Power, patience and pain: The real game behind the US-China tariff war

The US-China trade war tests resilience. Beijing bets its system can withstand economic pain better than the US. Trump’s tariff retreat amid financial market turmoil suggests China may be right. Economics professor Tan Kong Yam gives his take.

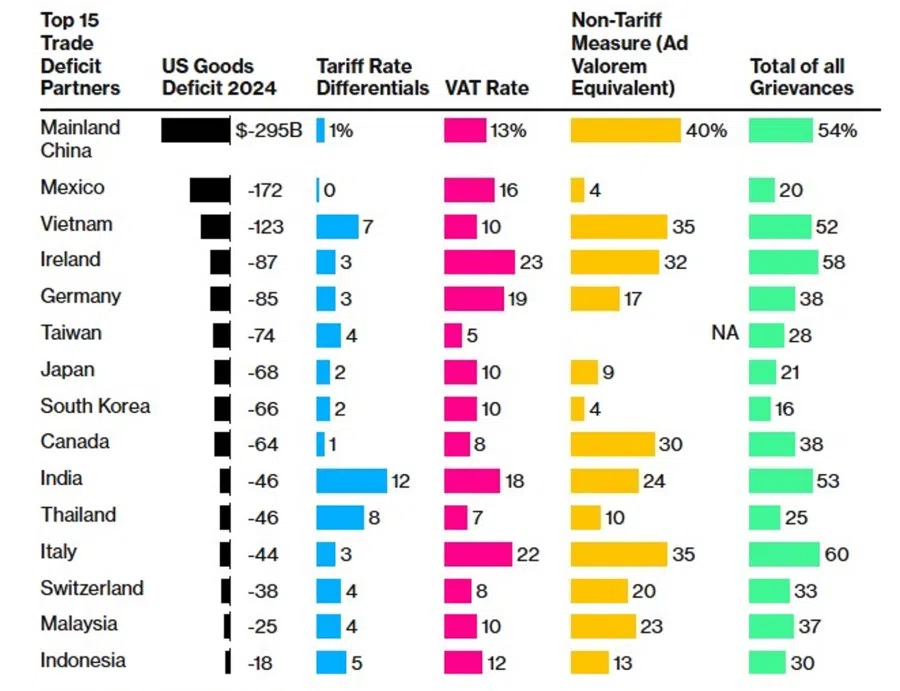

US President Donald Trump declared 2 April 2025 as “Liberation Day” from the White House’s Rose Garden, marking a seismic shift in US trade policy. Following Peter Navarro’s advice, Trump published his framework on the calculation and imposition of what Trump calls “reciprocal tariffs” — perhaps more correctly characterised as an expression of grievances — on all other countries bar a select few, like Russia, as illustrated below.

Much of Trump’s tariffs policy could be attributed to grievances harboured by controversial anti-trade economist and writer Peter Navarro, whom Trump again appointed to his team, as senior counsellor for trade and manufacturing. Navarro was recruited by Jared Kushner during Trump’s 2016 presidential campaign.

The widely reported story is that Trump’s son-in-law found Navarro by searching for books critical of China on Amazon.com, where Kushner came across Navarro’s book Death by China, where he posited his bizarre theories on trade. Impressed by the alignment with Trump’s rhetoric on trade and China, Kushner reached out, and Navarro was soon brought on as an economic adviser.

