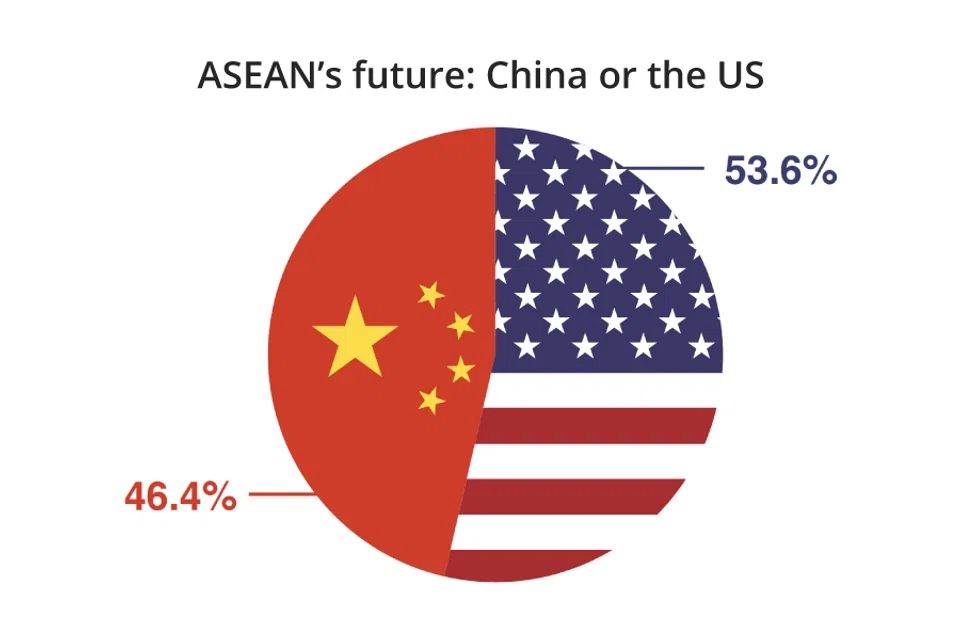

ASEAN's future: China or the US?

An online survey by the ASEAN Studies Centre at ISEAS-Yusof Ishak Institute shows that Southeast Asian opinion leaders are split down the middle when it comes to strategic alignment with the US or China. But who says it has to be one or the other? With US involvement in the region on a lower ebb and wariness of China on the rise, players such as Japan and the EU are increasingly looked upon as attractive and reliable alternatives.

The State of Southeast Asia: 2020 Survey Report was released by the ASEAN Studies Centre at ISEAS-Yusof Ishak Institute today. This is only the second time that the research institute has conducted an online survey to elicit Southeast Asian nationals' views on geopolitical and economic issues affecting the region. 58 questions were posed - 40 of them new - to 1,308 respondents in the fields of research, business and finance, the public sector, civil society and media. ThinkChina zooms in on the China-related issues in the report.

Key takeaways include views on China-US competition globally and in the region, the shifting shape of regional architecture, the double-edged sword of China's influence in Southeast Asia, China's soft power and points that China would do well to note in its relations with ASEAN countries.

