From East to West: Hong Kong art auction market's changing taste in the internet age

From establishing itself as a congregation of all and a cross pollination of buyers and art, the Hong Kong auction market has matured since 2000. It went from highlighting Asian art and artists to internationalising and conflating East and West, and then becoming a marketplace for a "curated" Asian palate with a huge appetite for Western contemporary works. The market has always ruled, and as the pace of life quickens and social media permeates daily life, so has the need for novelty and peer recognition increased.

The relocation of regional art sales by Christie's and Sotheby's to Hong Kong in the early 2000s allowed both houses to consolidate various categories of art sales - then Southeast Asian Art and the 20th Century Chinese Art, located respectively in Singapore and Taiwan - to a single venue in Hong Kong. Thereafter, the auction market in Hong Kong catapulted to a dizzying height that felt unstoppable.

It was a time when globalisation was still a buzzword; the 1.116 kbps average internet access speed by 2005, and the release of the finger-friendly touch interface iPhone 1 in January 2007, complemented this bull phase of the auction scene which was synonymous with the coming of age of the contemporary Chinese art as well as the mainland Chinese collectors. The ascent of smartphones and internet speed directly impacted the proliferation of images, when Ipeg images were sent at light speed whilst the auction catalogues were getting thicker and glossier.

It was also a time when the congregation of the diverse Asian markets in the free port Hong Kong witnessed the auctioneering of works, under the same roof, by the Chinese artist Cai Guo-Qiang whose explosive medium did not just blow up a museum but outlined a fiery vision of a ladder in the sky; the Japanese artist Takashi Murakami whose superflat art was re-negotiating the boundary of high and low art; and the super realistic work of Korean artist Kang Hyung Koo, Nyoman Masriadi from Indonesia and Ronald Ventura from the Philippines.

... wet canvases by young artists would go straight from the studio to the auction and be hammered at a record price but the expiry date on the artist in the secondary market would be between two to three years.

Buoyant market of the noughties

By the spring season of 2008, this formula of congregation of all and a cross pollination of buyers and art had become an established practice. While the music for the show was seemingly going strong, there were some signs of a wavering structure. The estimation printed in the auction catalogues as proposed by the specialists were increasingly becoming less a guide to potential buyers, and more of a price indicator that illustrated a buoyant market, where the realised prices were frequently compounded ten times over and more.

Another crippling sign that was emerging was the shortening of a lifespan of an artist in the market; wet canvases by young artists would go straight from the studio to the auction and be hammered at a record price but the expiry date on the artist in the secondary market would be between two to three years.

The music was blasting to the tune of the auction houses who declared Hong Kong as the 3rd biggest art market, after New York and London; it was indeed the platform to see the best of the Asian Arts where the best collectors - meaning those with the deepest pockets - congregated.

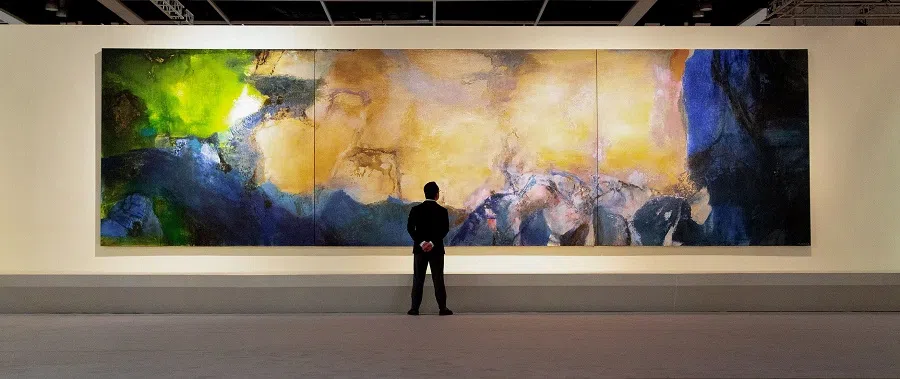

Catalogue entries were waxing lyrical about Zao Wou-Ki, who, as the pioneering generation of Chinese artists in abstraction, stood amongst the giants of the French Parisian School of artists - not as a poorer relation but as an ingenious colleague who made invaluable contributions to the East meet West trajectory.

