Trade war wake-up call: Will China finally fix its economy?

Export-oriented manufacturing provinces in China, such as Guangdong and Zhejiang, have been hit especially hard by Trump’s reciprocal tariffs and the ever-escalating China-US trade war. EAI senior research fellow Yu Hong tells us more about how these provinces are coping with the hostile trade environment and how China can survive the trade war.

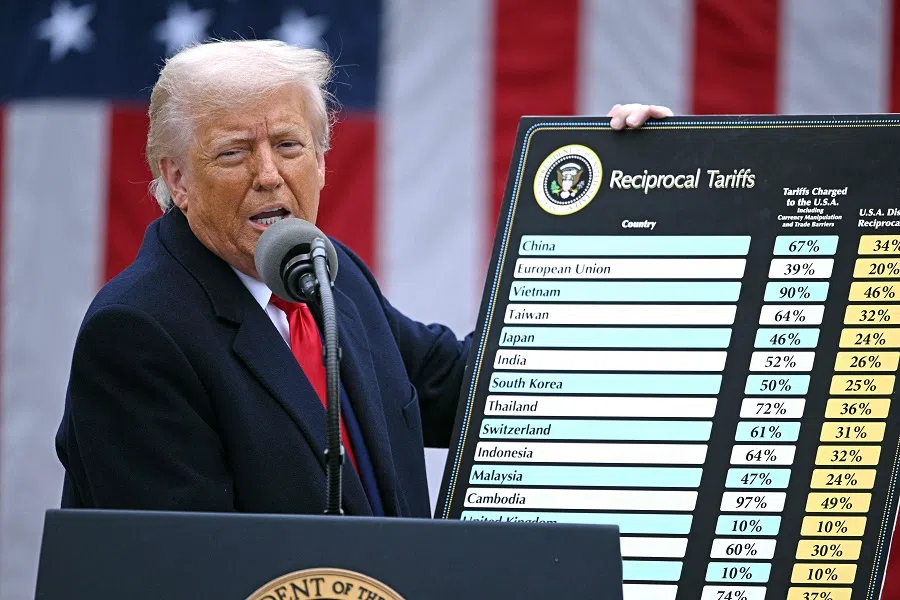

On 11 April 2025, China started to increase its tariff rate on imports of US goods from 84% to 125%. Before that, Trump 2.0 administration officials said that all Chinese exports to the US would face tariffs amounting to a minimum of 145%. President Trump further announced that the US was pausing the “reciprocal tariffs” for 90 days by imposing a 10% flat rate on all countries except China.

The Trump administration had earlier allowed exemptions from the “reciprocal tariffs” for nearly 20 goods imported from China, including smartphones, semiconductor devices and other electronic products. Although this move provides a short-term respite for the Chinese companies, the exemption might only be temporary. The Trump 2.0 administration is working on a separate set of trade investigations on semiconductors, which could lead to more tariffs on Chinese-made goods that were previously exempted.

A continuation of this downward spiral will bring the global trading system to the verge of collapse, since the GDPs of the US and China combined have accounted for more than 40% of global GDP.

Trade war’s collapse risk

US President Donald Trump has long claimed that China’s non-market economic policies and practices have severely weakened American industries and given China global dominance in key manufacturing industries. According to the White House, such practices cost the US 3.7 million jobs between 2001 and 2018 due to the widening China-US trade deficit, putting American workers out of work and undermining US competitiveness. These Chinese state-driven policies and practices were accused of threatening the US economy and national security by making the US more dependent on foreign-controlled supply chains for critical industries and daily necessities.

The recent rapid escalation of the trade war between China and the US has resulted in embargo-level tariffs on both sides. In the face of the Trump 2.0 administration’s tariff pressure, China has maintained a tough stance thus far, responding with swift and firm countermeasures and vowing to “fight until the end” in the trade war.

A continuation of this downward spiral will bring the global trading system to the verge of collapse, since the GDPs of the US and China combined have accounted for more than 40% of global GDP. According to the “Global Trade Outlook and Statistics” released by the World Trade Organisation in April 2025, the volume of world merchandise trade is likely to decrease by 0.2% in 2025 amid current conditions and broader spillover of policy uncertainty.

At a deeper level, Trump intends to completely restructure American participation in the current global trading system, which he perceives to work in China’s favour.

Bringing a structural shift in the US

On the surface, President Trump wants to reduce America’s long-standing trade deficit by imposing punitive tariffs on China and the rest of the world. At a deeper level, Trump intends to completely restructure American participation in the current global trading system, which he perceives to work in China’s favour. The China-US trade war is not just about foreign trade, and it is not just a one-off shock. It will bring about a structural shift in the bilateral economic and trade relationships between China and the US for decades to come.

In 2024, the US accounted for around 14.6% of China’s total exports. In addition, considering that Chinese companies tranship to the US through third countries such as Mexico and Vietnam, the US market is crucial for many Chinese trading firms and manufacturers. Therefore, the escalating China-US trade war could also threaten China’s status as the world’s trading and manufacturing superpower.

To the Trump administration, tariffs are a powerful weapon and bargaining chip against a sluggish Chinese economy heavily reliant on exports. President Trump anticipates that the “reciprocal tariffs” policy against China and other trading partners will help to reduce America’s trade deficits and move manufacturing back to American soil.