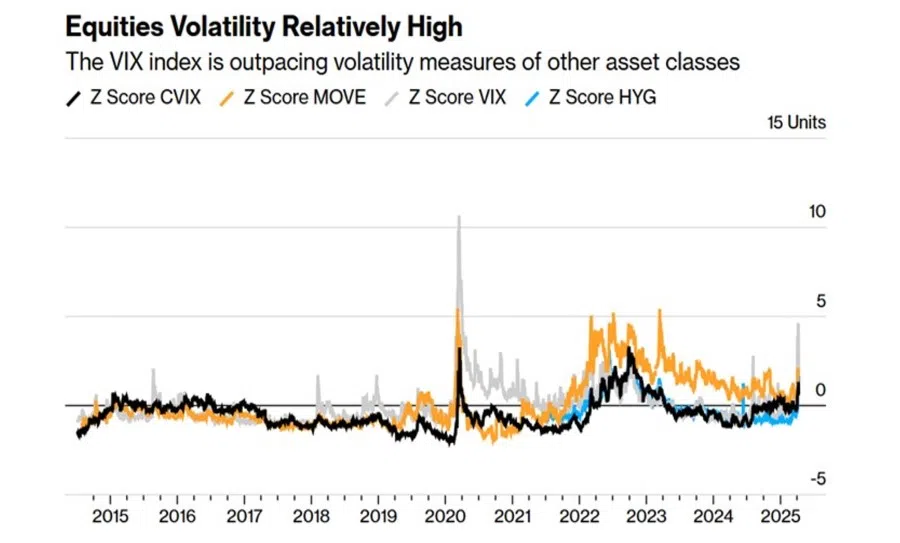

The escalating economic and geopolitical confrontation between the US and China in 2025 reflects a deeper clash of strategic resolve and systemic resilience. Trump’s renewed tariff campaign against the entire world, framed as a strategy to bring home manufacturing jobs, triggered volatility across financial markets, exposed the fragility of the US dollar-based economic system, and reignited fears of inflation and capital flight.

China, rejecting too-little-too-late diplomatic overtures and retaliating with reciprocal tariffs of its own, has positioned itself as a disciplined counterweight — confident in its centralised capacity to sustain the absorption of economic pain and bolstered by the rapid deployment of transformative technologies like DeepSeek.

As both powers confront mounting internal pressures, the standoff increasingly hinges on which society can endure more hardship for a longer period without political rupture. In this titanic clash of resolve, the stakes have surged, setting the stage for a world reshaped along deep strategic fault lines — mirroring a two-sun solar system.

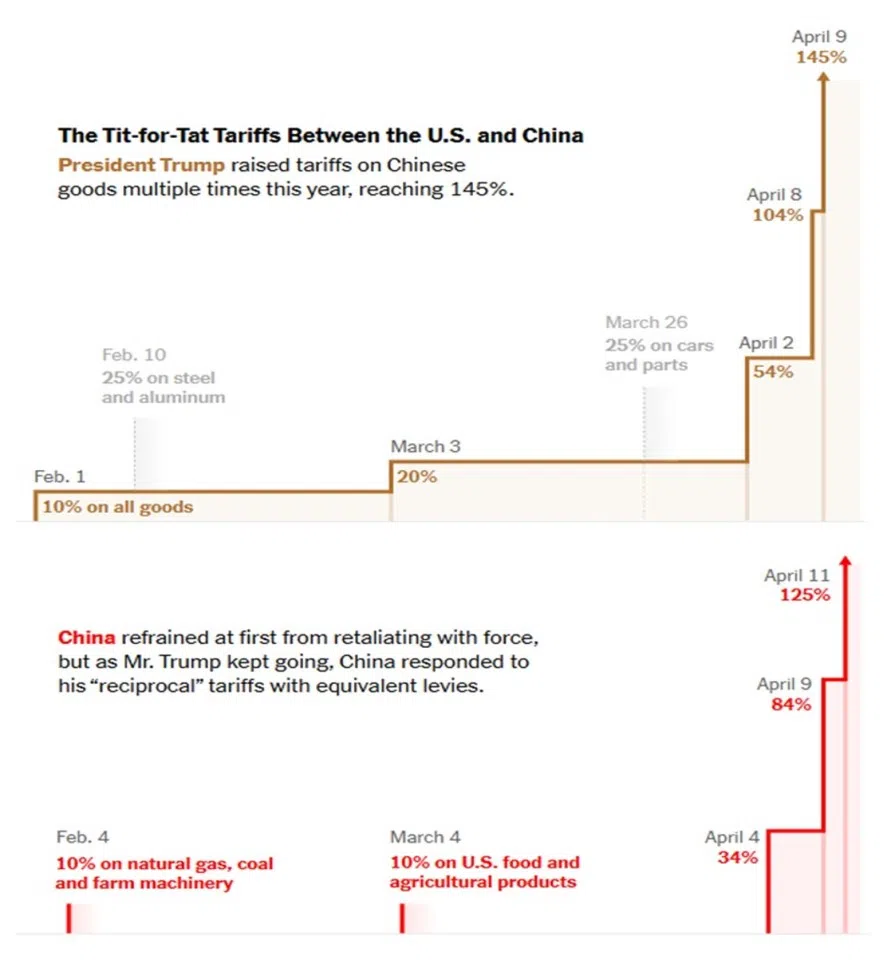

Unlike other countries who tried to plead for their cases by flying to Washington, China retaliated, going toe-to-toe with Trump’s tariffs increases, “mano a mano”.