China-US quagmire

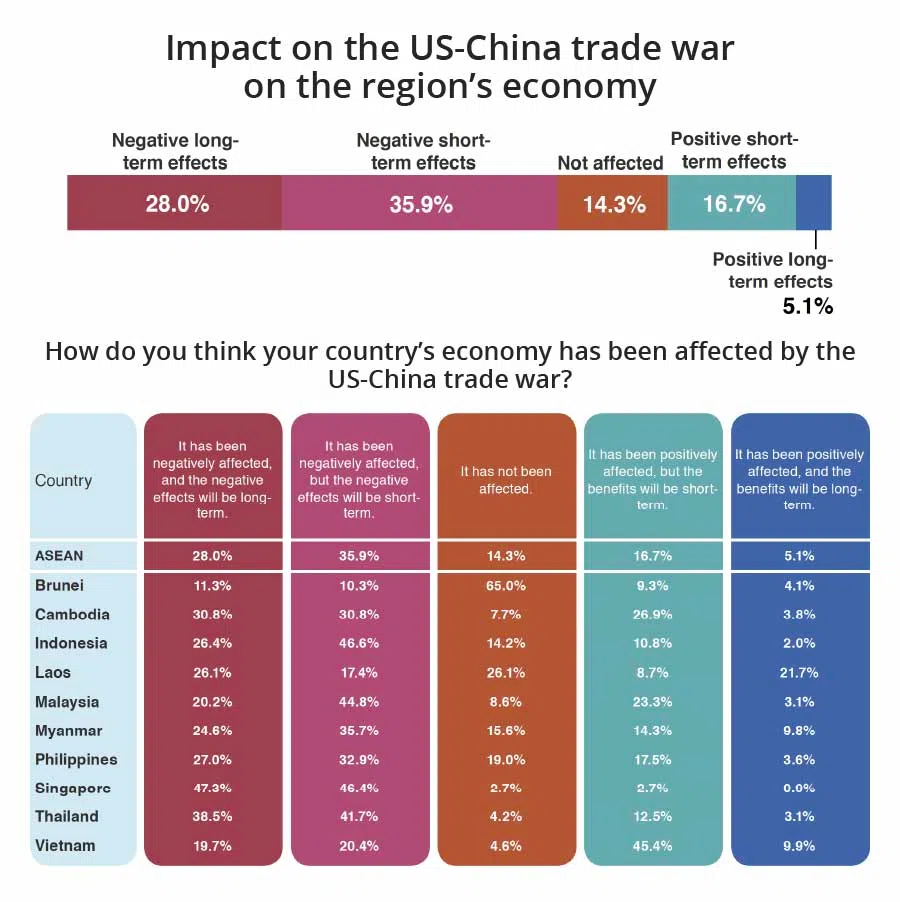

The China-US trade war has dominated headlines for much of 2019. All eyes are on whether the phase one deal signed on 15 January 2020 will lead to an in-depth "phase two" deal or further tussles that impact the global economy.

In Southeast Asia at least, the issue is high on the regional economic agenda. 63.9% say that their country's economy has been negatively affected by the US-China trade war, although respondents from countries such as Vietnam (55.3%) and Cambodia (30.7%) - who may be benefiting from trade diversions - feel that their economies have been positively affected. In total, 41.4% of respondents worry that "the trade war will spark a global economic slowdown", while 25.8% envision that "the threat of 'decoupling' will divide Southeast Asia into two exclusive trade blocs led by China and the US".

Overall confidence in the US's positive influence in the region continues to dip. Compared to last year's 34.6%, 47% of respondents this year have little or no confidence in the US as a strategic partner and provider of regional security, although 60.3% indicate that this assessment could change if there is a change in leadership.

