How BYD became the leading EV brand in Southeast Asia

The Chinese EV company BYD, after overtaking Tesla in selling more EVs in 2024, has ascended to the pole position in global green mobility. How did BYD rise so fast from a budding battery maker? And how did BYD expand its overseas markets? BYD senior specialist Huang Jiayi and US academic Chen Xiangming examine BYD’s success over the past three decades, with a focus on its footprint in Southeast Asia.

BYD’s rise to global prominence begins and ends with its founder and current president, Wang Chuanfu, who has leveraged China’s integration into global supply chains in the 1990s, the rapid growth of China’s automotive market in the 21st century and the electrification of the global automotive industry in recent years.

A humble start along an audacious journey

A battery expert, Wang Chuanfu, founded BYD in Shenzhen in 1995. BYD leveraged China’s abundant, low-cost labour to mass-produce nickel and lithium-ion batteries at a significantly lower cost than its foreign counterparts. This distinctive strength enabled BYD to supply Motorola in 2000, and then Nokia in 2002, when its IPO was listed on the Hong Kong Stock Exchange.

BYD entered car manufacturing in 2003 by acquiring Qinchuan Automobile Company. Wang believed that mastering internal combustion engine (ICE) vehicle technology through vertical integration would provide crucial insights into the automotive supply chain. According to Li Yunfei, BYD’s branding and PR general manager, vertical integration allows BYD to develop comprehensive solutions, rather than relying on external suppliers who prioritise their own profitability.

BYD produced its first ICE vehicle model in 2005 and its first battery electric vehicle (BEV) model in 2009. It launched F3DM (dual modes) in 2008 and became the world’s first company to sell plug-in hybrid electric vehicles (PHEV).

This commitment continues, with BYD investing 54.2 billion RMB in R&D in 2024. Supporting this effort is a global workforce of nearly one million, including over 120,000 R&D personnel.

In 2008, Wang strategically positioned BYD to develop commercial electric vehicles, viewing it as a key strategy in consumer education. By 2015, BYD’s K9 electric buses and e6 electric taxis were operating in over 190 cities across 43 countries.

This early investment paid off handsomely: BYD’s revenue soared to 424.1 billion RMB (US$59.16 billion) in 2022, earning it a spot on the Fortune Global 500, and continued its ascent to 777.1 billion RMB in 2024. BYD sold 4.25 million passenger vehicles in 2024, with over 417,000 sold overseas, and established over 40 international branch offices, reaching over 100 countries and regions.

Wang has been instrumental in shaping BYD’s technological core, prioritising long-term vision over short-term profits. In 2019, he spearheaded an 8.4 billion RMB R&D investment, despite a net profit of only 1.6 billion RMB.

As Li Yunfei notes, “Wang deeply understands BYD’s cutting-edge technologies. He knows how and when current bottlenecks will be solved. This technological expertise has helped BYD develop its long-term vision and strategy. In fact, over 80% of Wang’s meetings focus on technologies.”

This commitment continues, with BYD investing 54.2 billion RMB in R&D in 2024. Supporting this effort is a global workforce of nearly one million, including over 120,000 R&D personnel.

BYD’s expansion in Southeast Asia

BYD has swiftly expanded into Southeast Asia, strategically prioritising Thailand as a key manufacturing hub in response to growing regional demand. The company officially entered the Thai market in August 2022 and, just a month later, invested US$490 million to acquire land for a new passenger vehicle plant in Rayong province.

For the first five months of 2025, the number of newly registered BYD cars in Singapore reached 3,827, making up 19.8% of all new car registrations.

Construction of the factory began in March 2023 and was completed in just 16 months. By July 2024, the plant became operational, with an annual production capacity of 150,000 vehicles and the potential to create 10,000 jobs. This facility not only supports BYD’s regional growth but also brings substantial investment, employment opportunities, and technological development to Thailand.

BYD chose to establish its factory in Thailand for three key reasons. First, Thailand’s strategic location makes it a major transportation hub in Southeast Asia. Second, the country’s status as a regional automotive manufacturing and export center offers a well-developed infrastructure and supplier network. Third, the ASEAN market presents significant growth potential, with a population of over 600 million. From its Thailand base, BYD is well-positioned to meet the needs of ASEAN consumers and accelerate electric vehicle adoption across the region.