Trade war backfire: will Trump trigger a crisis?

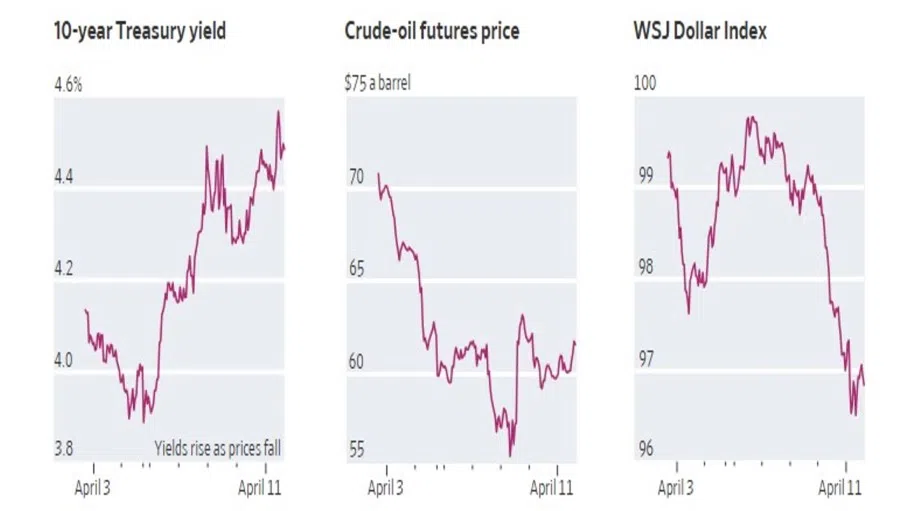

The extensive near-global “reciprocal tariffs” resulted in a spike of the yields of the ten-year US Treasury bills, a stock market crash, a fall in the US dollar, and lower oil prices, signifying a fear of falling global growth. Indices reflecting financial markets volatility all rose substantially in response.

Efforts to reduce the US current account deficit through tariffs and other protectionist measures risk destabilising global capital flows, unsettling asset markets, and exposing vulnerabilities within an increasingly hyper-financialised world economy.

The US current and capital accounts are inherently linked — by definition, the current account plus the capital account must sum to zero. Thus, any reduction in the current account deficit, whether by curbing imports or boosting exports, would necessarily entail a decline in capital inflows unless offset by other mechanisms.

His measures could inadvertently trigger capital flight, expose the fragilities of the dollar-based financial system, and spark the very crisis he seeks to avert — namely, the erosion of industrial strength through a financial market collapse.

In today’s financialised global economy — where financial assets such as stocks, bonds, and derivatives are five to ten times larger than global GDP, and cross-border capital flows far outpace trade flows — even a modest disruption in capital inflows could provoke outsized reactions in asset prices, which are acutely sensitive to interest rates, capital mobility, and investor confidence. Talk of America forcing its allies — especially those reliant on its security umbrella — to swap their treasury holdings for “century bonds” frightened its allies.

If tariff-driven uncertainty or the weaponisation of finance erodes confidence in US macroeconomic management, the dollar’s safe-haven status could weaken, accelerating diversification into alternatives like gold, euro-denominated assets, the renminbi and commodities. These dynamics risk creating policy error loops.

While Trump’s agenda is rooted in the belief that the US has been “cheated” on trade, his measures could inadvertently trigger capital flight, expose the fragilities of the dollar-based financial system, and spark the very crisis he seeks to avert — namely, the erosion of industrial strength through a financial market collapse.

Recent market behaviour underscores these risks: typically, crises see a “flight to safety” into US dollars and US Treasuries, but following a 19% stock market decline since its peak on 19 February, the dollar has instead fallen by 4.5%, and treasury yields have risen, contrary to historical norms. Treasury yields, which usually drop during periods of fear, have increased by 0.25% since early April, signaling underlying stress.

