Why China will win the tariff war

Thus far, the Trump administration has shown little finesse in trying to get China and other countries to the negotiating table on tariffs. Meanwhile, Trump’s policy incoherence is causing global uncertainty, casting doubt as to whether there is a method to the madness. Malaysian researcher Bunn Nagara shares his observations.

US foreign and trade policies are misaligned. While Donald Trump’s transactional style reflects his background as a lifelong businessman, his policy incoherence bears the mark of an inveterate showman.

Increasingly, ill-conceived premises form the basis of unsound policies. Result: blowbacks and backflips hurting trade partnerships and business confidence everywhere.

At root, Trump has an aberrant understanding of tariffs.

Trump’s disruptive tariffs

When rhetoric transitions into executive orders and meets harsh reality, chaos ensues. There are reasons why sweeping tariffs have been paused for 90 days, exemptions for electronic devices and in part for automobiles have been made, and why the TikTok ban that Trump 1.0 mooted has been delayed for 75 days, twice, and may now be affected by how the tit-for-tat tariffs play out.

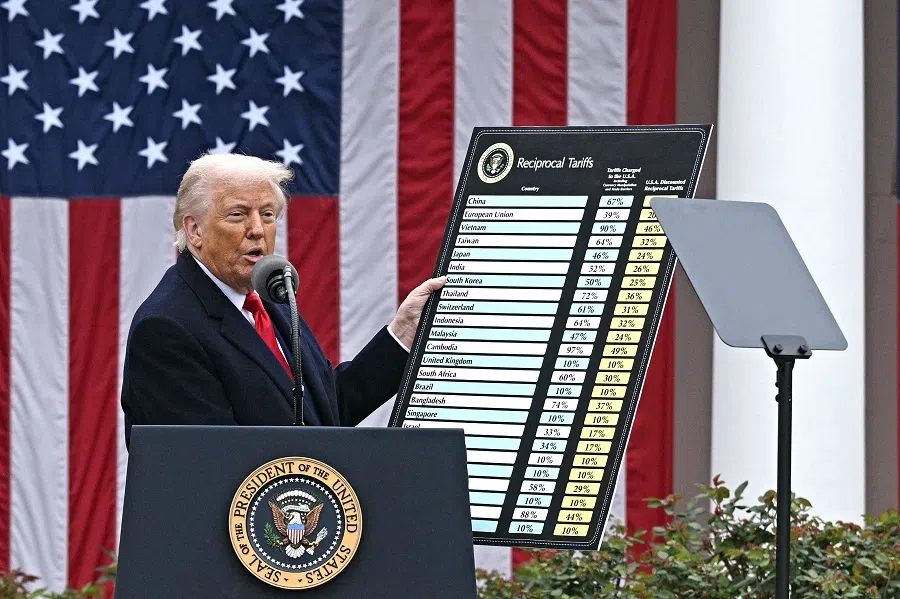

“Reciprocal tariffs” show no reciprocity, punishing imported Japanese automobiles, Singapore’s trade and the poorest Southeast Asian countries without justification. At root, Trump has an aberrant understanding of tariffs. In a viral clip responding to a question by a reporter from The Independent, he stated, “I think tariffs are paid by the (exporting) country.”

This suggests that the tariffs are paid not by consumers or retailers in the importing country, but supposedly by the exporting country’s government. Trump boasts about collecting two billion dollars daily, but both the Treasury and the Customs and Border Protection cite just 11-12% of that. Fawning White House appointees serve as accessories to the delusion, who are only too happy to ride a wonky bandwagon to keep their jobs.

Reducing manufacturing jobs in China does not amount to creating new jobs in the US.

Not a zero-sum game

Meanwhile, China is ostensibly the main target of these tantrums, but may actually be the prime beneficiary of Washington’s Cultural Revolution. The only reciprocal tariffs are tit-for-tat import taxes that the US and China piled on each other, as Washington persists in penalising its own companies and citizens for consuming imports.

This policy psychosis stems from a skewed zero-sum presumption in relations with China. If it looks or sounds like it’s hurting China, then it must be good for the US.

But reality rejects such simplistic equations. Reducing manufacturing jobs in China does not amount to creating new jobs in the US.

At the same time, Trump is unaware that China has more options in trade partnerships and enjoys a bigger slice of global markets. He thinks China has no alternative to the US market.

Overall, US dependence on China is more consequential.

But how significant has US-China trade become anyway? In 2023, China’s exports to the US formed only 2.9% of its GDP and as imports, just 1.5% of the US GDP.

Overall, US dependence on China is more consequential. China supplies 70% of rare earths globally, more than 90% of metals like yttrium and processes 98% of graphite.

Much the same applies to US pharmaceutical requirements, like generic antiviral and antibiotic medications. The US needs to import 83% of its top 100 prescribed generics, with China supplying 91% of hydrocortisone and 95% of ibuprofen, among others.

