ACFTA 3.0: The China-ASEAN deal that could shake US influence?

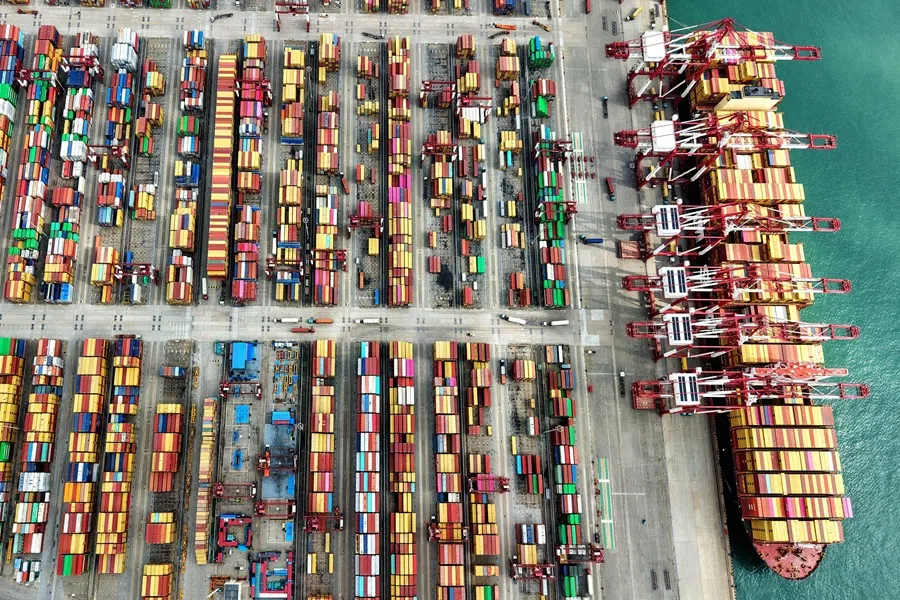

China’s upgraded trade pact with ASEAN promises deeper markets and tech ties, but rising regional dependence, local pushback and ongoing US-China rivalry could test the limits of its benefits, says researcher Genevieve Donnellon-May.

On 28 October 2025, during the 47th ASEAN Summit in Kuala Lumpur, China and the Association of Southeast Asian Nations (ASEAN) formally signed the ASEAN-China Free Trade Area (ACFTA) 3.0 Upgrade Protocol.

Concluded in October last year after negotiations began in November 2022, the agreement represents the most comprehensive revision since the ACFTA’s launch in 2010. It aims not only to strengthen bilateral trade and economic cooperation but also to cushion the region against external shocks — geopolitical, climatic and economic.

Expanding cooperation across nine areas, including the digital economy, green development, supply chain connectivity and support for micro, small, and medium enterprises (MSMEs), ACFTA 3.0 reflects a shift from traditional trade ties to stronger, multi-sector integration.

China and ASEAN — two major players in the global south — together account for one-quarter of the world’s population and are among the world’s biggest economies.

Support for micro, small and medium enterprises (MSMEs) is another key feature, reflecting the agreement’s broader goal of promoting inclusive growth.

Genesis of ACFTA

Since ACFTA’s inception in 2010 — ASEAN’s first FTA with an external partner — bilateral trade has nearly tripled, from US$235.5 billion in 2010 to US$696.7 billion in 2023. In 2024, bilateral trade approached US$1 trillion.

This growth has continued in 2025: during the first three quarters of this year, China’s total imports and exports with ASEAN countries reached 5.57 trillion RMB (US$382.37 billion), marking a 9.6% year-on-year increase and also accounting for 16.6% of China’s total foreign trade.

China has been ASEAN’s largest trading partner for 16 consecutive years, while ASEAN has been China’s top trading partner for the past five. In 2023, China ranked as ASEAN’s third-largest source of foreign direct investment, behind the US and EU, at US$17 billion — a nearly 20% year-on-year increase.

Key tenets of ACFTA 3.0

Several aspects of ACFTA 3.0 stand out. Digital cooperation features prominently, aiming to facilitate e-commerce, build digital infrastructure and establish cross-border data flow mechanisms while addressing cybersecurity and privacy concerns.

Green development is another central pillar. The agreement promotes collaboration on renewable energy, resource efficiency, and environmental standards, supporting ASEAN economies’ transition to low-carbon growth.

Support for micro, small and medium enterprises (MSMEs) is another key feature, reflecting the agreement’s broader goal of promoting inclusive growth. MSMEs make up over 90% of businesses in ASEAN and employ the majority of the workforce, while in China, they similarly represent a substantial share of employment and economic output.

By improving access to financing, technology transfer, and training, the upgraded ACFTA helps smaller enterprises on both sides integrate more effectively into regional and global supply chains.

For ASEAN, the upgraded pact strengthens supply chain resilience and deepens regional integration through greater access to China’s vast market and investment flows...

Benefits for both sides

For Beijing, the benefits are clear. Amid strained US-China relations, Southeast Asia offers both a major market and a large production base to diversify risk and reduce exposure to Western trade restrictions. The upgraded pact allows China to expand export markets, secure critical raw materials — such as minerals from Indonesia and Thailand — and encourage manufacturers to offshore production to lower costs and bypass Western constraints. These measures consolidate China’s position as a reliable regional economic partner, counterbalance US influence, and boost intra-Asian trade amid global uncertainty.

