Red Sea shipping chaos puts strain on Chinese exports

Academic Jasper Verschuur points out that the trade route disruptions caused by the Houthi attacks in the Red Sea and the Bab al-Mandab Strait are having a devastating impact on major shipping countries, not least China.

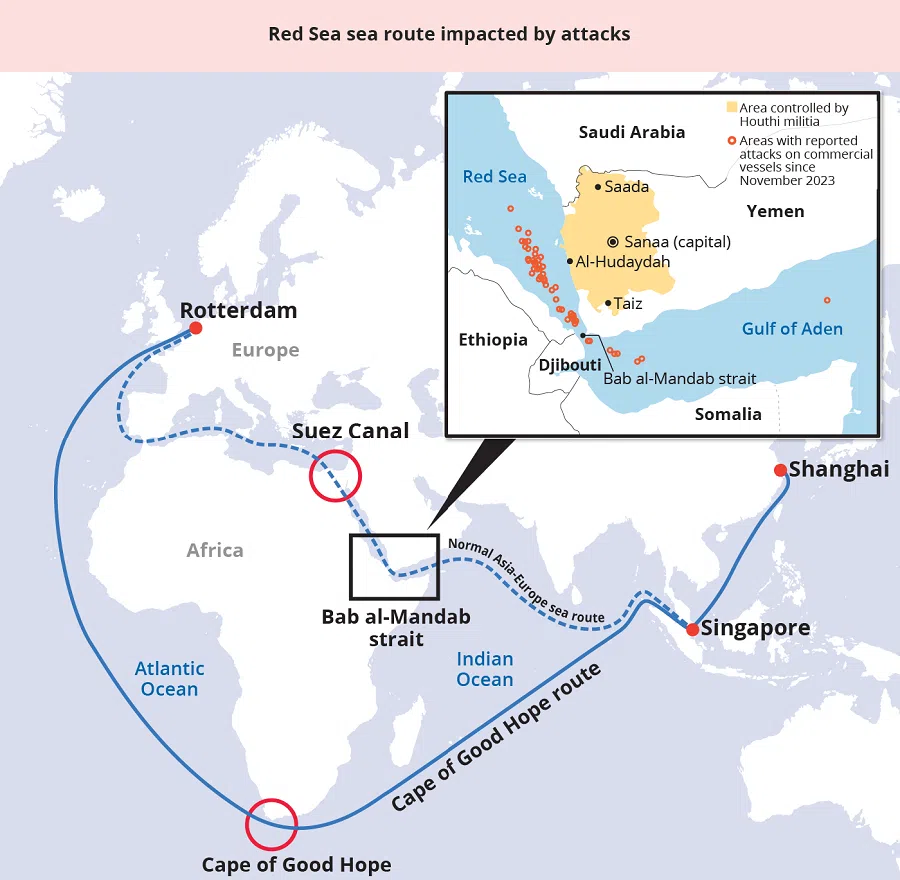

Since mid-December 2023, Houthi rebels have been causing chaos in the Red Sea and the Bab al-Mandab Strait, a narrow passage that connects the Red Sea with the Gulf of Aden.

The Houthi rebels, who control most of Yemen, are launching drone and missile strikes on ships belonging to Israel and its Western allies. Despite limited damage to ships and counterattacks by US warships, the situation, which has now lasted almost six weeks, has led many shipping companies to avoid this route.

Instead, ships have been rerouted around the Cape of the Good Hope, adding an extra ten to 14 days to journeys from Asia to Europe. Realtime shipping data provided by the PortWatch platform, a joint initiative between the International Monetary Fund and the University of Oxford, show that transit volumes through the Suez Canal (that connects the Red Sea with the Mediterranean Sea) were down 37% in 2024 (up until 16 January). Meanwhile, transit volume around the Cape of Good Hope was up 54% over the same time period.

An estimated US$120 billion of Chinese imports and US$160 billion of Chinese exports flow through the Bab al-Mandab Strait each year, out of the estimated US$1.5 trillion of total maritime trade.

Among various ripple effects, the emerging Red Sea situation is hampering Chinese trade flows in several different ways, each of which has severe economic consequences.

Chinese dependency on the Red Sea

The Bab al-Mandab Strait is key in connecting the Asian continent with Europe and North America, with around 12% of seaborne oil, 8% of LNG and a large percentage of container traffic moving through this narrow passage. According to research by Oxford University, trade originating from, or bound for, China contributes most to the value of trade flowing through this "maritime choke point".

