Why Chinese companies are eyeing SGX again

Chinese firms are returning to Singapore for secondary listings under simplified A-share rules. While governance scandals linger in memory, regulators insist transparency and oversight matter more than the market of choice. Lianhe Zaobao journalist Thomas Li Tao reports.

Connectivity between the capital markets of Singapore and China has continued to deepen, with cooperation strengthening and interest among Chinese companies in secondary listings in Singapore gradually rising.

Market participants noted that Chinese businesses now have clearer listing objectives and are increasingly using Singapore as a platform to expand their regional footprint and access international capital. As governance standards continue to rise, some longstanding governance issues are expected to fade into the past.

At the 21st Singapore-China Joint Council for Bilateral Cooperation (JCBC) held in Chongqing, both sides proposed supporting secondary listings on the Singapore Exchange (SGX) by China’s A-share companies. In a December 2025 statement, the Monetary Authority of Singapore said Singapore authorities and the China Securities Regulatory Commission support the initiative and have introduced measures such as streamlined prospectus requirements.

... under the framework set out by the JCBC, Chinese companies only need to comply with A-share listing rules in order to obtain a secondary listing in Singapore.

Easier path than Hong Kong

In an interview with Lianhe Zaobao, Chia Caihan, SGX Group’s head of capital markets for Greater China, pointed out that many Chinese companies were once interested in listing in Hong Kong and did not seriously consider Singapore. However, under the framework set out by the JCBC, Chinese companies only need to comply with A-share listing rules in order to obtain a secondary listing in Singapore.

“So, in terms of the process, it is much easier than Hong Kong. Because as long as they comply with A-share rules, they don’t need to comply with the Singapore rules.”

She added that SGX even accepts companies using China’s accounting and auditing standards, which better aligns with the thinking of Chinese firms. SGX has already received enquiries from some Chinese companies, and is advancing processes related to dual listings in the two markets.

Chong Hong Chiang, partner at WongPartnership LLP, which has helped several Chinese companies list in Singapore, said when interviewed that as there is a “long queue” for listings on the Chinese domestic securities market, with initial public offering (IPO) waiting times often measured in years, Chinese companies seeking an exit must consider options outside their home market.

Market observers: compliance standards have improved

Singapore’s securities market saw a wave of Chinese listings in the early 2000s. Chong recalled that “at that time, many of the companies attempting to list in Singapore were manufacturing firms from southern China engaged in processing trade and relevant activities which were generally small in scale”.

But not long after, corporate governance problems at some Chinese companies began to surface. A series of troubling cases emerged, including falsified accounts and even controlling shareholders who absconded. Many of these scandals to this day leave local retail investors uneasy.

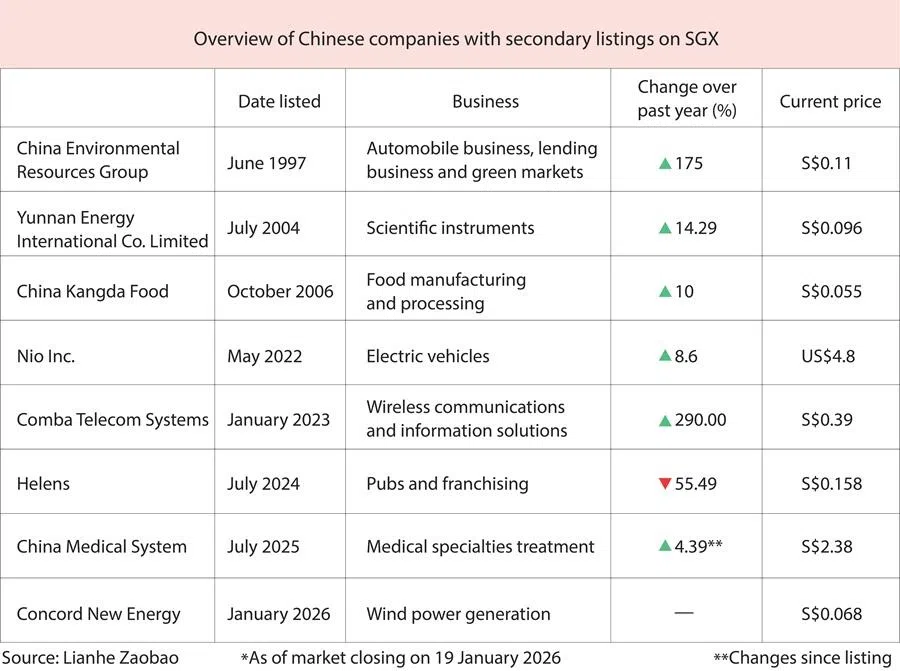

According to statistics, there are still around 100 Chinese companies listed on SGX today, accounting for nearly 20% of all listed companies.

