China’s ‘balanced vagueness’ diplomacy with the Middle East and north Africa

Academic Alessandro Arduino notes that China is engaging more with the Middle East and North Africa (MENA) region for various economic and geopolitical reasons.

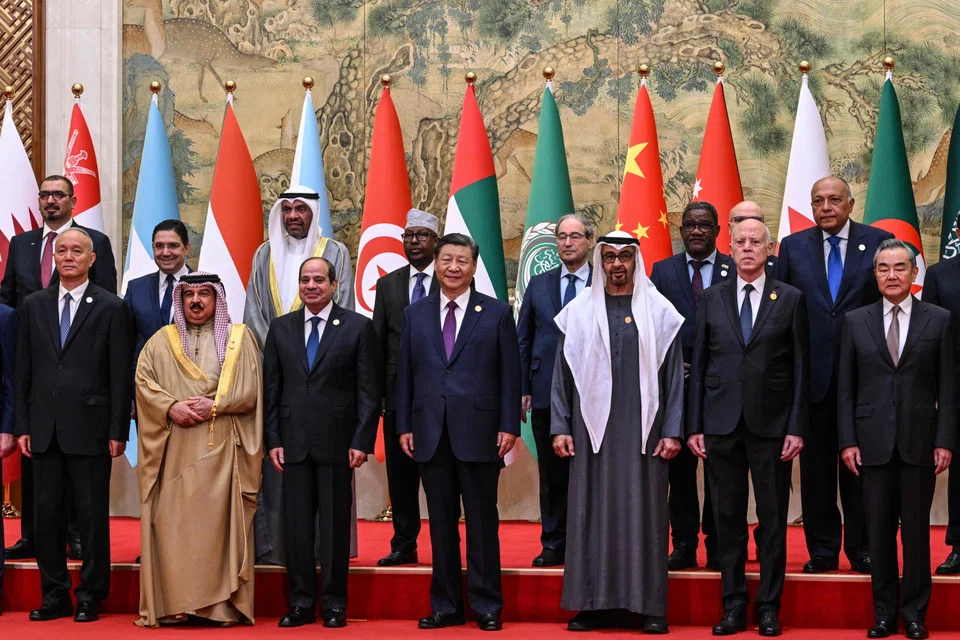

Recently, China is seeing the Middle East and North Africa (MENA) region taking the lead in foreign policy and security issues. Countries that took part in the 10th Ministerial Conference of the China-Arab States Cooperation Forum (CASCF) held on 30 May are expected to “raise a common voice from China and Arab states on the Palestinian issue” and follow up on new economic and cooperation projects in the coming months.

Greater engagement with Egypt, Bahrain and Tunisia

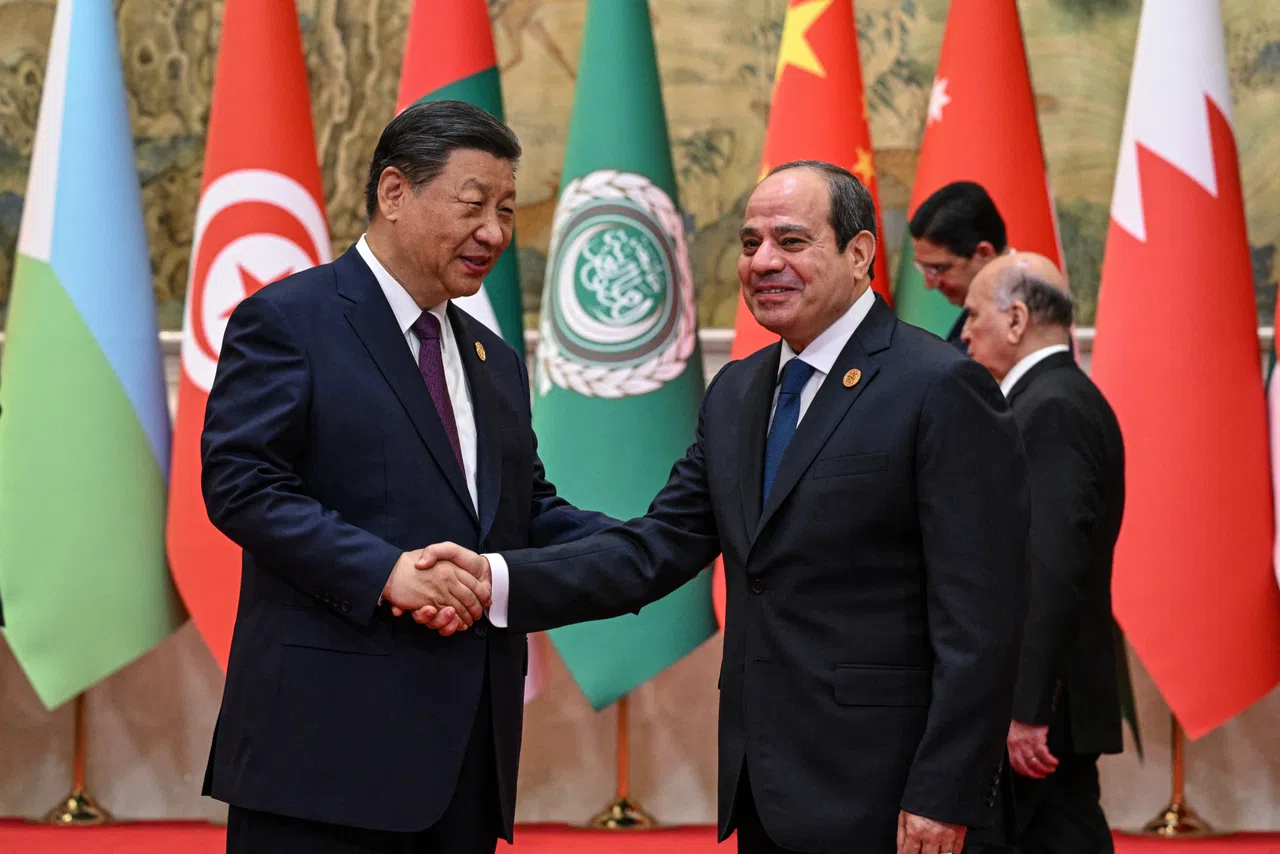

Making a state visit to China in conjuction with his attendance at the CASCF ministerial, UAE President Sheikh Mohamed bin Zayed Al Nahyan’s meeting with President Xi Jinping was closely watched in light of the two countries marking their 40th year of relations and emphasis on high-technology cooperation. But UAE-China relations was not the only relationship put under the spotlight.

