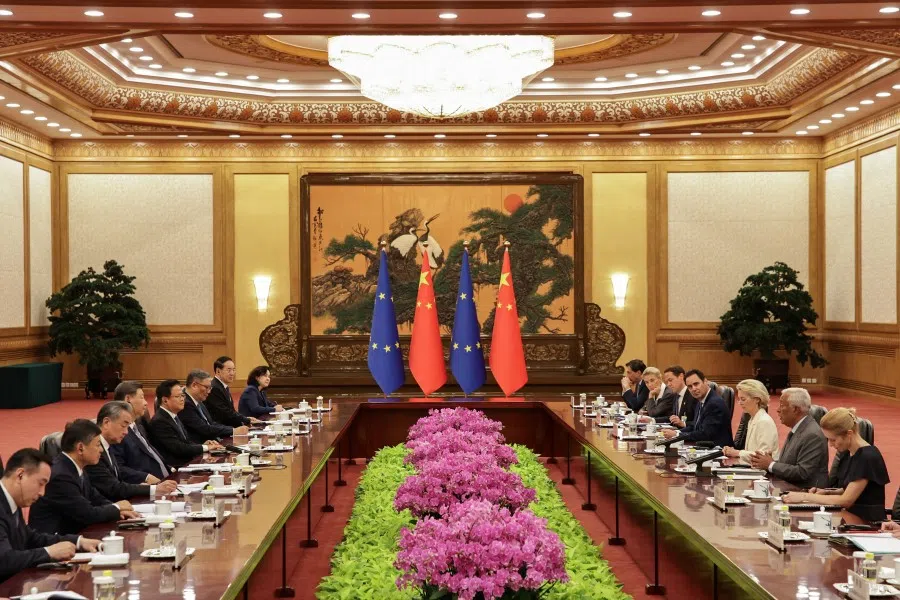

‘Jubilant’ China, exhausted Europe: The 25th EU-China summit

Those who expected that growing tensions within the transatlantic alliance might prompt China to adopt a more conciliatory approach on contentious issues with the EU, in an attempt to widen the divide with Washington, have been proven entirely wrong, says French researcher Mathieu Duchâtel.

The 25th EU-China summit unfolded against the extraordinary backdrop of the EU facing pressure from the Trump administration to negotiate a “rebalancing” transatlantic trade deal. Taken together, these developments highlighted the EU’s structural inability to credibly threaten escalation in its dealings with either China or the US.

In the case of China, the lack of transatlantic coordination in 2025 has not significantly weakened the EU’s position — but it has certainly not strengthened it. Those who expected that growing tensions within the transatlantic alliance might prompt China to adopt a more conciliatory approach on contentious issues with the EU, in an attempt to widen the divide with Washington, have been proven entirely wrong.

Quite the contrary, China has even turned its export control regime, originally conceived as leverage in the US-China trade dispute, against the EU, using it as a tool to constrain European assertiveness, threaten further escalation and seek concessions on other issues.

China’s ‘stinking fish’ strategy

The European Commission now calls the EU-China trade relationship “critically unbalanced”. Despite all the talk in Beijing regarding the rise of European “protectionism”, despite the activation in Brussels of trade defence instruments to address Chinese market distortions in electric vehicles or medical devices, the Chinese trade surplus keeps on ballooning. It exceeded 300 billion euros again in 2024. In both May and June 2025, Chinese exports to the EU were on a steep upward trajectory, rising by nearly 10% year-on-year each month and reaching record highs.

One European diplomat aptly described China’s approach as the “stinking fish” strategy — “you put a stinking fish on the table, and then you want me to pay you to take it away”.

Before, during, and after the summit, Europeans reiterated familiar concerns about market access in priority sectors like meat, cosmetics and pharmaceuticals; China’s trade measures on European brandy, pork and dairy, which the Commission describes as “misuse” of anti-dumping instruments for “retaliatory purposes”; and China’s use of export control measures on rare earths and permanent magnets.

One European diplomat aptly described China’s approach as the “stinking fish” strategy — “you put a stinking fish on the table, and then you want me to pay you to take it away”. This is indeed precisely how China is operating, by manufacturing new frictions in the EU-China economic relationship that consume the time and attention of European policymakers. By drawing focus to a series of intractable, lower-level disputes, Beijing effectively undermines Europe’s ability to pursue a broader and more strategic rebalancing of the relationship.

Despite the summit announcement that the EU and China had agreed to establish an “upgraded supply chain mechanism” allowing for “immediate checks in case of bottlenecks”, there are good reasons to remain sceptical that China’s export controls on rare earths and permanent magnets, specifically targeting Europe, are about to be lifted.

