China's 'China speed' reopening and its impact on the world

China's reopening to the world on 8 January has led to hopes that the Chinese economy will rebound sooner and faster than expected. Lianhe Zaobao correspondent Chen Jing speaks with experts and business owners to find out the obstacles ahead for China, and how China's reopening will impact the regional and global economy.

Singaporean businessman Roy Kee made long-awaited travel plans to meet with his business partners in Hong Kong, Shenzhen and Shanghai in February as soon as China announced a few weeks ago that it would remove its quarantine requirements for inbound travellers.

Kee, founder of a natural household cleaning products company, made monthly visits to his Shanghai office before the Covid-19 pandemic hit. But over the past three years, he travelled to China just once in November 2021, including a 14-day hotel quarantine, to participate in the international import expo.

He told Zaobao that the Chinese market currently accounts for 40% of his business and is set to surpass Singapore this year. He said, "If I'm able to travel to China every month again, I can find more business partners and grow the business at a quicker pace."

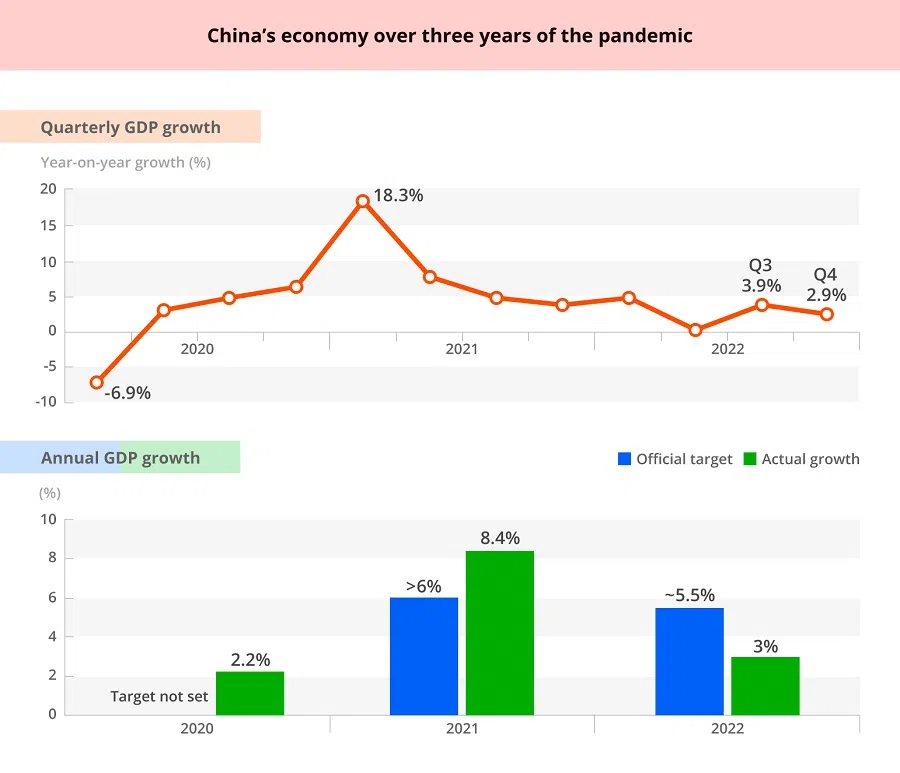

2022 growth far below target

As of 8 January, China removed PCR tests and centralised quarantine requirements for inbound travellers. The earlier-than-expected reopening, which was previously forecast for after March, has prompted several investment banks to raise their projections for China's 2023 GDP growth. JPMorgan Chase & Co. raised its forecast from 4% to 4.3%, Goldman Sachs raised theirs from 4.5% to 5.2%, and Morgan Stanley optimistically raised theirs from 5% to 5.4%.

China's GDP grew by 3% in 2022, the National Bureau of Statistics said on 17 January. That was better than the 2.8% forecast in a Reuters poll but far below China's official growth target of around 5.5%. With the rapid lifting of Covid-19 restrictions since November last year, the market expects the world's second largest economy to bottom out this year. The only question is how quickly and to what extent will the Chinese economy rebound.