The agreement also complements China’s broader regional initiatives, including the Belt and Road Initiative (BRI) and the Digital Silk Road — the latter which promotes digital infrastructure projects, including fibre optic networks, 5G cloud computing, and artificial intelligence-powered services — by integrating trade and investment facilitation alongside policy coordination. In doing so, it positions ASEAN as a testing ground for regional standards in digital governance while advancing China’s agenda in digital connectivity and technological influence.

For ASEAN, the upgraded pact strengthens supply chain resilience and deepens regional integration through greater access to China’s vast market and investment flows; priorities that have grown increasingly important amid shifting global trade dynamics. It also reinforces ASEAN’s central role in shaping East Asia’s evolving economic architecture and underscores China’s position as a leading driver of Asian-led integration.

Moreover, key aspects of the upgraded agreement like green development (such as renewable energy) align with ASEAN’s regional priorities and various national goals of member-states. By embedding technology, sustainability, and connectivity, ACFTA 3.0 signals a shift toward longer-term, inter-regional cooperation rather than transactional trade ties.

Domestic sensitivities surrounding Chinese investment, especially in strategic sectors like technology and energy, have already sparked backlash in parts of Southeast Asia.

Domestic sensitivities and US-China rivalry

Nevertheless, challenges loom large. ASEAN economies vary widely in digital infrastructure, environmental standards and administrative capacity, which could slow implementation. Divergent e-commerce laws, data privacy rules, and customs procedures may also hinder integration. Realising the agreement’s potential will require major investment in training, regulatory reform and institutional capacity.

Dependence on Chinese trade and investment adds both economic and geopolitical vulnerabilities. US technology restrictions have prompted Chinese firms to shift production to ASEAN to bypass tariffs and avoid the “Made in China” label. While this relocation creates new opportunities, it also heightens Southeast Asia’s exposure to China’s economic cycles and policy shifts. While larger economies such as Vietnam and Indonesia are well positioned to capture investment and integrate into supply chains, smaller economies in contrast may risk marginalisation.

At the same time, an influx of cheaper Chinese imports, including electric vehicles, lithium batteries and solar panels, could undercut local producers, widen trade deficits, and intensify competitive pressures, potentially widening inequality across the region.

Geopolitical tensions compound these risks. Domestic sensitivities surrounding Chinese investment, especially in strategic sectors like technology and energy, have already sparked backlash in parts of Southeast Asia. Meanwhile, disputes in the South China Sea remain a flashpoint, particularly between the Philippines — the incoming ASEAN chair — and China. Confrontations at sea are frequent, and distrust runs deep: an OCTA research poll from August found that the overwhelming majority (85%) distrust China, with two-thirds citing maritime tensions as the cause.

... the recent ACFTA upgrade underscores a widening gap between US’s security-focused initiatives and China’s trade-centred regional diplomacy.

Continued US-China rivalry further clouds the outlook. Washington’s push for “friendshoring” and supply chain diversification seeks to reduce reliance on Chinese manufacturing, indirectly affecting regional trade through export controls, tariffs and investment restrictions. Despite expanding economic ties with Beijing, regional policy elites continue to favour Washington: the 2025 State of Southeast Asia Survey by Singapore’s ISEAS-Yusof Ishak Institute found that 52.3% of respondents would prioritise the US over China if forced to choose, underscoring persistent geopolitical sensitivities.

For Washington, the ACFTA 3.0 signing complicates its long-term engagement strategy with ASEAN. As China and ASEAN deepen bilateral trade and broader integration, the US risks being perceived as economically absent from the region, especially after withdrawing from the Trans-Pacific Partnership in 2017 and amid limited progress under the Indo-Pacific Economic Framework. Further exacerbating matters, the second Trump administration’s tariffs on both Chinese and selected ASEAN products, alongside strained US-China ties and US-ASEAN ties, risk undermining Washington’s credibility as a partner in promoting open, rules-based trade.

In more extreme cases, this may end up driving Southeast Asian economies to double down on Asian-led frameworks, including the Regional Comprehensive Economic Partnership.

In this light, the recent ACFTA upgrade underscores a widening gap between US’s security-focused initiatives and China’s trade-centred regional diplomacy. Over time, this may even help tilt ASEAN’s economic orientation further toward Beijing, even if the regional bloc continues to rely on the US for foreign direct investment, trade and at times security and political stability.

What the future holds

Going forward, ASEAN’s ability to maximise economic gains while managing geopolitical exposure will be crucial. Its longstanding hedging strategy of pursuing economic pragmatism while preserving strategic autonomy remains key to navigating these complex dynamics.

As China and ASEAN tighten economic linkages under ACFTA 3.0, their ability to balance opportunity with resilience will shape the region’s economic trajectory. The pact’s long-term significance lies not only in trade liberalisation, but in how it helps anchor stability and strategic autonomy amid a divided global order. Its success, however, will depend on whether both sides can translate ambition into sustainable outcomes while managing intensifying geopolitical headwinds.

![[Big read] When the Arctic opens, what happens to Singapore?](https://cassette.sphdigital.com.sg/image/thinkchina/da65edebca34645c711c55e83e9877109b3c53847ebb1305573974651df1d13a)