How will the US import tariff hikes impact Chinese industries?

As part of a broader strategy said to prevent Chinese manufacturers from undercutting their US counterparts and threatening American jobs, the US’s Joe Biden administration announced a decision to increase tariffs on US$18 billion worth of Chinese imports across various sectors. How will China be affected?

(By Caixin journalists Zhao Xuan, Zhai Shaohui, Cui Xiaotian, Zhang Erchi, Lu Yutong, Li Rongqian, Du Zhihang, Luo Guoping, Wang Xintong and Ding Yi)

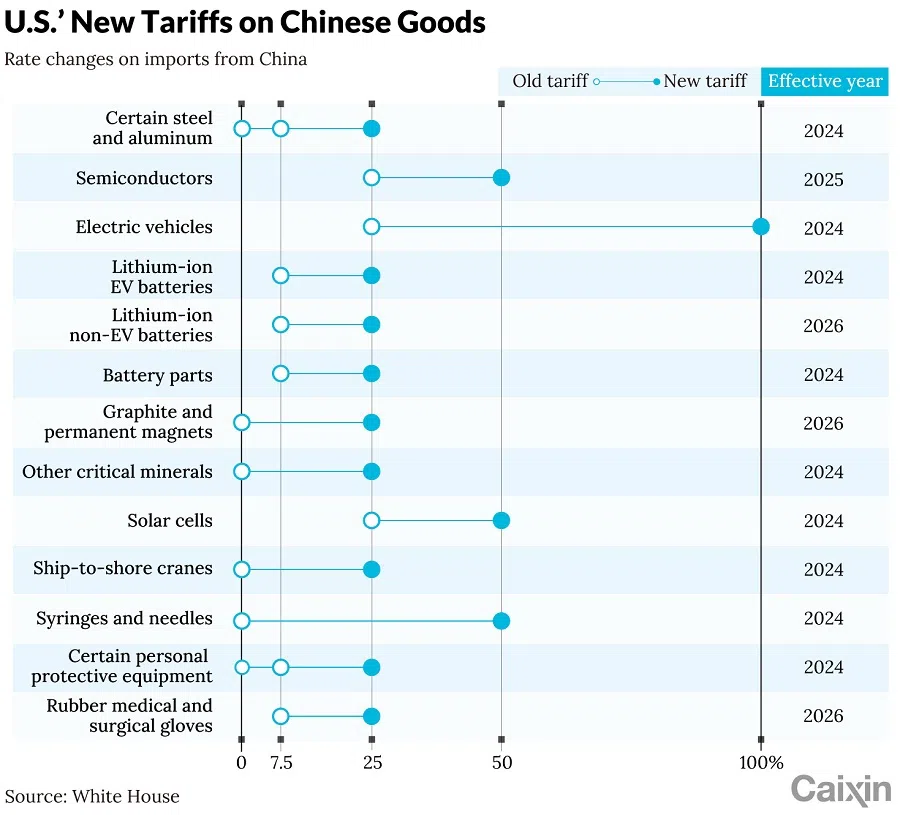

The Biden administration on 14 May announced a decision to increase tariffs on US$18 billion worth of Chinese imports across strategic sectors including electric vehicles (EVs), semiconductors, lithium-ion batteries and steel.

The move is part of a broader strategy said to prevent Chinese manufacturers from undercutting their US counterparts and threatening American jobs.

The additional tariffs could further inflame friction between the world’s two largest economies, with China’s Ministry of Commerce on the same day voicing strong opposition and vowing to “take resolute measures” to safeguard Chinese companies’ rights and interests.

Some analysts said that the new tariffs were largely symbolic and intended to shore up votes in an election year. In April, US President Joe Biden said that he was “not looking for a fight with China”, but that the US needed to stand up to Beijing’s “unfair economic practices and industrial overcapacity”.

Here’s how the tariff hikes will impact Chinese companies in each of the sectors.

EV makers

The Biden administration said that it will quadruple tariffs on Chinese-made EVs to 100% from 25%, a level that was levied by former President Donald Trump, in a move to ensure “the future of the auto industry will be made in America by American workers”.

Nomura Holdings Inc. analysts led by Wang Jing said in a report on 15 May that they “expect a limited near-term impact” from the US tariff hike on Chinese EVs as the US only accounts for 1% of China’s total exports of the vehicles. The Center for Strategic and International Studies (CSIS) said that China only exported 12,362 EVs to the US in 2023, of which about 10,000 were from a single firm, Polestar.

But Nomura’s analysts warned that the impact on Chinese EV-makers may be substantially larger if other major EV importers, especially the EU and UK, join the US in imposing restrictive measures.

Chinese EV makers see Western Europe as a key export destination because of the region’s specific timetable for the phasing out of sales of traditionally powered cars... — TrendForce report

In October, the European Commission launched a probe into whether Chinese EV firms are benefiting from alleged state subsidies that allow them to undercut their EU rivals, with EU trade chief Valdis Dombrovskis recently reportedly hinting that Brussels might impose tariffs before the summer break.