Chinese economy will see a V-shaped rebound this year. - Tommy Xie, head of Greater China Research, OCBC Bank

Tommy Xie, head of Greater China Research at OCBC Bank, told Zaobao that the speed at which China's Covid-19 wave has peaked after reopening is unseen in the world. Major cities are already past their infection peak and economic activities have gradually resumed, signalling that China will enjoy a faster economic rebound than other countries.

Xie predicted that the Chinese economy will see a V-shaped rebound this year. As China's GDP still grew by 4.8% in the first quarter of 2022, its economic growth is expected to be lacklustre in the first quarter of this year but may see a significant rebound of over 7% in the second quarter. Xie explained, "If China's economy is said to have started high and ended low last year, it will be quite the opposite this year. Although China's growth may slow in the second half of the year, its overall growth for 2023 is still set to be above 5%."

Consumption gains steam as tourism rebounds

Despite being the worst performer among China's "troika" of growth drivers (consumption, exports and investment) last year, consumption is expected to recover significantly this year. Last month, the Chinese government revealed a guideline aimed at expanding domestic demand. It also reiterated during the Central Economic Work Conference (CEWC) that the recovery and expansion of consumption will be prioritised. As Chinese exports falter due to weakening external demand, analysts believe that officials will introduce more policies to promote consumption and fuel domestic demand.

While specific policies aimed at boosting consumption have yet to be released, the tourism industry, which has been in a three-year slump, is starting to see a glimmer of hope with the relaxation of Covid-19 measures over the past month. Negative PCR test results or health codes, as well as quarantine on arrival, are no longer required in order to travel within the country.

Data from Trip.com show that flight bookings for New Year's Day and the Spring Festival soared by 145% and 260% year-on-year respectively.

After the Chinese authorities announced on 26 December 2022 that inbound travellers will no longer have to quarantine from 8 January onwards, outbound flights and hotel searches on travel platform Trip.com hit a three-year high that same night. The next morning, bookings for outbound flights from mainland China skyrocketed 254% compared with the previous day, with ticket prices falling by an average of 12.9%. The rising volume of flight bookings and falling flight prices signal that a travel boom is imminent.

Data from Trip.com show that flight bookings for New Year's Day and the Spring Festival soared by 145% and 260% year-on-year respectively. Meanwhile, searches related to Spring Festival tours recorded a sixfold increase. Indeed, the recovery of the tourism sector will bode well for the transportation and food and beverage sectors.

At the same time, foreign enterprises that were turned away by China's harsh anti-Covid measures can now reenter this massive market with more investments.

Joerg Wuttke, president of the European Union Chamber of Commerce in China, welcomes China's reopening as it boosts business confidence and allows senior executives from European companies to set foot in China again after three years, while bringing in with them more investments. However, Wuttke pointed out that European companies will most likely wait and see what happens to China's Covid-19 outbreak in the coming weeks before making long-term decisions about investing in China.

He also noted that China's pandemic situation is still uncertain and enterprises are worried that a new variant may emerge. He added, "As the Chinese economy continues to face serious headwinds, several members of the European Chamber are hesitant about sending more employees to China."

... reopening does not provide immediate relief and it could take three to six months for consumer activity to return to "something resembling normality". - Julian Evans-Pritchard, senior China economist, Capital Economics,

Economy affected by Covid-19 surge

China is facing a steep rise in Covid-19 cases after its abrupt reopening, with the raging pandemic sweeping through major cities and spreading to smaller cities and rural areas within a month. An increased number of people have been hospitalised, adding to the woes of the struggling economy.

China's manufacturing Purchasing Managers' Index (PMI) was 47 in December last year (a PMI reading below 50 indicates a contraction), the lowest since February 2020. At the same time, the non-manufacturing PMI was 41.6 in December, down from 46.7 in November, the lowest reading in three years.

JPMorgan Chase & Co. warned that China's supply chain could be disrupted in the short term if the surge in Covid-19 infections causes a shortage of staff. Julian Evans-Pritchard, senior China economist at Capital Economics, believes that reopening does not provide immediate relief and it could take three to six months for consumer activity to return to "something resembling normality".

