[Big read] Dongguan: A Chinese city reliant on foreign trade losing its shine

Following the easing of Covid-19 pandemic restrictions in China this year, the city of Dongguan which has been called "the world's factory" has experienced a sharp decline in business orders as it came in last in economic growth within the province of Guangdong. Following China's reform and opening up, the city developed rapidly and its GDP had even exceeded a trillion RMB. So, what is behind its current downturn, and where does its future lie?

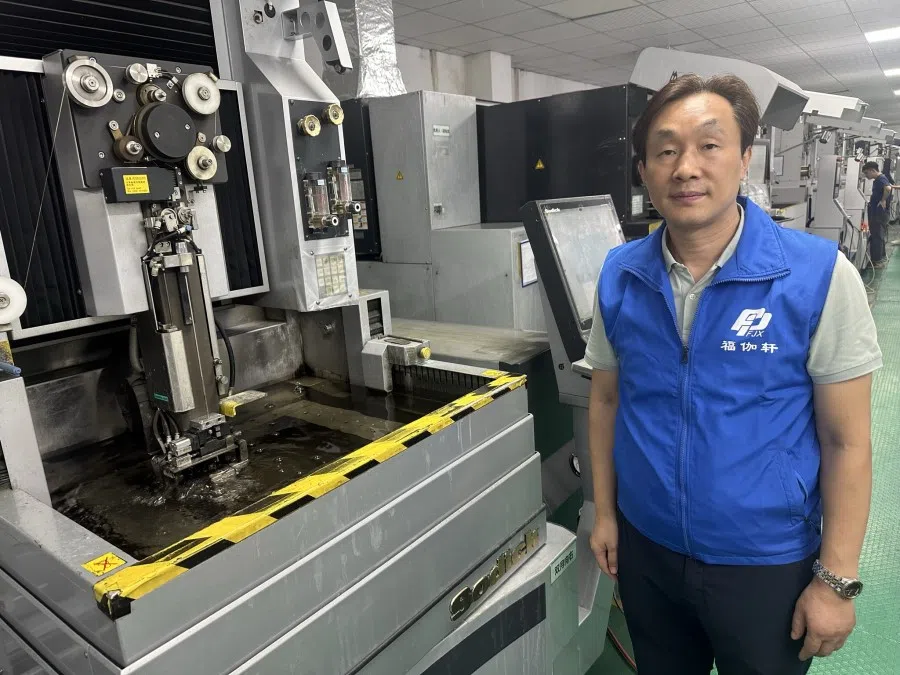

(All photos by Daryl Lim.)

Walking along the streets of Dongguan in Guangdong province, "To let" notices were everywhere on the walls of industrial buildings, as well as empty shop spaces. It was a working day, but there were few people and vehicles around. Apart from a few shop owners sitting together chatting, the streets were exceptionally quiet.

Cabbie Mr Zhang lamented that even during the pandemic, the Humen high-speed railway station was bustling and filled with people. "Now, much fewer people come to Dongguan, and I can hardly pick up any passengers here."

Madam Lu runs a dormitory in Shijie town in Dongguan to provide migrant workers with short-term accommodation. This year, more than two-thirds of the 20 or so rooms in her dormitory are unoccupied. "In the past, my husband and I would be so busy running the dormitory. Now, our business is so poor that he has to take on some temporary work outside to supplement our household expenses."

Moment of glory

The town of Chang'an is Dongguan's manufacturing hub. At its peak, it was home to some 1,600 companies that produce hardware moulds. Zhang Weilun is the founder of D.Werkz Precision, which manufactures high-precision hardware moulds. In 2017, Zhang set up his factory in Chang'an as he saw its well-developed supply chain and concentration of companies.

Currently, there is a surplus of factory spaces in Chang'an, with "To let" notices everywhere. Zhang said this is a stark contrast with 2021, when units were hard to come by.

He recalled that at the time, the pandemic was still sweeping the globe; work, production and operations were halted in many countries, and so orders flowed to China, where economic and social activities were back to normal. As "the world's factory", Dongguan's external-oriented economy allowed it to benefit directly, and the second-tier city had its moment of glory.

In 2021, the city's GDP exceeded one trillion RMB for the first time to reach 1.0855 trillion RMB (US$152.4 billion) as its GDP grew by 8.2% year-on-year, making it the fourth city in Guangdong with a GDP in excess of a trillion RMB, after Guangzhou, Shenzhen, and Foshan. It also became the 15th Chinese city with a GDP exceeding a trillion RMB and a population of more than 10 million.