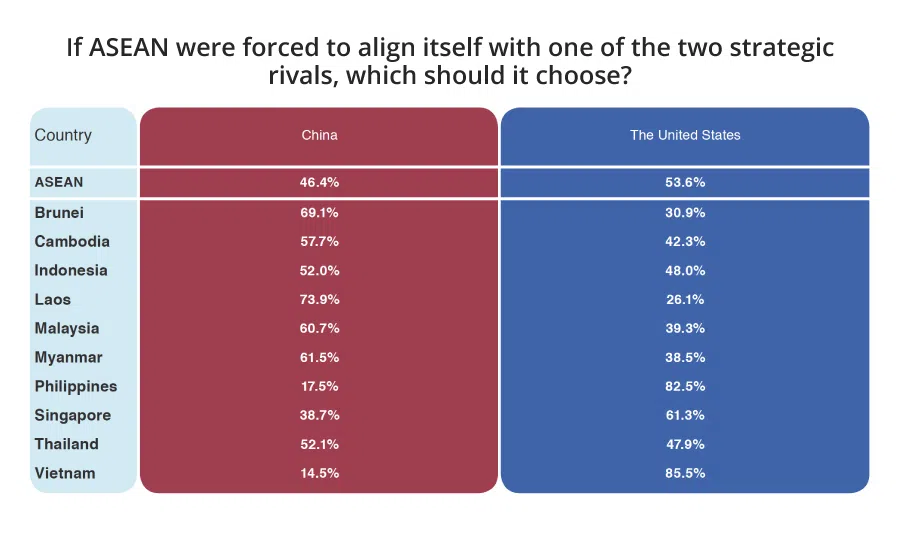

But this does not mean that China gains an upper hand. When it comes to placing bets on China or the US, respondents seem to be split down the middle between the two. In response to the question: "If ASEAN were forced to align itself with one of the two strategic rivals, which should it choose?", 53.6% of respondents went with the US, while 46.4% chose Beijing.

However, responses are not evenly distributed across the ASEAN countries, with more than half of respondents from the Philippines, Vietnam and Singapore falling on the side of the US, and over half of respondents from Brunei, Cambodia, Indonesia, Laos, Malaysia, Myanmar and Thailand saying ASEAN should cast its lot with China.

Regional shifts

In fact, 31.3% of respondents believe that ASEAN should continue its policy of not taking sides in the tussle between the US and China, while 48% think that ASEAN should enhance its resilience and unity to fend off pressure from the two major powers.