From 2017 to 2022, Chinese investment in Egypt increased by 317%. During the same period, US investment in Egypt decreased by 31%.

The presence of Egyptian President Abdel-Fattah El-Sisi in Beijing was also significant, showcasing the evolving relationship between Egypt and China. The recent surge in economic activity in Egypt is largely due to the influx of Chinese companies and funding for Egyptian infrastructure projects, particularly in Egypt’s New Administrative Capital. China’s State Construction Engineering Corp., for instance, has signed a deal reportedly worth US$15 billion to fund the construction of various buildings in the new city.

Additionally, the presence of Chinese firms in Egypt is likely tied to significant Chinese investments in ports within the strategically located Suez Canal Economic Zone. This year also marks the “China-Egypt Year of Partnership”, celebrating the tenth anniversary of the two countries’ comprehensive strategic partnership. This milestone is expected to enhance economic cooperation and technological exchanges, spanning areas from aerospace to e-commerce infrastructure development. From 2017 to 2022, Chinese investment in Egypt increased by 317%. During the same period, US investment in Egypt decreased by 31%.

On a similar note, the state visit of Tunisia’s leader in Beijing is a testament to Beijing’s further economic involvement in the Mediterranean region under China’s global south rubric. Xi emphasised China’s commitment to aligning development strategies with Tunisia, enhancing cooperation in infrastructure, new energy, health care, green development, water resources, and agriculture.

Although several Western pundits pointed fingers at the forum being a box ticking exercise where MOUs were a starting point and not the end point, the CASCF ministerial offered the opportunity to Bahrain to reach the pinnacle of cooperation with Beijing with a comprehensive strategic cooperation agreement and Tunisia becoming a strategic partner.

Syria and Lebanon have long had high expectations for Chinese reconstruction funds, but the region’s turmoil and China’s current economic situation offer little hope.

Regional turmoil preventing further economic cooperation

From a security standpoint, China and the UAE have expressed a readiness to share experiences on defence and security to enhance the capabilities of their military personnel and security institutions.

Meanwhile, representatives from Libya’s Government of National Accord (GNA) are awaiting economic support from Beijing for the country’s reconstruction. However, this support is unlikely to materialise any time soon because the ongoing conflict between the GNA and Libyan National Army (LNA), fuelled by heavy foreign interference and numerous mercenary groups operating with impunity, shows no signs of resolution.

Similarly, Syria and Lebanon have long had high expectations for Chinese reconstruction funds, but the region’s turmoil and China’s current economic situation offer little hope.

Also, China’s diplomatic efforts in the MENA region face additional speed bumps with allies like Iran. Tehran vehemently opposes China’s verbal support for the UAE in a territorial dispute over the contested Abu Musa island.

Turkey finding a balance

Simultaneously, Turkey, a major regional player with ambitious goals, navigates a cautious diplomatic path with China. Ankara seeks to establish clear boundaries between cooperation and competition while addressing the ongoing security crises stretching from Gaza to the Persian Gulf.

Just after the CASCF, Turkey’s Foreign Minister Hakan Fidan visited China, the first Turkish diplomatic visit in 12 years. He discussed with his counterpart Wang Yi trade and transport routes and cooperation patterns, including the Middle Corridor, the BRI and Turkey’s potential BRICS membership.

While Ankara reaffirmed support for China’s territorial integrity, Turkey’s foreign minister followed his predecessors in visiting Kashgar and Urumqi in Xinjiang, this time urging the Chinese government to protect the cultural rights of the Uighur minority.

Ankara is eager to attract more Chinese investments, being the natural connection point between Asia and the EU. More efficient trade routes through Central Asia and the Caucasus will undoubtedly benefit Turkey, but Moscow’s presence in Central Asia cannot be discounted.

The war in Ukraine has not distracted Russia from its strategic objective in the region, and both China and Turkey are not forgetting Moscow’s security and diplomatic reach from Kazakhstan to Kyrgyzstan. In this respect, Turkey, a NATO member, is not shy to find a balance that favours its ambitions in the region. Therefore, China’s possible involvement in building a nuclear power plant in Turkey will provide an alternative to Russian, South Korean, and American options.

China is an economic juggernaut that relies on investment and trade as its main diplomatic strategies. However, the region is increasingly relying heavily on military measures.

Lack of actionable options?

Overall, following the unprecedented detente brokered between Iran and Saudi Arabia, Beijing is stepping back to a more cautious diplomatic engagement of the region, due to rising geopolitical turmoil. In this regard, Beijing’s decision to revert to its well-known diplomatic strategy of what I call “balanced vagueness” should not necessarily be seen as a lack of resolve in engaging the region; instead, it likely reflects a lack of actionable options.

China is an economic juggernaut that relies on investment and trade as its main diplomatic strategies. However, the region is increasingly relying heavily on military measures. Even China-Israel relations being at their lowest point in decades follow this path, and Beijing’s alignment with the Arab world is also to be viewed within the broader context of US-China competition in the Middle East.