[Big read] Singapore a key driver of foreign investment in Vietnam

Singapore has become Vietnam's biggest source of foreign investment amid the China-US rivalry and disrupted global supply chain. Several Singaporean companies have established themselves in Vietnam and are playing important roles in helping the local government attract foreign investors. Lianhe Zaobao journalist Yush Chau interviews Singapore entrepreneurs in Vietnam to find out more.

As multinational companies seek to diversify their supply chains, Vietnam has become an investment hotspot, with the regional business hub of Singapore an important gateway for foreign investments into this market.

According to figures from Vietnam's Ministry of Planning and Investment, foreign direct investment (FDI) in the country exceeded US$38 billion in 2019. While the number fell during the Covid-19 pandemic, it stayed above the US$27 billion level, and rose to US$27.72 billion in 2022. In the same year, Vietnam's FDI disbursement also increased to US$22.4 billion, up 13.5% year-on-year.

For three consecutive years from 2020 to 2022, Singapore was Vietnam's largest source of investments. In 2022, Singapore accounted for nearly US$6.5 billion worth of investments in Vietnam, or 23% of its total FDI. At the end of 2022, Singapore's accumulated investments in Vietnam reached US$70.8 billion.

... investors are either Singaporean small and medium-sized enterprises (SMEs) or foreign companies that have set up entities in Singapore for the purpose of investing in Vietnam. - Dr Le Hong Hiep, senior fellow, ISEAS-Yusof Ishak Institute

Dr Le Hong Hiep, senior fellow at the ISEAS-Yusof Ishak Institute and coordinator of its Vietnam Studies Programme, told Lianhe Zaobao that Singapore is a gateway for foreign investments into Vietnam and other Southeast Asian countries.

On the topic of Singapore becoming Vietnam's biggest source of foreign investments, Le pointed out that the investors are either Singaporean small and medium-sized enterprises (SMEs) or foreign companies that have set up entities in Singapore for the purpose of investing in Vietnam.

SMEs in Vietnam

In the first half of this year, Enterprise Singapore, a Singapore government agency, helped more than 180 Singaporean companies expand into Vietnam. These companies came from the education, energy, food services, food manufacturing, infrastructure and manufacturing sectors.

Enterprise Singapore executive director for Southeast Asia Kow Juan Tiang said, "We encourage local companies in the energy, infrastructure development, manufacturing, and consumer and lifestyle sectors to explore opportunities in Vietnam because of the enormous potential for growth in these areas."

SMEs from Singapore are no stranger to Vietnam, with several having a presence there for many years. One such example is Falcon Incorporation, a high-end furniture maker that entered Vietnam in 2003. Currently, the company has two factories located near Hanoi and around 1,500 employees. Its executive chair Low Heng Huat has been doing business in Vietnam for more than two decades. He shared that the Vietnamese are hardworking and eager to learn, making them outstanding workers.

Low said, "My company's main manufacturing base is located in Vietnam and it processes lots of orders. We ship at least six containers worth of goods each day."

... the VSIPs have attracted more than 880 companies and brought in more than US$18 billion worth of investments. - Koh Chiap Khiong, CEO for Singapore and Southeast Asia at Sembcorp Industries

Joining hands to attract foreign investors

Aside from contributing towards the development of Vietnam's economy, Singaporean companies that have taken root there also play important roles in helping the Vietnam government attract foreign investors.

Koh Chiap Khiong, CEO for Singapore and Southeast Asia at Sembcorp Industries, said that his company has been supporting Vietnam's economic development since 1996 through developing industrial parks and power-generation assets.

Sembcorp has already developed 12 Vietnam Singapore Industrial Parks (VSIPs) in the country and is currently working with its longstanding partner Becamex IDC to jointly invest around US$1 billion in five more VSIPs. Koh shared that the VSIPs have attracted more than 880 companies and brought in more than US$18 billion worth of investments.

This year marks the 30th anniversary of United Overseas Bank (UOB) in Vietnam. Victor Ngo, CEO of UOB Vietnam, said that UOB utilised the region's well-developed interconnectedness to facilitate the entry of FDI into Vietnam through its FDI advisory unit, which provides a one-stop shop for companies looking to set up their regional operations in Asia.

