Where the Chinese are parking their investments in a low-interest-rate era

China’s economy is under increasing pressure from weak domestic consumption and rising external uncertainties, prompting policymakers to increase efforts to stimulate growth. As the central bank adopts looser monetary policies, interest rates are trending downward. How are individual investors and corporates in the banking and insurance sectors dealing with it?

(By Caixin journalists Ding Feng, Liu Ran, Wu Yujian, Quan Yue and Han Wei)

When Li Zhen went to renew the 50,000 RMB (US$6,824) she had locked into a five-year fixed deposit back in 2020, she was taken aback by the bank’s latest offering. The interest rate for same-term deposits at large state-owned banks had fallen to around 1.6%, a stark contrast to the 4.2% she had earned five years ago.

Finding a reliable, safe alternative with decent returns is no easy task. Most wealth management products and money market funds now offer annual returns well below 2%.

With traditional investment avenues yielding less and less, both individuals and institutions are scrambling to find new strategies in the face of a shifting economic landscape.

Like Li, Chinese residents are finding it increasingly difficult to decide where to park their money in an era of historically low interest rates. With traditional investment avenues yielding less and less, both individuals and institutions are scrambling to find new strategies in the face of a shifting economic landscape.

China’s economy is under increasing pressure from weak domestic consumption and rising external uncertainties, prompting policymakers to increase efforts to stimulate growth. As the central bank adopts a looser monetary policies, interest rates are trending downward.

Often referred to as the “price of money”, interest rates influence the cost of consumption, borrowing and investment. A broad-based reduction in interest rates helps lower costs for market participants across the economy.

China’s interest rate system has three layers. The first is the policy interest rate, directly controlled by the central bank, such as the seven-day reverse repo rate. In 2024, the central bank cut rates twice, by 30 basis points in total, signalling an easing cycle. The second level is the market benchmark rate, which influences other rates and asset pricing, like the Loan Prime Rate (LPR) for loan pricing and the ten-year government bond yield as the benchmark rate for the bond market. The third level consists of market interest rates, which are the deposit and loan rates businesses and consumers encounter daily.

The current downward trend in interest rates is unfamiliar to many in China. Since the late 1970s, following the opening up reforms, the country has enjoyed robust growth, with interest rates remaining relatively high. While analysts noted a shift toward fluctuating and declining interest rates since 2014, the pace of rate cuts accelerated in 2024. This shift marks China’s entry into a low-interest-rate era, just as the US, Japan and many European countries experienced after periods of high growth.

Analysts expect low interest rates to persist as China undergoes its economic transformation with monetary easing. Both individuals and financial institutions will need to adjust their strategies to navigate this period, they say.

The stock market’s three-year decline since 2022 has left many Chinese individual investors with losses from their equity investments, despite a market rebound since September. Coupled with weakened expectations for future income growth due to the economic downturn, this has made investors more risk-averse, leading them to prioritise safer assets that offer stable returns.

Financial institutions are also facing increasing challenges. Narrower interest rate spreads are making it harder for banks to generate profits, while competition intensifies. The fund market is also shifting, with money market funds shrinking and bond funds gaining popularity. However, the potential for further bond price increases is limited, making high returns harder to achieve.

As a result of these rate cuts, yields on deposits, insurance and wealth management products have decreased, with most fixed-term deposit rates now falling below 2%.

