Chinese pharma turns to global deals to cure capital crunch

The uptick in recent deals and global pharmaceutical giants' growing interests in novel drug development in China has invigorated the industry, yet not without underlying concerns.

(By Caixin journalists Hua Ang, Cheng Xi and Han Wei)

After enduring the chill of a prolonged capital winter, China's drugmakers have begun to feel a thawing breeze.

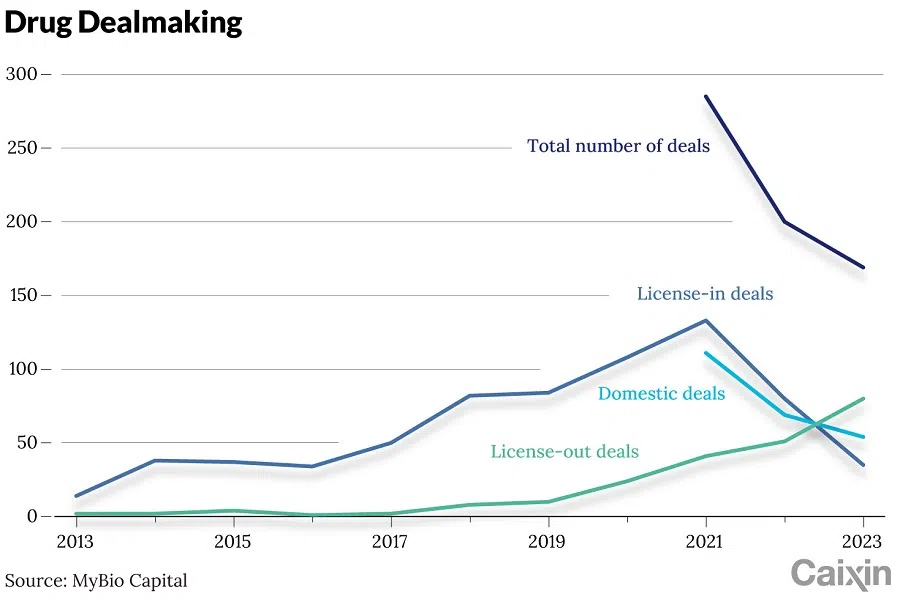

Deal-making has surged in 2024, with the nation's pharmaceutical industry attracting increased attention from international rivals for their innovative treatments. Last year, Chinese drugmakers set a record for new drug out-licencing deals - in which a company allows another party to use its product, technology or intellectual property - and saw the first-ever acquisition of a domestic biotech firm by a multinational pharmaceutical giant.

For the first time, the number of China's outbound deals involving rights for treatments exceeded the number of inbound deals. According to market data, Chinese biopharma companies disclosed over 80 out-licencing deals with international partners in 2023, valued at a record US$45 billion. The growth trend has continued this year, with almost 20 transactions announced in January alone valued at more than US$10 billion, including upfront payments of US$4 billion.

The resurgence comes as China's drugmakers face a sustained investment contraction, mirroring a wider pullback by investors amid the country's stock market slump. Over the past three years, Chinese pharmaceutical shares have lost US$600 billion in market value.

After reaching US$17.2 billion between 2018 and 2019, early-stage venture capital and private equity investment in China's biopharmaceutical sector plummeted to US$4.5 billion between 2022 and September 2023, according to Bi Jingquan, executive vice-chairman of the China Center for International Economic Exchanges.

A squeeze on funding in the capital-intensive biopharmaceutical industry suggests that many manufacturers are under financial pressure. The recent uptick in international licencing deals will not only provide much-needed cash flow for companies to weather the downturn but also serve as endorsements for Chinese-developed treatments, industry sources told Caixin. Increasingly, China's drugmakers are involved in global efforts at developing new medicines through biotech startups and traditional pharmaceutical companies.

"The recent surge in foreign licencing deals by Chinese pharmaceutical companies marks a strategic pivot from developing 'me-too' drugs, which closely mimic existing therapies, to pursuing more distinctive and innovative treatments," said Cai Jiaqiang, co-founder of MediLink Therapeutics.

Already this year, the value of several licencing agreements topped the billion-dollar threshold, accompanied by a wave of biotech mergers and acquisitions.

Currently, of the 13,537 medications in clinical research worldwide, Chinese companies have developed or participated in the development of 4,774 of the therapies, or 35%, second only to the US, according to Bi.

