It may be too early to celebrate China's exports rebound

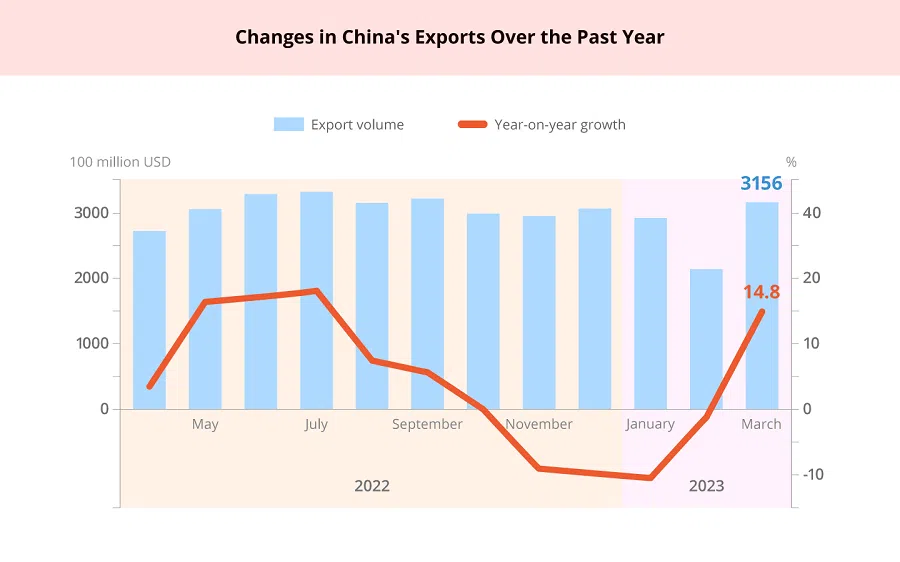

China's exports grew by 14.8% in US dollar terms in March from the year before, ending five straight months of decline. But a spike in exports may be a false hurrah for China's economic economy, given the mixed signals from different data indicators. Levels of consumption and inward investment are important as well, and the improvement of these factors will need to take into account the impact of US-China tensions on foreign enterprises in China.

"We're still filling the orders for more than a dozen containers. All my workers are doing overtime and we even have 70 temporary staff."

Chairman of Beauty Yaurient Cosmetics Accessories (Shenzhen) Wu Jiang told Zaobao that the year's orders have exceeded that of the same period last year by 40%. Since Chinese New Year, the company's factories in Guangdong and Hunan have been rushing to fill orders.

Beauty Yaurient's makeup brushes are mainly exported to the US, Europe and Japan. According to Wu, orders are up in all of these markets and exports are expected to return to pre-pandemic levels by April. He said, "With the end of the pandemic, the demand for cosmetics has returned. I told my employees that we should make up for three years of lost time."

As the effects of the pandemic on China's manufacturing industry peters out, foreign trade manufacturers like Beauty Yaurient have bounced back from rock bottom. According to data from the General Administration of Customs, China's exports grew by 14.8% in US dollar terms in March from the year before, ending five straight months of decline.

This export jump exceeded market expectations, driving up the country's first quarter export volume by 8.4%. Due to the exports dark horse, China's GDP achieved 4.5% first-quarter growth from a year ago, surpassing the 4% estimate.

However, a clear discrepancy between export growth figures and other related data has sparked controversies and doubts. For example, the export volumes of South Korea and Vietnam, which are closely correlated with Chinese exports, actually fell by 13.6% and 13.2% respectively in March from a year ago. And since the Spring Festival, empty containers have been piling up at the ports in Shanghai and Zhejiang, raising concerns over China's foreign trade.

Yu Jianhua, head of China's General Administration of Customs, responded in late March that the container pile-up was due to excess containers being released to the market, the low cost of storing containers at Chinese ports, and the quick turnaround of empty containers after the global easing of the pandemic. Other analysts agreed, saying that aside from sluggish external demand, an oversupply of containers over the past two years was the main reason for the pile-up.