Whilst the Indonesian maestro Affandi had done a stint at the Ohio State University, his mural work at the East-West Center in Hawaii and various participations at biennales in Brazil (1952) and Venice (1954) were emphasised to demonstrate that the Asian artists had long wooed the Western audience, and more importantly, that the Asian artists were respectable peers of their Western counterparts and that Hong Kong was the best platform to showcase such diversity of dazzling talents.

With all the flurry of activity, the players of the primary market buzzed around the auctions, and under the helm of Magnus Renfrew, came the 1st edition of Art Hong Kong in October 2007 at the Hong Kong Convention Center.

Just when the art party was gearing up for a prolonged night into the wee hours, there came the Lehman Brothers' crisis. When the firm declared its bankruptcy on 15 September 2008, a shock wave was sent immediately across the global financial market and everyone thought the art bubble would burst and it seemingly did.

The autumn season in 2008 in Hong Kong was concluded in a much subdued manner; the sold percentage was kept at a respectable level of over 70% for both houses but the hammered value mostly stayed within the range of estimation, for a market that had been sensationalised by explosive pricing, it was a bad day at the auction playground.

After the financial crisis, art became an asset class

Randomly pulling out an artist from the list of regular fixtures at the auction market of that period for a pricing chart would see a dip in the curve that lasted from the last quarter of 2008 to 2010. But then the market bounced back with a vengeance. By 2011, the global market at large was still reeling from the shock of the crisis which proved to have a lasting social impact that consequently led to the Occupy Wall Street Movement at the end of that year.

... whilst the 99% never recovered from the 2008 financial crisis, the 1% has not only recovered but gotten richer and the art world is their playground.

The art market, on the other hand, was poised to scale new heights. From then on and continuing for a decade, the auction market in Hong Kong was on an adrenaline rush which made the 2008 financial crisis seem nothing more like hiccups, a temporary setback which was quickly overcome and dealt with.

In actuality, however, the 2008 crisis completed the baptism of the art market. Art henceforth crossed the threshold and formally came to be an asset class. If the Occupy Wall Street Movement illuminated the ills of the financial institutions and inertia of the political elites that contributed to the widening gap between the rich and poor, then the auction art market's resilience testified to the fact that, whilst the 99% never recovered from the 2008 financial crisis, the 1% has not only recovered but gotten richer and the art world is their playground.

An 'international' flavour: conflating East and West

The music was roaring on but the scene of the party had changed. When art was increasingly viewed as an asset class, the rules of the game were re-negotiated. 3rd party guarantees became a regular feature for the auctions in Hong Kong, taking a bit of the unknown out of the equations and some bits of the spontaneity and magic of the game were lost forever. This romance was beginning to feel like a pre-arranged marriage.

Something else was changing on this glamorised stage of Asian art as touted by the houses, with the addition of a host of 2nd and 3rd-tier players - Philips, Guardian Hong Kong and Poly Hong Kong to name just a few consequential ones. Also by 2013, the successful-enough Art HK was bought out by the MCH group and rebranded as Hong Kong Basel and launched its 1st edition on 28 May 2013.

... Hong Kong by 2013 had truly developed into a vibrant trading hub of modern and contemporary art with a full set of players from the primary and secondary players.

In sum, Hong Kong by 2013 had truly developed into a vibrant trading hub of modern and contemporary Art with a full set of players from the primary and secondary players. However this platform for art trading and displaying was increasingly looking to be very "international", using the rhetoric of the auction houses, with the inclusion of Western artists.

In May 2018, Christie's Hong Kong made a change to the name of the sale categories and included the new label "Contemporaries: Voices from East and West", while still retaining the name of Asian 20th Century & Contemporary Art (evening sale) as the main category of sale for the evening. The Western inclusion were a mere 8 lots out of 77 lots for that evening with the likes of Sean Scully, Gerhard Richter, Georg Baselitz, George Condo, Jean-Michel Basquiat, Keith Haring, Botero and Peter Doig.

