China unveils monetary support to stem US tariff impact

Amid growing concerns over the tariff war with the US, China is ramping up efforts to boost domestic demand and support the stock and property markets, introducing a slew of monetary easing measures. But is this enough?

(By Caixin journalist Qing Na)

China’s central bank unveiled a raft of monetary easing measures on Wednesday, intensifying efforts to boost domestic demand and support the stock and property markets amid increasing concerns that the tariff war with the US is starting to weigh on economic growth.

The announcement by the People’s Bank of China (PBOC) at a press briefing with two other financial regulators came shortly after confirmation by both the US and China that their officials will hold talks in Switzerland later this week to try and resolve their trade dispute.

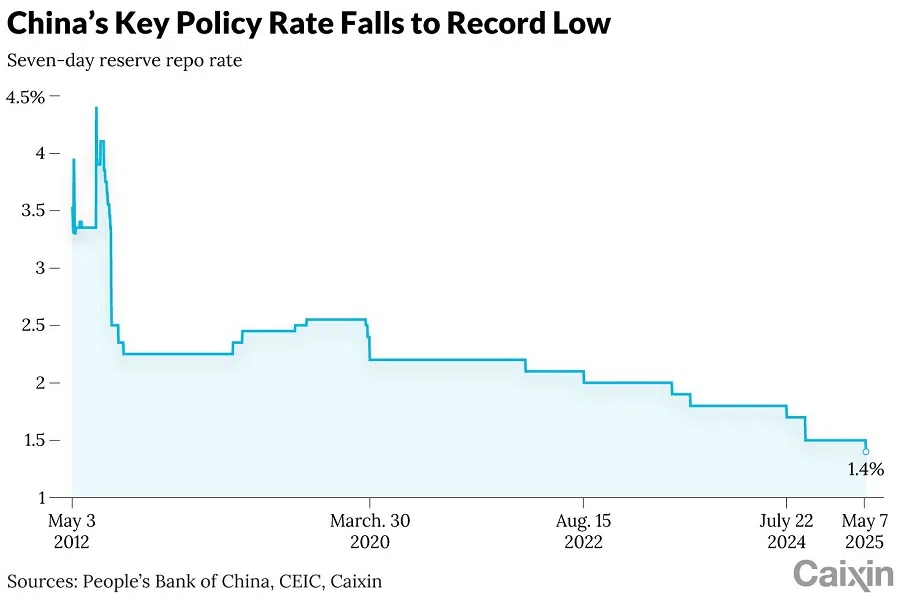

PBOC governor Pan Gongsheng announced ten monetary policy measures that include lowering banks’ reserve requirement ratio (RRR) for the first time since September and temporarily scrapping the ratio altogether for auto finance and financial leasing firms, cutting its key policy rate by ten basis points to a record low, and slashing rates on housing provident fund (HPF) loans and the pledged supplementary lending programme by 25 basis points.

To bolster support for capital markets, the central bank has combined the quotas of two programmes — an existing 500 billion RMB (US$69.2 billion) swap facility for qualified institutional investors and a 300 billion RMB relending facility for qualified listed companies and their major shareholders. Meanwhile, Li Yunze, head of the National Financial Regulatory Administration, told the briefing that the agency will expand a pilot programme for long-term equity investment by insurance funds by 60 billion RMB.

... more support would be required if China wants to get close to its GDP growth target for this year of around 5%. — Harry Murphy Cruise, Head of China Economics, Moody’s Analytics

The PBOC will also set up a 500 billion RMB relending tool to boost loans for services consumption and elderly care, Pan said.

Li said that banks and insurance companies will be encouraged to boost support for exporters hit by the tariff war through export credit insurance, broader access to financing, faster loan approvals, and help to switch their focus to supplying the domestic market.

Implications

“The package signals to households, businesses and investors that policymakers are willing to bolster the economy as needed,” Harry Murphy Cruise, head of China economics at Moody’s Analytics, wrote in a note following the regulatory announcement. However, more support would be required if China wants to get close to its GDP growth target for this year of around 5%, Cruise said.

Although China posted better-than-expected first-quarter growth of 5.4% year-on-year, the latest surveys of purchasing managers in both manufacturing and services show that the tariff war is affecting activity and demand.