According to the latest CITIC Futures research report, after the empty container situation eased in April, international container freight rates rebounded, with freight rates on Asia and Africa routes growing 20% more than the 2019 average.

... after the outbreak of the Russia-Ukraine war last year, orders from Europe significantly declined, while orders from the US dropped around 20% this year.

In response to Chinese exports outperforming South Korean ones in March, chief macro analyst of GF Securities Guo Lei assessed that this was due to South Korea's excessive focus on consumer electronics and semiconductor products. Affected by weak global demand, the export of these products also performed poorly in China during the same period. Labour-intensive products such as bags and fashion items, and the "new three types" (新三样) - electric vehicles, lithium-ion batteries and solar cells - became the main drivers of export growth.

Also, China's exports probably did better than that of Vietnam, which also exports labour-intensive products, because the backlog of orders was filled in one go.

Zhai Suoling, chairman of Guangsheng Metal & Plastic Products Co., told Zaobao that their backlog was only cleared in March as the impact of the pandemic only started easing at the beginning of the year, and soon after, their workers left for their Spring Festival holidays. "But this situation will not last for long. Business will go down again once this batch of orders are filled," he said.

The toys, RFID tags and other products that Zhai's company manufactures are mostly exported to Europe and the US. Zhai said that after the outbreak of the Russia-Ukraine war last year, orders from Europe significantly declined, while orders from the US dropped around 20% this year. Both supply and demand are falling.

Amid sluggish demand in developed economies, Russia and Southeast Asia are becoming the new drivers of China's export growth.

On the supply side, the US Federal Reserve's interest rate hike has raised inventory costs, prompting retailers to reduce purchases. On the demand side, the economic downturn has led to lower purchasing power, pushing consumers to buy cheaper products. Zhai worries that further interest rate hikes from the Federal Reserve will result in their US customers slashing their orders even more.

Russia and Southeast Asia new export growth drivers

Amid sluggish demand in developed economies, Russia and Southeast Asia are becoming the new drivers of China's export growth. China's exports to Russia shot up by 136.4% in March, while exports to ASEAN soared by 35.4%, an increase of 27.1 percentage points from the previous month.