Even Trump himself acknowledged growing financial market unease shortly before pausing his latest round of tariffs. Fiscal vulnerabilities compound these risks, with the US running a US$2 trillion annual budget deficit — around 7% of its GDP —– even as foreigners hold about US$7 trillion in treasury bonds, or a third of publicly held US debt.

Sustained foreign demand for treasuries is crucial: JPMorgan estimates that a mere US$300 billion decline in foreign holdings could raise yields by 0.33 percentage points. Meanwhile, concerns persist that China, if sufficiently provoked, could retaliate by reducing its treasury holdings, although such a move would likely be a last resort. Recent events also challenge the long-standing assumption that the greenback’s reserve currency status immunises it from fiscal-market revolts.

The UK’s 2022 political and economic “mini-budget” crisis, triggered by then Prime Minister Liz Truss’s ill-conceived tax plan that resulted in spiking yields and her resignation, serves as a cautionary tale. Developments over the past few weeks suggest that even the US is not immune to a crippling market backlash when policymakers behave erratically and irresponsibly.

Trade war: denting US consumer confidence, stoking inflation fears

The US consumer sentiment index declined precipitously from 57 in March 2025 to 50.8 in April, reflecting a broad and deepening sense of pessimism across the population. This figure represents the second-lowest reading in the index’s recorded history, only marginally above the all-time low of 50 reached in June 2022, when inflation surged amid Covid-related supply chain disruptions.

The deterioration in sentiment was both bipartisan and widespread, with significant declines observed among Democrats, Republicans, and independents. Sentiment among independents fell to a record low, while Republicans recorded their weakest outlook since late 2020, during the fraught presidential transition from Donald Trump to Joe Biden. Inflation expectations have worsened markedly: consumers now anticipate a 6.7% rise in prices over the next year – the highest one-year inflation expectation since the early 1980s.

Although actual consumer price inflation stood at 2.4% as of March 2025, fears were mounting that tariffs would soon rekindle inflationary pressures. Longer-term inflation expectations had similarly deteriorated, with five-year forecasts rising to 4.4% at the time, up from 3% a year earlier, underscoring a deepening concern about persistent price increases.

Simultaneously, confidence in the labour market is eroding. The proportion of consumers expecting unemployment to rise reached its highest level since 2009, following five consecutive months of increases — a troubling development given that the unemployment rate has remained at or below 4% for over three years.

Although some Trump advisers floated the idea of direct talks with President Xi Jinping’s inner circle — figures such as Cai Qi — Chinese officials declined, wary of the political risks involved.

China’s long vision and counter strategies

Beijing’s early overtures and Washington’s strategic silence

Following Donald Trump’s return to office, Beijing cautiously embraced a spirit of guarded optimism. Despite Trump’s protectionist campaign rhetoric, Chinese leaders hoped that pragmatism and sanity would prevail. President Xi sent Vice-President Han Zheng to attend the inauguration, signalling China’s willingness to reengage. Trump’s inaugural address offered little cause for immediate concern: China was mentioned only once, in passing, regarding the Panama Canal. Moreover, early signals suggested Trump might be amenable to transactional agreements, including increased China imports and investment into the US.

However, Beijing’s overtures were systematically rebuffed. Efforts by Foreign Minister Wang Yi to secure a meeting with then national security adviser Mike Waltz went unanswered, while Ambassador Xie Feng’s attempts to establish informal communication channels with influential Trump confidants, such as Tesla and SpaceX supremo Elon Musk, failed to gain traction. Letters from Commerce Minister Wang Wentao to key US officials were either ignored or redirected to lower-ranking counterparts, signaling a deliberate unwillingness to engage bilaterally.

Notably absent in Trump’s second term is the informal backchannel diplomacy that characterised his first administration, when figures like Kushner facilitated communications with Beijing. The resulting vacuum has been exacerbated by a fundamental mismatch of diplomatic styles: Trump’s preference for personalised, informal diplomacy clashes with Beijing’s reliance on hierarchical, protocol-driven exchanges.

Although some Trump advisers floated the idea of direct talks with President Xi Jinping’s inner circle — figures such as Cai Qi — Chinese officials declined, wary of the political risks involved. Meanwhile, US business leaders who had previously acted as informal bridges between the two capitals have largely disengaged, seeing little advantage in assuming such a role under the current climate.