Rapid growth through diversification and localisation

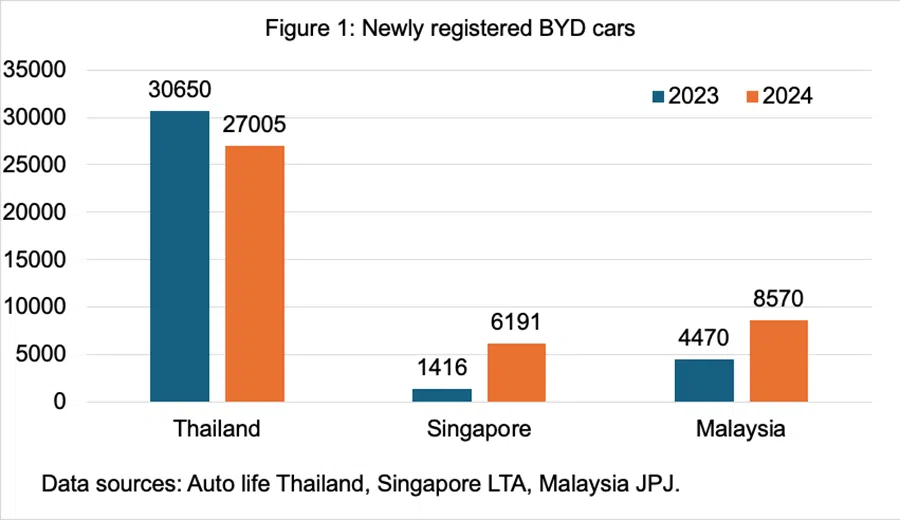

BYD’s projected regional sales proved accurate, with newly registered BYD cars experiencing rapid growth in two of the three major Southeast Asian markets over the past two years.

In Thailand, BYD made up 40% and 38.5% of new EV registrations in 2023 and 2024, respectively. New registrations of BYD cars in Singapore quadrupled from 2023 to 2024, when BYD made up 14% of Singapore’s new car registrations. For the first five months of 2025, the number of newly registered BYD cars in Singapore reached 3,827, making up 19.8% of all new car registrations. In Malaysia, BYD was the bestselling EV brand in 2024.

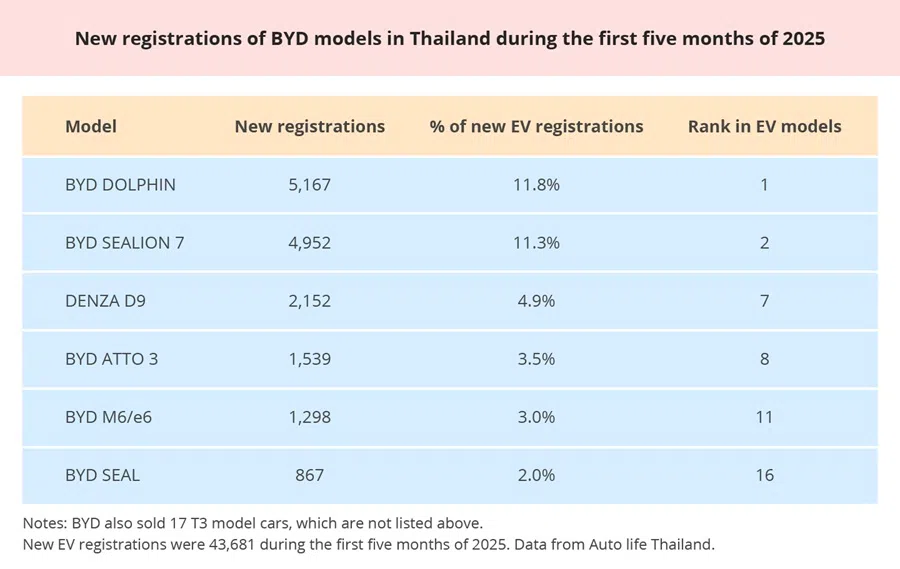

To meet diverse consumer demands in Southeast Asia, BYD offers a range of models. The first vehicle produced at its Thailand factory was the BYD DOLPHIN, a compact BEV. In Thailand, BYD’s ATTO 3 BEV model derives its name from “attosecond”, an extremely short unit of time in physics, symbolising BYD’s pursuit of automotive excellence.