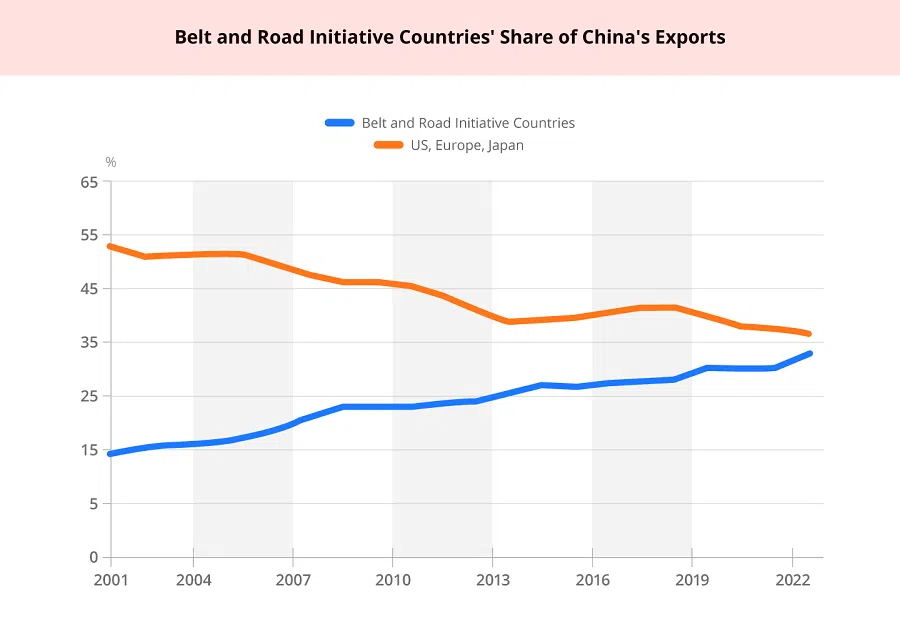

Data from Soochow Securities show that China's trade with Belt and Road Initiative (BRI) countries in 2022 accounted for 32.9% of the country's total foreign trade, up from 25% a decade ago. China's trade with ASEAN recorded the biggest climb, while trade with traditional trading partners such as Europe, America and Japan continued to decline. Soochow Securities analysts Tao Chuan and Shao Xiang predict that amid China-US competition, BRI countries are set to gradually replace Europe, the US and Japan to become China's main trading partners.

"Relying solely on Russia and BRI countries is not enough to offset the impact of weakening demand in Europe, the US and Japan on China's exports." - Tommy Xie, head of Greater China Research & Strategy, OCBC Bank

Tommy Xie, head of Greater China Research & Strategy at OCBC Bank, said that while China is ASEAN's largest trading partner, ASEAN countries only account for 15.8% of China's export share, which is below the US's 16%. He said, "If the global economy slows again, Southeast Asia will not escape unscathed. Relying solely on Russia and BRI countries is not enough to offset the impact of weakening demand in Europe, the US and Japan on China's exports."

Xie further assessed that China's massive export growth in March was unusual and China's exports could fall again in the second quarter. He explained, "China's seemingly economic stellar performance in March does not hide the fact that the European and American economies are slowing. Data from the Canton Fair (China Import and Export Fair) in April also indicated that orders from Europe and the US did not increase significantly, which is not good news for China's exports."

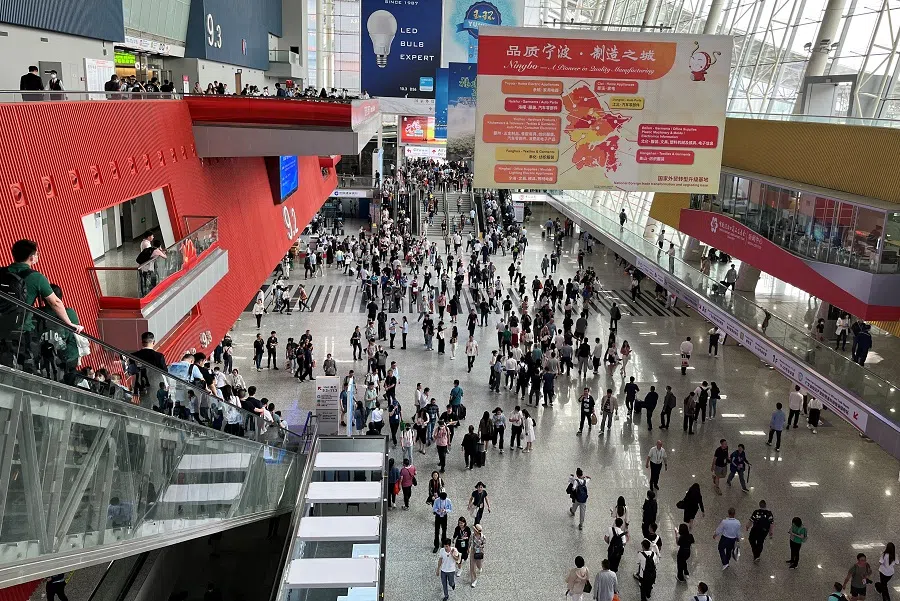

The exhibition area and number of on-site exhibitors at the Canton Fair held in mid-April saw record highs this year. However, a survey of 15,000 exhibitors showed that orders have decreased, which means that insufficient demand is still the main challenge facing enterprises. Chinese vice-minister of commerce Wang Shouwen said at a press conference that the survey results matched the government's expectations and reflected the "severe and complicated" foreign trade situation.

