China's red-hot concert market is driving tourism consumption

Following the pandemic, pent-up demand for live concerts is driving up ticket prices to astronomical levels. Amid a less than encouraging economy, people are generally cutting down on non-essential spending, but the hope is that concerts will encourage travel and consumption and revitalise the economy. Lianhe Zaobao correspondent Chen Jing takes a closer look at the situation.

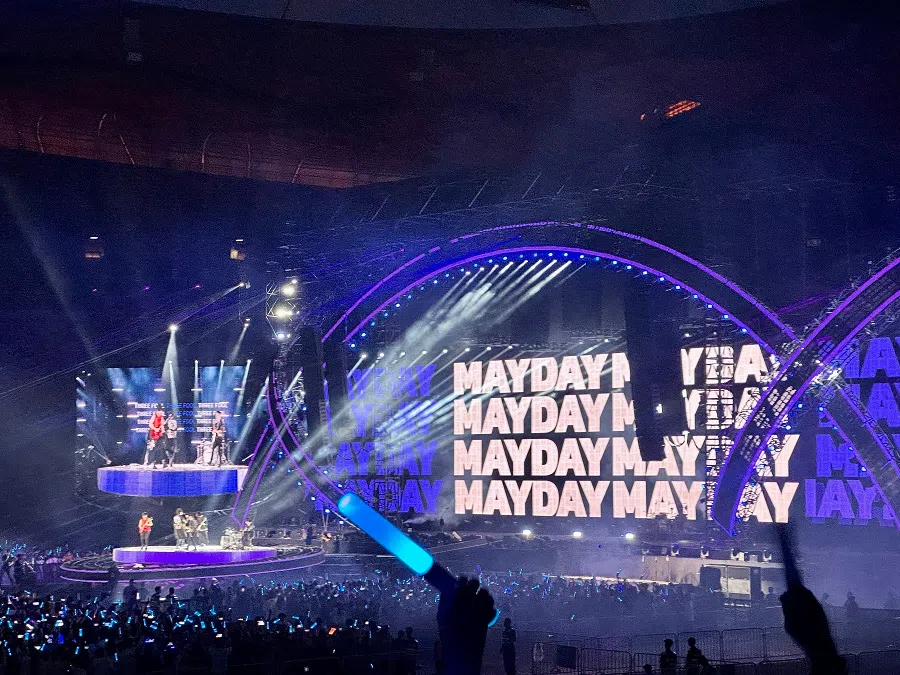

After watching three concerts by the Taiwanese band Mayday in the second half of the year, 29-year-old Xu Zhipeng will be heading to Guangzhou and Shanghai in the next two months to watch two more Mayday concerts.

This Mayday fan, who teaches at a training institution in Hangzhou, told Lianhe Zaobao that he used to watch an average of two Mayday concerts a year in the past, but the three-year-long pandemic completely derailed his plans. Upon learning that Mayday will hold its first post-pandemic mainland China tour in Beijing this year, Xu broke his habit of only watching performances in the Jiangsu, Zhejiang and Shanghai areas and went to the capital city to watch two concerts in a row, "to make up for all the concerts that I missed in the past three years".

Since Mayday's return to the mainland China concert market in May this year, as many as 47 concerts have been and will be held, covering 12 first- and second-tier cities such as Beijing, Shanghai, Shenzhen, Wuhan and Nanjing. And this is just the tip of the iceberg for this year's "revenge" rebound in China's concert market.

... concerts and music festivals have become important drivers of local cultural tourism consumption this year.

Concerts driving tourism

With the reopening of the concert market after the pandemic, concerts and music festivals have become important drivers of local cultural tourism consumption this year. Statistics from the China Association of Performing Arts (CAPA) showed that a total of 428 large-scale concerts and music festivals were held across the country in the second quarter of the year, bringing in 2.231 billion RMB (US$310 million) in ticket sales, an increase of 738.6% compared to the first quarter of the year. Attendances also jumped 611.7% to 4.8233 million from the first quarter of the year.

Also, according to entertainment data platform Lighthouse Professional Edition (灯塔专业版), as of 1 October, among offline performances this year, revenue from music performances exceeded 7.4 billion RMB, accounting for a whopping 90.7% of overall ticket sales, of which 80.6% of ticket sales came from concerts.

... during Chou's four-day concert in Tianjin in early September, Tianjin hotel bookings increased 447.7% year-on-year, which also led to a 269% year-on-year increase in air, train and concert tickets.