Substantive negotiations on major points of friction — including tariffs and the future of the wildly popular social media platform TikTok — have failed to materialise. Instead, economic tensions escalated. Trump appeared genuinely surprised by Xi’s readiness to respond decisively; China retaliated with tariffs reaching up to 125% on American imports, demonstrating Beijing’s willingness to engage in a protracted contest.

The Dragon thus identified a critical vulnerability: Trump’s relatively low tolerance for economic and financial instability and a lower threshold for pain.

China’s strategic calculus and narrative framing

Beijing’s response is rooted in a strategic assessment that its authoritarian governance model is better positioned to endure political and economic hardship than the US, where economic disruption tends to rapidly translate into political instability. This theory was tested when financial market turmoil — including a sharp rise in US government bond yields threatening dollar hegemony — prompted Trump to partially retreat. By 12 April, his administration announced exemptions for smartphones, computers, semiconductors and other electronics from certain China tariffs. The Dragon thus identified a critical vulnerability: Trump’s relatively low tolerance for economic and financial instability and a lower threshold for pain.

Within China, a broad consensus has emerged — encompassing both critics and supporters of the government — that the unfolding contest may ultimately hinge on which leader can persuade their citizenry to endure greater hardship for national objectives.

China has strategically positioned itself as a pillar of global stability in contrast to what it characterises as American “unilateral bullying”. Rather than replicating Washington’s military alliances or global footprint, Beijing seeks diplomatic advantage, emphasising trade as a catalyst for global development and reiterating its commitment to respecting national sovereignty. Official narratives highlight China’s support for high-level opening up, adherence to a rules-based international order, and advocacy for multilateral economic governance.

Xi’s assessment is that Trump respects strength and despises weakness — so China must stand firm. China can better absorb economic pain due to its centralised control and greater societal tolerance for hardship.

This “pain point differential” is the cornerstone of China’s current strategy.

Hence, while carefully avoiding general escalation, China has prepared targeted retaliatory measures in sectors such as rare earths, aerospace (Boeing), and agriculture. In the near term, America’s vulnerabilities in financial markets and inflation expectations are viewed as more acute, whereas China’s domestic challenges — rising unemployment, weak exports and sluggish internal demand — are expected to materialise with a longer lag. Domestic policy tools, including interventions by China’s “national team” of state-backed investors, have been deployed to stabilise equity markets and bolster public confidence. In this respect, the Chinese stock market’s low valuation and the US stock market’s high valuation is another factor in China’s favour.

Throughout this confrontation, Beijing insists that it will not be intimidated. Chinese officials reaffirm China’s commitment to mutual benefit, economic globalisation, and the defense of multilateral rules. Simultaneously, Beijing frames the US as a destabilising force undermining international norms, calling on the global community to reject unilateralism and economic nationalism.

Domestically, Chinese messaging aims to reinforce public resilience. Authorities emphasise the economy’s underlying strength, strategic readiness, and the leadership’s ability to navigate external pressures. Xi has personally sought to reassure the nation, invoking the metaphor of China as a vast, resilient ocean:

“China’s economy is a vast ocean, not a small pond. It can endure trade storms and demonstrate to the world the confidence and composure of a nation that embraces all rivers.”

Through this strategic framing, China aspires not only to withstand current challenges but to project itself as a global stabiliser – a steady, enduring presence amid mounting geopolitical and economic turbulence.

If the domestic pressures facing both Washington and Beijing become unbearable, the odds of a compromise would increase.