Chinese EV makers see Western Europe as a key export destination because of the region’s specific timetable for the phasing out of sales of traditionally powered cars, followed by Southeast Asia, where the penetration rate of EVs has much room to grow, according to market research firm TrendForce in a June report.

Lithium-ion batteries

Tariffs on lithium-ion EV batteries and battery parts will increase to 25% from 7.5% this year, while tariffs on lithium-ion non-EV batteries, mainly those used for energy storage, will make the same jump in 2026.

Analysts expect the tariff hikes to have further impact on Chinese companies exporting lithium-ion EV batteries and battery components, which already face restrictions from subsidy policies currently in place. This could give Japanese and Korean battery companies a greater edge to fill the void in the US market, they said.

But the move could benefit Chinese battery makers with plans to build plants in the US — including the battery unit of Envision Group Inc. and Gotion High-tech Co. Ltd., a person from a leading Chinese battery company told Caixin.

The person expects more impact by 2026, when the 25% tariff on lithium-ion non-EV batteries takes effect. At that point, Chinese battery storage exporters could see their cost advantage eroded compared with their US counterparts, who could take advantage of tax breaks offered by the Biden administration under provisions of the Inflation Reduction Act.

Natural graphite

Tariffs on natural graphite will increase in 2026 to 25% from zero.

The delay in the rollout of the tariffs on natural graphite is not surprising, Gracelin Baskaran, director of the Project on Critical Minerals Security at CSIS, said in an analysis on 14 May.

“The United States needs a significant amount of graphite for domestic electric vehicle production,” but “there’s simply an insufficient supply of non-Chinese graphite in the world,” she said.

The US has less than 1% of the world’s graphite, whereas China is the largest producer and processes about 90% of the world’s supply, she added.

While the short- to medium-term impact remains unclear, Baskaran warned that if EVs ultimately become unaffordable, then it will be the domestic auto industry that is adversely affected.

Rare earths

Tariffs on permanent magnets, including rare-earth magnets, will similarly jump to 25% in 2026. This was “unexpected”, a rare earth industry veteran told Caixin, since the current US rare earth industry is unable to compete with China’s in terms of cost, processing experience and supporting capabilities.

Rare earths are non-renewable and important strategic resources, and processed rare earths are widely used in new energy fields such as new energy vehicle motors and wind turbines.

Yet, the move is taken to protect its domestic enterprises and reduce its reliance on rare earth imports from China, the industry veteran said.

China is the world’s largest producer of rare earth permanent magnets. The country produced 240,000 tons of rare earth products last year, accounting for 68% of the global total, data from the US Geological Survey showed.

... Chinese chipmakers can integrate their chips into products like home appliances and electronic devices and then export the finished products to the US as a way to circumvent the tariffs — industry analysts

Semiconductors

The US tariff rate on semiconductors from China will increase to 50% from 25% by 2025, coming at a time when the Biden administration is making a nearly US$53 billion investment in the American semiconductor sector.

Some industry analysts told Caixin that the increased tariffs could undermine China’s chipmaking industrial ecosystem, citing the examples of Taiwan-based chip packaging firms selling their plants on the Chinese mainland in recent years to lessen the impact of the US tariffs on their business.

But Chinese chipmakers can integrate their chips into products like home appliances and electronic devices and then export the finished products to the US as a way to circumvent the tariffs, they said.

However, a 2022 report by the Peterson Institute for International Economics said that Chinese contract makers of legacy semiconductors — larger, mainstream chips — were irreplaceable because their Taiwanese and South Korean rivals like Taiwan Semiconductor Manufacturing Co. Ltd. and Samsung Semiconductor Inc. focus on producing more profitable, higher-end chips made with more advanced node technology.

... due to trade restrictions imposed on Chinese-made PV cells and modules since 2012, producers seeking access to the US market have shifted their supply chains to the Southeast Asian countries... — Tan Youru, Analyst, BloombergNEF

Solar cells

Tariffs on solar cells will double to 50% by this year. Nomura’s analysts expect the tariff hikes to have a limited near-term impact on Chinese-made solar panels, as they estimate that the US accounts for only 0.2% of China’s total exports of these products.

This is because Chinese solar panel makers have already relocated their supply chains to several ASEAN countries, including Malaysia, Cambodia, Thailand and Vietnam to avoid US restrictions, the analysts said.

Tan Youru, a photovoltaic (PV) analyst at BloombergNEF, agreed, saying that due to trade restrictions imposed on Chinese-made PV cells and modules since 2012, producers seeking access to the US market have shifted their supply chains to the Southeast Asian countries, which are granted a two-year tariff exemption until this June.