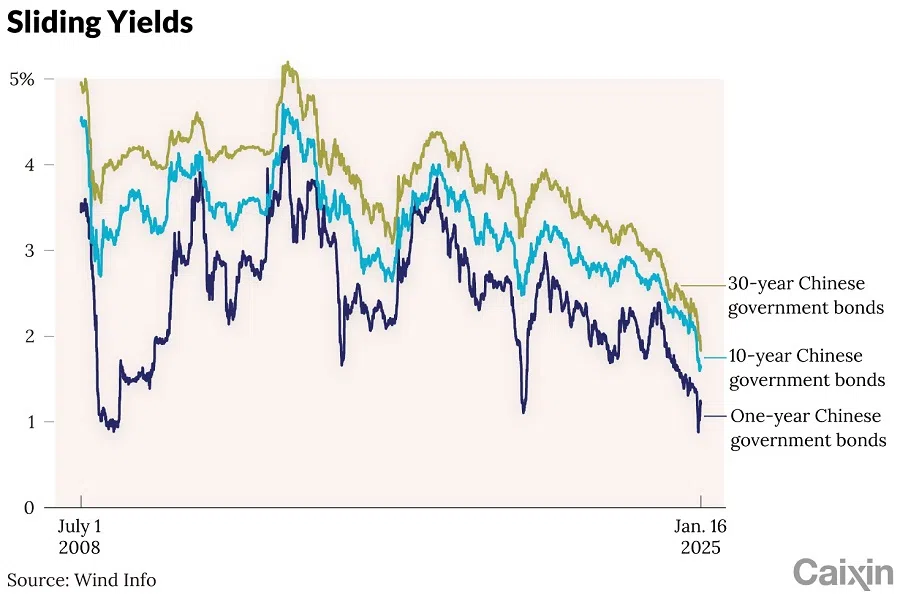

Shrinking yields

In 2024, to stimulate the sluggish economy, China’s central bank cut benchmark interest rates three times, lowering the one-year LPR by 35 basis points and the five-year LPR by 60 basis points, along with two reductions in the reserve requirement ratio for banks. One basis point equals one-hundredth of a percentage point.

As a result of these rate cuts, yields on deposits, insurance and wealth management products have decreased, with most fixed-term deposit rates now falling below 2%.

As individual investors seek higher yields, US dollar-denominated deposits and wealth management products have become popular options. For instance, Hong Kong’s Bank of East Asia offers interest rates on US dollar deposits over US$10,000 ranging from 3.4% to 4.5%. Similarly, US dollar-based wealth management products, primarily investing in dollar bonds, typically offer returns between 3% and 4.5%, according to rates listed by China Merchants Bank. However, these higher yields come with the risk of exchange rate fluctuations.

In a recent report, Haitong Securities, citing experiences in the US, Europe and Japan, said investors typically shift toward more liquid and safe assets in the face of declining rates, increasing allocations to cash and deposits while reducing exposure to equities and investment funds.

In China’s current low-rate environment, individual investors may consider US dollar deposits and wealth management products, high-dividend stocks, gold and equity-based passive products as key areas for future investment, analysts said.

Finding alternatives

By the end of 2024, China’s mutual funds had a total asset under management of 31.94 trillion RMB, making them the largest segment in the country’s hundreds-trillion-RMB asset management market. Among them, money market funds led with 13.02 trillion RMB, accounting for 40.85% of the total, followed by bond-focused funds with 10.39 trillion RMB, or 32.57%. The remaining 23.76% was divided between stock-focused mutual funds and funds invested in a mix of assets.

At the same time, China’s sluggish economic performance has increased the appeal of government bonds, the country’s safest assets, fuelling a historic rally in the bond market in 2024.

Although still the largest segment, money market funds are losing their appeal as yields have plummeted. These funds, primarily invested in short-term government bonds, interbank certificates of deposit and fixed deposits, have seen their returns drop sharply from a peak of nearly 6% in 2013. For example, the seven-day yield of Yu’ebao, the world’s largest money market fund managed by Tianhong Asset Management Co. Ltd. and sold through Alipay, has fallen to around 1.2%, down from 2.4% at the start of 2024.

At the same time, China’s sluggish economic performance has increased the appeal of government bonds, the country’s safest assets, fuelling a historic rally in the bond market in 2024. By the end of September, mutual funds held 16.8 trillion RMB in bonds, accounting for 53.64% of the total assets managed by these funds.

Bond prices, which move inversely to yields, have benefitted from low inflation expectations and interest rates, as well as an increased demand for safe assets. By December, the yields on ten-year and 30-year central government bonds had fallen below 2%, marking the lowest levels since comprehensive government bond data became available in 2002.

As bond yields continue to decline, many bond-focused funds are adapting their investment strategies.

In a trend similar to Japan’s during its low-rate period in the 2010s, Chinese investors are increasingly looking abroad for higher returns, although they are limited by China’s investment restrictions.

The primary route for Chinese funds to invest overseas is through the Qualified Domestic Institutional Investor (QDII) programme, with investment quotas controlled by the State Administration of Foreign Exchange. By the end of 2024, the total QDII quota was US$167.8 billion, with a modest increase of US$8 billion over the past two years.

Mutual recognition funds are another popular investment vehicle, which, unlike QDII products, have no investment quota restrictions. These funds, part of a cross-border financial market collaboration between the Chinese mainland and Hong Kong, were in high demand among institutional investors. By the end of September, there were 39 mutual recognition funds in Hong Kong, with a net sales volume of around 36.6 billion RMB in mainland China.