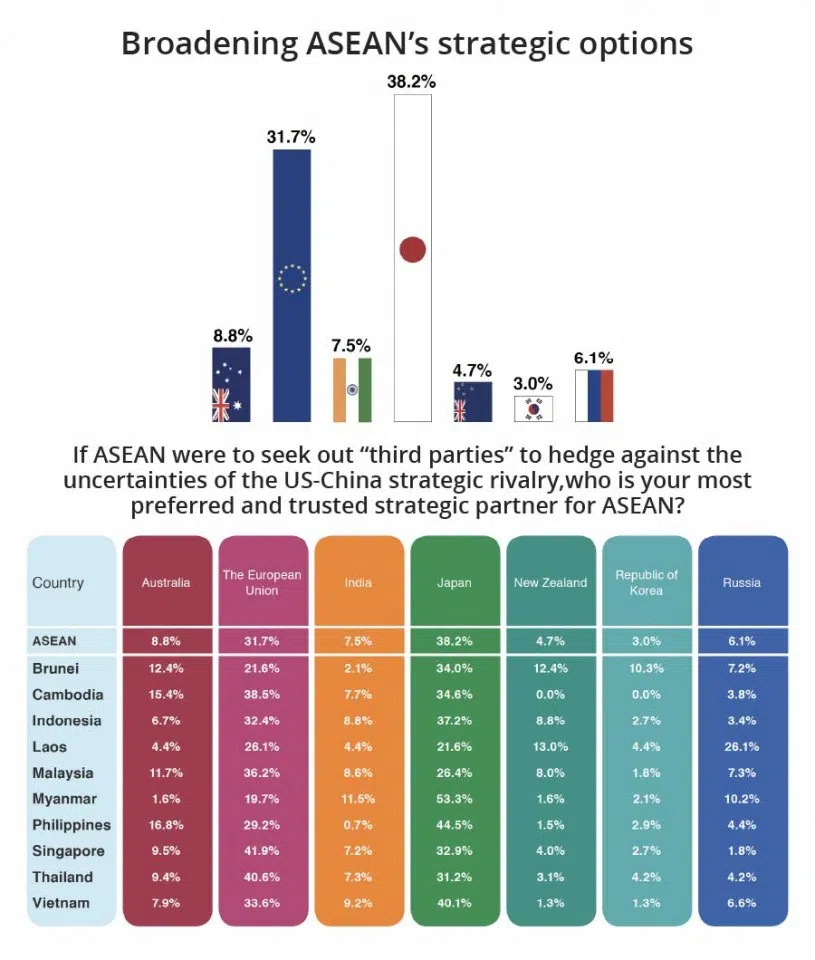

In practice, this suggests that rather than going with either of the two powers, ASEAN may look to other plausible partners. When asked the question: "If the US is perceived as unreliable, who would you look to as your country's preferred strategic partner?", Japan received the highest votes (31.7%), followed by the EU (20.5%) and then China (20.3%). And for the question: "If ASEAN were to seek out 'third parties' to hedge against the uncertainties of the US-China strategic rivalry, who is your most preferred and trusted strategic partner for ASEAN?", Japan came out tops (38.2%), followed by the EU (31.7%). Japan is also the preferred partner of choice among the younger respondents.

In addition, in terms of regional architecture, ASEAN seems open to configurations that would be inclusive and help it better hedge its bets. For one, 55.8% of respondents think RCEP's membership "should be opened to all qualified parties and not be limited to geography", including entities such as the UK and the EU. For another, the number of respondents who view the Indo-Pacific (for which ASEAN leaders adopted an "ASEAN Outlook on the Indo-Pacific" at the ASEAN Summit in Bangkok in June last year) as a viable option for a new regional order, rose from 17.2% in 2019 to 28.4% this year.

Support for the Quad - a new quadrilateral security dialogue comprising Australia, India, Japan and the US geared towards the Indo-Pacific - remains soft. 54.2% of respondents think that the Quad has either "very negative", "negative", or "no impact". However, 61.6% of them, chiefly the Philippines, Myanmar and Vietnam think that their countries should participate in security initiatives and military exercises under the Quad.

ASEAN countries' concerns about China

Regional tectonics aside, the survey shows that China would do well to first allay the ambivalent impressions it may have amassed in the region. 38.2% of respondents, particularly from Vietnam, Malaysia, Philippines and Singapore, agree that China is a revisionist power and intends to turn Southeast Asia into its sphere of influence. Compared to the figure of 45.4% in 2019, this perception seems to have softened.

On the other hand, 34.7% acknowledge that China is gradually taking over the US's role as a regional leader, particularly those in Cambodia, Indonesia, Laos and Thailand.

In line with its mixed feelings towards China, ASEAN countries' reception of China is consistently equal parts welcoming and wary. An overwhelming 79.2% of respondents picked China as the most influential economic power in the region in an increase from last year's 73.3%. At the same time, a high 71.9% are worried about its economic might in the region.

Indicatively, China's Belt and Road Initiative (BRI) continues to receive the lukewarm reception it got last year when 47% thought it would bring them closer into China's orbit. This year's poll shows that 63.6% of respondents have little or no confidence in China's new BRI approach (unveiled in September 2019 as "open, green and clean"). The sense of distrust is most visible in respondents from Vietnam, the Philippines and Laos who expressed the highest "no confidence" rates.

