Will Trump’s tariffs backfire and strengthen BRICS?

Threatened by the prospect of BRICS currencies’ potential dominance, Donald Trump has warned BRICS countries that he will impose tariffs on them if they attempt to challenge the supremacy of the US dollar. However, these tariffs may end up backfiring on Trump, says academic Amitendu Palit.

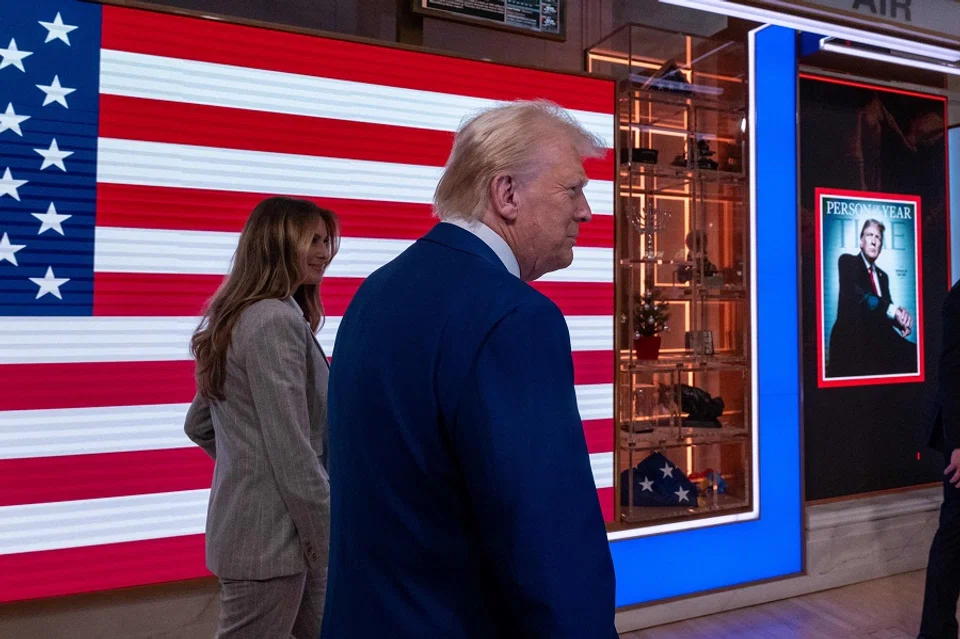

In the run-up to his return to the White House, US President-elect Donald Trump has been vocal in indicating his penchant for using tariffs. Countries mentioned in this context do not just include China and United States-Mexico-Canada Agreement (USMCA) partners Mexico and Canada. They also include the BRICS group of countries.

In a statement posted on social media platform X on 1 December 2024, Trump insisted that BRICS must confirm it will not create a new currency, or back an alternative one against the US dollar. If they do so, then their exports to the US will attract 100% tariffs.

The statement suggests that Trump thinks BRICS is working on an alternative currency to challenge the supremacy of the “mighty” US dollar. He also feels that even if the bloc does not create a BRICS currency, the US dollar will be challenged if BRICS members promote another currency from amongst them as an alternative to the dollar.

The rising cost of procuring the US dollar has made mutual settlements of financial transactions in local currencies an attractive option.

BRICS Pay: a threat to the US dollar?

Trump’s threat appears to have been provoked by a couple of decisions made by BRICS at its latest summit in Kazan, Russia, held from 22 to 23 October 2024. These decisions include the group’s plan to enhance usage of local currencies in financial transactions between its members, and to explore the possibility of establishing a cross-border payment system involving the messaging of financial information.

For many countries, the US dollar has become a difficult currency to use for financial transactions, particularly in cross-border trade settlements. Since the outbreak of Covid-19, the US dollar has strengthened against various national currencies of the world, especially those of emerging markets. This has made it onerous for exporters and importers from these markets to invoice their transactions in US dollars, as they have to pay much more in local currencies for sourcing US dollars.

The rising cost of procuring the US dollar has made mutual settlements of financial transactions in local currencies an attractive option. For BRICS, this is an economically rational option too. Greater usage of local currencies is already being explored bilaterally by members, and a bloc-wide effort will hasten the process.

The wider usage of local currencies will be facilitated by BRICS Pay — a cross-border financial information messaging mechanism. More takers for the BRICS Pay — a SWIFT (Society for Worldwide Interbank Financial Telecommunication)-like mechanism — will gradually see greater usage of local currencies among BRICS members as cross-border financial payment conditions mutually align across borders.

As enabling conditions encourage more trade in local currencies at the expense of the US dollar, the latter’s role in trade invoicing — and therefore in global trade — has reduced, with implications for US strategic heft.

The US dollar remains unthreatened, for now

Currently, the US dollar has an overwhelming preponderance in the invoicing of world exports and imports, as most countries prefer using it as their currency of choice. This widespread usage has made the US dollar the most powerful currency in the world, which has contributed significantly to the global geopolitical eminence of the US. As enabling conditions encourage more trade in local currencies at the expense of the US dollar, the latter’s role in trade invoicing — and therefore in global trade — has reduced, with implications for US strategic heft.

Is Trump worried about such a possibility? Even if he is, the prospect will take a very long time to materialise. The main reason for that is that hardly any of the BRICS currencies, except for the Chinese RMB, are global reserve currencies. This means that BRICS member currencies are not a widely preferred choice for invoicing.

However, tariffs might not succeed in discouraging BRICS members from invoicing intra-BRICS trade in local currencies.

Even the Chinese currency has a share of about 4.3% of global payments, compared with about 47% for the US dollar and 23% for the euro. It will therefore be a while before the RMB and other prominent BRICS member currencies, such as the Indian rupee and the Brazilian real, become more popular currencies for invoicing trade transactions and capturing significant shares in global trade.

Trump might be pre-empting the possibility of the US dollar being traded increasingly less in global transactions and will work to make sure that it retains its pole position. He is not hesitating to “weaponise” access to the US market for this purpose.

Tariffs may backfire on Trump

However, tariffs might not succeed in discouraging BRICS members from invoicing intra-BRICS trade in local currencies. Increased tariffs will make exports to the US more costly, requiring exporters to buy more US dollars at even higher prices. Many of them may switch to invoicing in non-dollar local currencies, even if it means giving up a part of the US market. They might even prefer working out trade deals in local currencies with non-BRICS countries that do not attract Trump tariffs, and are able to re-export their products to the US.

During his previous term, Trump singled out China and several other countries as currency manipulators. Tariffs might actually force the BRICS countries to devalue their currencies for making their exports competitive in the US market. Thus, non-manipulators might be forced to turn into manipulators!

The prospect of widespread currency devaluation will increase if Trump extends existing tariffs on BRICS to its partners as well. These partners now include major economies from Southeast Asia (Indonesia, Malaysia, Thailand and Vietnam) along with those from Central Asia (Belarus, Kazakhstan and Uzbekistan), Africa (Algeria, Nigeria, Uganda), Latin America (Bolivia, Cuba) and Europe (Turkey).

If Trump 2.0 carries out the threat of imposing tariffs on BRICS, it might set in motion a series of reactionary policies. These will run contrary to the goals of the tariffs and act as a shot-in-the-arm for the BRICS plan to use local currencies and implement BRICS Pay.

![[Video] George Yeo: America’s deep pain — and why China won’t colonise](https://cassette.sphdigital.com.sg/image/thinkchina/15083e45d96c12390bdea6af2daf19fd9fcd875aa44a0f92796f34e3dad561cc)