Apart from ticket revenue, large-scale concerts also attract fans from different cities, boosting consumption in various areas such as transport, accommodation, food and beverage, and retail. Taiwanese singer Jay Chou's four-day concert in Haikou, Hainan province in late June generated 976 million RMB in tourism revenue, three times the figure during the Dragon Boat Festival holiday. Also, data from the travel platform Ctrip showed that during Chou's four-day concert in Tianjin in early September, Tianjin hotel bookings increased 447.7% year-on-year, which also led to a 269% year-on-year increase in air, train and concert tickets.

According to CAPA, audiences at concerts and music festivals are mainly the younger generation, with those aged between 18 and 34 accounting for over 75% of concertgoers. But in stark contrast to the booming concert market is the country's grim youth unemployment situation. Chinese officials suspended the publication of its youth jobless data in August, while the last published unemployment rate among 16- to 24-year-olds was 21.3%, registering a record high for the third consecutive month.

... demand for offline socialising, which was highly suppressed during the pandemic, rapidly rebounded this year, leading to the popularity of large-scale offline events... - Professor Xu Jian, Shanghai Jiao Tong University

Changing consumption patterns

Xu Jian, a professor at the School of Media and Communication at Shanghai Jiao Tong University, said in an interview that following the three-year-long pandemic, urban youths have become more pragmatic in their material consumption, shifting from luxury goods to value for money products. On the other hand, demand for offline socialising, which was highly suppressed during the pandemic, rapidly rebounded this year, leading to the popularity of large-scale offline events such as anime conventions and concerts.

Liu Yuanju, a researcher at the Shanghai Institute of Finance and Law, assessed that when the economy is not doing well, people cut down on big-ticket purchases like houses or cars, but have more "spare cash" to buy relatively cheap non-essential items like lipstick as a form of retail therapy; the revival of the concert market is a manifestation of this "lipstick effect".

Xu estimates that the hype surrounding the concert market will last until at least next year, and will gradually revive consumption in other areas. "While a concert ticket costs only a few hundred to upwards of a thousand RMB, this kind of high frequency, low-cost consumption will gradually spread to other industries in the economic chain, and bring about a general economic rebound."

Hype around concerts give rise to high-priced resale tickets

For Xu Zhipeng, the hardest thing about watching a concert is not the price of a ticket, but rather whether he is able to secure one in the first place. He said before the pandemic, it was not that hard to get a ticket to a Mayday concert, but now, every show is sold out the minute sales open. "I never once managed to snag a ticket myself; my friends helped me get them."

A scalper who started six years ago revealed to Lianhe Zaobao that prospects for this year were better than in the past, with most concert tickets able to be sold at a higher price.

Explosive demand for tickets has driven up prices of scalping. When Jay Chou held his concert in Tianjin, a ticket that originally cost 700 RMB had its price hiked up to nearly 4,000 RMB by scalpers. For idol group TFBoys, who held their 10th anniversary concert towards the end of July, a front row seat ticket which originally cost 2,013 RMB was hiked up to a whopping 200,000 RMB.

A scalper who started six years ago revealed to Lianhe Zaobao that prospects for this year were better than in the past, with most concert tickets able to be sold at a higher price. He receives several hundred orders monthly for tickets, and on average he earns roughly 100 RMB from each ticket sold, or 600 RMB for front row seats. In other words, just by reselling tickets, scalpers can earn tens of thousands of RMB a month.

Government regulations

China's Ministry of Culture and Tourism and Ministry of Public Security jointly announced in September that it would step up the management of large-scale performance events with an audience of 5,000 people and above. The announcement stipulated that for large-scale events, open ticket sales must account for no less than 85% of the approved total audience capacity, and purchasing of tickets as well as entry should be identity-based. This means that for each event, each individual would be allowed to buy one ticket using their identity card, and the buyer and attendee must be the same person.

The scalper said if the new policy is strictly implemented, it would be difficult for them to resell tickets, and scalpers can only help others to scramble for a ticket when the sale for tickets goes online. As seats are randomly assigned with no price category options, scalpers would suffer a "sharp dip in profits".

Wu Changchang, an associate professor at East China Normal University's School of Communications, said scalping is individual rent-seeking behaviour and creates a negative externality effect on the concert market; given the temporary spike in the concert market this year, it is expected that more parties would be seeking to profit, either through inflated ticket prices or price gouging by scalpers. He said, "This would only serve to spur even more hysterical fandom behaviour, while dampening the desire for average consumers to spend. The recent government regulations are an attempt to remedy this problem at its core."

This article was first published in Lianhe Zaobao as "演唱会报复性红火 拉动地方文旅消费".

![[Video] George Yeo: America’s deep pain — and why China won’t colonise](https://cassette.sphdigital.com.sg/image/thinkchina/15083e45d96c12390bdea6af2daf19fd9fcd875aa44a0f92796f34e3dad561cc)