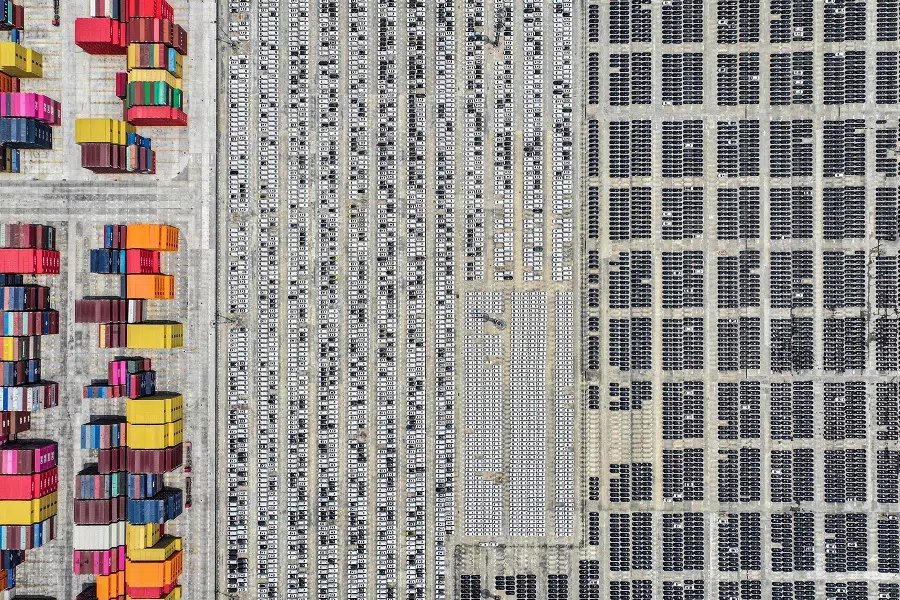

In the last two decades, China has been closing the gap with the US as the world’s biggest consumer market in purchasing power parity (PPP) terms. It displaced the US as Japan’s main trading partner in 2004, then Africa’s in 2009, Saudi Arabia’s in 2011 and the EU’s in 2020.

In 2013, the World Bank ranked China’s economy the biggest in PPP, while China also displaced the US as the largest trading nation. China trades with more than 200 countries and territories, enjoys surpluses with over 170 of them, and is the main trade partner for some 140.

China holds the largest forex reserves at more than 15 times US reserves, while leading the world in 57 of 64 critical technologies. China has beaten the US in filing the most patent applications, having the most top-notch scientific research institutions, and graduating the most STEM professionals.

Vice-President JD Vance’s dismissal of loans from Chinese “peasants” is particularly perverse. Advances in mechanisation and digitisation have made agricultural drones most prevalent on Chinese farms, while Chinese factories are the most advanced in industrial robotics.

China’s inroads into ASEAN markets

US commentator Bill O’Reilly’s smirk that ASEAN countries like Malaysia cannot afford Chinese goods exemplifies surreal ignorance. China has been Malaysia’s largest trading partner for 16 consecutive years, and counting.

ASEAN became China’s biggest trading partner in 2020, and from 2023 displaced the US as China’s biggest export market. The ASEAN-China Free Trade Agreement implemented in 2010 is being upgraded again, while the ASEAN-led Regional Comprehensive Economic Partnership including China matures.

More ASEAN countries are preparing to join BRICS after Indonesia’s full membership in January. They are in-principle supportive of China’s bid to join the Comprehensive and Progressive Trans-Pacific Partnership, a process the US abandoned besides squandering the opportunity to join the China-led Belt and Road Initiative.

Southeast Asia’s robust China trade, now nudging 2,000 years, is newly motivated to expand exponentially. Meanwhile as the US shrinks from globalisation, foreign investment funds flood Hong Kong and China’s mainland.

The weakest link in the tariffs chain is its shelf-life: this is just a temporary bargaining ploy, principally against China.

US scoring several own goals

Trump’s tariffs are another faux pas energising US allies, partners and competitors to organise a defensive resistance. As ASEAN countries regroup, Northeast Asia re-engages within, and Europe warms towards China, more countries revitalise multilateral institutional hedging against US economic hegemony for the longer term.

The tariffs are half of what unnerves global markets, while the other half is taking them too seriously. The weakest link in the tariffs chain is its shelf-life: this is just a temporary bargaining ploy, principally against China.

Trump 1.0’s 2018 tariffs on China are instructive: they got enough of Beijing’s attention to produce the January 2020 phase one deal, but as former US national security adviser John Bolton indicated, they were not meant to last. Now that Trump needs a bigger deal with China, the tariffs likewise represent bigger stakes but need not last any longer.

Tariffs can be leveraged in a deal, but they are also a destabilising element before any agreement. To be an effective bargaining tactic, tariffs have to look tough and sound mean.

It’s about bulking-up before the weigh-in, as the contenders square up against each other exchanging taunts. The match is the final dealmaking.

Since China is better placed as a world trader and a US supplier, it weighs in with a weight advantage and a better reach. Predictable outcomes out of this situation include a steadfast China and an unpredictable Washington’s series of policy rollbacks.

In the process, the US is profusely bleeding soft power as well.