An estimated US$120 billion of Chinese imports and US$160 billion of Chinese exports flow through the Bab al-Mandab Strait each year, out of the estimated US$1.5 trillion of total maritime trade. While this is only a small fraction of total Chinese maritime trade (~10%), this disruption could put an additional drag on Chinese trade, which is already facing pressures from US-China trade tensions and ongoing trade relocation away from China.

The main rail corridor from Shanghai to western Europe, which takes around 15-20 days, has seen a surge in demand.

Rerouting trade restricted by other disruptions

Shipping through the Bab al-Mandab Strait is much less than usual but continues to take place, especially for Chinese- and Russian-owned vessels that have been promised safe passage by Houthis. However, most shipping companies, in particular container ships, have decided to divert their ships towards the Cape of Good Hope.

During normal times, some of the trade flows that are now going around the Cape of Good Hope could be rerouted via rail to Europe or through the Panama Canal to the US East Coast. However, these transport corridors are similarly facing severe disruptions.

The main rail corridor from Shanghai to western Europe, which takes around 15-20 days, has seen a surge in demand. Traditionally, rail freight between China and Europe travelled via Russia (through the Trans-Siberian railway). However, the Russian invasion of Ukraine led many rail operators to avoid this route. Instead, alternative longer itineraries via the Caspian Sea have been used, but these routes lack the capacity to facilitate major trade volumes.

For reference, while a large container ship can carry over 23,000 containers, an international freight train from China to Europe usually handles around 80 to 100 containers.

As a consequence of the vessel rerouting, and resulting delays in shipments, factories across Europe have had to halt operations.

To serve the east coast of the US from China, the maritime route transiting the Panama Canal usually serves as the alternative option. However, the Panama Canal has been struck by a major drought since the start of 2023, which has caused restrictions in terms of the number of vessels being allowed through the locks. Transit volumes are down 30 to 35% in 2024 according to PortWatch data, and any surge in additional traffic wanting to go through the Panama Canal will likely cause long waiting times - similar to those seen in 2023.

Ongoing disruptions across these other major transport corridors are thus forcing ships to go around the African continent.

Business interruptions due to delivery delays

As a consequence of the vessel rerouting, and resulting delays in shipments, factories across Europe have had to halt operations. Companies most affected by delays are those relying on "just-in-time" inventory management, which matches production to the delivery of critical supplies, thereby requiring minimal stocks. For instance, Tesla and Volvo Car have halted production in their Germany production plants, as well as the Suzuki factory in Hungary, due to shortages of critical components.

In addition, oil and gas supplies in many European countries are tightening given the lack of supplies coming from the Middle East. For instance, Britain may be forced to rely on its emergency fuel stocks after Qatar has suspended shipments through the Red Sea. Similarly, gas shipments from the US to China are seeing major delays.

China's oil trade with Iran has also been stalled as Iran is asking higher prices for its oil, forcing China to increase supplies from alternative oil suppliers such as Russia. Although the delays are mainly causing issues in the short run, the persistence of these disruptions could increase the price of commodities.

... a price increase in Chinese supermarkets is anticipated for products that originate from Europe such as wine, dairy and meat, but also grains.

Will we see higher consumer prices?

Simply speaking, longer journeys mean more fuel, which increases the cost of the shipping. On top of that, longer routes mean that less ship capacity is available (given a finite number of vessels), which can further increase the price of shipping.

As a result, the price to ship a container from Shanghai to Rotterdam reached its highest point since September 2022 on 18 January. Back in September 2022, major shipping disruptions due to the pandemic caused container rates to reach an all-time high.

This price increase will likely be passed on to consumers, and is expected to raise the price of products in European supermarkets. Similarly, a price increase in Chinese supermarkets is anticipated for products that originate from Europe such as wine, dairy and meat, but also grains. Although some warn that the increase in consumer prices could cause global inflation to rise slightly, others say it is too early to say whether this disruption will affect inflation.

Rocky start for Chinese maritime trade

The Red Sea trade disruption, together with other disruptions to transport corridors that connect China to the rest of the world, puts additional pressure on Chinese trade. There are already some early signs of a reduction of around 10-15% of exports leaving Chinese ports.

These shipping disruptions are happening at a time when China is preparing for its upcoming Lunar New Year, which traditionally slows down Chinese exports considerably. While Beijing is staying clear of any involvement in the Red Sea dispute, as the country that has the most to lose from this conflict, it will continue to keep a close watch on the developments in the region.

![[Big read] When the Arctic opens, what happens to Singapore?](https://cassette.sphdigital.com.sg/image/thinkchina/da65edebca34645c711c55e83e9877109b3c53847ebb1305573974651df1d13a)