There are growing signs that the global market for innovative drug deals is rebounding. Multinational pharmaceutical companies are intensifying efforts to broaden their product offerings and identify the next breakthrough medications as major economies emerge from the shadows of the Covid-19 pandemic. Already this year, the value of several licencing agreements topped the billion-dollar threshold, accompanied by a wave of biotech mergers and acquisitions.

"The biggest difference between pharmaceutical companies and other manufacturing enterprises lies in the fact that even the best products face patent expiration issues," said Yang Feng, founding partner and CEO of Blue Ocean Capital Group. "Companies must continually work to refine and build their portfolios of innovative products."

The uptick in recent deals and global pharmaceutical giants' growing interests in novel drug development in China has invigorated the industry, yet not without underlying concerns.

Industry investors told Caixin that the recent upswing in China's outbound drug transactions did not happen overnight. Rather, it represents the fruition of several years of diligent strategic development and investment. Bi said the newly launched drugs and out-licencing agreements are primarily the results of venture capital commitments made five years earlier. He cautioned that the sharp drop in investment in recent years may lead to a decline in the production of innovative drugs in the foreseeable future.

Licencing out

Pharmaceutical licencing gives the licencee some or all of the rights to a treatment of the licencor, including the right to develop, promote and sell the product.

In 2023, Chinese pharmaceutical companies signed more than 80 out-licence deals with foreign partners, a record. Of these, nearly 20 transactions were valued at more than US$1 billion each. Data from MyBio Capital showed that the cumulative upfront payment for these transactions reached US$4.63 billion, a four-fold increase from the previous year.

Chinese drugmakers began out-licencing rights to new treatments in 2016. According to data tracker DXY Insight, the number of licencing deals for rights to domestic pharmaceuticals grew to 41 transactions worth a combined US$6.8 billion in 2020, almost ten times that of the previous year. In 2022, 37 licencing agreements were signed at a value of US$23.7 billion.

In one of the biggest deals in 2023, Sichuan-based Biokin Pharmaceutical Co. Ltd. in December licenced Bristol Myers Squibb the rights to develop and market a cancer treatment outside China. The US multinational agreed to pay US$800 million up front and up to US$8.4 billion over the life of the agreement.

That deal covered an antibody-drug conjugate (ADC) that has shown promise against a range of solid tumors, including non-small cell lung cancer and breast cancer. The treatment is in early-stage clinical trials.

ADCs have emerged as a focal point in the global pharmaceutical industry in recent years. These sophisticated therapies differ from traditional chemotherapy by acting more like precision-guided missiles that target cancer cells, potentially minimising collateral damage to healthy cells. Pfizer Inc., Merck & Co. Inc., and AbbVie Inc. have recently announced deals for ADC treatments.

Early-stage products come with greater uncertainties, which often results in more modest licencing fees.

European and US drugmakers are the primary buyers of rights to ADC products in 2022 and 2023, while sellers are equally divided among China, Europe and the US, according to Tang Jun, founding partner of InScienceWeTrust BioAdvisory. Companies in Japan and China have received the largest total in upfront payments, Tang said.

In 2023, more than ten Chinese companies, including Biokin, Hansoh Pharmaceutical Group Co. Ltd. and CSPC Pharmaceutical Group, signed 15 out-licencing deals related to ADC projects with multinationals including Bristol Myers, Pfizer, Merck and AstraZeneca plc.

Most of the 15 ADC out-licencing deals secured by Chinese firms in 2023 featured products in the nascent stages, such as Phase 1 clinical trials. "Multinational pharma companies are capitalising on the financial constraints of Chinese biotechs to strike more economical deals," Cai said.

Early-stage products come with greater uncertainties, which often results in more modest licencing fees. Companies tend to sell rights to these products early on, aiming to generate cash flow amidst a tough capital environment and to reduce their exposure to risk, according to Cai.

Buying Chinese biotech firms

"Compared to licencing deals, mergers and acquisitions are the true barometers of big pharma's strategic plans," Tang said.

In established markets like Europe and the US, biotech startups are increasingly aiming to be acquired by pharmaceutical giants rather than turn to initial public offerings to raise capital or make an exit strategy. In 2023, about 19 biotech firms debuted on the US stock market, a 10% decline from the previous year, according to Fengshuo Venture Capital. They raised a total of US$2.65 billion, up 66% from the previous year, with an average fundraising of US$139 million per company, an 84% increase.

On 26 December, AstraZeneca agreed to buy out China-based clinical-stage biopharmaceutical company Gracell Biotechnologies for US$1.2 billion, marking the first full takeover of a Chinese biotech by a multinational drugmaker.

