Taiwan’s US dilemma: Between security and semiconductors

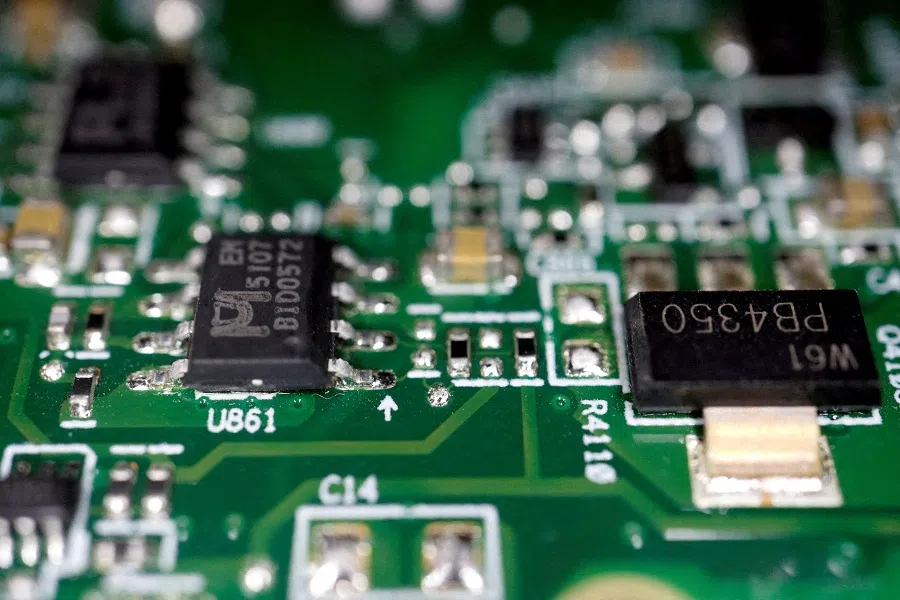

With the US putting greater demands on Taiwan to relocate Taiwan Semiconductor Manufacturing Company (TSMC) production lines to the US, Taiwan is facing a dilemma between security and semiconductors that could leave it vulnerable to trade tariffs and access to military aid. Academic Hao Nan delves into the issue.

Taiwan’s relationship with the US is entering a critical phase, shaped by escalating pressures and difficult choices. On 14 February, Taiwanese President Lai Ching-te convened a National Security Council meeting in response to President Donald Trump’s renewed threats on tariffs and semiconductor relocation. Lai announced plans to raise Taiwan’s defence budget above 3% of GDP, increase US arms purchases and expand Taiwanese investments in the US.

While these moves aim to secure US security commitments, they come at a steep cost — potentially weakening Lai’s domestic standing, exacerbating cross-strait tensions, and accelerating Taiwan’s economic vulnerability under Washington’s increasing demands.

The price of decreasing trade dependence on mainland China

At the heart of Taiwan’s predicament is its changing trade landscape. Since 2016, the Democratic Progressive Party (DPP) administrations have been intentionally seeking to reduce Taiwan’s export dependence on mainland China, which has consistently exceeded 40%. By 2024, that number had significantly dropped to 31.7%, a 22-year low, with Taiwan’s trade surplus with China declining by 15% from 2023’s US$80.55 billion to US$70 billion.

Meanwhile, exports to the US surged to 23.4% of Taiwan’s total exports, driven primarily by high-tech goods, particularly semiconductors. This led to a record US$64.9 billion trade surplus with the US, up 83% from 2023. While this shift aligns with Taiwan’s diversification efforts, it also exposes the island to heightened economic leverage from Washington — particularly with Trump’s insistence on “fair trade” policies.

Among the most contentious proposals is the possibility of forcing TSMC into a joint venture with Intel, effectively transferring critical chip manufacturing capabilities to the US.

The semiconductor industry, Taiwan’s most prized asset, is at the core of US demands. Taiwan Semiconductor Manufacturing Company (TSMC), the world’s leading chipmaker, has been pressured into relocating key production lines to the US. Trump’s administration began this push in his first term, leading TSMC to invest heavily in its Arizona facilities. Most recently, TSMC announced that it would spend US$100 billion in US over the next four years.

However, TSMC’s relocation faces serious challenges, from high operational costs to labour disputes. More alarmingly, this move threatens Taiwan’s “silicon shield” — the strategic advantage of being an irreplaceable hub in the global semiconductor supply chain, which has long served as a deterrent against Chinese military aggression and a bargaining chip for securing Western support.

Meanwhile, US expectations for Taiwan’s semiconductor industry continue to rise. Trump’s rhetoric has been particularly pointed, accusing Taiwan of “stealing” US chip business and threatening tariffs if production does not shift back to American soil. Recent reports indicate that Trump’s camp is considering modifying the CHIPS Act to exert even greater control over TSMC’s operations.

