Japan’s debt restructuring plan for Sri Lanka must include China

Japanese academic Shin Kawashima notes that resolving Sri Lanka’s debt situation would require various debtor countries to come together to find an all-round solution. While Japan has its plans, China’s participation is crucial.

Sri Lanka’s debt issue has become well known around the world, along with China’s “debt-trap” loans. Sri Lanka’s inability to repay the financial assistance received from China for the development of Hambantota International Port resulted in the Chinese state-owned company China Merchants Port Holdings taking control of the port for 99 years.

It was widely reported that there were close ties between China and Sri Lanka’s then President Mahinda Rajapaksa and his family. Furthermore, the interest rates for loans from China are higher compared to those from other lending nations.

Concerns were also raised about China’s use of port facilities for military purposes as a typical example of a debt trap (NB: even though this was disputed by some observers who said that Hambantota’s location is strategic only from a business perspective.)

In addition to Hambantota International Port, the Chinese-built Mattala Rajapaksa International Airport was alleged as another “white elephant project” of President Rajapaksa. It was named the “world’s emptiest airport” and its operating capacity is still extremely low today.

Large-scale aid from China still attractive

However, not all Chinese assistance ends up like Hambantota. For example, the development of the port of Colombo with Chinese assistance has been relatively successful.

Moreover, the lenders of Sri Lanka’s loans are also not limited to China. Although it has been criticised as a debt trap, Sri Lanka has chosen to receive aid from China among many potential lenders. Currently, given the financial limitations of developed countries and international organisations to support extensive infrastructure projects in developing nations like Sri Lanka, the substantial aid from China might appear appealing.

One solution is to support the financial management of countries suffering from excessive debt.

Indeed, China’s support for large-scale infrastructure construction is said to have declined since the late 2010s due to a lack of funds. However, China continues to make overseas investments in infrastructure and other areas, which remains attractive to developing countries. Hence, it can be said that the risk of a debt trap still exists.

So what can developed countries and international organisations do? Given the challenge of supporting large-scale infrastructure projects, developed countries should focus on addressing the other needs of developing countries. One solution is to support the financial management of countries suffering from excessive debt.

Developed countries can impart best practices in financial management

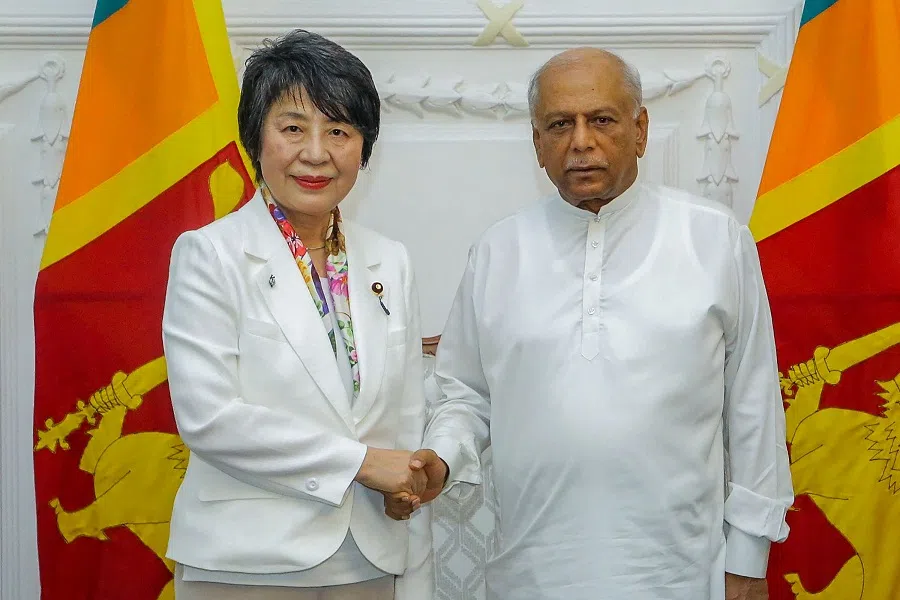

In May 2024, Japanese Foreign Minister Yoko Kamikawa visited Sri Lanka and held a meeting of foreign ministers. One of the main topics of discussion was the foreign debt issue.

Sri Lanka has suspended external debt payments and is unable to make interest payments on some government bonds. As Sri Lanka tries to get its finances back on track, Japan, which holds 20% of Sri Lanka’s debt, is co-chairing an Official Creditors Committee (OCC). The OCC was established in April 2023 together with France and India. China, which holds 52% of Sri Lanka’s debt, is only an observer at the committee.

During her visit, Foreign Minister Kamikawa conveyed to the Sri Lankan side the importance of the early signing of the memorandum of understanding (MOU) on debt restructuring with the OCC, and swift implementation of debt restructuring with all creditors in a transparent and fair manner.

Upon signing the MOU and a bilateral agreement with the Sri Lankan government, Japan would promptly reinstate the existing yen loan arrangements to sustain its support for Sri Lanka’s development. This is Japan’s avenue to assist Sri Lanka in overcoming its default situation.

For Japan, Sri Lanka is a country at a strategic point in the Indo-Pacific. It is important for Japan to strengthen bilateral relations by resolving Sri Lanka’s debt and normalising its repayment capacity.

On the other hand, China also showed interest in Sri Lanka’s debt restructuring. During Sri Lankan Prime Minister Dinesh Gunawardena’s visit to China in March 2024, both countries discussed the reduction, waiver, suspension and restructuring of debt repayments.

China expressed openness to addressing these issues within multilateral frameworks. Similarly, Japan is also exploring a comprehensive solution to Sri Lanka’s debt problem, which appears to involve China, at least superficially.

For Japan, Sri Lanka is a country at a strategic point in the Indo-Pacific. It is important for Japan to strengthen bilateral relations by resolving Sri Lanka’s debt and normalising its repayment capacity.

And as Prime Minister Fumio Kishida said in India in May 2023, Japan’s Free and Open Indo-Pacific (FOIP) respects “diversity,” “inclusiveness” and “openness,” and an important principle is that “we do not exclude anyone, we do not create camps, and we do not impose values”.

That being the case, even if it is highly challenging, how to involve China in Sri Lanka’s debt settlement, how to proceed with the debt settlement while holding talks with China, and whether Japan’s “important principle” will translate into actionable policy, are crucial issues to resolve. Such an all-round solution would be good for Sri Lanka.