The World Trade Organization predicted this month that the volume of world merchandise trade is expected to grow by 1.7% this year, which is higher than the previous estimate of 1% but still lower than the 2.7% growth last year. While US inflation appears to have eased, the Fed announced that it would be raising interest rates by 0.25 percentage points, following its 2-3 May meeting, which would further dampen consumer demand.

International Monetary Fund officials warned in mid-April that while the European economy has performed relatively well recently, it still faces the triple challenge of easing inflation, maintaining economic recovery, and safeguarding financial stability as overall growth weakens.

Lü Daliang, spokesperson of the General Administration of Customs, pointed out that China's external environment is still severe and complicated as a result of sluggish external demand and geopolitical factors.

"American politicians and media platforms have continued to vilify China's image and call for US enterprises to withdraw from China. This puts great pressure on us, as foreign enterprises in China, as well as on our clients." - US businessman Philip Richardson

Foreign enterprises pressured by China-US tensions

Apart from sluggish external demand, the challenging geopolitical situation is yet another sword of Damocles hanging over China's foreign trade.

US businessman Philip Richardson, who supplies audio equipment to Europe and US markets, complained that deteriorating China-US relations have continued to put pressure on Chinese manufactured products. He said, "American politicians and media platforms have continued to vilify China's image and call for US enterprises to withdraw from China. This puts great pressure on us, as foreign enterprises in China, as well as on our clients."

Running an audio equipment factory in Guangdong's Panyu, Richardson decided to give his workers a seven-day vacation during the Labour Day holiday since they were done with their backlog of orders. Rather than a fall in orders, what is more worrying to Richardson is the intensification of the China issue with the fast-approaching US presidential elections next year, further restricting products from China. This has made him more determined to expand his product lines to reduce the risk of overreliance on a single product.

Chinese Premier Li Qiang stressed at a State Council executive meeting in early April the importance of trying all means to stabilise exports to developed economies, guiding enterprises to further develop markets in ASEAN and other regional markets, giving full play to major Chinese trade provinces in stabilising foreign trade, and encouraging various regions to come up with support policies in accordance with local conditions.

In the face of mounting foreign trade pressure, since the fourth quarter of 2022, Chinese provinces and cities have been sending trade delegations overseas to fight for orders, with the US, Europe, and Southeast Asia being the main destinations of these trips.

"... it is more important for foreign trade enterprises who are on the chopping block like us to strengthen our ties with American clients. We have to understand our client's thinking to safeguard our competitive advantage." - Wu Jiang, chairman, Beauty Yaurient Cosmetics Accessories (Shenzhen)

After participating in Cosmoprof Asia in Singapore in November last year, Wu flew to Italy to attend Cosmoprof Bologna in March this year. He plans to visit Japan, France, the US and Morocco next, hoping to make up for all the international fairs that he missed over the last three years. He also intends to visit the US for more than two weeks, visiting old and new clients along the way.

He said, "The Chinese say that 'meeting in person leaves a better impression'. Now that China-US decoupling has caused an uproar, it is more important for foreign trade enterprises who are on the chopping block like us to strengthen our ties with American clients. We have to understand our client's thinking to safeguard our competitive advantage."

Consumption and investment more important

As the "exports" key growth driver weakens, "consumption" and "investment", the other two members of the "growth drivers troika", will play a more important role.

After China's anti-Covid measures were eased, consumption rebounded sharply in the first quarter of the year, contributing 66.6% to overall GDP growth. Yet, the growth of China's fixed-asset investment in the same period was less than expected, adding more uncertainties to China's road to economic recovery.

Sluggish private investments aside, China's foreign investments are not looking up either. Data from the Chinese commerce ministry showed that China's inbound foreign direct investment stood at US$189.13 billion in 2022; this is significantly lower than the US$334 billion in 2021 and US$253.1 billion in 2020. Figures for China's balance of payments data, which takes into account foreign capital withdrawal, were even worse than the data from the commerce ministry.

