A nervous world seeks shelter in gold

Amid economic uncertainty and a weakening US dollar, central banks and investors are seeking safety in gold, the traditional safe-haven asset.

(By Caixin journalists Luo Guoping and Han Wei)

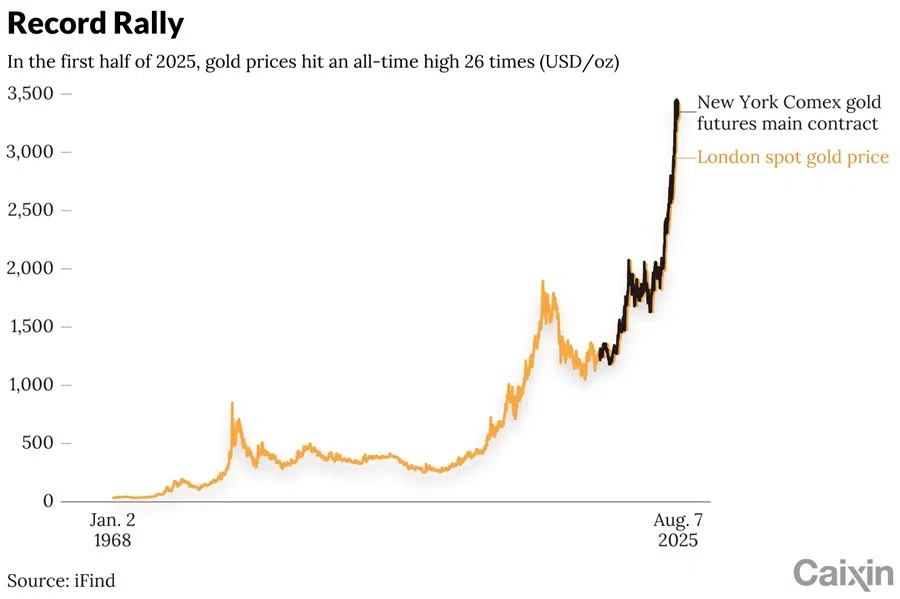

Gold prices are rocketing up, smashing dozens of records this year and delivering a windfall to mining companies as central banks and investors seek safety amid economic uncertainty and a weakening US dollar.

The rally — which saw prices break the US$3,500-an-ounce barrier this spring — is being driven by a potent mix of persistent geopolitical conflicts, lingering effects of pandemic-era monetary stimulus, and mounting expectations of Federal Reserve interest rate cuts.

The confluence has solidified gold’s status as the top-performing alternative asset over the past 18 months, sparking a frenzy of corporate deal-making and setting the stage for a sustained bull run, analysts and industry leaders say.

Since the start of 2025, spot gold has climbed 40%, setting 26 new highs in the first half alone — on top of 40 records in 2024, according to the World Gold Council (WGC). From a late-2022 trough of US$1,600 an ounce, bullion has more than doubled, blasting to a fresh peak of US$3,534.10 in New York trading on 8 August.

The soaring prices have delivered spectacular profits for miners. Newmont Corp., the world’s largest gold producer, saw first-half net profit jump 286% from a year earlier to US$3.95 billion. China’s top producer, Zijin Mining Group Co. Ltd., forecast a 54% increase in six-month net profit to 23.2 billion RMB (US$3.2 billion). Other major producers, including Zhongjin Gold Co. Ltd. and Shandong Gold Group Co. Ltd., also reported profit growth exceeding 50%.

An accelerating de-dollarisation trend and declining US Treasury values have led central banks to aggressively buy gold as a hedge. — Li Gangfeng, Commodity Discovery Fund

“Gold’s value has been re-recognised and reinforced,” said Chen Jinghe, chairman of Zijin Mining. “Gold is the currency of currencies and the ballast stone for economic security.”

Catalysts for the rally

Analysts cited several reasons for the rally. Pandemic-era quantitative easing by central banks around the world laid the groundwork, said Li Gangfeng of Commodity Discovery Fund, a Dutch commodities-focused investment firm. An accelerating de-dollarisation trend and declining US Treasury values have led central banks to aggressively buy gold as a hedge, he added.

