The costly standoff between fragile superpowers

The world has watched the latest US-China framework with cautious hope, says economist Lili Yan Ing. But unless both sides convert it into enforceable commitments — with clear timelines, credible enforcement and real structural progress — this will be, at best, a tactical pause.

Donald Trump has returned to the White House, and so has his aggressive trade stance marked by sweeping tariffs, tighter investment curbs and threats of financial decoupling. Yet despite the tough rhetoric, recent US-China negotiations suggest Beijing may now hold the upper hand in several key areas.

In early June 2025, the US and China reached a provisional trade framework in London, offering what many view as a temporary reprieve. The agreement outlines four key components.

First, the US and China agreed on a calibrated tariff reset. US tariffs on Chinese imports, once peaking at 145%, will be consolidated at 55% — a combination of a 10% base tariff, 20% tied to fentanyl-linked imports and residual layers from earlier rounds. In exchange, China will reduce its retaliatory tariffs from 125% to a uniform 10%.

Second, Beijing has agreed to resume exports of critical rare earth minerals and permanent magnets essential to the US technology and defence sectors. In return, Washington will partially ease export restrictions on civilian-use components, though dual-use items remain off-limits.

... the US continues to raise alarms over China’s limited market access, intellectual property violations, forced technology transfers, digital protectionism and massive state subsidies. These are not technical issues — they are structural.

Third, both sides pledged selective rollbacks of export restrictions for non-sensitive goods and modest gains in people-to-people mobility, including improved re-entry for Chinese and American students. However, core restrictions on AI chips and advanced semiconductors remain untouched.

Fourth, and most tentatively, the deal includes a provisional enforcement mechanism: quarterly compliance reviews and third-party arbitration via a WTO-observed panel. While a step forward, its details remain vague, and its enforceability is uncertain.

Great uncertainty despite temporary reprieve

Despite cautious optimism, the agreement leaves fundamental disputes unresolved. From China’s perspective, US export controls, investment bans, economic coercion and ideologically driven sanctions reflect not just competition, but containment. Meanwhile, the US continues to raise alarms over China’s limited market access, intellectual property violations, forced technology transfers, digital protectionism and massive state subsidies. These are not technical issues — they are structural.

Without credible enforcement and a timeline for deeper progress, this latest accord risks being more of a tactical pause than a durable peace. Indeed, markets and policymakers alike increasingly view the agreement not as a resolution, but as a truce in a longer strategic confrontation.

The challenge for Xi is no less complex than for Trump

First, the political cost of escalation is growing. Trump now stands at a constitutional and political crossroads. Retreating from his tariffs risks validating the “TACO” (Trump always chickens out) narrative, a moniker that taunts both the bravado of his trade crusade and his refusal to face its consequences. But doubling down carries even greater risk: a constitutional defeat that could unravel the legal scaffolding of his economic strategy.

In May 2025, the US Court of International Trade ruled that Trump’s global tariffs violated the International Emergency Economic Powers Act. In a rare and sweeping rebuke, the court struck down the tariffs entirely. As legal appeals proceed and investor confidence wavers, the ruling threatens to reassert institutional checks on executive trade authority — and constrain Trump’s second-term ambitions.

While China has countered US tariffs with calibrated retaliation and deepened ties beyond the West, Xi’s model of state-led growth is showing signs of fatigue.

Xi Jinping, meanwhile, governs with concentrated power and long-term vision. Yet his position is not without strain. While China has countered US tariffs with calibrated retaliation and deepened ties beyond the West, Xi’s model of state-led growth is showing signs of fatigue. Youth unemployment remains stubbornly high. Private investment is tepid. The property sector, once a key driver of growth, is weighed down by debt and oversupply.

Xi’s “dual circulation” strategy — aimed at bolstering domestic resilience and reducing dependence on foreign tech — offers strategic insulation. But absent reforms, it also risks deepening China’s economic insularity. The challenge for Xi is no less complex than for Trump: maintain ideological authority while restoring confidence in a slowing economy.

Economic repercussions widening for the US and China

Second, the economic fallout is spreading. For the US, Trump’s tariffs are proving self-defeating. Designed to protect American producers and confront foreign coercion, they are instead stoking inflation, suppressing business confidence, and straining domestic supply chains.

The Federal Reserve has warned of inflationary flare-ups linked to trade frictions. Farmers, automakers, and electronics firms — heavily reliant on Chinese components — are facing higher input costs and export barriers. Capital inflows are slowing, markets remain volatile and the dollar has weakened against key currencies. As the 2026 midterms loom, growing economic anxiety threatens to erode Trump’s standing in crucial swing states.