Nonetheless, several major cities are seeing signs of recovery as they swiftly move past the infection peak. Bloomberg reported that as of 28 December 2022, traffic congestion levels across 15 major Chinese cities rebounded nearly 60% compared with a week ago.

Nanyang Technological University economics professor Tan Kong Yam believes that, if a new variant emerges from China's Covid-19 outbreak, it would become a black swan event in 2023. However, as there has been no reports of new variants from China's Covid-19 spike, the market has an optimistic outlook.

Tan pointed out that China will be hit by several Covid-19 outbreaks after reopening, just as the other countries had gone through. But the US's and Singapore's experiences highlight that the impact of subsequent outbreaks will gradually reduce as the healthcare system, businesses and population become more resilient to the outbreak.

He surmised, "It's like throwing a rock into a lake. The first drop causes a big splash but the ripples gradually spread out and fade."

If China's economic growth can hit 6% or even 7%, that would be a strong driver for the growth of developing countries in Southeast Asia, Latin America and Africa. - Tan Kong Yam, economics professor, Nanyang Technological University

Decline in Europe and US economies might mean China stands out

Despite closing its doors over the past three years, China remains connected to the world economy. When Covid-19 first broke out in 2020, China was the only major economy to maintain normal growth. With this year's downturn in Europe and US economies, China's economy has another opportunity to stand out and take on the sizeable task of driving global economic growth.

In regard to the "troika" powering the global economy, Tan said that the US economy is showing signs of decline while the European Union is also seeing weak growth, and only China has a hope of speeding forward. He noted, "While there remain many risks to China's economic recovery, its growth potential cannot be ignored. If China's economic growth can hit 6% or even 7%, that would be a strong driver for the growth of developing countries in Southeast Asia, Latin America and Africa."

China's enormous spending potential was immediately felt after reopening its borders. Data from financial information services company CEIC shows that in the three years of Covid-19, Chinese families saved over US$4.8 trillion, more than the GDP of the UK. The recent spike in infections has led to many countries tightening entry restrictions on Chinese travellers, while Southeast Asian countries such as Thailand and Singapore that have not done so will benefit the most from the recovery in international travel.

... there was a sixfold increase in flight bookings to Singapore.

Figures from Trip.com show that after mainland China announced the lifting of quarantine restrictions for border entries, flight bookings for Singapore, South Korea, Hong Kong, Japan and Thailand saw the biggest jumps, while there was a sixfold increase in flight bookings to Singapore.

China's economic recovery might add to global inflation

The Tourism Authority of Thailand forecasts that the number of Chinese travellers to Thailand this year could significantly increase to 5 million, compared with 220,000 last year. UOB economists also forecast that Singapore could bring in S$2 billion (US$1.5 billion) in retail sales if the wave of Chinese travellers comes back this year.

Given the close trade links, Singapore also stands to gain from China's opening up. The World Bank estimated that each percentage point increase in China's GDP will bring a 1.2 percentage point gain in Singapore's GDP. Australia, Thailand, Malaysia and Indonesia's GDP will also grow as China's trade recovers.

... demand for crude oil could go up by 1 million barrels a day after China's reopening, and the rising prices for commodities such as oil will put pressure on developing economies. - Tan Kong Yam, economics professor, Nanyang Technological University

However, despite the support towards global economic growth, China's economic recovery is also causing inflation to worsen, thus exacerbating the already-high global inflation. Hence, various central banks are confronted with the dual challenges of economic decline and high inflation, adding to the volatility in the global economy.

Tan believes that demand for crude oil could go up by 1 million barrels a day after China's reopening, and the rising prices for commodities such as oil will put pressure on developing economies.

OCBC's Xie warned that inflation is the "grey rhino" faced by the Chinese and global economy this year. China's inflation pressure will ease in the first quarter of this year, but gradually increase in the second half of the year, with an inflation rate of possibly more than 3%.

Xie added, "But because China's economy accounts for nearly 20% of the global economy, its support of the global economy overall is expected to outweigh its inflationary impact."

