Chinese academic: Less exports, more wealth redistribution needed in China

China's imports and exports of goods totalled 18 trillion RMB in the first half of this year, 27% higher than the same period last year. However, instead of rejoicing over soaring numbers, Chinese academic Peng Shengyu warns that huge exports also point to a great loss of domestically created material wealth flowing overseas. He says by unreservedly supplying China-made goods to the US who has the power to print money in abandon, and leaving wealth accumulation in the hands of individuals, the Chinese government has not done enough to improve the lives of its people, especially the poor.

With the US printing money with abandon and buying all it can, should China play along and export unreservedly to the US? Definitely not.

One major intention behind the US's recent soothing of relations with China is so that China will go along with the US in turning trillions of printed US dollars into cheap physical goods, while making sure that this crazy printing of cash will not affect the US's own financial and economic health.

According to China Customs statistics, in the first half of this year, China's imports and exports of goods totalled 18.07 trillion RMB, 27.1% higher than the same period last year and 22.8% higher than 2019, showing positive growth for 13 consecutive months year-on-year. Exports were worth 9.85 trillion RMB, up by 28.1% from last year and 23.8% from 2019, while imports were worth 8.22 trillion RMB, up by 25.9% from last year and 21.7% from 2019.

In June, China's foreign trade imports and exports were worth 3.29 trillion RMB, an increase of 22% year-on-year, and the 13th consecutive month of positive growth year-on-year since June 2020.

...unbridled exports are the start of the vicious cycle of China's outflow of wealth.

In the first half of the year, China's imports and exports with its top three trade partners ASEAN, the EU and the US were worth 2.66 trillion, 2.52 trillion and 2.21 trillion RMB respectively, showing increases of 27.8%, 26.7% and 34.6%. Its imports and exports with Japan were worth 1.18 trillion RMB, up by 14.5%.

In the same period, China's imports and exports with countries along the Belt and Road Initiative (BRI) as well as its Regional Comprehensive Economic Partnership (RCEP) partners went up by 27.5% and 22.7%.

Unbridled exports lead to an outflow of wealth

Many people would automatically think that the more exports and US dollars, the better. This is not true. With goods and wealth flowing out, while the US dollars gained can only be used overseas, the ones who benefit are the company owners, while China's wealth is lost. It can be said that unbridled exports are the start of the vicious cycle of China's outflow of wealth.

The US uses paper to print money, while China has to take care of their daily needs. To a great extent, the power and benefits enjoyed by the US dollar are due to the actions of the manufacturing countries, especially China.

The US government is now most concerned with getting China to cooperate with the US in turning trillions of US dollars into cheap goods. Its enormous taxes on China have not impacted China's exports, and the US is now in a hurry to negotiate with China to gain more benefits for an exchange of lower tariffs. This is basically why the US has recently been soothing relations with China. Not only should China not give the US too many benefits, but China should also not export too much to the US.

A vicious cycle

The US dollars earned through exports only benefits China in two ways. First, some US dollars are exchanged for materials that China lacks. Second, it helps China's distribution and circulation. Other than that, there are not many benefits of value. Most of what China imports are in fact also exported, while distribution and economic circulation can actually be encouraged through other means besides exports.

...in the first half of 2021, private and foreign-invested enterprises accounted for 85% of China's foreign trade, which means 85% of the US dollars earned flowed into the pockets of private enterprise owners and foreign businesses.

In the first half of 2021, imports and exports for China's private enterprises totalled 8.64 trillion RMB, an increase of 35.1% and accounting for 47.8% of China's foreign trade total, up by 2.8 percentage points from last year, and continuing to stand out as China's largest foreign trade entity.

In the same period, imports and exports for foreign-invested enterprises totaled 6.61 trillion RMB, up by 19%; the total for state-owned enterprises was 2.75 trillion RMB, up by 23.8%.

From the figures above, we can see that in the first half of 2021, private and foreign-invested enterprises accounted for 85% of China's foreign trade, which means 85% of the US dollars earned flowed into the pockets of private enterprise owners and foreign businesses.

How much of this money serves the people of China? And the goods and resources exported are China's. It is clear that with China's exports, it loses domestic goods and wealth, while from the start of the export process, the US dollars earned goes into a vicious cycle of an outflow of wealth from China.