Heightened geopolitical tensions — including the wars in Ukraine and the Middle East — and uncertainty over US trade policy have boosted gold’s appeal. US President Donald Trump’s erratic tariff policies, combined with persistent geopolitical conflicts, have intensified economic uncertainty and driven investors toward gold as the “ultimate safe-haven asset”, said Sheng Wen, an analyst at Beijing Antaike Information Co. Ltd.

Trump’s push to cut interest rates to stimulate US manufacturing is at odds with his strategy of imposing global tariffs, a combination that could stoke domestic inflation, Li said. These contradictory goals have created confusion in the market.

“The whole world is stockpiling gold to cope with economic uncertainty and financial risks,” Sheng said.

Experts expect gold to hold near current highs in the short term and remain bullish over the long run. In a 13 July report, Goldman Sachs maintained its forecast that strong, structural buying from central banks will push gold to US$3,700 per ounce by the end of 2025 and US$4,000 by mid-2026. On 4 August, Citibank reversed its previously bearish view, raising its three-month price target from US$3,300 to US$3,500 per ounce.

Underpinning the long-term optimism is a fundamental supply constraint. The world has already extracted more than 80% of its total gold reserves, with only about 59,000 tons left to be mined...

“In the commodities space, our opinion is to be long gold,” said Samantha Dart, global co-head of commodities research at Goldman Sachs.

Underpinning the long-term optimism is a fundamental supply constraint. The world has already extracted more than 80% of its total gold reserves, with only about 59,000 tons left to be mined, according to the WGC. This increasing scarcity, analysts say, will support high prices for years to come.

Central banks and ETFs

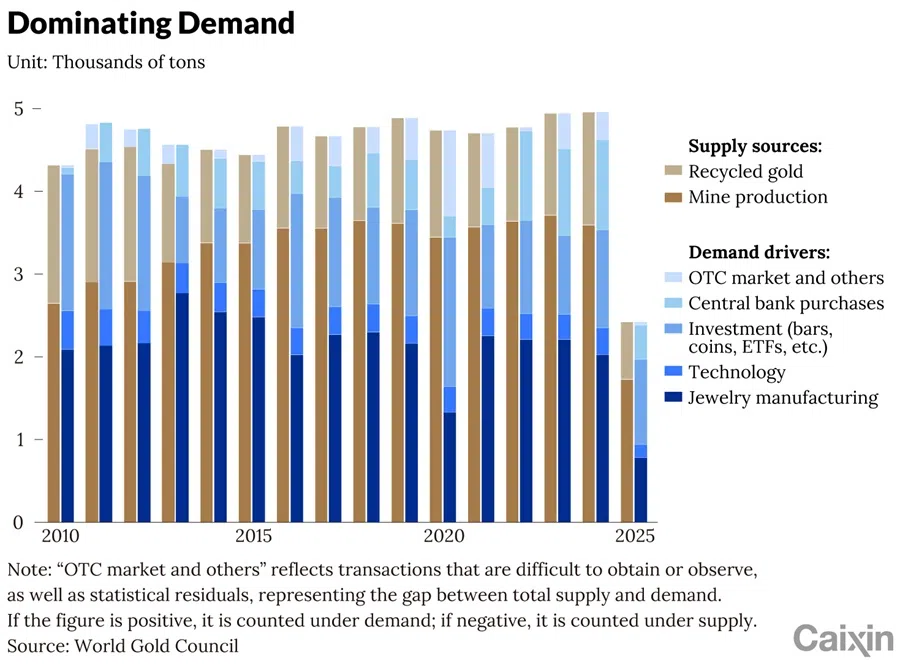

Central banks diversifying away from the US dollar and investors pouring into exchange-traded funds (ETFs) have become the main engines of demand. The freezing of Russia’s US dollar assets in 2022 prompted emerging-market central banks to boost gold reserves, Dart said.