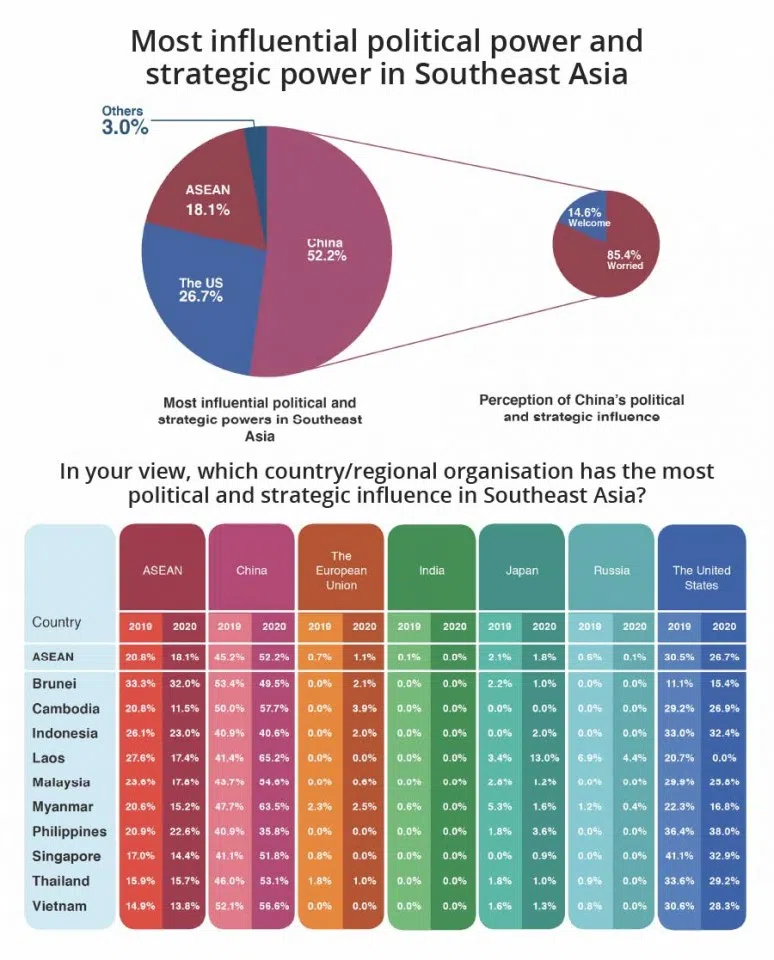

In another example, China is viewed as the most influential political and strategic power in Southeast Asia (at 52.2% versus the US's 26.7%), yet a high 85.4% of respondents, particularly among the younger generation, are worried about this. It may be of little surprise then, that on the back of possible security concerns, the survey finds that Korea's Samsung (38.5%) is the preferred company to build ASEAN countries' 5G infrastructure, compared to China's Datang Telecom, Huawei or ZTE (24.6%).

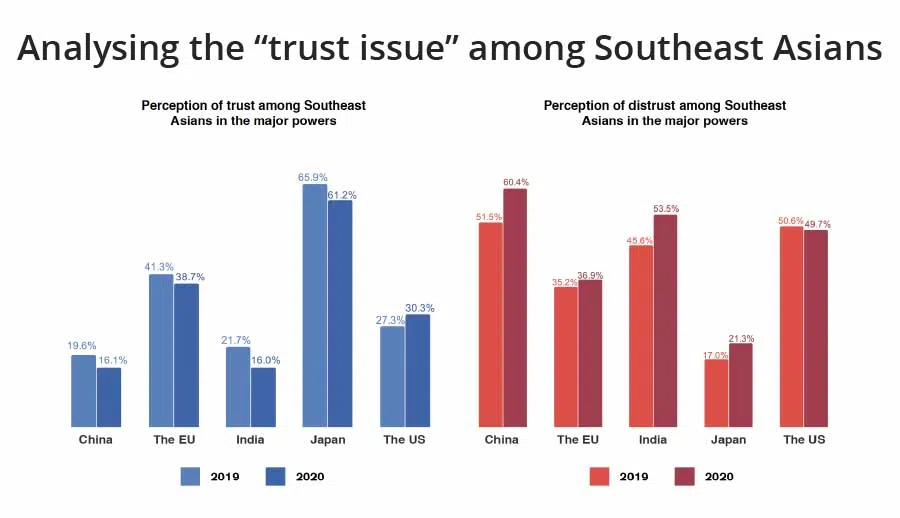

In terms of trust, the double-edged sword veers its head again. In response to the question: "How confident are you that China will 'do the right thing' to contribute to global peace, security, prosperity and governance?", 60.4% of respondents have little or no confidence, which is a rise from 2019's 51.5%.