That same year, almost 40 M&A deals were completed by large drugmakers, at a total value of US$138 billion. Four of the transactions exceeded US$10 billion, and another four ranged from US$5 billion to US$10 billion.

On 26 December, AstraZeneca agreed to buy out China-based clinical-stage biopharmaceutical company Gracell Biotechnologies for US$1.2 billion, marking the first full takeover of a Chinese biotech by a multinational drugmaker. The transaction was completed last week, the British-Swedish acquirer said.

Gracell, which was founded in 2017 and listed on the Nasdaq in 2021, produces cell therapies for cancer and autoimmune diseases. Since its inception, the company has initiated six rounds of financing, raising more than US$200 million in total. As of the end of the third quarter of 2023, Gracell reported US$234 million of cash and marketable securities on its balance sheet.

"This is a very positive signal, as it sets a precedent for a multinational pharmaceutical company fully taking over a Chinese pharmaceutical firm, rather than just selected assets," Liu Dan, a senior partner at Beijing-based CDH Investments, told Caixin.

Ten days after AstraZeneca announced the Gracell deal, Swiss pharmaceutical company Novartis acquired SanReno Therapeutics, a Chinese clinical-stage biotech firm focused on kidney diseases.

Waiting for the spring

The uptick in biotech firms' overseas deals poses a pivotal question: might this trend bolster industry confidence and potentially pull the industry out of the capital winter?

Investors have become more cautious about financing pharmaceutical development in the post-pandemic era as demand for Covid-19 drugs and vaccines has plummeted and economic growth has slowed. In addition, the fundraising plans of Chinese drugmakers have been affected by the government's tightening of IPO rules, a move in a bid to bolster the sagging stock market.

Investor sentiment remains weak. In the fourth quarter of 2023, the CSI Innovative Pharmaceuticals Index - which covers most large and medium-sized biopharma firms - fell 1.96%. For the entire year, the index dropped almost 12%, exceeding the 7% decline for the overall health care sector. The Hang Seng Hong Kong-listed Biotech Index lost 24% of its value.

Few signs of improvement have appeared this year. Liu said conditions in the secondary market will continue to influence the climate for venture capital investments in the pharmaceutical industry in 2024.

While macro-economic conditions, capital markets and interest rates all affect venture capital investment, business performance on the micro-level and whether it can gain recognition from global clients are key issues, Liu said.

The rise of outbound deals will serve as a catalyst for investment sentiment, according to Liu. But the macroeconomic environment and capital market conditions remain uncertain.

Industry insiders have raised concerns that Chinese drugmakers remain at a disadvantage in negotiations with global pharmaceutical giants, often resulting in their assets being undervalued.

Facing a cooling domestic market, Chinese drugmakers are gearing up their quest for overseas opportunities. In the first two weeks of January, Chinese pharmaceutical companies clinched 12 licence-out deals with combined upfront payments of US$330 million and a total transaction value of more than US$9 billion, according to China Merchants Bank Research Institute data.

Industry insiders have raised concerns that Chinese drugmakers remain at a disadvantage in negotiations with global pharmaceutical giants, often resulting in their assets being undervalued.

Some Chinese innovative drug projects have been sold at relatively modest prices, reflecting the firms' constrained cash flow and concerns about losing deals to competitors, said MediLink's Cai.

According to Liu, as Chinese innovative pharmaceutical companies engage more in international transactions, they will gain a better understanding of market dynamics and the valuation of their assets during deal-making discussions.

For drug developers, cash flow generated from overseas deals will offer a lifeline for them to survive the winter. "If one or two projects are sold and we have enough money on hand, we will be able to proceed the remaining projects with promising clinical results and achieve greater value," Cai said.

The growth of overseas deals not only reflects multinational recognition of China's innovative drug research capacity but also steers local biotech firms to refine their focus, said Yang from Blue Ocean. "The combination of research and (overseas) business development will increasingly shape China's biotech industry landscape," Yang said.

This article was first published by Caixin Global as "Cover Story: Chinese Pharma Turns to Global Deals to Cure Capital Crunch". Caixin Global is one of the most respected sources for macroeconomic, financial and business news and information about China.

![[Video] George Yeo: America’s deep pain — and why China won’t colonise](https://cassette.sphdigital.com.sg/image/thinkchina/15083e45d96c12390bdea6af2daf19fd9fcd875aa44a0f92796f34e3dad561cc)

![[Big read] When the Arctic opens, what happens to Singapore?](https://cassette.sphdigital.com.sg/image/thinkchina/da65edebca34645c711c55e83e9877109b3c53847ebb1305573974651df1d13a)