From 2022 to 2024, global central banks purchased more than 1,000 tons of gold a year, up from 400 to 500 tons in the previous decade, WGC data show. By 2024, gold had overtaken the euro to become the second-largest reserve asset worldwide, accounting for 19.8% of global reserves, behind the US dollar’s 46.4%.

China’s central bank extended its gold-buying spree for a ninth month in July, adding 60,000 ounces to reach 73.96 million ounces. A June WGC survey found 95% of central banks expect global gold reserves to rise in the next year, with 43% planning to add to their holdings.

Dart believes the trend could persist for another two or three years as emerging economies, whose gold holdings are often below 10% of their total reserves, push toward the global average of about 20%.

Yet central bank purchases alone do not explain the most recent price explosion. WGC data showed that in the first half of 2025, central bank buying actually fell by more than 20% year-on-year to 415 tons. With jewellery demand also down, the main driver was a surge in investment demand.

According to a July Goldman Sachs report, the primary force has shifted from speculative positions, which drove the market in 2024, to “sticky” structural funds. These funds represent potential sustained buying from central banks and, crucially, a flood of money into gold-backed ETFs in anticipation of Federal Reserve rate cuts.

WGC data show overall investment demand soared 117% year-on-year in the first half of 2025 to 1,028.4 tons. While purchases of physical bars and coins grew modestly, holdings in gold ETFs and similar products ballooned by 397 tons, a 250% increase from the previous quarter. By the end of June, global gold ETF assets under management had hit a record US$382.8 billion, up 41% from the start of the year.

In China, trading in gold and silver futures and options was the most active in the market, with the volume of gold futures contract up 79%. The trading value for the first half of the year had already exceeded the full-year total for 2024, according to the China Futures Association.

From global giants to emerging Chinese buyers, companies are pouring billions into acquiring operating mines and development projects. The logic is simple: at today’s prices, even lower-quality assets can turn a handsome profit...

A golden M&A boom

The soaring price has led to a global merger and acquisition boom, as cash-flush mining companies scramble to expand production and lock down resources.

From global giants to emerging Chinese buyers, companies are pouring billions into acquiring operating mines and development projects. The logic is simple: at today’s prices, even lower-quality assets can turn a handsome profit, making acquisitions the fastest and most effective path to growth.

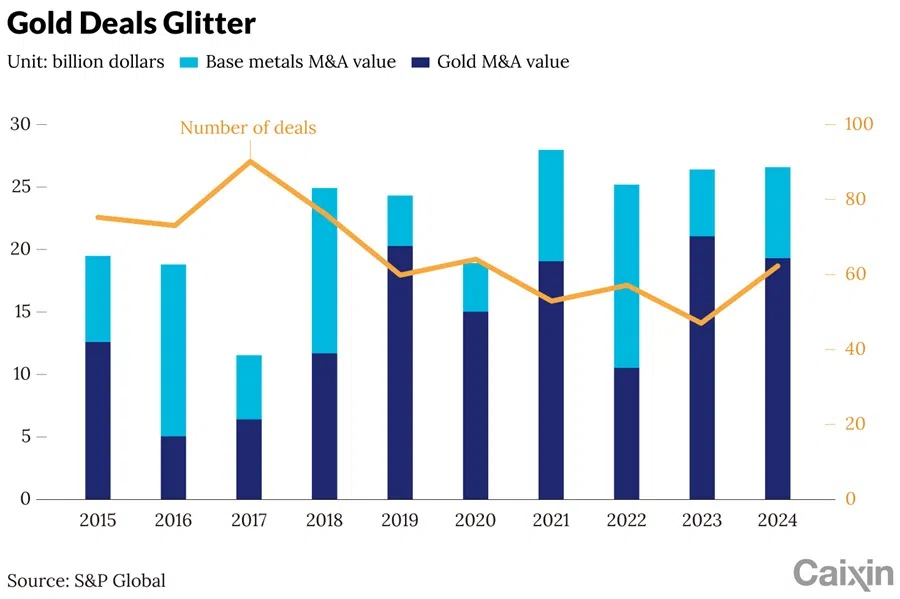

Gold has been the top target in the mining merger-and-acquisition (M&A) boom of the past two years, with deal values reaching US$21.1 billion in 2023 and US$19.3 billion in 2024, according to S&P Global. “The market views gold as a resilient hard currency and expects it to maintain stable, high profitability,” said Li Xiaofeng, a senior partner at Dacheng Law Offices.