Among the most contentious proposals is the possibility of forcing TSMC into a joint venture with Intel, effectively transferring critical chip manufacturing capabilities to the US. This has raised alarms in Taiwan’s political and business communities, with experts warning that such a move could erode Taiwan’s technological edge and economic independence. Some analysts have likened this to a slow-moving industrial takeover, where TSMC’s technology and expertise are siphoned off while Taiwan is left with diminishing control over its own semiconductor industry.

Defence spending falls short of covering trade deficit

Lai’s plan to increase defence spending and arms purchases from the US presents another double-edged sword. Although Taiwan’s defence budget has steadily increased over the past eight years under Tsai Ing-wen administration of the same DPP affiliation with Lai, rising from NT$365.8 billion (US$11.16 billion) in 2016 to NT$606.8 billion in 2024, it has never reached 3%, a goal aimed by Tsai.

Lai faces even stronger resistance at home. The opposition coalition Kuomintang (KMT) and Taiwan People’s Party (TPP), which together control the Legislative Yuan, have aggressively challenged Lai’s budget proposals. The legislature has slashed NT$ 207.5 billion and frozen NT$ 160.7 billion, setting a historical record. More than half of the budget cuts, amounting to NT$ 89.9 billion, came from the defence budget. This means, the proposed 2025 defence budget NT$ 476.0 billion, would only reach 2.45% of GDP in 2025. Budget items, according to the Budget Act, deleted or reduced by the Legislative Yuan “may not be reallocated”. This certainly falls well short of the US expectation for defence spending to increase to around 10% of GDP to deter war with China, as stated by President Donald Trump’s nominee for a top Pentagon policy adviser on 4 March.

Taiwan’s chip industry could face a hollowing-out effect — losing both high-end manufacturing to the US and mid-range production to mainland China.

For Taiwan, the implications of this dilemma between security and semiconductors are stark. If the US succeeds in relocating significant portions of Taiwan’s semiconductor industry, it could set off a dangerous economic chain reaction. Taiwan’s semiconductor exports account for 34.8% of its total exports, making it the backbone of its trade-driven economy. Losing this dominance would not only weaken Taiwan’s leverage in global affairs but also expose its economy to new vulnerabilities.

Moreover, mainland China could exploit this shift by intensifying efforts to capture the low- and mid-tier semiconductor markets, effectively squeezing Taiwan from both ends. Analysts have warned that within a few years, Taiwan’s chip industry could face a hollowing-out effect — losing both high-end manufacturing to the US and mid-range production to mainland China.

Challenges and tradeoffs

Politically, Lai and the DPP face mounting challenges. Lai’s ruling DPP has launched a large-scale recall movement, targeting opposition KMT legislators, aiming to break the obstructionism by KMT-TPP coalition’s legislative majority. As of 13 February, a total of 54 recall proposals have been submitted: 51 targeting legislators, one targeting a county mayor, and two targeting county councillors.

While the recall might face procedural barriers set by the Civil Servants Election and Recall Act, it clearly marks the inter-party struggles between the DPP and the opposition coalition. Hence, the upcoming 2026 mayoral elections and the 2028 presidential race will serve as key tests for Lai’s ability to balance US demands with domestic expectations.

Without sufficient cooperation from Taipei, Trump could impose punitive tariffs or slow-walk critical military aid — leaving Taiwan increasingly exposed to Chinese pressure.

Abandoning US demands, however, carries its own risks. Taiwan relies heavily on American security assurances, military training, and arms sales to maintain its defensive capabilities. While the Biden administration has maintained bipartisan support for Taiwan under the Taiwan Relations Act, Trump’s transactional approach could make future arms deliveries contingent on further economic concessions. Without sufficient cooperation from Taipei, Trump could impose punitive tariffs or slow-walk critical military aid — leaving Taiwan increasingly exposed to Chinese pressure.

Taiwan’s room for manoeuvre is shrinking, and its path forward is fraught with difficult trade-offs. The choices made in the coming months will not only shape Taiwan’s relationship with the U.S. but also determine the island’s long-term security, economic sustainability, and geopolitical standing.

![[Big read] When the Arctic opens, what happens to Singapore?](https://cassette.sphdigital.com.sg/image/thinkchina/da65edebca34645c711c55e83e9877109b3c53847ebb1305573974651df1d13a)

![[Video] George Yeo: America’s deep pain — and why China won’t colonise](https://cassette.sphdigital.com.sg/image/thinkchina/15083e45d96c12390bdea6af2daf19fd9fcd875aa44a0f92796f34e3dad561cc)