This group cites "China's economic and military power could be used to threaten my country's interest and integrity" as their main source of concern. But along similar lines, those who are "confident" or "very confident" that China would "do the right thing" feel that they trust China because "China has vast economic resources and strong political will to provide global leadership".

China's low soft power influence in Southeast Asia

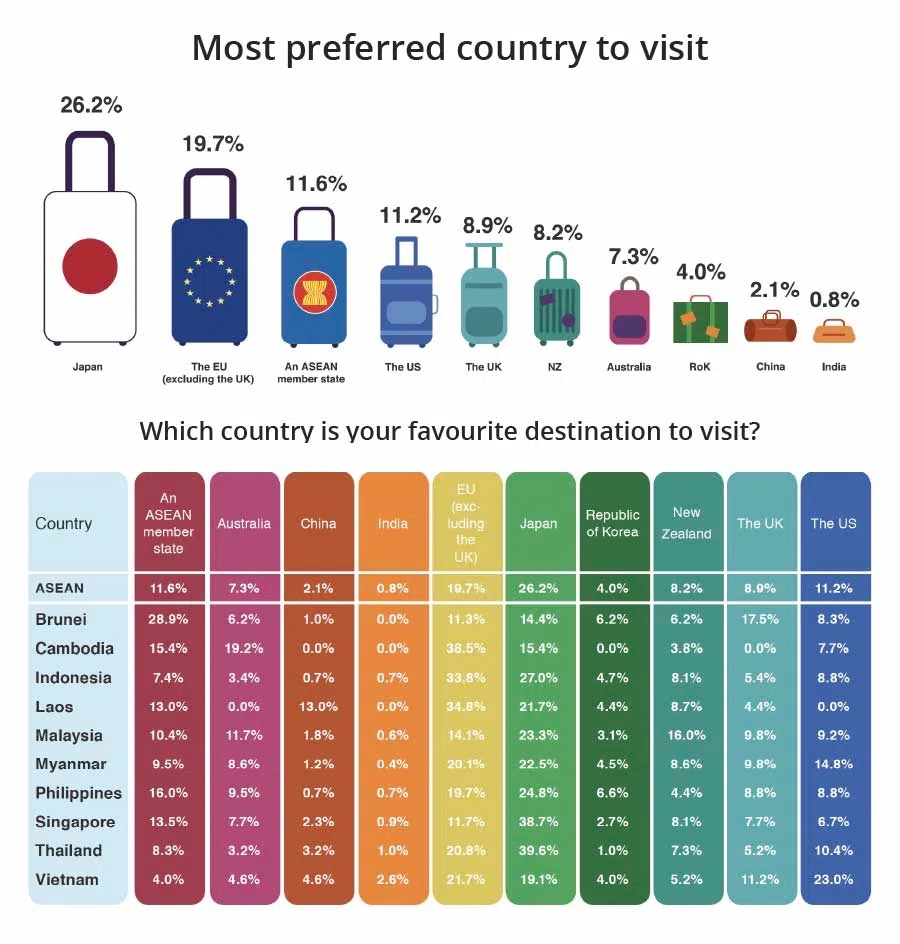

Not for a lack of effort, China's soft power efforts have not borne as much fruit as it could. A paltry 3.1% of respondents are keen to study in China compared to the 29.3% who would head to the US. This is despite several policies put in place by the Chinese government to woo students from the ASEAN region. Neither is China on the top of the list when it comes to travel destinations. Only 2.1% of respondents list China as their favourite destination. Comparatively, Japan is the top destination to visit, coming in at 26.2%. While Mandarin (39.1) is the second top language to learn, same as 2019, it's a far cry from English at 95.4% and lower than last year's figure of 44.7%.