Dongguan's vibrant manufacturing sector attracted an influx of workers. Many businesses expanded to cope with the extra orders, while demand for factory space rose sharply and rentals increased by 10 to 20%.

"When we had many orders, all 90 machines were running and it wasn't enough for production. Now that business is bad, the workers just clean the machines every day." - Wang Yingying, Managing Director, Infinique

A plunge in orders

However, this moment of glory seems to be over for now. With the global economic downturn, faltering domestic and external demand, US interest rate hikes, and the Sino-US trade war, many businesses are complaining of plunging orders and sliding revenues this year.

For example, Zhang's D.Werkz Precision mainly serves European and US clients, including some titans in the automotive industry. This year, D.Werkz clinched 30% fewer orders year-on-year - even the number of companies making price enquiries has halved.

Zhang said, "Each vehicle has more than a thousand hardware parts. When the economy is bad and people change vehicles less often, car makers will consider cutting back on product development or use existing moulds to manufacture components for new vehicle models, so we end up with fewer orders."

Infinique is another company in Dongguan, in the business of injection-moulding parts processing and manufacturing, where European and US companies made up 70% of its clients. Its managing director Wang Yingying said Infinique's orders "plummeted" this year, and its revenue is down by around 50%.

Wang said due to the lack of orders, about half of the machinery in her company has not been switched on this year and the company headcount has fallen from more than 500 at its peak to 200 now. "When we had many orders, all 90 machines were running and it wasn't enough for production. Now that business is bad, the workers just clean the machines every day."

Other than companies in the traditional processing and manufacturing industry, some Dongguan companies in emerging industries are also facing difficulties. One example is Haiwang Automation (海望自动化科技公司), a tech company that produces customised industrial robots. Its founder, Xie Shaoqi, pointed out that the performance of the automation industry depends on the traditional manufacturing industry because automation aims to help companies use less manpower and boost both efficiency and production capacity. When companies receive fewer orders, they do not invest in automation equipment.

"It's a chain reaction. When they do well, we do well; when they don't do well, we have it worse." This year, the orders for Xie's company fell by more than 50%.

Negative competition and faltering economy

Insufficient external demand has forced an increasing number of Dongguan companies to turn to the domestic market, leading to "involution" (内卷) and negative competition in certain segments of the manufacturing industry.

Gong Fuzhou, the owner of Dongguan Fujiaxuan Precision Hardware Mould, a hardware mould manufacturer which serves the Chinese market, described the overcapacity in his industry as a problem of "too many wolves but too little game".

Some companies give very low quotes to clinch orders, so market prices have dropped by around 20%. "Our orders have not fallen much when compared to those that are export-focused, but with rising operating costs from rental, utilities, and manpower, as well as lower order prices, our profit margin has shrunk even more."

Tough market conditions have led some Dongguan factories to cease operations. According to media reports, the Hubang Hardware and Plastics Manufacturing (虎邦五金塑胶制品公司), a veteran that has been operating for 32 years in the local manufacturing industry, shut down at the end of October this year due to "crippling losses and insurmountable difficulties".

Into the third quarter of this year, Dongguan has not shaken off its malaise, as its GDP only grew by 2% to place last within Guangdong.

Other than companies involved in processing and manufacturing, there have also been frequent reports of those in consumer goods manufacturing (such as furniture and clothes) closing down in Dongguan this year. When I visited the premises of two factories to verify online rumours that they had closed down, I found that the furniture factory had been sealed off by the judicial authorities, while a new tenant had already taken over the premises where a clothes factory used to be.

The severe drop in the revenue of companies in Dongguan has also impacted local economic growth. Official data shows that Dongguan's GDP for the first half of 2023 was 526.2 billion RMB, an increase of 1.5% year-on-year, but far lower than the national average of 5.5%. Into the third quarter of this year, Dongguan has not shaken off its malaise, as its GDP only grew by 2% to place last within Guangdong.

At the start of this year, Dongguan aimed to expand its GDP by 6%, but that is looking almost impossible to achieve now.

Song Ding, a researcher at the China Development Institute (CDI), said when interviewed that back in 2009 and 2012 when the European and US economies went into recession, Dongguan's economy also faltered in the first half of the year, but on both occasions, it managed to recover strongly in the second half to achieve its economic targets.

However, this time round, Song feels that it would be a tall task for Dongguan to do so again owing to transformative changes to the global economy and trade, as well as the city's socio-economic make-up in the past few years.

Dongguan is still among the top three Chinese cities in terms of reliance on external trade.