Their main businesses include renewable energy, high-end manufacturing, healthcare and consumer technology, and they possess stronger global competitiveness. — Chia Caihan, Head of Capital Markets for Greater China, SGX Group

Chong observed that enquiries from Chinese firms began to pick up again around 2021. The nature of Chinese firms now listing in Singapore is very different from those of the early 2000s. “Chinese companies now considering overseas listings are larger in scale, with more mature brands and higher market visibility.”

She also stressed that Chinese companies now coming to list in Singapore have clearly stepped up their knowledge of corporate governance and compliance.

Chia pointed out that Chinese companies currently exploring a Singapore listing had mostly already planned to expand operations outside China, with many having projects and footholds in Southeast Asia. Their main businesses include renewable energy, high-end manufacturing, healthcare and consumer technology, and they possess stronger global competitiveness. “Conversely, if a company’s business is too traditional or too domestic, it may not be suitable for a Singapore listing.”

... the Chinese market’s current listing rules are in fact stricter than those in many other jurisdictions. — Chia

Recent Chinese companies obtaining secondary listings in Singapore include pharmaceutical firm China Medical System and wind power company Concord New Energy — their share prices rose by around 10% on their first day of trading here.

Under the new framework, Chinese A-share companies listing in Singapore need only comply with Chinese listing rules. In response to investor concerns about whether this could create regulatory loopholes, Chia felt that the Chinese market’s current listing rules are in fact stricter than those in many other jurisdictions.

“It is actually quite prescriptive in terms of disclosure. There are a lot of hard disclosures that the companies are required to make, which you don’t see in Singapore.”

For many Chinese firms that shifted their headquarters to Singapore, once they obtain listed status, not only does financing become smoother, it is also easier to build trust with partners regionally.

Singapore listing raises status and credibility

Besides aiding in fundraising, a Singapore listing also helps Chinese companies elevate their credibility and bargaining position in regional markets. For many Chinese firms that shifted their headquarters to Singapore, once they obtain listed status, not only does financing become smoother, it is also easier to build trust with partners regionally.

Chong revealed that a Chinese client that had set up a company in Singapore sought to develop property projects in Malaysia, and approached local banks for financing to expand its capital base. “Malaysian banks made it clear that if the company could obtain a listing platform in Singapore or another market, the loan could possibly be approved.”

Chia noted that, in contrast to the earlier image of “raising funds first, then develop”, Chinese companies now coming to list in Singapore have clearer financing objectives and seek to achieve growth by bringing in high-quality investors.

Additionally, many Chinese companies typically deal with Chinese state-owned and local government funds, and their valuations are not always fully recognised by international investors when they enter global markets. In contrast, Singapore allows these Chinese firms to broaden their investor base to include regional sovereign wealth funds, family offices and funds established under Singapore’s latest Equities Market Development Plan (EQDP).

“And when (these Chinese firms) engage with their clients, when they engage with their other future strategic investors, they can profile themselves as really moving out of the China radar into a broader market.”

Chong pointed out that many companies, when initially exploring a listing in Singapore, would already express a desire to connect with Singapore’s sovereign wealth funds.

Listing does not enable ‘Singapore-washing’

Chia also stated that many Chinese companies that choose to list in Singapore in recent years trade in Singapore dollars. On the one hand, this is due to regional revenues or costs being denominated in Singapore dollars, on the other hand, it allows them to hedge exchange-rate risk.

“The various agencies in different jurisdictions do not just look at where a company is listed. What is more important is their actual businesses, their controlling parties and whether it has a transparent governance structure.” — Chia

As for longstanding concerns that Chinese firms might use a Singapore listing to burnish their image or even evade regulation, thereby achieving so-called “Singapore-washing”, Chong felt that this view was not entirely accurate.

She pointed out that against the backdrop of today’s international regulatory environment, listing as a way to “whitewash” offered no substantive benefit to companies. Regulatory agencies would not turn a blind eye to a firm simply because it is listed in Singapore. “The various agencies in different jurisdictions do not just look at where a company is listed. What is more important is their actual businesses, their controlling parties and whether it has a transparent governance structure.”

This article was first published in Lianhe Zaobao as “监管合作促中企回流新交所 融资目标更清晰”.