In 2015, UOB signed its first Memorandum of Understanding with the Foreign Investment Agency of Vietnam's Ministry of Planning and Investment. This allowed UOB to help more than 250 companies enter Vietnam, bringing with them an estimated more than S$5.8 billion (US$4.3 billion) worth of investments. These companies were mainly in the industrial, consumer goods, real estate and technology sectors.

UOB has plans to bring more than S$2 billion worth of investments into Vietnam over the next three years. - Victor Ngo, CEO of UOB Vietnam

In July this year, UOB extended its partnership with the Vietnamese authorities to attract high-end FDI in the technology, digitalisation, sustainable development, renewable energy, semiconductors and financial services sectors. Ngo shared that UOB has plans to bring more than S$2 billion worth of investments into Vietnam over the next three years.

UOB currently has five branches in Ho Chi Minh City and Hanoi, with a total of 1,200 staff. It is in the midst of consolidating Citibank's retail banking operations in the country following its acquisition.

Singapore an important platform for Vietnamese companies

While foreign investment is flowing into the country, Vietnamese companies are also actively expanding abroad. They view Singapore as an important avenue that can help them link up with foreign capital markets. For instance, the Vietnamese electric vehicle (EV) manufacturer VinFast, which is planning for its public listing in the US, moved the headquarters of its legal and finance functions to Singapore in 2022.

VinFast's deputy CEO Pei Jinchui said, "We had our IPO (initial public offering) in mind when choosing Singapore because we wanted to internationalise our operations and enhance our legal interconnectedness."

VinFast, Vietnam's first homegrown automotive brand, was founded by the country's richest person, Pham Nhat Vuong, in 2017 and is on track to become the first Vietnamese company to be publicly listed in the US. Initially, VinFast planned for a listing on the Nasdaq stock exchange through an IPO, but subsequently opted for the special purpose acquisition company (SPAC) route via a merger with Black Spade and is now aiming to be listed in the US this year. If all goes well with its public listing, VinFast's market capitalisation is expected to be around US$23 billion.

Confident in Vietnam's long-term potential

Even though Vietnam's economic growth this year is unlikely to be a repeat of its strong showing in 2022, economists agree that it will continue to be a favourite among foreign investors.

In 2022, Vietnam's real GDP grew by 8% year-on-year, only second to the 8.2% record set in 1997. Due to its weakened manufacturing sector and external demand, the Vietnamese economy only grew by 3.72% year-on-year in the first half of 2023, lower than the 6.46% achieved during the same period in 2022, prompting economists to lower their forecasts.

Suan Teck Kin, head of UOB's Global Economics and Market Research, pointed out that Vietnam's economic growth for the first half of this year is far slower than official targets. Taking into account the upcoming challenges, especially the higher base for comparison in the fourth quarter of 2023, the bank has lowered its annual GDP growth forecast for Vietnam from 6% to 5.2%.

Vietnam's structural characteristics that make it attractive to FDI remain undiminished, and the country continues its trajectory of developing into a manufacturing hub. - Chua Han Teng, economist, Development Bank of Singapore

Despite the short-term cyclical headwinds to economic growth, Development Bank of Singapore economist, Chua Han Teng, believes that Vietnam's structural characteristics that make it attractive to FDI remain undiminished, and the country continues its trajectory of developing into a manufacturing hub.

Chua also observed that Vietnam's manufacturing sector was resilient during the pandemic years despite global economic headwinds, and the industry has seen a strong rebound in new investments this year. He said, "This shows that foreign investors remain confident in Vietnam's long-term potential, and the country will continue to be one of their favourites."