“Mining companies are bullish on the future of gold,” said Bo Shaochuan, an independent director at Zijin Mining. He noted that the stock prices of junior mining companies, which are still in the exploration and feasibility stages, remain relatively inexpensive, creating attractive takeover targets.

The landmark deal was Newmont Corp.’s all-stock acquisition of Australian rival Newcrest Mining Ltd. for A$25 billion (US$16.5 billion) in November 2023, cementing its position as the world’s top gold producer. In 2024, major transactions continued, including Australian miner Northern Star Resources Ltd.’s US$3.26 billion purchase of De Grey Mining Ltd. and Africa’s largest producer, AngloGold Ashanti PLC, acquiring Egypt-focused Centamin PLC for US$2.48 billion.

Chinese buyers have been particularly aggressive. Zijin spent US$1 billion in October 2024 to acquire the Akyem gold mine in Ghana from Newmont, followed by a US$245 million purchase of a Peruvian copper-gold project in November. In June 2025, it acquired the Raygorodok gold mine in Kazakhstan for US$1.2 billion.

Other Chinese firms are also expanding abroad. Shandong Gold completed its acquisition of Canadian-listed Osino Resources Corp. in August 2024, gaining control of the Twin Hills gold mine in Namibia. In June 2024, Zhaojin Mining Industry Co. Ltd. completed its A$740 million acquisition of Australian-listed Tietto Minerals Ltd., whose flagship asset is the Abujar mine in Côte d’Ivoire.

In the current high-price environment, “even gold mines of lesser quality can be profitable, which encourages investors to boldly pursue mergers and acquisitions”, Li said.

The financial rewards are clear. According to a PwC report, gold revenues have become an increasingly large share of income for the top 40 global mining companies. In 2024, these firms saw their gold revenues jump 15%, while earnings before interest, taxes, depreciation and amortisation (EBITDA) from gold surged 32%.

“The rapid rise in gold prices has brought some challenges to overseas M&A, but it has also been a shot in the arm,” said a China Gold Group executive. “The rate of return on investment is expected to increase, stimulating companies to carry out more overseas gold project investigations and explorations.”

Since most countries have not yet classified gold as a critical mineral, “gold is still a very good target for investment and M&A target for Chinese companies”. — Bo Shaochuan, an independent director at Zijin Mining

Bo noted that acquisitions offer a faster path to boosting reserves than greenfield exploration. Since most countries have not yet classified gold as a critical mineral, “gold is still a very good target for investment and M&A target for Chinese companies”, Bo said.

While Chinese miners have become a fast-growing force — acquiring assets globally and leveraging lower costs and higher efficiency — their overall impact on supply remains limited. As relative newcomers with only three decades of international experience, compared with the centuries-long history of Western firms, Chinese companies have rarely secured top-tier, large projects at the source, Li said.

For now, the combined forces of geopolitical risk, central bank strategy and investor speculation continue to propel gold to new heights. “As global economic competition intensifies, the trend of gold’s price movement is full of uncertainty,” Sheng said. “But volatile upward movement remains the main theme.”

Qin Xinhao contributed to the story.

This article was first published by Caixin Global as “In Depth: A Nervous World Seeks Shelter in Gold”. Caixin Global is one of the most respected sources for macroeconomic, financial and business news and information about China.

![[Big read] When the Arctic opens, what happens to Singapore?](https://cassette.sphdigital.com.sg/image/thinkchina/da65edebca34645c711c55e83e9877109b3c53847ebb1305573974651df1d13a)

![[Video] George Yeo: America’s deep pain — and why China won’t colonise](https://cassette.sphdigital.com.sg/image/thinkchina/15083e45d96c12390bdea6af2daf19fd9fcd875aa44a0f92796f34e3dad561cc)