Over-reliance on external trade

The main problem is the homogeneity of Dongguan's industrial make-up, which is centred on conventional manufacturing, and its over-reliance on external trade.

Song said that while this economic model enabled Dongguan to achieve stable growth in the past when the international situation was favourable, it also makes it less resilient to turbulence in the global markets which began this year, causing its economy to slow down significantly.

As an important processing and manufacturing base on the global stage, Dongguan's reliance on foreign trade is higher than that of the average city. In 1995, this reached 434%, meaning its total import and export volume was more than four times its GDP. Simply put, for every RMB worth of goods it produced, over 4 RMB were spent on importing and exporting raw ingredients and goods, showing how plugged in it is to the global economy. While a sustained push in the last 15 years to transform its industrial make-up has reduced this figure to 128% as of 2022, Dongguan is still among the top three Chinese cities in terms of reliance on external trade.

Peng Peng, the executive chairman of the Guangdong Society of Economic Reform, thinks that against the current backdrop of trade protectionism in the US and Europe, as well as calls for economic decoupling, Dongguan's figure is still not low enough. Based on current data, Dongguan is still not out of the woods and the authorities need to revamp its development to tackle its issue of insufficient endogenous economic drivers.

Peng said, "Dongguan needs to enhance its dual circulation thinking and strategy, and switch its focus from foreign to domestic markets, especially the Greater Bay Area."

Official statistics indicate that Dongguan's exports in 2022 amounted to 924.013 billion RMB, with the US and Europe accounting for 39%, or 366.733 billion RMB. On the other hand, emerging markets like Latin America only had a share of nearly 5%, or some 46.039 billion RMB.

Peng also thinks that Dongguan needs to work the emerging markets like Africa, the Middle East, and South America, while trying to regain its share in its traditional European and US markets. However, he emphasised that this is not a short-term endeavour, but one which takes determination, patience, and time.

... many companies thought that the resumption of travel would boost business, but "unexpectedly, investors did not come in, but more factories moved out". - Zhang Weilun, founder, D.Werkz Precision

Shifting from Dongguan to Southeast Asia

In 2018, the US started a trade war against China by imposing tariffs on hundreds of billions in US dollars worth of Chinese imports. As a result, many American companies avoided buying goods manufactured in China, sending many Dongguan companies to the brink of closing down. To avoid the tariffs, many companies moved part of their production lines to Southeast Asia, making things worse for the flagging Dongguan economy.

D.Werkz's Zhang said when many potential US clients heard that his factory is in China, they were hesitant due to the expensive tariffs. "Our American clients are down from ten to three. In the past two years, we didn't win any new American clients, while many previous clients were unwilling to extend their contracts."

In January this year, China lifted its pandemic restrictions after nearly three years, and started admitting tourists. Zhang said many companies thought that the resumption of travel would boost business, but "unexpectedly, investors did not come in, but more factories moved out".

As the strategic rivalry between China and the US intensifies, there are signs that both economies are beginning to decouple. To mitigate supply chain disruption and reduce additional costs from import tariffs, many multinational companies are accelerating the rollout of their "China+1" strategies, redistributing part of their investments in China to other countries, and asking their downstream manufacturing partners to do likewise.

Zhang said, "There has been plenty of news of companies leaving Dongguan this year. I know of four to five such businesses. In particular, those that clinched work orders from Apple Inc. have been busy moving out this year."

Infinique started discussions this year with its business partners in Malaysia and Vietnam to set up processing and manufacturing facilities there. Its managing director, Wang Yingying said as the US market accounts for the majority of their business, they have no choice but to go along with the strategic considerations of its clients in order to survive.

For some Dongguan companies, Southeast Asia is like a transit point to receive foreign orders and export goods to Europe and the US.

Hardware mould manufacturer Gong Fuzhou has rented a factory in Vietnam and is preparing to relocate part of his company's production away from Dongguan. Gong feels that even though industrial amenities in Vietnam are quite comprehensive, advanced mould processing facilities are quite backward and lacking in precision.

He said, "We hope to bring some precision equipment over and send some of our engineers there to train the local staff, but that will take time, perhaps three to five years."

Gong said in the short term, his company will retain most of its production capabilities in Dongguan because it still does not have the capability to produce more sophisticated products in Vietnam. However, it will export finished goods to Europe and the US via Vietnam to sidestep trade barriers.

In the last few years, bilateral trade between China and ASEAN has continued to grow robustly, with each being the other's largest trading partner for three consecutive years since 2020.