The Chinese economy, though more shielded, faces a different set of challenges. Beijing has absorbed much of the tariff pressure through targeted fiscal support and trade diversification. Yet economic headwinds are intensifying. Youth unemployment exceeds 14%, property markets remain fragile, and regulatory tightening has chilled entrepreneurial activity. Foreign firms are reassessing their exposure, citing rising political risk, policy unpredictability and post-Covid scars.

While China’s pivot to self-reliance has borne fruit in areas like electric vehicles and green tech, it has also bred inefficiencies. Household consumption remains subdued, and productivity gains are waning. Unless Beijing shifts gears toward more market-based reforms, its long-term growth potential will continue to narrow.

China’s innovation rise is not guaranteed — but neither is America’s dominance.

Technology battleground comes to the fore

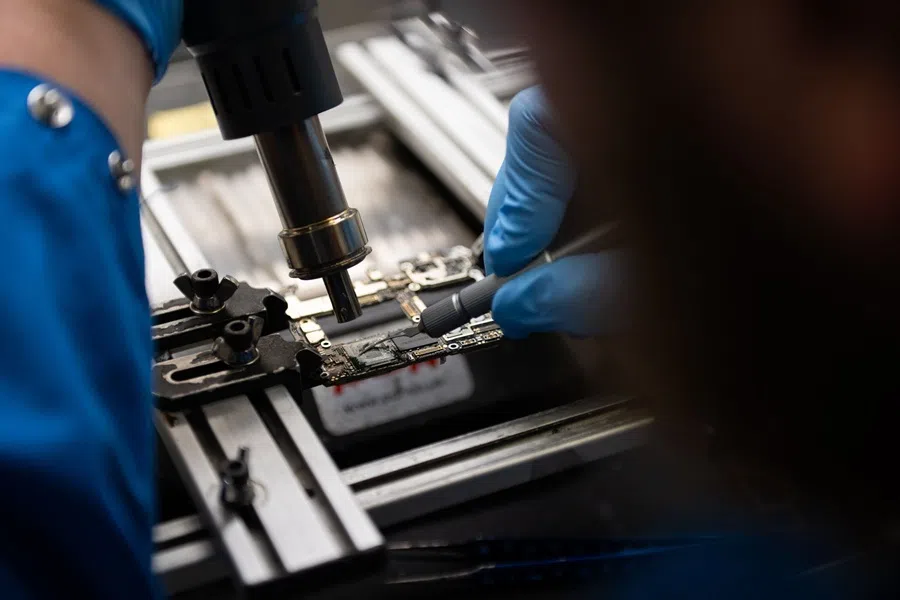

Third, the technological front has become the new fault line. The race for innovation supremacy is now the centrepiece of US-China competition. Washington holds a lead in semiconductors, aerospace, biotech and foundational AI. But its strategy of containment — export bans, blacklists, and investment screenings — has yielded mixed results. While it has slowed Beijing’s access to next-gen chips, it has also turbocharged China’s drive for technological autonomy. The CHIPS Act and IRA have catalysed new manufacturing hubs, but delays and private sector hesitance persist. US tech giants remain caught between national duty and market access, weakening policy coherence.

Beijing, in turn, has massively scaled up state support for strategic tech sectors. Firms like Huawei, BYD and SMIC are no longer imitators — they are innovators. The release of Huawei’s 7nm chip in 2024, despite US sanctions, signalled a new phase in China’s tech ascent.

Simultaneously, China is building alternative digital ecosystems across the global south, positioning itself as the infrastructure provider of choice. Yet risks remain: talent shortages, R&D inefficiencies and Western decoupling continue to hinder progress. China’s innovation rise is not guaranteed — but neither is America’s dominance.

No real winners

In conclusion, the prolonged standoff between the world’s two largest economies threatens to fracture supply chains, inflate costs, depress investment and weaken global growth. In this contest, there are no real winners — neither Trump nor Xi, and certainly not the global economy.

The world cannot afford another lost decade. With global growth slowing, debt burdens rising and geopolitical uncertainty deepening, the return to tariffs and unilateralism could prove catastrophic. The world has watched the latest US-China framework with cautious hope. But unless both sides convert it into enforceable commitments — with clear timelines, credible enforcement and real structural progress — this will be, at best, a tactical pause.

At worst, it may be the calm before another storm.

![[Big read] When the Arctic opens, what happens to Singapore?](https://cassette.sphdigital.com.sg/image/thinkchina/da65edebca34645c711c55e83e9877109b3c53847ebb1305573974651df1d13a)

![[Video] George Yeo: America’s deep pain — and why China won’t colonise](https://cassette.sphdigital.com.sg/image/thinkchina/15083e45d96c12390bdea6af2daf19fd9fcd875aa44a0f92796f34e3dad561cc)