Booming manufacturing creates opportunities

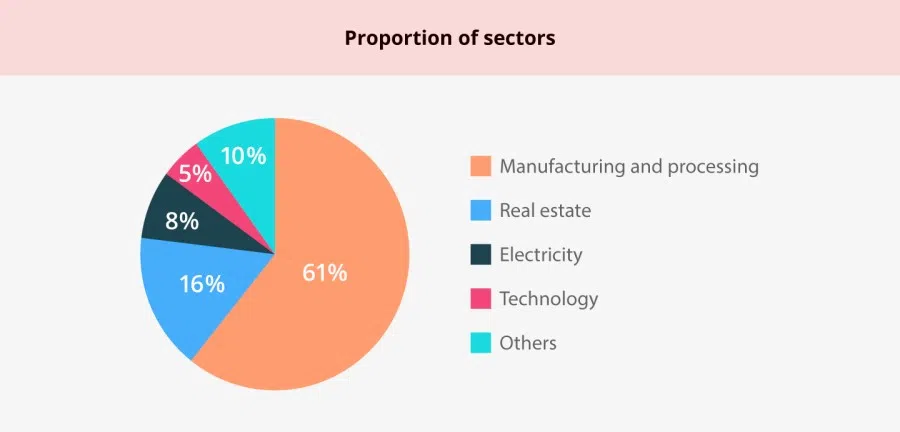

Among Vietnam's various industries, its manufacturing sector is the most attractive to foreign investors. In fact, manufacturing and processing accounted for more than 60% of the country's FDI in 2022.

In order to execute their "China+1" strategies, multinational companies see Vietnam as a primary destination to diversify their supply chains outside China. This has created a boom in its manufacturing industry and presents good opportunities for Singaporean companies.

Maybank Securities economist Brian Lee pointed out that over the last ten years, Vietnam has accumulated consumer electronics experience and technical expertise. As a result, Vietnam has become a critical hub for global consumer electronic goods manufacturing.

Enterprise Singapore's Kow believes that Vietnam enjoys many advantages that make it a highly attractive manufacturing hub in Asia. These include low operating costs, its proximity to raw materials and sales markets, transport interconnectedness, a conducive business environment, and an extensive network of free trade agreements.

Kow highlighted, "A booming Vietnamese manufacturing sector creates excellent opportunities for Singaporean companies because the market can be expanded to diversify the manufacturing base, attract new clients and lower production costs."

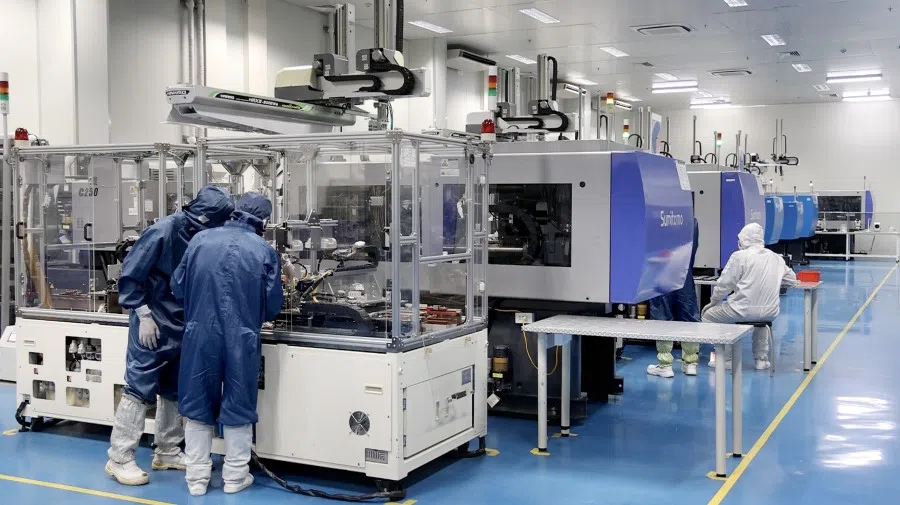

In 2018, Nanofilm Technologies, a Singaporean company listed on the Singapore stock exchange, expanded its production into Vietnam through a merger and acquisition. This year, the company purchased land in Vietnam to build new plants. In the first phase of the expansion, Nanofilm will increase its factory floor space by 22,000 square metres, with construction scheduled for completion by the end of 2023.

The company specialises in vacuum coating and vacuum equipment production, which have wide applications ranging from EVs to energy storage, photovoltaic cells, knives and mobile phone accessories. Besides Vietnam, Nanofilm Technologies also has manufacturing plants in China, Japan and Singapore.

"We mainly serve multinational tech companies, and they would prefer for us to have manufacturing plants in Southeast Asia aside from China, so that they can easily access supporting services." - Gary Ho, CEO of Nanofilm Technologies

Gary Ho, CEO of Nanofilm Technologies, said that outside China, Vietnam is likely to become another major manufacturing base for his company. Its Vietnamese operations already produce high-precision nanochips and sensor components. He said, "We mainly serve multinational tech companies, and they would prefer for us to have manufacturing plants in Southeast Asia aside from China, so that they can easily access supporting services."