In December, the cap on the proportion of mutual recognition funds sold in the mainland was raised from 50% to 80%. Following this adjustment, several funds quickly sold out after reopening, reflecting strong demand from mainland investors seeking international investment opportunities.

Reshaping banking business

“China’s banking industry has entered an era of low interest rates, low interest margins and low profitability,” according to Wen Bin, chief economist at China Minsheng Bank.

Data from the National Financial Regulatory Administration (NFRA) shows that China’s commercial banks’ net interest margin stood at 1.53% in the first three quarters of 2024, down 20 basis points from the previous year. The margin is expected to further narrow in 2025 as the country shifts toward a more easing policy stance. A person close to the central bank said that while the narrowing of net interest margin is an ongoing trend, efforts are being made to slow down its pace.

The experiences of banks in Japan and Europe show that, during periods of low interest rates and shrinking margins, global banks typically lower risk exposure on the asset side, cut costs on the liability side and boost non-interest income, a path most Chinese banks follow.

Net interest income continues to be the main revenue source for most banks in the near and long term. Everbright Securities analyst Wang Yifeng emphasises the need for banks to enhance asset-liability management, control net interest margins more effectively and maintain stable income in a low-rate environment.

On the asset side, banks are focusing on securing higher-yield assets. This involves boosting loans to the real economy, especially small and medium-sized enterprises, while competing for high-quality individual clients, a bank staffer said.

In 2024, many banks began to increase bond investments and boost non-interest income. A study by Dai Zhifeng, an analyst at Zhongtai Securities, of the interim reports from 42 A-share listed banks reveals that non-interest net income for these institutions rose by 1.3% year-on-year in the first half of 2024. This growth was mainly driven by gains in investment returns and changes in fair value.

Experts also called for consolidation among smaller lenders to help the industry weather the changing market environment. China should accelerate the disposal of troubled assets and financial institutions, reduce the number of banking licenses and enhance governance and management practices, said Zhang Shuaishuai, an analyst at China International Capital Corp.

The impact of declining interest rates is even more profound for the insurance industry, where liability cycles typically last ten years or longer.

Life insurers’ challenges

The impact of declining interest rates is even more profound for the insurance industry, where liability cycles typically last ten years or longer.

Before China’s previous rate cut cycle starting in 1996, domestic life insurance companies aggressively sold policies with guaranteed interest rates exceeding 8% and terms of more than 20 years to capture market share. An actuarial expert told Caixin these high-interest policies are now entering their payout phase. As market interest rates and investment returns fall, the risk of spread losses from these policies may be greater than anticipated.

In an environment of low interest rates, China’s life insurance industry has gradually lowered its guaranteed rate ceiling since 2020, from 4.025% to 2.5%. Recently, the NFRA introduced a system linking guaranteed rates to market rates, allowing more flexible and timely adjustments which will help reduce insurers’ costs on liabilities. On the investment side, achieving returns above the cost of capital is critical for addressing legacy spread losses.

To navigate the challenges of low interest rates, China’s insurance industry is exploring various strategies, though each comes with significant challenges. One approach is increasing investments in long-term government bonds to reduce the asset-liability duration mismatch, a strategy successfully adopted by insurers in Japan and the US. However, China faces a shortage of suitable long-duration bonds which places higher demands on investment capabilities.

Another strategy is to boost global asset allocations, yet this is constrained by policy restrictions and the professional expertise required for international investments. As of 2023, overseas investments by insurance funds accounted for less than 2% of the total, far below the regulatory cap of 15%.

The industry is also seeking to increase exposure to equity and alternative investments, such as gold. Li Yuze, director of the NFRA, said in June that the regulator had been exploring ways to allow insurance funds to invest in products from the Shanghai Gold Exchange.

Wang Liwei and Wang Shiyu contributed to the story.

This article was first published by Caixin Global as “Cover Story: Where Best to Invest in China’s Low-Interest-Rate Era”. Caixin Global is one of the most respected sources for macroeconomic, financial and business news and information about China.

![[Big read] When the Arctic opens, what happens to Singapore?](https://cassette.sphdigital.com.sg/image/thinkchina/da65edebca34645c711c55e83e9877109b3c53847ebb1305573974651df1d13a)