The future of the US-China tariff war

Following the punitive tariffs between the US and China, a truce was reached in Geneva in May. However, how will things pan out, and what might be the end result? Japanese academic Toshiya Tsugami takes us through the possible developments.

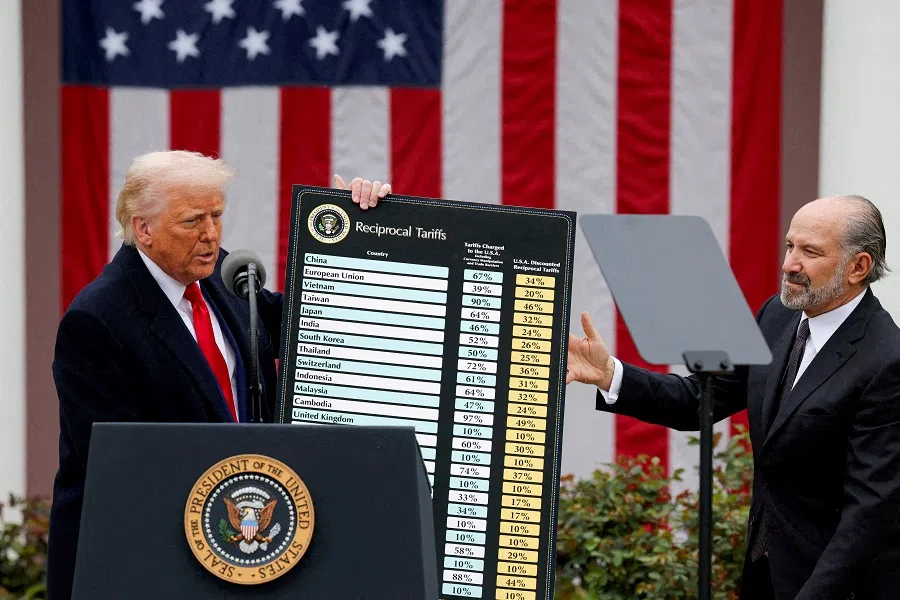

The tariff war between the US and China once escalated to the point where punitive tariffs of over 100% were imposed on each other’s goods. However, on 12 May, the two countries announced a significant reduction agreement in Geneva, entering into a temporary truce.

The general view is that US President Donald Trump misread the situation and did not expect China to fight back. This view is accompanied by the explanation that there was an asymmetry between the democratic US and authoritarian China. Americans will criticise Trump when everyday items disappear from store shelves and prices rise as a result of the tariff war. In contrast, the people of China, a communist dictatorship, cannot protest if exports to the US stop and companies go bankrupt.

I believe that there is another asymmetry, concerning whether people support each government’s stance.

... most Chinese people believe that they must not succumb to Trump’s threats, otherwise they will suffer even more, and they support the government’s policy of resistance.

Different reactions

If the tariff war damages the US economy, the public will criticise the government, as described above. Conversely, the Chinese public has long been taught that since the 19th century, China has suffered from colonial policies of Western powers and Japanese aggression, persistently resisting external pressures and ultimately achieving victory. There is also a strong narrative that giving in to foreign pressure is an act of a traitor.

As a result, most Chinese people believe that they must not succumb to Trump’s threats, otherwise they will suffer even more, and they support the government’s policy of resistance. In other words, China was able to adopt a hardline stance not only because it suppressed public opposition through authoritarian power.

China was not entirely committed to total resistance. China’s position has always been consistent: If it is a fight, they will see it to the end; if it is a talk, the door is open. In other words, China has employed a dual “hard and soft” stance, as evident in the Geneva truce agreement. China had previously argued that it would not negotiate under the threat of unilateral tariff increases, but still entered into negotiations even though the unilateral imposition of 20% tariffs due to the influx of fentanyl raw materials had not been lifted.