Sotheby's on the other hand, since December 2012, had already started a sale that occurred out of the regular spring/autumn calendar which the house christened as "Boundless: Contemporary Art" in which they presented the works of Andy Warhol, Damien Hirst, Botero, Roy Lichtenstein, Claude Lalanne, Yves Klein, Marc Quinn from the West, with some of the top-selling Asian artists such as Zao Wou-Ki, Christine Ay Tjoe, Ju Ming, Yayoi Kusama, MR, Hiroshi Sugimoto, Yoshitomo Nara, Zeng Fanzhi and Zhang Xiaogang in the same section.

It was quite a different list of Western names compared to Christie's Evening sale in 2018, but this formula of conflation between the East and West in the Hong Kong auction market was the same principle followed by the two houses.

Present skew towards the West

A look at the 2023 Spring auction season in Hong Kong, however, shows both houses have already dropped the Asian label and simply named the selling categories as "Modern and Contemporary Art by Sotheby's" or "The Post-Millennium 20th and 21st Century by Christie's". The change of the names is sufficient evidence of the fact that on this glitzy Asian Art platform, a game of musical chairs is played and who are the ones who are eliminated and left without a placement in this party?

... this much lauded Asian platform which promised to present the best of Asian artists is increasingly becoming a marketplace for a presentation of a "curated" Asian palate with a huge appetite for Western contemporary works.

There is a stark difference between the list of names appearing in the present Hong Kong auction scene and the list a decade ago. Evidently, the market follows the law of the jungle which is the survival of the fittest.

Some artists are continuing to hold the fort: Zao Wou-Ki, Sanyu, Yayoi Kusama and Yoshitomo Nara to name a few. These are artists who have remained consistent and scaled new heights whilst many have gone under such as the contemporary Asian artists, and most notably the Contemporary Chinese artists, whose prices were adjusted in 2008 and never recovered.

To fill in the looming gap, the houses turned to the West, and the inrush of Western galleries setting up their branches in Hong Kong (Gagosian 2011, White Cube 2012 etc.) hastened this conversion. And here is what we have today, this much lauded Asian platform which promised to present the best of Asian artists is increasingly becoming a marketplace for a presentation of a "curated" Asian palate with a huge appetite for Western contemporary works.

To discuss the scene in such general terms is problematic and subjected to gross simplification; nonetheless, the tracing of the development is particularly poignant when it is placed in a larger context of art collecting in a post-pandemic, globalisation-bashing, Instagram-images-flooding and TikTok-videos-viral era.

The floodgates seem to be wide open and gatekeepers are being redefined. We have ushered in a time when internet speed is now measured by megabits per second and online auction is here to stay; when the consumption of images and information is reduced to the screen of a smartphone, the art we are looking at and collecting are also changing.

The auction houses have no obligation to safeguard any category of art of any locality; wherever the money is, the market would follow.

The auction houses have no obligation to safeguard any category of art of any locality; wherever the money is, the market would follow. It would not be the responsibility of the auction houses to question the fairness of the overwhelming dominance of the Western Contemporary Art market as positioned by a much more matured ecosystem - well positioned by giants of the likes of Basel Art Fair, Western museums and mega Western galleries. In brief, it is hardly a level playing field.

Fairness is definitely not a rule in this game - strength is. Though it is getting increasingly muddled as to who is flexing the muscle. The auction houses are ever-shortening informative catalogue entries, inviting celebrities to curate the selection of a sale category, and the life span of a new artist in the auction market is now between six to 12 months - at least for the majority of the contemporary segment, to be more precise.

In a time when anti-establishment is the zeitgeist of the day and almost all social media platforms celebrate the authenticity and independence of opinions, this newest generation of collectors are ironically displaying a stupendous sense of herd collecting and the auction houses are bowing and scraping.

Related: Tropical pursuits: Collecting ink paintings in Singapore | Who are the Nanyang women artists? | Kaii Higashiyama's art as tribute to Chinese monk Jianzhen | Singapore's Xiu Hai Lou Collection and what it tells us about late 19th-20th century Chinese art | Are the Chinese truly collecting art?

![[Big read] When the Arctic opens, what happens to Singapore?](https://cassette.sphdigital.com.sg/image/thinkchina/da65edebca34645c711c55e83e9877109b3c53847ebb1305573974651df1d13a)