In Thailand, BYD launched SEALION 7 (SUV) and DENZA D9 (premium MPV) in late 2024. Both models made up 11% and 4.9% of new EV registrations in Thailand in the first five months of 2025, while DOLPHIN and SEALION 7 were the bestselling EV models.

Beyond EV production in Cambodia, BYD is collaborating with the Cambodian government to develop a robust EV charging infrastructure and to train technical personnel.

BYD’s expansion into Southeast Asia has advanced its globalisation strategy while supporting the region’s green transition and the development of a robust automotive supply chain. The company exports mature, environmentally friendly technologies to its Thailand factory, which covers all four key stages of automotive manufacturing: stamping, body-in-white, painting and final assembly.

The facility also produces auto parts and features a highly automated, flexible assembly line capable of handling multiple vehicle models. In addition, the factory offers comprehensive training programmes to enhance both the technical and administrative skills of its workforce.

Beyond Thailand

With its Thailand factory now established as a major EV production hub for Southeast Asia, BYD has continued to expand its regional presence through additional local manufacturing and sales outlets.

In April 2025, BYD broke ground for a new factory in the city of Sihanoukville, Cambodia. Covering 12 hectares and scheduled to be operational in the fourth quarter of 2025, this factory is capitalised at US$32 million and capable of producing 10,000 new energy vehicles every year.

Beyond EV production in Cambodia, BYD is collaborating with the Cambodian government to develop a robust EV charging infrastructure and to train technical personnel. This initiative aims to localise the new energy vehicle industry, fostering technology transfer and boosting local employment.

BYD’s EV sales in Cambodia will benefit from the recently operational highways linking Phnom Penh and Sihanoukville and beyond, built by China.

In the meantime, orders for BYD cars in Cambodia rose by 521% in the first quarter of 2025. At Cambodia’s largest Auto Expo held on 1-2 March 2025, BYD accounted for 24% of all new car orders, leading all automotive brands.

In addition, BYD plans to open ten brand dealerships — including showrooms — across the region, featuring a flagship location in Cambodia that will become the country’s largest car dealership, spanning 15,000 square metres. By happy coincidence, BYD’s EV sales in Cambodia will benefit from the recently operational highways linking Phnom Penh and Sihanoukville and beyond, built by China.

In Laos, where consumers mostly use motorcycles and light trucks for mobility and transport due to relatively poor road conditions, BYD has begun to make some inroads, as exemplified by its dealership prominently located in the CBD of Vientiane.

Thailand’s longstanding automotive manufacturing tradition, established decades ago with the arrival of Japanese carmakers like Toyota, makes it an attractive host for BYD’s major production base, while Cambodia is a relative newcomer to the industry.

BYD’s rapid expansion in Southeast Asia is an integral part of its global ambition to lead the world’s green mobility transition. Southeast Asia presents particularly favourable opportunities for BYD. With a massive population and a growing middle class, Southeast Asia offers a large and potentially lucrative market.

Thailand’s longstanding automotive manufacturing tradition, established decades ago with the arrival of Japanese carmakers like Toyota, makes it an attractive host for BYD’s major production base, while Cambodia is a relative newcomer to the industry. The overall shift of some manufacturing activities from China to Southeast Asia bodes well for companies like BYD in reorganising their cross-border supply chains.

BYD faces certain challenges in Southeast Asia, particularly the dominance of motorcycles and the rapid rise of electric two-wheelers and three-wheeled tuk-tuks. These forms of micromobility are gaining traction due to their affordability, accessibility, and strong government incentives promoting greener transportation alternatives.

Challenging road conditions in countries like Myanmar and Laos may hinder the widespread adoption of EVs. However, the region’s push toward energy transition and green mobility, along with BYD’s commitment to innovation and its leadership in battery technology, positions the company for continued success — not only in Southeast Asia, but globally as well.

Author’s note: To place BYD’s success in Southeast Asia in a global and China’s domestic context, we draw from our recent article in The European Business Review for the first section of this article.

![[Video] George Yeo: America’s deep pain — and why China won’t colonise](https://cassette.sphdigital.com.sg/image/thinkchina/15083e45d96c12390bdea6af2daf19fd9fcd875aa44a0f92796f34e3dad561cc)

![[Big read] When the Arctic opens, what happens to Singapore?](https://cassette.sphdigital.com.sg/image/thinkchina/da65edebca34645c711c55e83e9877109b3c53847ebb1305573974651df1d13a)