Structural weaknesses in China

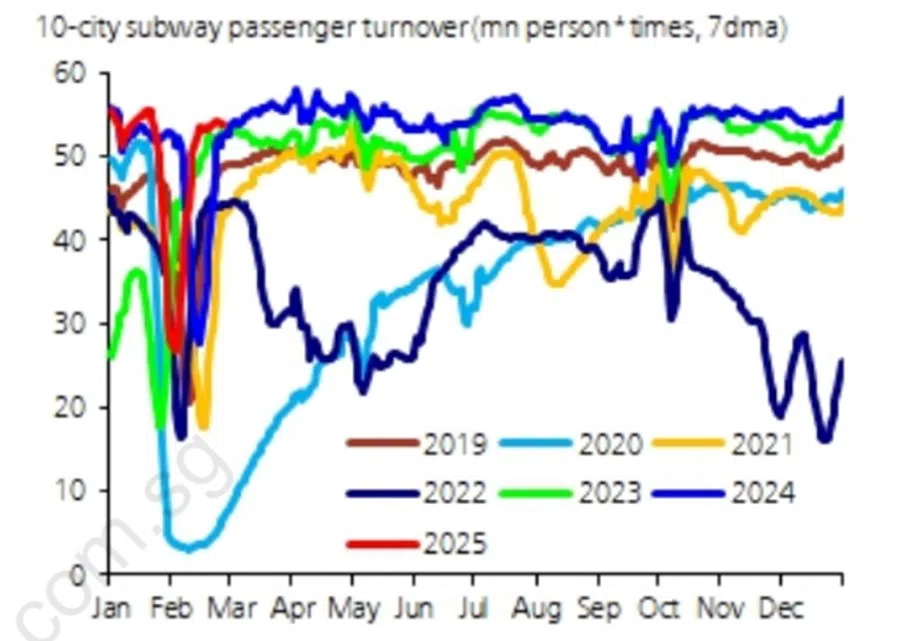

Since Beijing’s policy-induced deflation of China’s real estate bubble in 2020, China’s domestic economy and consumption have been tepid. Its 18-city subway passenger turnover has only just started to recover, reaching only 2023 levels.

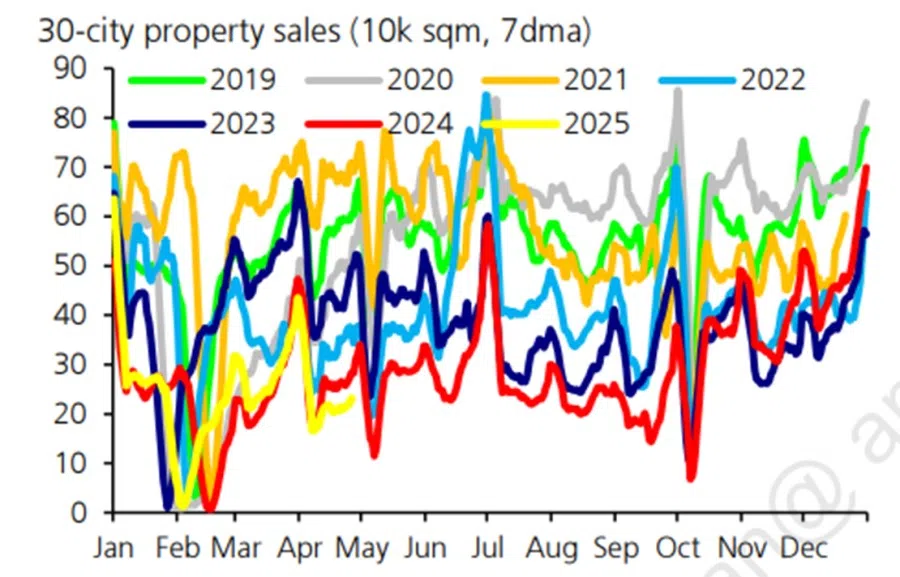

Property sales in 30 cities are still below the year 2019.