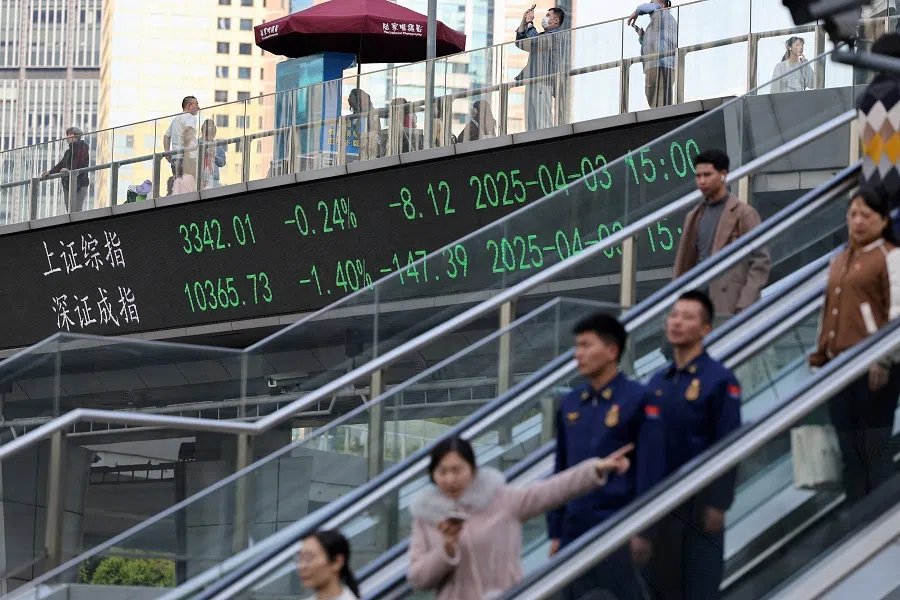

The stock market on the Chinese mainland gave a muted response to the announcement, with the benchmark CSI 300 Index, which tracks the top 300 companies listed in Shanghai and Shenzhen, closing up just 0.61%. In Hong Kong, the benchmark Hang Seng Index closed up 0.13% and the Hang Seng Tech Index fell 0.75%.

China is under growing pressure to support domestic consumption, the government’s No.1 economic priority for this year, in the face of rapidly escalating trade tensions with the US since President Donald Trump took office. His 2 April announcement of “reciprocal tariffs” on dozens of countries, including China, triggered concerns they would damage global trade, drag down China’s economic growth and send the US into recession.

Although China posted better-than-expected first-quarter growth of 5.4% year-on-year, the latest surveys of purchasing managers in both manufacturing and services show that the tariff war is affecting activity and demand.

The Caixin China General Manufacturing Purchasing Managers’ Index (PMI) fell to 50.4 in April from 51.2 the previous month, with new export orders declining at the quickest pace since July 2023 as the China-US trade row intensified. The Caixin China services PMI declined to 50.7 from 51.9 in March, with demand growing at the lowest rate since December 2022 and optimism weakening significantly.

Any boost to credit demand “will be modest”, and the measures “are no substitute for an expansion in fiscal support”. — Julian Evans-Pritchard and Zichun Huang, Economists, Capital Economics Ltd.

“The economic impact of all this will be positive but modest,” Julian Evans-Pritchard and Zichun Huang, economists at Capital Economics Ltd., wrote in a report after the briefing. “The RRR cut will provide some much-needed relief to the banks… but we doubt it will do much to boost bank lending where the main constraint now is a lack of demand not the supply of reserves.”

Any boost to credit demand “will be modest”, and the measures “are no substitute for an expansion in fiscal support”, they wrote.

Wednesday’s announcement comes in the wake of a Politburo meeting in April where leaders vowed to roll out more support for the economy to cushion the impact of rising external shocks. The meeting, chaired by President Xi Jinping, said that the foundation of China’s economic recovery needs to be enhanced and requires a “proactive” policy stance, including lower interest rates, a more proactive fiscal policy and support for technological innovation and consumer spending.

Policy breakdown

“These policy measures will provide financial institutions with substantial low-cost medium- to long-term funding, helping to lower their funding costs and stabilise net interest margins,” Pan said at the briefing. “The effects are expected to further transmit to the real economy, leading to a steady decline in overall financing costs, boosting market confidence, and effectively supporting stable economic growth.”

Banks’ RRR will fall by 0.5 percentage points on 15 May, injecting about 1 trillion RMB in long-term liquidity into the financial system, according to the PBOC. The seven-day reserve repo rate, which was last cut by 20 basis points in September, will be lowered by 10 basis points to 1.4% Thursday to reduce borrowing costs. That is expected to guide market benchmark loan prime rates (LPR) lower by ten basis points, Pan said. The one-year LPR currently stands at 3.1%, while its five-year-plus counterpart, a key reference for mortgage rates, is 3.6%.

To support automotive consumption and facilitate the country’s equipment upgrading campaign, the PBOC is set to temporarily cut the RRR for nonbank financial institutions that provide financing services for auto-related consumption or financial leasing services to 0% from 5%, which will “enhance their capacity to supply credit to these targeted areas”, Pan said.

The 25-basis-point cut to loan rates related to the HPF, which provides subsidised mortgages to homebuyers, will bring the rate on long-term loans for first-time homebuyers to 2.6% starting Thursday.

“We are looking for another 20 basis points of rate cuts and 50 basis points of RRR cuts this year, and we expect that the next move might not come until after the US Federal Reserve resumes rate cuts.” — Lynn Song, Chief Economist for Greater China, ING Bank NV

“The move is expected to save households over 20 billion RMB in annual interest payments on HPF loans, helping to support essential housing demand and stabilise the property market,” Pan said.

He said the two measures introduced in October, aimed at encouraging listed companies and financial institutions to buy stocks, have played a crucial role in stabilising market expectations in the face of external shocks. In the wake of Trump’s announcement of “reciprocal tariffs” early last month, the use of the swap facility increased significantly, and share repurchases by listed companies have also been active, Pan said.

The government is likely to roll out more support if needed, said Lynn Song, chief economist for Greater China with ING Bank NV.

“After today’s moves, we still think there’s room for additional policy easing if needed, given deflationary pressures and the risk of moderating growth,” he wrote in a report. “We are looking for another 20 basis points of rate cuts and 50 basis points of RRR cuts this year, and we expect that the next move might not come until after the US Federal Reserve resumes rate cuts.”

This article was first published by Caixin Global as “Update: China Unveils Monetary Support to Stem U.S. Tariff Impact”. Caixin Global is one of the most respected sources for macroeconomic, financial and business news and information about China.