"... it cannot be ruled out that these companies might move more of their production capabilities there, emptying out Chinese manufacturing and China's economy." - Professor Tao Ran, School of Humanities and Social sciences, Chinese University of Hong Kong (Shenzhen)

Professor Tao Ran, head of the development and governance teaching and research department in the school of humanities and social sciences at the Chinese University of Hong Kong (Shenzhen), felt that Southeast Asia is unable to fully absorb China's massive export capacity, and the growth in bilateral trade actually reflects an acceleration in the relocation of production lines from China to Southeast Asia.

He said, "Presently, Dongguan manufacturers are only shifting part of their production lines, but if the trade conflicts continue to worsen, or if government policies, supply chains, and infrastructure in these ASEAN countries improve, it cannot be ruled out that these companies might move more of their production capabilities there, emptying out Chinese manufacturing and China's economy."

Upgrading and transformation

Experts interviewed felt that continuous industrial upgrading and transformation is the way to go for Dongguan, but they also said transformation should not be a case of completely abandoning the old for the new; traditional and new industries have to move together.

For more than a decade, Dongguan has made efforts to push its traditional manufacturing industry to upgrade and transform, including having a zone for robotics companies in the Songshan Lake High-tech Industrial Development Park, and promoting the quality development of its digital economy.

At the same time, various districts in Dongguan are also actively trying to attract high-tech enterprises, including taking in companies spilling over from Shenzhen and other parts of China. However, some analysts have also pointed out that there is a lack of integration between industry and academia in Dongguan, so it can only attract a limited number of companies, while market demand for this sector is not strong enough.

Dongguan should not worry about its conventional manufacturing industry because that is its strength, and the world needs the basic consumer goods it produces. - Song Ding, researcher, China Development Institute

CDI researcher Song Ding said in the process of industrial upgrading, Dongguan has to avoid moving too aggressively by getting rid of the numerous companies in low-value industries before the new ones in high-value industries have moved in, because "there may be space in the cage, but the birds may not be able to come".

Song suggested that rather than rushing to push out its traditional manufacturers, it may be better for Dongguan to take a moderate approach and make them more technologically sophisticated through reforms, so that they can progress together with the technologically-advanced newcomers.

He said Dongguan should not worry about its conventional manufacturing industry because that is its strength, and the world needs the basic consumer goods it produces. However, it should keep raising its technological content and standards.

Song also feels that Dongguan has to adjust its economic structure and ramp up its services sector, especially in terms of modern services such as infocommunications, software and technology, scientific research, and logistics targeting the advanced manufacturing industry.

Official figures show that Dongguan's industrial makeup in 2022 was 0.3: 58.2 : 41.5, with its secondary industry still well ahead its tertiary industry.

Song pointed out that the modern services industry can promote the development of the advanced manufacturing industry, and a manufacturing hub like Dongguan should not rely entirely on other cities for the provision of such services.

He feels that Dongguan is again at a crossroads of adjusting its industrial structure, and it needs to make major reforms. However, he said frankly, "This is quite difficult, because Dongguan's foundations in non-manufacturing industries is still quite weak."

Dongguan needs to create better living conditions for its migrant workers and tackle housing and education issues through land reforms. - Tao

To push for industrial upgrading and structural transformation, Dongguan also needs to establish a talent pool for future high-quality development. Professor Tao Ran of CUHK (Shenzhen) feels that Dongguan needs to create better living conditions for its migrant workers and tackle housing and education issues through land reforms.

Dongguan is among the Chinese cities with the highest proportion of migrants: 76% of the population there do not have a Dongguan hukou (household registration). Amid waning labour demand in Dongguan's factories, some migrant workers have returned to their home provinces. Official figures show that its resident population fell by nearly 100,000 in 2022 as compared to 2021.

Tao added, "Whether Dongguan can continue to make waves in the global market depends on international relations. This is not something that Dongguan can control, and perhaps something not even China can influence on its own. Our efforts cannot be just on the industry, but there also has to be focus on long-term development of people."

This article was first published in Lianhe Zaobao as "东莞海外订单骤减 中国"世界工厂"为何失速?".

![[Big read] When the Arctic opens, what happens to Singapore?](https://cassette.sphdigital.com.sg/image/thinkchina/da65edebca34645c711c55e83e9877109b3c53847ebb1305573974651df1d13a)

![[Video] George Yeo: America’s deep pain — and why China won’t colonise](https://cassette.sphdigital.com.sg/image/thinkchina/15083e45d96c12390bdea6af2daf19fd9fcd875aa44a0f92796f34e3dad561cc)