The securities chief’s curse: Family, alumni and associates that toppled Yi Huiman

China’s capital market has been in the slumps the past year, not helped by the controversy surrounding the China Securities Regulatory Commission. Lianhe Zaobao China news editor Yang Danxu takes a look at the latest downfall of its chair, Yi Huiman.

After much speculation within financial circles, the removal of Yi Huiman, former chair of the China Securities Regulatory Commission (CSRC), has been confirmed. On 6 September, the Central Commission for Discipline Inspection and the National Supervisory Commission announced that Yi was under investigation for suspected serious violations of discipline and law. He is the eighth ministerial-level “tiger” to fall this year.

On the financial hotseat

Yi was serving as deputy director of the Committee for Economic Affairs of the Chinese People’s Political Consultative Conference (CPPCC), but his issues did not arise from this nominal position. On the same day, his “former employer”, the CSRC, emphasised during a meeting that the investigation into Yi reflected the Chinese Communist Party (CCP)’s stance to “insist on no forbidden zones, full coverage, and zero tolerance in anti-corruption”.

According to Chinese media reports, Yi was taken away for investigation around 29 August along with several family members. Prior to that, some of Yi’s old classmates were also investigated.

Yi’s five-year tenure at the CSRC affirmed once again a scathing joke in Chinese society: the two most challenging chair positions in China are the ones for the Football Association and the CSRC.

Compared with previous CSRC chairs, 61-year-old Yi had humble beginnings. His initial education was modest, graduating from the relatively unknown Zhejiang Banking School (later upgraded to Zhejiang Financial College) in the 1980s. His career was also quite linear, working his way up from a rank and file credit officer to an executive at the Industrial and Commercial Bank of China (ICBC), before joining the CSRC.

In January 2019, Yi became CSRC chair, replacing Liu Shiyu, who was reassigned as the deputy secretary of the party committee of the All-China Federation of Supply and Marketing Cooperatives. At the time, his grassroots background, pioneering spirit, steady style and lack of deep political ties were thought to be traits appreciated by top leadership.

Yi’s five-year tenure at the CSRC affirmed once again a scathing joke in Chinese society: the two most challenging chair positions in China are the ones for the Football Association and the CSRC. One gets criticised when the Chinese men’s football team performs poorly, while the other becomes the target of disgruntled investors when the stock market hits a slump.

Stock traders often look for auspicious signs, and both the CSRC and its leader are frequently surrounded by “mysticism”. In June this year, when the CSRC updated its logo, changing the previous one dubbed “the chain trap” to a design featuring three “V” shapes encircling each other, it sparked heated discussions among investors who hoped for a market turnaround. The Chinese stock market did indeed experience a positive trend, and it is anybody’s guess if it is due to mystical forces.

Investors even believed that, regardless of Yi’s capabilities, at least his name, Yi Huiman (易会满, lit. easily filled to the brim), was more auspicious than those of previous CSRC chairs.

When Yi was parachuted into the CSRC in 2019, the Chinese stock market was in a slump. The public hoped that this new chair would invigorate the capital market and inject new life into the sluggish stock market. Investors even believed that, regardless of Yi’s capabilities, at least his name, Yi Huiman (易会满, lit. easily filled to the brim), was more auspicious than those of previous CSRC chairs.