The backdrop to this is the current economic difficulty in China, which relies heavily on robust exports. Disruptions to exports to the US, China’s largest export destination, would cause enormous damage. Furthermore, China likely believes that if it were to launch a full-scale resistance and completely ruin Trump’s reputation, Trump would do everything in his power to get revenge.

Agreement, then what?

Although the 12 May announcement temporarily reassured the world, the future remains uncertain. There is only a month left to the 90-day grace period announced on 9 April, until the next negotiation deadline on 9 July. Furthermore, it will be challenging for China to offer meaningful concessions that would save Trump’s face.

In its first term, the Trump administration won a phase one economic and trade agreement in 2019, in which China promised to increase imports significantly. However, it will be difficult for China to make a similarly bold promise in the current climate of sluggish domestic demand.

Chinese companies could pledge to increase their direct investment in the US. However, the US will likely reject China’s offer due to security concerns.

There will be strong resistance to any exchange rate adjustment within the Chinese communist regime and among the Chinese people, who are worried that China will repeat Japan’s mistakes.

In theory, China could also agree to raise the renminbi’s exchange rate against the dollar to reduce the trade deficit. However, in China, there is a strong belief that the US set up the Plaza Accord of 1985 to prevent Japan’s rise, and Japan got caught in the trap and fell into a decline known as the “lost two decades”. There will be strong resistance to any exchange rate adjustment within the Chinese communist regime and among the Chinese people, who are worried that China will repeat Japan’s mistakes.

Even if the negotiations fail, it will be difficult to wield the cudgel of raising tariffs on China again, which is a major disadvantage for Trump.

Does Trump have any options left? One option would be to try to compensate for the lack of results with China by increasing pressure on the EU and Japan with reciprocal tariffs. This is something Japan would never welcome.

Trump’s miscalculations

Trump misread China’s reaction. More significantly, however, he misread the reaction of US financial markets. The markets’ response to the policy of reciprocal tariffs, which overturns the free trade system, and in particular the tariff war that could disrupt the massive US-China trade, was a triple sell-off and simultaneous decline in stocks, bonds, and the US dollar. In particular, Trump did not anticipate that the creditworthiness of US Treasury bonds would be questioned, which would influence overall US interest rates.

The biggest reason why Trump could no longer maintain a tough stance against China was the confusion in the financial markets. If he raises the cudgel of tariffs again, the same thing will happen again.

Does Trump have any options left? One option would be to try to compensate for the lack of results with China by increasing pressure on the EU and Japan with reciprocal tariffs. This is something Japan would never welcome.

... a transaction that involves changing the type of US government bonds held by a foreign government could lead to a substantial amount of US foreign debt forgiveness. US experts oppose this as well, arguing that it would undermine the dollar’s credibility.

Another concern for me is a potentially dangerous idea, referred to as the “Mar-a-Lago Accord”. Many people assume that the name refers to a repeat of the Plaza Accord of 1985, but that is probably not the case. The hidden aim is to “persuade” foreign governments to replace the short-term US government bonds held in their foreign currency reserves with long-term zero-coupon bonds, which have a smaller redemption burden. The Trump administration liked this idea and promoted its creator, Stephen Miran, to a cabinet-level position.

Depending on how it is executed, a transaction that involves changing the type of US government bonds held by a foreign government could lead to a substantial amount of US foreign debt forgiveness. US experts oppose this as well, arguing that it would undermine the dollar’s credibility.

China would never agree to such a deal if the US forced it upon them unilaterally. However, they might consider it if they get something in return. When that happens, will the deal be purely about economics? After all, outside of econmics, China has one primary goal that it has long sought to achieve.

![[Big read] When the Arctic opens, what happens to Singapore?](https://cassette.sphdigital.com.sg/image/thinkchina/da65edebca34645c711c55e83e9877109b3c53847ebb1305573974651df1d13a)

![[Video] George Yeo: America’s deep pain — and why China won’t colonise](https://cassette.sphdigital.com.sg/image/thinkchina/15083e45d96c12390bdea6af2daf19fd9fcd875aa44a0f92796f34e3dad561cc)