How China’s e-commerce titans are squeezing global rivals

Chinese e-commerce platforms Shein, Temu, AliExpress and TikTok Shop, collectively known as the “four little dragons”, are gaining global market share with competitive pricing and effective supply chains. However, regulatory scrutiny in the US poses challenges.

(By Caixin journalists Bao Yunhong and Elise Mak)

Lured by ultra-low prices and free shipping for orders as low as US$10, global shoppers are flocking to a quartet of Chinese e-commerce platforms — fast fashion giant Shein, upstart Temu, AliExpress and newcomer TikTok Shop — to buy everything from clothing to electronics.

Dubbed the “four little dragons” for their rapid growth in global sales and influence, they reshaped online shopping by connecting consumers directly to China’s manufacturing power. Their disruptive rise has prompted scrutiny from foreign regulators and rivals including US e-commerce titan Amazon.com Inc.

Last year, Temu — the international sibling of China’s Pinduoduo — and Shein were the top two shopping apps globally in number of downloads and download growth, according to market analysis firm Data.ai. Alibaba Group Holding Ltd.’s AliExpress ranked third and fourth respectively in those metrics. TikTok, owned by Beijing-based ByteDance Ltd., was the most downloaded social media app globally, amassing over one billion monthly active users.

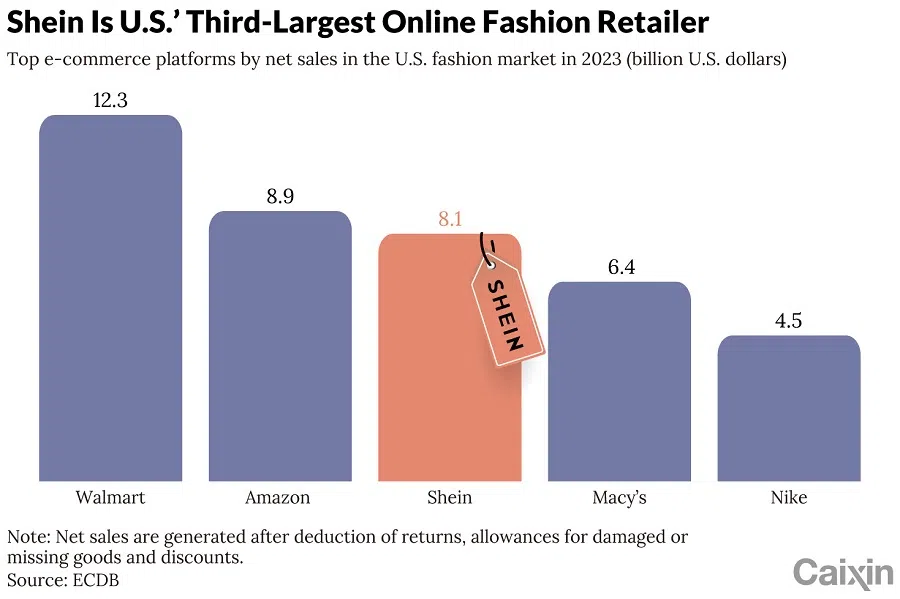

Their dominance is now extending to market share. Shein has ascended to become the third largest online fashion retailer in the US, trailing only Amazon and Walmart, and has a presence in over 150 countries. Temu, launched in the US in September 2022, has already expanded to 66 countries and regions, overtaking eBay in Europe with four million more monthly active users in October.

The quartet raked in over US$100 billion in gross merchandise value (GMV) in 2023, exceeding one-third of China’s total cross-border e-commerce GMV for the year. AliExpress led at US$40 billion, followed by Shein at US$36.5 billion and newcomer Temu at US$16.5 billion, according to an HSBC report in March. TikTok Shop also hit US$13.6 billion, data firm YipitData found.

Temu also creates price wars among merchants by rewarding the lowest bids with more traffic.

HSBC expects China’s cross-border e-commerce market to reach US$500 billion by 2025, with this quartet leading the way as they continue to acquire new users worldwide.

Faster and cheaper

The “four little dragons” found global success early on by making online shopping cheaper and faster through price wars, efficient management, and flexible manufacturing.

Temu stood out with an ultra-low-price model that proved successful in China. It requires suppliers to match or undercut market prices in order to sell their products on the platform, a home goods merchant told Caixin. Temu also creates price wars among merchants by rewarding the lowest bids with more traffic.