European Union Chamber of Commerce in China (EUCCC) president Joerg Wuttke said at a press conference in April that the European Union (EU) invested nearly US$10 billion last year, double the amount invested the previous year. However, if we remove German automaker BMW's investment in its Shenyang plants which was postponed for two years due to the pandemic, the EU's investment in China actually fell by 40% last year.

... they remained upbeat about the huge potential of China's market, they were also cautious given the production disruptions they experienced during the pandemic, not to mention the ongoing ratcheting up of geopolitical tensions.

Since the start of the year, various local Chinese governments have been introducing policies aimed at optimising the business environment and attracting domestic and foreign investments. When receiving leaders from Singapore, France, the EU and other countries and regions, Chinese higher-ups have also made it a point to emphasise the strengthening of economic and trade cooperation.

At the same time, since China reopened its borders at the beginning of this year, large trade shows like the Canton Fair and Shanghai Auto Show have also welcomed tons of overseas exhibitors bringing new investments. During the recently concluded Shanghai Auto Show, German carmaker Volkswagen announced a 1 billion euro (about US$1.1 billion) investment to develop a new development and procurement centre for electric vehicles in China.

Foreign businessmen interviewed for this article said that while they remained upbeat about the huge potential of China's market, they were also cautious given the production disruptions they experienced during the pandemic, not to mention the ongoing ratcheting up of geopolitical tensions.

EUCCC vice-president Jens Eskelund told Zaobao that prior to the coronavirus outbreak, European companies had been attracted to China for its quality manufacturing sector and its stable, predictable and efficient supply chain. But supply chain disruptions brought about by anti-Covid measures have forced European enterprises to diversify their production bases to reduce risks. He said, "We must have serious discussions [with the Chinese government] about how we can improve supply chain resilience so that the chaotic situation we experienced last year will not happen again."

The EUCCC will release its European Business in China Business Confidence Survey 2023 in June this year. Wuttke said that the proportion of surveyed companies willing to stay in China has dropped from 41% last year to 35%, while companies planning to set up production bases outside China have increased from 8% to 10%.

... foreign investors "would like to see a better balance between state-owned enterprises and the private sector". - Craig Allen, president of the US-China Business Council

According to the latest survey released by the American Chamber of Commerce in China last month, more than half of the 109 US companies surveyed are optimistic about China's business outlook, while 87% of respondents are pessimistic about current China-US relations, which is 14 percentage points higher than half a year ago. At the same time, 27% of respondents said that they are again considering to shift their supply chains to other countries. This figure is up 21 percentage points from the previous survey.

Apart from hoping that Chinese officials would further increase openness, foreign companies are also looking forward to policymakers boosting consumer and private sector confidence and creating a more vibrant domestic market.

In Eskelund's estimation, the Chinese government is currently more focused on the manufacturing sector and other outward-looking industries, and is not doing enough to boost domestic demand. Amid the grim employment situation, it is uncertain if the consumer rebound will last for a long time, and this in turn affects investor confidence.

Craig Allen, president of the US-China Business Council, stressed at the annual China Development Forum in March that if private enterprises were to be better developed and treated more fairly, multinational companies investing in China would be given a boost. He added that foreign investors "would like to see a better balance between state-owned enterprises and the private sector".

This article was first published in Lianhe Zaobao as "中国出口逆袭仅昙花一现?".

Related: China's powerful export engine losing steam amid Covid-19? | How China's export surge left the shipping industry with a hangover | Export slowdown reveals cracks in one of China's economic pillars | Why China's exports are in the doldrums | China's first quarter figures positive, but pandemic leaves a long shadow

![[Big read] When the Arctic opens, what happens to Singapore?](https://cassette.sphdigital.com.sg/image/thinkchina/da65edebca34645c711c55e83e9877109b3c53847ebb1305573974651df1d13a)

![[Video] George Yeo: America’s deep pain — and why China won’t colonise](https://cassette.sphdigital.com.sg/image/thinkchina/15083e45d96c12390bdea6af2daf19fd9fcd875aa44a0f92796f34e3dad561cc)