Yi Huiman’s downfall

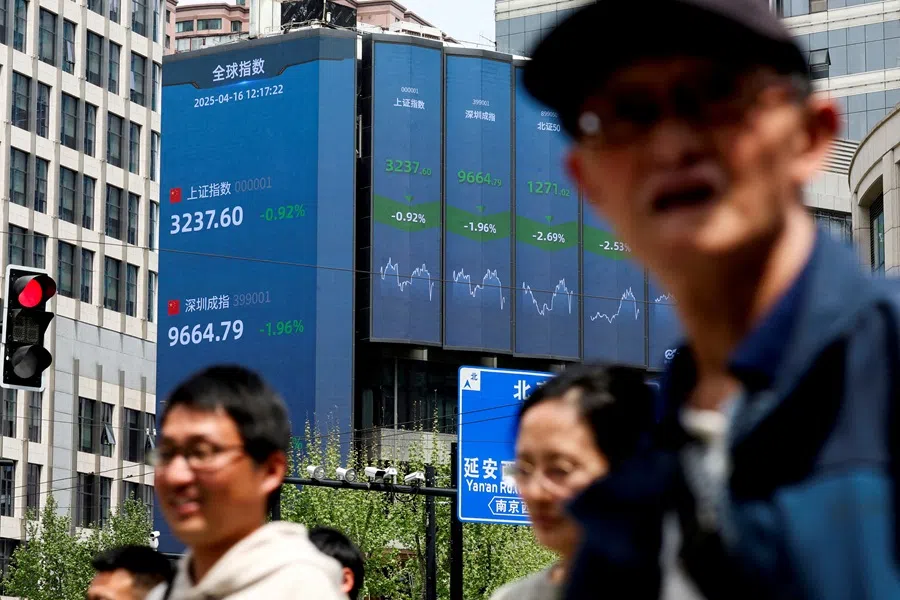

During Yi’s five-year tenure at the CSRC, China implemented a registration-based reform of its capital markets and saw a surge in IPOs. However, Yi ultimately failed to bring good fortune to the stock market; when he was in office, A-shares were highly volatile and frequently fell below 3,000 points. In February last year, amid a prolonged market slump, Yi was abruptly removed from his post and took a back seat. He was succeeded by the “broker butcher” Wu Qing.

According to various media reports, Yi’s investigation appears to centre around three key “circles”. The first is the “ICBC circle”, rooted in his long-standing ties to the bank. Over the past two years, several ICBC executives have been caught up in the financial anti-corruption crackdown, including former vice-president Zhang Hongli, who previously worked with Yi, and Gu Jiangang, a trusted subordinate and former asset management chief of ICBC.

The second is the “alumni circle” from Yi’s alma mater, Zhejiang Financial College. According to The Economic Observer, several of Yi’s schoolmates had already fallen from grace before his probe, including Lin Peng, former party committee member and discipline inspection secretary at the Agricultural Bank of China’s data centre, and Shen Rongqin, former president of ICBC’s Zhejiang branch.

Lastly, Yi’s “family circle” has also drawn attention. Reports suggest that his elder brother operated in Zhejiang’s financial circles under the guise of being a relative, leveraging Yi’s influence to participate in corporate financing. It was also reported that Ding Wei, former chair of China International Capital Corporation (CICC) Capital, was previously detained in connection with a massive private equity investment project — and Yi’s son also works at CICC. The unravelling of this case may have ultimately contributed to Yi’s downfall.

The downfall of two consecutive CSRC chairs highlights that the head of China’s securities regulator is not only expected to take the blame for market downturns but is also becoming a high-risk position amid frequent corruption scandals.

With the news of Yi’s investigation now officially confirmed, he has become the second head of the CSRC to fall from grace, following Liu Shiyu. In 2019, Liu turned himself in and was subsequently given a two-year probation within the party. He was stripped of his official position and demoted to first-class investigator.

High-risk position

While the details of Yi’s case remain under investigation, unlike Liu’s case, the statement regarding Yi made no mention of him “voluntarily surrendering” or “cooperating” with the investigation. Combined with widespread rumours, it is widely believed that Yi’s case may be more serious, with a prison sentence a possibility.

The downfall of two consecutive CSRC chairs highlights that the head of China’s securities regulator is not only expected to take the blame for market downturns but is also becoming a high-risk position amid frequent corruption scandals.

In fact, since last year, numerous senior officials within the securities system — both at the central and local levels — have come under investigation. These include former CSRC vice-chair Wang Jianjun, who worked alongside Yi for over two years and was dismissed in May this year, as well as former CSRC party committee member Wang Huimin, former party secretary and director of the Jiangsu Securities Regulatory Bureau Ling Feng, and former party secretary and director of the CSRC’s Shenzhen branch Chen Xiaopeng.

The “high-risk” nature of working within the securities regulatory system underscores the fact that China’s financial sector — including the capital markets — still harbours significant rent-seeking opportunities. Financial corruption permeates every corner of the system.

As the authorities push to develop the capital markets to better serve China’s economy, and as investors look forward to a long-term bull market, failure to root out corruption through effective institutional reform will not only undermine market confidence but could also lead to systemic risks, making it even more difficult to unlock the potential of finance in serving the economy.

This article was first published in Lianhe Zaobao as “证监会主席成高危岗位”.