... the so-called “upgraded supply chain mechanism” remains at the conceptual stage — and when it comes into existence, the Chinese side appears intent on using it as a platform to push back against EU export controls affecting Chinese firms.

In the lead-up to the summit, China appeared to ease pressure on the EU. China’s exports of rare earth magnets to the EU, surged by 245% in June compared to May, reaching 1,364 metric tons. However, this was still 35% below the levels recorded a year earlier, according to customs data. Behind this partial recovery, European industry voices are sounding the alarm: time is running out to secure stable, long-term supplies. Some companies are operating on stockpiles and may be forced to halt production within weeks or months.

While the EU is actively pressing China’s Ministry of Commerce (MOFCOM) to issue export licenses without delay, all signs suggest that Beijing intends to retain this tool as a source of leverage. For now, the so-called “upgraded supply chain mechanism” remains at the conceptual stage — and when it comes into existence, the Chinese side appears intent on using it as a platform to push back against EU export controls affecting Chinese firms.

Moreover, in both China and Europe, export control measures ultimately aim to restrict access for military end-users, who can be denied import licenses. While the European defence industry may represent only a minor share of demand for Chinese processed rare earths and permanent magnets in value terms, access to these critical materials remains essential for Europe’s broader defence modernisation efforts.

European defence companies will have no choice but to secure more reliable and politically stable sources of supply. It would be naïve to assume that China will facilitate Europe’s rearmament at a time when Europe is actively working to deny the Chinese military access to advanced technologies and components.

That said, one important risk has so far been averted: the EU has managed to prevent individual member states from seeking bilateral “green corridor” arrangements with MOFCOM, which would have fragmented Europe’s position and undermined its collective leverage.

Xi Jinping’s Russia priority

China’s second key status quo objective vis-à-vis the EU is to ensure that its critical support for Russia’s war in Ukraine can continue with minimal consequences. So far, this pursuit of impunity has proven remarkably effective.

This time, China has reacted much more strongly to the inclusion of two local banks from Northeast China that facilitate military cross-border trade between China and Russia...

One week before the summit, the European Council unanimously adopted its 18th package of sanctions, aimed at weakening Russia’s ability to sustain its war effort in Europe. Seven Chinese entities were included for their role in circumventing export restrictions, notably in the supply of unmanned aerial vehicles. The EU began listing entities from third countries in its 13th sanctions package, adopted in February 2024. The number of designated Chinese firms has steadily grown since then.

Until recently, Beijing had largely turned a blind eye to this issue — seemingly preferring to downplay its relevance. On one hand, the sanctions have no visible impact on China-Russia trade in defence electronics, which remain critical for the Russian arms industry; on the other, Beijing likely sought to avoid allowing the Russia-Ukraine war to dominate the EU-China diplomatic agenda.

This time, China has reacted much more strongly to the inclusion of two local banks from Northeast China that facilitate military cross-border trade between China and Russia, Suifenhe Rural Commercial Bank and Heihe Rural Commercial Bank. MOFCOM reacted to the first inclusion of financial institutions to the EU’s sanctions lists by announcing it would take “necessary steps” in response.

China may choose to retaliate or tie the issue to its export control regime. China’s entire legal arsenal of geoeconomic measures is anchored in Article 7 of its Foreign Trade Law, which provides the legal basis for imposing “countermeasures” in response to any “prohibitive, restrictive, or other similar measures” taken against China.

Meanwhile, scarcely a month goes by without new evidence of growing Chinese support for Russia’s arms industry. The latest example is the documented transfer of Chinese-manufactured engines labelled as “industrial refrigeration units” to IEMZ Kupol, the Russian manufacturer of the Garpiya-A1 drone, an enhanced version of the Iranian Shahed-136.

How much longer can the EU-China relationship continue its slow but steady deterioration?

Past the ‘inflection point’?

China’s status quo inertia is exhausting European patience. Not only has Beijing succeeded in preserving access to the European market, but it is also skilfully managing to expand its exports. China continues to provide a lifeline to the Russian invasion of Ukraine without fully derailing the EU-China relationship. One European diplomat described Chinese posture vis-à-vis the EU in the lead-up to the summit as “jubilant”. How much longer can the EU-China relationship continue its slow but steady deterioration?

In Beijing, European Commission President Ursula von der Leyen characterised the EU-China relationship as having hit an “inflection point”. The EU’s summit press release gives a clear elaboration of what the term means: “The EU remains ready to continue to engage in constructive dialogue to find negotiated solutions. As long as this is not the case, the EU will take proportionate, legally compliant action to protect its rightful interests”. Further trade defence measures seem very likely in the short term as Europe addresses China’s persistent market distortions, leading to more frictions and asymmetric retaliation. This cycle of protracted confrontation is likely to persist as long as China continues to treat access to the European market as a given.