“Products on Temu are on average 60% to 80% cheaper than those offered on Amazon,” said Charlene Liu, head of HSBC’s Asia Pacific Internet and Gaming Research, adding that Chinese e-commerce players leverage low prices and innovative business models.

Temu, for example, introduced a “full-consignment” model that allows merchants to simply hand over goods to the platform, which handles the rest — from marketing, and shipping to fulfillment and customer service. Its peers quickly followed suit with similar models.

The model can help boost participation from merchants who previously had no experience selling overseas, Huang Yonglin, an official at the Shenzhen Cross-Border E-Commerce Association, previously told Caixin.

This year, Chinese e-commerce firms went a step further to promote the “semi-consignment” model. Merchants with inventory overseas can utilise the platforms’ marketing and customer services while managing their own logistics.

Under this model, large items that are not suitable for air shipping can be offered on the platform, and fulfillment can be up to a week faster. With this model, Temu is luring merchants selling larger goods such as furniture and appliances.

Meanwhile, Shein thrives on its agile supply chain, characterised by “small orders with quick returns” that prioritises flexibility and speed to quickly react to changes. This model enables faster product launches and testing compared with traditional fast-fashion brands, with more competitive prices.

“It requires a deep understanding and control of China’s supply chain to do so,” said Bian Xiaonan, a partner at Shein’s investor Lupin Capital. He added that this advantage is difficult for other competitors to replicate in the short term.

Amazon rivals

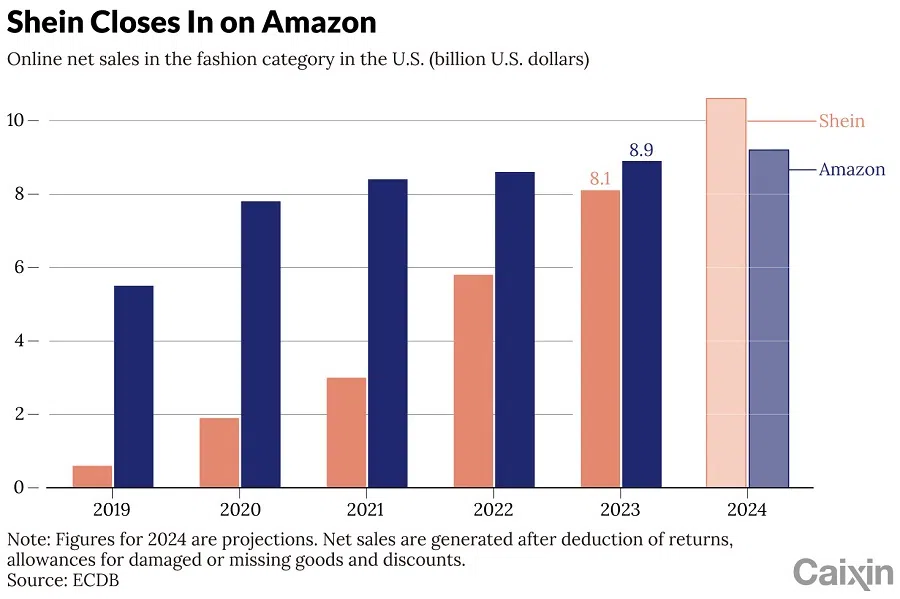

Amazon is feeling the cutthroat competition from its Chinese counterparts. Shein surpassed Amazon in US mobile app downloads for the first time in the second quarter of 2022, according to Sensor Tower data.

To keep up with its Chinese competitors, Amazon has launched an interactive shopping channel, FAST Channel, on Prime Video and Freevee in the US market in April, allowing users to engage with TV content and purchase items using their mobile devices.

... Amazon knows it is not in direct competition with Chinese e-commerce players. It has a mid-to-high-end price positioning, while Temu and Shein have a lower price point...

The move came amid the company’s announcements starting late last year that it would reduce commission rates for low-priced apparel items in the US, Europe, Japan and Canada, targeting Shein and Temu’s merchants.

But Amazon knows it is not in direct competition with Chinese e-commerce players. It has a mid-to-high-end price positioning, while Temu and Shein have a lower price point, emphasising value for money.

Cindy Tai, Amazon’s vice-president and head of Asia global selling, said the company hopes merchants will embrace a long-term vision, introduce innovative products, and build global brands, rather than engage in price wars with homogenous products.