Urgency of energy transformation and infrastructure development

Aside from manufacturing, Singaporean companies are also actively involved in developing Vietnam's infrastructure to aid its energy transformation.

Sembcorp entered Vietnam's power generation sector through investing in and operating the country's Phu My 3 power plant, which is also Vietnam's first independent power project. Over the last two decades, the power plant has been a reliable source of energy for the country's power grid. Additionally, Sembcorp also provides rooftop solar energy solutions for towns, cities and industrial parks in Vietnam.

Singapore and Vietnam are aiming for net-zero greenhouse gas emissions by 2050, and Sembcorp's Koh believes that both countries can learn from each other in their journeys towards achieving this.

In June this year, a heatwave led to a power shortage in northern Vietnam, impacting the local manufacturing and tourism sectors, and making energy transformation a priority for the Vietnamese government.

Koh explained that energy security, reliability and affordability are factors that need to be taken into account during the energy transformation. At the same time, growing demand has to be met using sustainable means. He said, "Vietnam needs to modernise its power grid infrastructure to allow the huge influx of electrical power generated through renewable means. This will also allow it to smoothly integrate intermittent power from renewable sources with stable power from conventional sources."

He also said that the power generation industry in Vietnam needs a skilled workforce to support the government's decarbonisation efforts, and Singaporean SMEs can provide training for local project developers to acquire such capabilities.

When I toured the enormous Hai Phong production facility of emerging automaker VinFast, I gained a good sense of the meteoric rise of Vietnamese companies.

World's factory a possibility for Vietnam in the near future

For two weeks in July, I experienced Vietnam's scorching summer as I conducted a series of interviews and visits. Fortunately, my worries of running into a major power outage proved unfounded as the air conditioning in my hotel room ran uninterrupted. When I visited the furniture factories and semiconductor plants of Singaporean companies in Vietnam, I also did not see any production disruptions caused by power shortages.

In today's Vietnam, the manufacturing sector is no longer dominated by multinational companies. When I toured the enormous Hai Phong production facility of emerging automaker VinFast, I gained a good sense of the meteoric rise of Vietnamese companies. The locals quickly took to their first, and as of now, only homegrown automobile brand; and VinFast's flashy "V" logo is a common sight on the country's roads.

On whether Vietnam can replace China as the "world's factory", I can certainly see that happening in the near future. Of course, the prerequisite is that Vietnam properly develops its infrastructure. After all, its recent move to purchase electricity from China again following a seven-year hiatus can only be a temporary fix to its energy troubles.

At the end of May this year, Vietnam approached Guangxi Power Grid Company for the resumption of power supply. Subsequently, both parties signed a power purchase agreement whereby the Chinese company would supply electricity to Mong Cai in Vietnam using 110-kilovolt power transmission lines via Shengou in China.

The move by Vietnam to purchase electricity from its neighbours is controversial because the 4 million and 7 million kilowatt-hours that it imports daily from China and Laos respectively are but a drop in the ocean when compared with the 450 million kilowatt-hours required by its northern regions each day. Furthermore, the issue of integrating its renewable energy sources with a power-generation capacity of 4.6 gigawatts into its power grid remains unresolved.

So, are the Vietnamese apprehensive of further power shortages following the recent power crunch? Many of the country's EV owners did not seem worried, as evidenced by VinFast's expectations to sell 50,000 EVs this year, several times more than the 7,400 units sold in 2022. Consumer sentiments in the EV market are certainly a test of public confidence in the Vietnamese government's ability to supply electricity reliably.

This article was first published in Lianhe Zaobao as "小红点凝聚动力 促外资涌入越南".

Related: Can 'Made in Vietnam' replace 'Made in China'? | Vietnam is balancing China-US rivalry with deft statecraft, but for how long? | Vietnam not veering closer to the US or China | Vietnam needs to do more to reduce trade dependence on China | Foreign investors exiting China: Vietnam milks the gains | Chinese investment and diversion of investment from China: Opportunities abound for Vietnam