In 2023, the four Southeast Asian countries accounted for about 75% of total US imports, according to BloombergNEF.

However, the Chinese producers’ tactic to avoid tariffs has raised heckles from their US competitors, with some solar manufacturers petitioning the Department of Commerce in April to impose new tariffs on imports from these Southeast Asian countries.

If their proposal is adopted, “PV modules from Southeast Asian countries will be difficult to export to the US,” said Zhong Baoshen, chairman of Longi Green Energy Technology Co. Ltd., at an earnings conference late last month, who added that Chinese solar manufacturers may have to open factories in the US to head off the potential measures.

Medical devices

This year, tariffs on syringes and needles will jump to 50% from zero and those on certain personal protective equipment, including certain respirators and masks, will increase to 25% from the current range of zero to 7.5%. Tariffs on rubber medical and surgical gloves will rise to 25% from 7.5% in 2026.

The US is China’s top export market for medical devices, with Chinese shipments amounting to nearly US$10.8 billion last year, according to a report published in February by the China Chamber of Commerce for Import and Export of Medicines and Health Products.

However, the impact on the sector in China is likely to be limited, as many manufacturers of Covid-related products have shifted to other industries following a sharp drop in demand after the pandemic.

Several businesspeople who produced masks during the pandemic told Caixin that they have switched industries.

“The industry is currently in a major depression and [we] cannot survive,” said one manufacturer who shifted from producing protective clothing to wipes.

Demand for these preventive products has weakened since Covid-19 restrictions were lifted by countries around the world in 2022. The following year, China’s exports of five major categories of such products plummeted 75.7% to around US$3.9 billion, the chamber’s report said.

... US defence officials expressed concerns that Chinese ship-to-shore crane maker Shanghai Zhenhua Heavy Industries Co. Ltd. could be used by Beijing as a possible spying tool, remarks China slapped down as being “paranoia-driven”.

Ship-to-shore cranes

On ship-to-shore cranes, the US tariff rate will increase to 25% from zero in 2024, which the White House said will “help protect US manufacturers from China’s unfair trade practices that have led to excessive concentration in the market.”

The tariff hike comes after the US Coast Guard in February issued a Maritime Security Directive on cyber-risk management actions for ship-to-shore cranes manufactured by China located at US Commercial Strategic Seaports.

In early 2023, US defence officials expressed concerns that Chinese ship-to-shore crane maker Shanghai Zhenhua Heavy Industries Co. Ltd. could be used by Beijing as a possible spying tool, remarks China slapped down as being “paranoia-driven”.

About 80% of ship-to-shore cranes moving goods at US ports are made in China and use Chinese software, senior US administration officials said at the time.

Steel and aluminum

For certain steel and aluminum products, tariffs are set to increase to 25% from the current range of zero to 7.5% this year, with the White House citing unfair competition in the sectors due to “China’s non-market overcapacity in steel and aluminum, which are among the world’s most carbon intensive”.

The impact on steel trade with China is likely to be limited, one industry veteran told Caixin. This is due to relatively low US import volumes, and because Chinese steel products already face significant tariffs.

China accounted for less than 1% of US steel imports in the first two months of 2024, according to a report by S&P Global Market Intelligence. The US is the world’s largest steel importer.

Others warned that certain aluminum product manufacturers should treat the tariff hikes with caution. Chinese aluminum products exported to the US are mainly high-value-added and end-use aluminum-containing products, which are mainly supplied by privately owned companies and small and midsize enterprises, another person in the sector said.

He warned that it would be very difficult for these aluminum companies to wrestle back market share from other regions once US clients find alternatives.

What other impacts could the tariffs have?

Nomura’s analysts said that they expect the US action to have limited impact on Chinese exporters in the short term as the targeted products account for only 4.2% of total US imports from China and less than 1% of China’s total exports.

Yet, there could be a spike in Chinese exports this year for products that would only face higher tariffs next year and in 2026, as traders seek to minimise the impact, they said.

A more concerning impact is other regions following suit and potentially imposing similar trade-restrictive measures, especially for the EU and the UK, the analysts warned.

“Rising trade tensions may impede the export sector and encourage more supply chain relocation away from China in the longer run,” they said.

This article was first published by Caixin Global as “Caixin Explains: How Will the U.S. Import Tariff Hikes Impact Chinese Industries?”. Caixin Global is one of the most respected sources for macroeconomic, financial and business news and information about China.

![[Big read] When the Arctic opens, what happens to Singapore?](https://cassette.sphdigital.com.sg/image/thinkchina/da65edebca34645c711c55e83e9877109b3c53847ebb1305573974651df1d13a)

![[Video] George Yeo: America’s deep pain — and why China won’t colonise](https://cassette.sphdigital.com.sg/image/thinkchina/15083e45d96c12390bdea6af2daf19fd9fcd875aa44a0f92796f34e3dad561cc)