“Customers definitely trust Amazon more, but they may buy non-essential items from Temu,” a Chinese merchant who uses Amazon told Caixin.

While Chinese merchants are keen to give new platforms a try, they generally continue operating on Amazon, according to Zheng Zhikun, general manager of Chinese cross-border payment platform PingPong.

Zheng believes that over the next two years, major e-commerce platform operators, including Amazon, will be vying for factory-type sellers with price advantages and manufacturing capabilities.

For now, Amazon still dominates the e-commerce market, boasting 428 million unique monthly global visitors in the first quarter of 2024, according to website analytics firm SimilarWeb Ltd., Temu, AliExpress and Shein had 185 million, 164 million and 80 million unique monthly visitors respectively.

The US tech giant also held a leading 39.6% market share in its home country in 2023, market research firm eMarketer found. Its share is expected to expand to 40.9% by 2025.

“People often exaggerate the impact of China’s four little dragons on US e-commerce players,” said Bian of Lupin Capital.

He explained that the e-commerce market penetration rate in the US, percentage of population that conduct online shopping, was 22% in 2023, still leaving room for growth compared with China’s 27%. Temu and Shein also found niche markets that US players had not fully penetrated, he added.

“Amazon provides American consumers with an unparalleled logistics fulfillment experience, which no emerging e-commerce platforms can achieve in the short term,” said Bian, referring to the company’s well-established Fulfilled by Amazon service, which enables businesses to store, pick, pack and ship customer orders.

Regulatory hurdles

While Chinese e-commerce platforms are making strides in the US, they find themselves exposed to higher regulatory risks. US lawmakers have been calling for measures to curb the influx of ultra-cheap Chinese imports to protect local businesses.

Temu, Shein and other Chinese e-commerce companies have been accused of exploiting the US’s “de minimis” rule in duties and customs inspections when importing goods via airfreight.

A case in point is 99 Cents Only Stores, a brick-and-mortar retailer founded in 1982. In April, it announced the closure of all 371 of its chain stores in the US, with its parent company filing for bankruptcy protection. It primarily sold household items — both the product categories and price range closely match what is available on Temu.

Temu, Shein and other Chinese e-commerce companies have been accused of exploiting the US’s “de minimis” rule in duties and customs inspections when importing goods via airfreight. The rule allows imports worth no more than US$800 to enter the U.S. duty-free. In 2023, there were over one billion such packages, surging fivefold from 2016.

In April, the Department of Homeland Security announced a crackdown on small package shipments to prohibit illicit goods from entering the US market, with measures including tightening scrutiny of packages applicable to de minimis exemptions.

The Biden administration “is protecting thousands of American workers and the US textile industry”, said Secretary Alejandro N. Mayorkas.

Temu and Shein likely accounted for more than 30% of all de minimis packages shipped to the U.S. every day, according to a 2023 report published by the House Select Committee on the Chinese Communist Party.

Supply chain and intellectual property protection are two other pain points for Chinese e-commerce players, as they need to ensure no forced labor is involved in production and all measures have been taken to protect intellectual property to meet US and EU requirements. A person close to Pinduoduo told Caixin that Temu is reducing its weight in the US market to offset these risks.

But the worst threat is a potential ban from the market altogether.

In April, US President Joe Biden signed a bill requiring TikTok parent ByteDance to divest or for the platform to cease operations in the US This dealt a blow to TikTok Shop, which just launched in the US in September.

“TikTok’s potential is huge thanks to its traffic,” said Li Mingtao, chief e-commerce researcher at the China International Electronic Commerce Center. TikTok Shop’s GMV in the US market could reach US$24.3 billion in 2024, according to an earlier estimate by Guosen Securities Co. Ltd.

Han Lijie, a partner at Katten Muchin Rosenman LLP specialising in Chinese tech business, believes the ban will inevitably hurt other e-commerce players like Temu and Shein.

“It reflects a fundamental attitude in American politics — unfriendliness towards Chinese companies,” he said.

Zou Xiaotong contributed to this story.

This article was first published by Caixin Global as “In Depth: How China’s E-Commerce Titans Are Squeezing Global Rivals”. Caixin Global is one of the most respected sources for macroeconomic, financial and business news and information about China.

![[Big read] When the Arctic opens, what happens to Singapore?](https://cassette.sphdigital.com.sg/image/thinkchina/da65edebca34645c711c55e83e9877109b3c53847ebb1305573974651df1d13a)