Though it's not the only factor, soft power is correlated to building trust. In the findings for the question "Why do you trust China", 18.1% of those who are confident or very confident that China would "do the right thing" to contribute to global peace, security, prosperity and governance, say they respect China and admire its civilisation and culture. Comparatively, when posed the same trust question, 23.2% of those who expressed confidence in Japan admire its civilisational and cultural attributes. For that matter, Japan retains its spot this year as the most trusted power in 2020 (61.2%), albeit mostly due to the factor that it is a "responsible stakeholder that respects and champions international law" (51%).

What can China do?

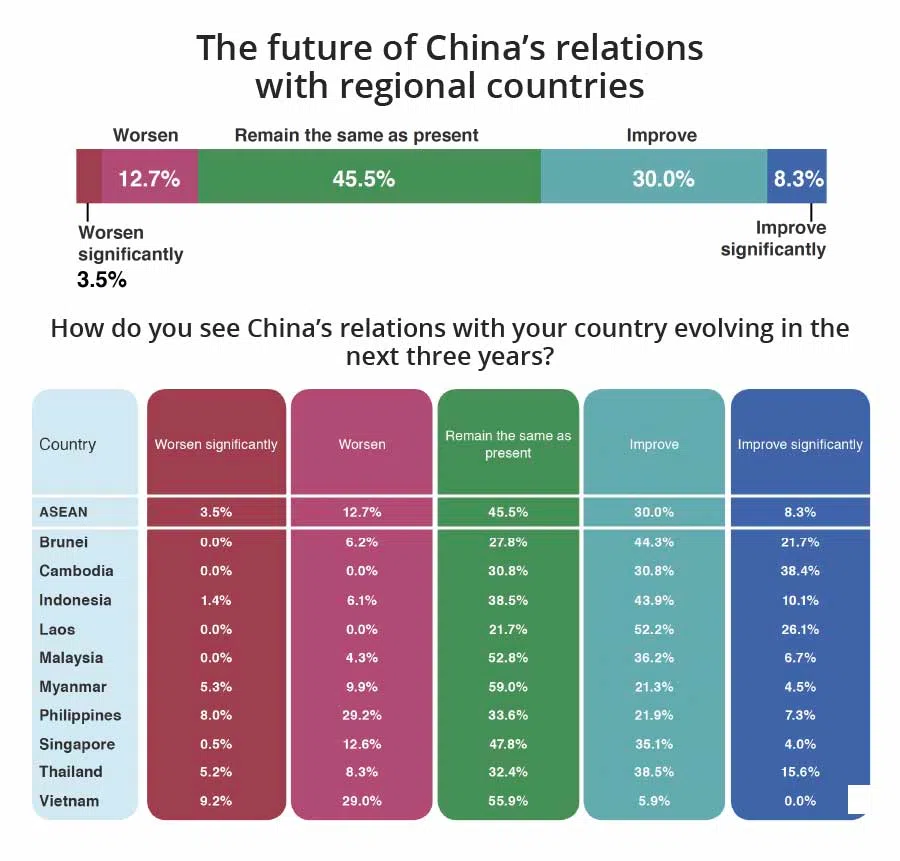

45.5% of respondents expect China's relations with their country in the next three years to remain the same. Among those who think relations would improve, "China's growing economic dominance and political influence in my country (55.5%)", and "China's strong-arm tactics in the South China Sea and the Mekong (53.9%)" are listed as the top two concerns.Those who expect relations with China to worsen say that "China should resolve all territorial and maritime disputes with regional states peacefully in accordance with international law" (74.1%) and "China should respect my country's sovereignty and not constrain my country's foreign policy choices" (61.8%).

Based on these findings, China will do well to advance its engagement of Southeast Asia while treading carefully when it comes to issues of national sovereignty and ASEAN centrality.

_________________

This condensed report with a China focus, was put together by Charlene Chow, ThinkChina.

The full report is available here.

![[Big read] When the Arctic opens, what happens to Singapore?](https://cassette.sphdigital.com.sg/image/thinkchina/da65edebca34645c711c55e83e9877109b3c53847ebb1305573974651df1d13a)