Also, the slide in external demand due to the economic decline in various countries has also made it difficult for China's exports to continue to outperform. Since October last year, China's exports have declined after more than two years of growth; November exports fell by 8.7%, the lowest figure since March 2020. Indeed, both China and the global economy will face the challenge of driving growth amid domestic and external pressures in 2023.

Boosting confidence the key to improving the economy

Amid growing economic headwinds and the rapid shift in China's Covid-19 policies, there has been an obvious shift in attitude among policymakers in their respective areas.

In mid-December last year, the CEWC shifted its tough stance of over two years against the "disorderly expansion of capital", towards encouraging and supporting the growth and success of the private sector and enterprises. As for the worsening property market, the meeting reiterated that "houses are for living, not for speculation", while emphasising the need to ensure the stable growth of the property market, and preventing and defusing risks of high-quality and industry-leading developers.

Over three years of the pandemic, the strict Covid-19 controls and high-pressure sector controls, coupled with a sliding economy, have resulted in several market entities led by private companies to shutter, while the property sector struggles with a cash flow crisis. Whether the property market can rebound and private companies rise again in the new year are the key factors that will determine the speed of China's economic recovery, which in turn depends on how the authorities recover lost market confidence and boost the low economic forecasts.

Whether policies are consistent or effectively communicated would determine the level of support for the economy. - Tommy Xie, head of Greater China Research, OCBC Bank

OCBC's Xie said that China is a highly policy driven economy and official policies will affect forecasts, which will in turn affect market behaviour. Whether policies are consistent or effectively communicated would determine the level of support for the economy. Hence, the CEWC called for boosting public expectations and confidence for development when planning for this year's economic efforts.

However, the recent hasty opening up and policy shifts have led the market to doubt the consistency of policies. Xie said, "If policies waver, that will impact forecasts and weaken the effectiveness of policy transmission."

For the property market, he noted that the authorities have relaxed controls over the past year but demand has not rebounded due to low expectations. After being beaten down in the past, platform companies are also wary about future policy support. "It is difficult to immediately boost market forecasts about macro policies - it could take anywhere from several months to several quarters," Xie added.

Over the past month, the authorities have frequently signalled support for the property market and private sector. On 4 January, the People's Bank of China said at its annual work conference that it would ramp up financial support for domestic demand and supply systems, treat all companies fairly, and support a stable and healthy property market. The following day, it announced new rules to allow cities with weak property prices to independently lower property loan rates, in an attempt to boost the property market through demand.

A few days after the CEWC, Zhejiang party secretary Yi Lianhong visited Alibaba, urging the platform giant to "fully display their capabilities" in growth, job creation and international competition. At the end of last year, Alibaba subsidiary Ant Group also received approval to raise 10.5 billion RMB (US$1.5 billion) for its consumer unit, in the best-ever start for US-listed China concept stocks.

"After suffering in recent years, private entrepreneurs are no longer easily swayed by the official narrative. Not only do they want to see what the leaders say, but also what they do." - former MAS Academy director and current NUS visiting professor Pei Sai Fan

However, former MAS Academy director and current NUS visiting professor Pei Sai Fan said that when he spoke with several Chinese entrepreneurs who recently moved to Singapore, he felt their disappointment at the policies.

He shared, "After suffering in recent years, private entrepreneurs are no longer easily swayed by the official narrative. Not only do they want to see what the leaders say, but also what they do. Gone are the days when leaders' statements and short-term policies were enough to boost corporate confidence."

Pei suggested that the authorities should reduce their intervention in market operations, and build a fair, orderly, lawful and healthy operational and competitive environment to direct market growth. He noted, "The only way to restore private sector confidence is a fundamental reform of the system with fair treatment for every sector."

This article was first published in Lianhe Zaobao as "国门重开中国经济待春暖花开".

Related: Ten years of political intervention: China's economy at a crossroads | Can China save its property market and economy amid fastest-spreading outbreak to date? | Dual circulation strategy revisited: China deepens integration with the global economy | Are the Chinese facing a crisis of confidence in the government?

![[Big read] When the Arctic opens, what happens to Singapore?](https://cassette.sphdigital.com.sg/image/thinkchina/da65edebca34645c711c55e83e9877109b3c53847ebb1305573974651df1d13a)