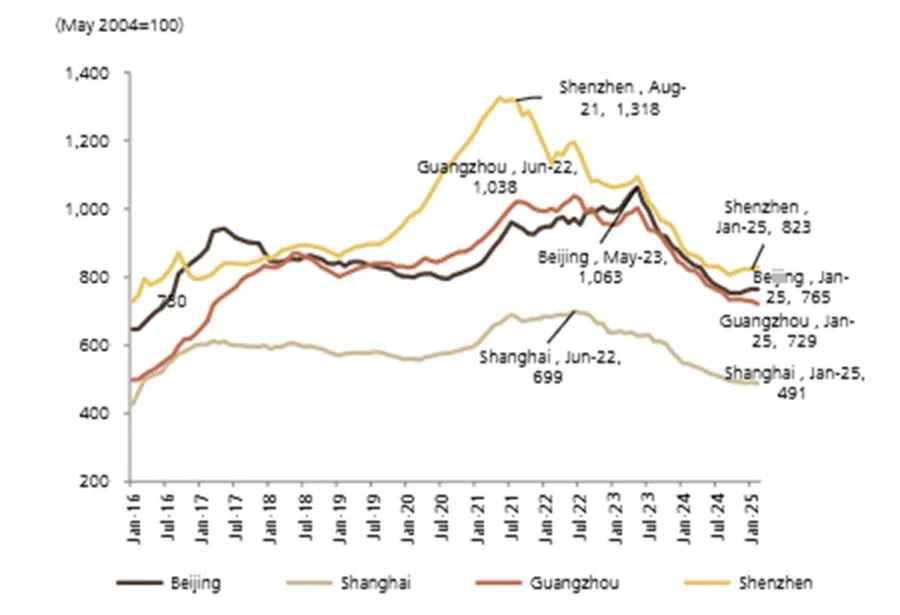

By February 2025, there are some indications that prices for new properties in good locations in Tier-1 cities have been robust, after declines of 30%-45%. On the other hand, property prices in Tier-2 and -3 cities are still weakening.

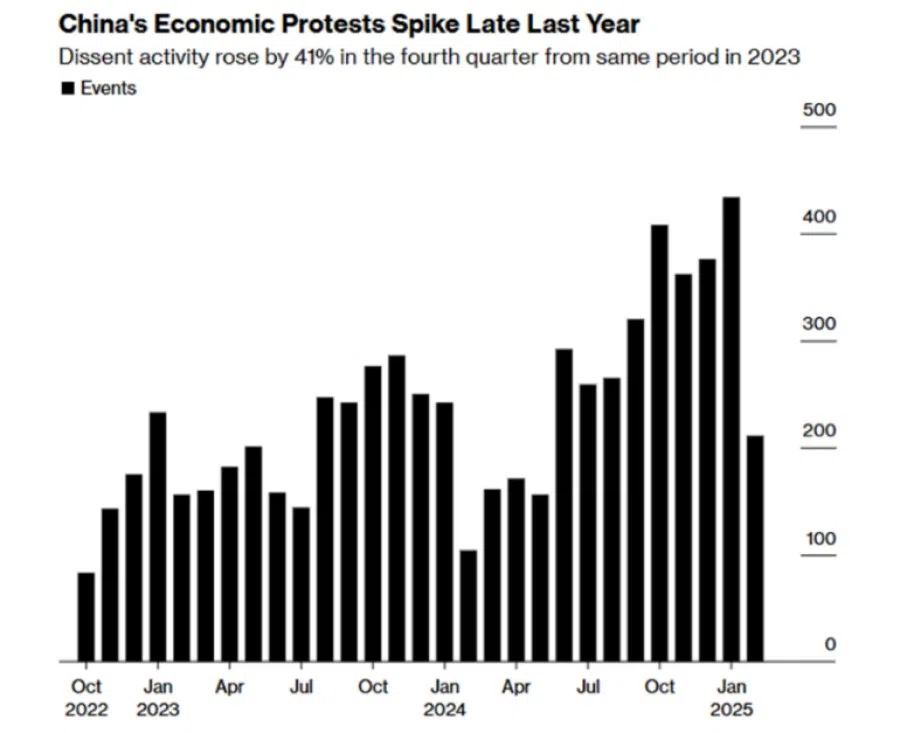

The pressure from unemployment and falling domestic demand have resulted in rising protests since early 2024. It is possible that over the next three to six months, Beijing may face rising pressure from a soft economy and escalating unemployment as well as underemployment, forcing China to compromise with Trump. We see this prospect as remote.

Conclusion and future trends

Building on its experience during the first Trump administration, China has positioned itself for a sustained period of elevated economic and geopolitical tensions.

In response to the renewed imposition of US tariffs, I expect Beijing to intensify domestic stimulus measures, particularly to support small and medium-sized enterprises (SMEs), which are crucial for maintaining employment and social stability. Many more months will likely pass before key economic indicators start to reflect the dissipation of underlying weakness in the Chinese economy.

If the domestic pressures facing both Washington and Beijing become unbearable, the odds of a compromise would increase.

Should inflationary pressures in the US accelerate while growth visibly slows in the coming months, President Trump could encounter significant political challenges in the lead-up to the 2026 midterm elections. Under such pressures, Trump might be the first party to blink.

Be that as it may, the risk premium of US dollar assets has certainly risen quite substantially because of the increased unpredictability of Trump and his policy making. Across the Pacific Ocean, the Chinese stock market — which has been deemed uninvestable — now looks decidedly investable.