfinished projects across the country. Take Zhengzhou for example. Just 60 of the city's 147 pre-sold unfinished projects have received loans ranging from 10 million RMB to 100 million RMB, Caixin has learned.

If all of these projects cannot be completed and delivered eventually, alternative arrangements will need to be negotiated between developers, creditors, and homebuyers, such as swapping with other properties or refunds...

The loans can only cover the pre-sold parts of the projects, with developers left to find other financing for the construction of the remaining unsold portions, a local developer told Caixin.

Evergrande, which as of September had over 700 unfinished projects across the country, said in March that it needs additional financing of 250 billion RMB to 300 billion RMB to ensure delivery of properties.

If all of these projects cannot be completed and delivered eventually, alternative arrangements will need to be negotiated between developers, creditors, and homebuyers, such as swapping with other properties or refunds, said a person close to the central bank.

Notably, many of the loans have mainly gone to state-owned developers and provide limited help to the more desperate private players. Banks are more willing to provide loans to state-owned developers, including even those with some flaws, said a credit executive at a state-owned large bank.

Banks are cautious as home sales are sluggish and the outlook is unclear, said a branch head of a joint-stock commercial bank.

With the market downturn stretching into its third year, many developers with weak credit ratings have been pushed out of the market, and the survivors are those with better governance and strategic judgement...

It's normal for banks to offer loans to state-owned developers as they have been the major buyers of land in the past year, while most private developers have suspended purchases, said another credit executive at a large state-owned bank. If a private developer has a parcel in a prime location and nearby projects have been selling well, banks would still be willing to lend money to it, the banker said.

With the market downturn stretching into its third year, many developers with weak credit ratings have been pushed out of the market, and the survivors are those with better governance and strategic judgement, said a person close to the central bank. If they can manage to hang on through the difficult times, they may gain a larger market share, he said.

"On the surface, it seems like a crisis, but for the whole real estate industry, it is also an opportunity to transition to a new development model," the person said.

This article was first published by Caixin Global as "Cover Story: China's Property Crisis Contagion Spreads to State-Backed Developers". Caixin Global is one of the most respected sources for macroeconomic, financial and business news and information about China.

Related: China's housing downturn: Household registration reform needed | Shanghai's falling property prices indicate economic gloom in China | Chinese local governments facing debt crisis: Waiting for bailouts | China's property companies going bust may be a common sight in 2023 | China lines up yet more aid for the property sector, but will it be enough? | China's overreliance on land finance could lead to its downfall

![[Big read] When the Arctic opens, what happens to Singapore?](https://cassette.sphdigital.com.sg/image/thinkchina/da65edebca34645c711c55e83e9877109b3c53847ebb1305573974651df1d13a)

![[Video] George Yeo: America’s deep pain — and why China won’t colonise](https://cassette.sphdigital.com.sg/image/thinkchina/15083e45d96c12390bdea6af2daf19fd9fcd875aa44a0f92796f34e3dad561cc)