Needs of companies vs needs of country

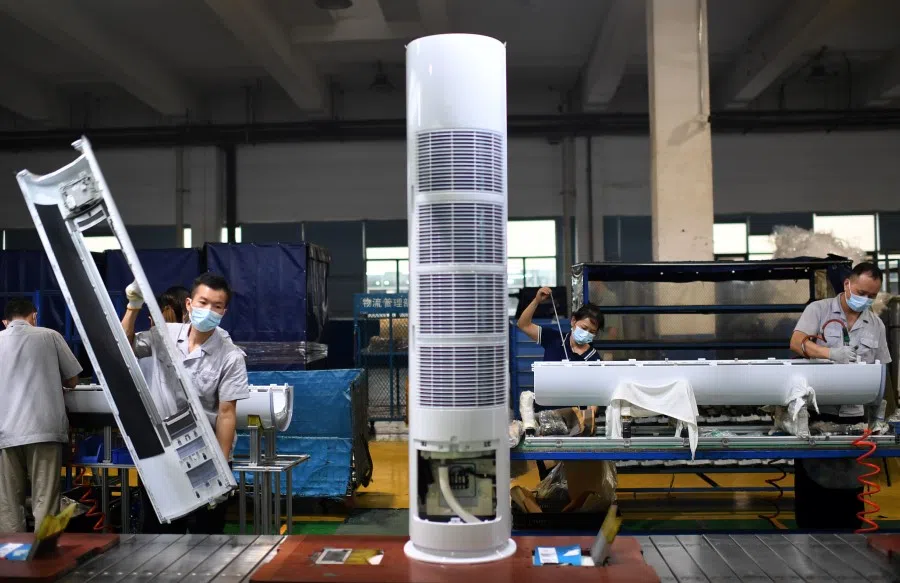

In the first half of 2021, China's mechanical and electrical exports were worth 5.83 trillion RMB, up by 29.5% and accounting for 59.2% of all exports, an increase of 0.6 percentage points from the same period last year. Exports of automatic data processing equipment and peripherals, mobile phones, and automobiles grew by 17%, 23.3%, and 101.4% respectively, while exports of labour-intensive products grew by 17.1%, and medical products and medicine by 93.6% in the same period.

Are these exports things that Chinese people do not need? No. A lot of it is what the general population and the poor do not want to spend on or cannot afford to buy.

It is apparent that exports are basically led by private companies and foreign-invested companies. The pursuit of exports by companies and balancing national interests are separate matters. We have to understand that the will of company owners may not be aligned with the will of the country.

Now, the US is obsessed with printing money and buying Chinese products, and companies cannot resist the lure of the market and say no to orders coming in. The country must then look at the bigger picture.

...there are 964 million people in China with monthly incomes of less than 2,000 RMB.

Change the export-oriented economy

The export-oriented external circulation economy will stimulate economic circulation, but there is also the huge drawback of wealth outflow. China needs to push for domestic circulation, which is the only way to prevent wealth outflow. Pushing redistribution and going for shared prosperity are ways to boost domestic circulation, and change the current situation of external circulation.

In 2019, a team led by Associate Professor Wan Haiyuan from the China Institute for Income Distribution at Beijing Normal University conducted a study involving 70,000 random cross-sectional representative samples, which showed that 39.1% of people in China, or 547 million people, had a monthly income of less than 1,000 RMB, while 600 million people had a monthly income of less than 1,090 RMB. Taking 1,090 to 2,000 RMB as low- to middle-income, this group numbers 364 million, which means there are 964 million people in China with monthly incomes of less than 2,000 RMB.

China should channel goods and wealth to its own people, and not the US. China can consider a certain degree of trade decoupling from the US. Breaking free of being tied down by exports to the US means that the US cannot simply print US dollars and prosper; it means that the Chinese people will have more material wealth. Less chasing of exports to the US and fundamentally achieving an equal exchange of goods - using what China has an excess of in exchange for what it lacks - would be good enough.

A country's wealth comes from domestic production and also from outside of the country. While China improves its external wealth purchasing power, it also needs to pay attention to the problem of domestically created material wealth flowing overseas.

If poor people can only seek wealth through their own capabilities, China's progress will be slow.

National redistribution of wealth within China overdue

On a national level, China's proactive redistribution of material wealth has been weak. Wealth accumulation among the Chinese people is mostly individual action - there is little done on a national level, which should not be the case.

The idea that the poor have to always depend on themselves to create their own wealth has to change; the state has to do more to directly help the poor. If poor people can only seek wealth through their own capabilities, China's progress will be slow. So, the state needs to be proactive in leading wealth distribution, to speed up the slow rate at which these poor people become more wealthy. That way, China's progress would also depend on its leadership ability and actions, and on the overall ability and actions of the people, rather than the individual wealth-creating ability and actions of poor people.

In order to boost wealth possession and improve the standard of living of 1.4 billion people, three things need to be done: one, companies have to be encouraged to reasonably keep material wealth within the country; two, let material wealth from overseas flow into China; three, China needs to step up on redistribution of wealth to the poor, and not simply wait for the poor to earn it bit by bit through their own effort. We have to understand that the wealth of the country is created for the people, and so it is reasonable and necessary to distribute it fairly among the people.

The US printing money for its people to buy goods exported from China is its way of distributing wealth in the country. China can seriously consider learning from the US and distribute a reasonable amount of cash for its 947 million ordinary people to consume domestically these goods originally meant for export to the US. If this can get the domestic economy circulating, then China will not be far away from freeing itself of an export-reliant economy.

Related: How China's dual circulation strategy will affect the world economy | Dual circulation strategy revisited: China deepens integration with the global economy | Why China needs to set its own house in order with a regulatory spurt | How to build a 'super-sized domestic market' in China | China's turn towards domestic market amid global uncertainties - good for the world?