Greatest impact on Zhejiang and Guangdong provinces

Foreign trade has long been one of the important engines supporting China’s economic growth. According to China’s official statistics, 180 million people are directly or indirectly employed in China’s foreign trade, accounting for 23% of the country’s total employment. The escalating China-US trade war could potentially affect the business of more than 700,000 import and export operators directly. This will involve 180 million people in the upstream and downstream industrial chains, heaping huge pressure on China’s economic development. Tariffs that Washington and Beijing have slapped on each other’s merchandise goods will all but extinguish China-US bilateral trade.

US tariffs on China have put enormous pressure on many export-oriented manufacturing companies located in Zhejiang and Guangdong.

The potential impact of the China-US trade war on China’s export-dependent manufacturing provinces such as Zhejiang and Guangdong is significant. According to the ratio of China’s foreign trade exports to the US in 2024, the escalation of the China-US trade war will have the greatest impact on Zhejiang and Guangdong provinces, which exemplify China’s status as the “world’s factory”.

Meanwhile, more than 80% of China’s foreign trade enterprises are private enterprises, and their import and export value accounts for over half of China’s total foreign trade value. Interestingly, Zhejiang and Guangdong are both provinces with a high concentration of private enterprises, so they have also been particularly affected by the trade war.

US tariffs on China have put enormous pressure on many export-oriented manufacturing companies located in Zhejiang and Guangdong. For example, Zhejiang’s top ten exports to the US include textile products and clothing, furniture, auto parts and accessories, hand or machine tools, mattresses, bedding and similar articles, bags and similar containers. Many local factories that rely on exports to the US have seen their output plummet or shut down, while some warehouses are overstocked with goods that were intended for export.

Chinese enterprises exert agency

Faced with great uncertainty and tariff pressure, China appears to be much better prepared this time compared to the Trump 1.0 era. President Trump started to impose punitive tariffs against Chinese-made goods in 2018, during his first term in office. Six years later, Chinese firms are now bracing themselves for the sequel.

On the one hand, some companies are trying to negotiate with American merchants on how to share the burden and cost of tariffs fairly and reduce or offset the negative impact of tariff policies. These firms are also trying to increase retail sales in the United States through cross-border e-commerce platforms.

Despite US tariffs on Chinese exports reaching 145% and above, China’s dominant role across a range of manufacturing sectors (e.g. textiles and garments, toys, furniture, electric vehicles, renewable energy equipment, smartphone, and machinery) will make it extremely difficult for American — and foreign — importers to switch suppliers, at least in the short term.

To cope with the escalation of the China-US trade war, many affected Chinese firms located in Zhejiang and Guangdong are adopting a two-pronged strategy. Namely, they seek to diversify their export market and to shift to the domestic market as much as possible.

Open for business: Earth

On the market diversification front, local manufacturers are trying to reduce their dependence on the US market and customers by expanding into other countries.

As they attempt to mitigate trade risks, Chinese companies are trying to avoid putting all their eggs in one basket. The American market share of China’s direct exports has declined substantially since 2018. According to China’s Ministry of Commerce data, the percentage of US-bound exports in China’s total export volume fell from 19.2% in 2018 to 14.6% in 2024.

In addition to targeting ASEAN countries, affected companies are trying to tap into the European Union and emerging markets, such as Russia, Central Asia, the Gulf Cooperation Council states, Africa and Latin America.

In the past, the US market accounted for half of many Zhejiang and Guangdong companies’ exports. However, Chinese enterprises now hope to diversify their export markets by expanding into emerging countries, so as to offset the negative impact of the China-US trade war on their own enterprises.

In contrast to the decline of China’s direct exports to the US, China’s trade with emerging economies and Belt and Road countries has grown in recent years. Among them, ASEAN’s strategic position in China’s foreign trade portfolio is rising. Since 2020, ASEAN has become China’s largest trading partner. In 2024, according to China Customs statistics, the proportion of bilateral trade with ASEAN in China’s total foreign trade further increased to more than 16%. It is interesting to note that this comparative decline in US status began under the Trump 1.0 administration.

Chinese firms are now eyeing the huge ASEAN market, with its population of over 650 million and booming economy. Chinese products have entered Southeast Asian countries, with “Made in China” products becoming ubiquitous across sectors ranging from consumer goods and food, household appliances, to high-end train locomotives, smartphones and communication equipment. In addition to targeting ASEAN countries, affected companies are trying to tap into the European Union and emerging markets, such as Russia, Central Asia, the Gulf Cooperation Council states, Africa and Latin America.

China’s continued export dominance shows that the China-US trade war has not caused stagnation in China’s foreign trade and exports; rather, it has further stimulated the expansion of Chinese enterprises overseas.

According to China Customs statistics, the total value of China’s imports and exports reached 43.85 trillion RMB (US$6 trillion) in 2024 — a year-on-year increase of 5%. In the first quarter of 2025, China’s import and export of goods amounted to 10.3 trillion RMB — a year-on-year increase of 1.3%, with exports increasing by 6.9%. These trade statistics suggest that China’s global export dominance has risen despite the tariffs. China’s continued export dominance shows that the China-US trade war has not caused stagnation in China’s foreign trade and exports; rather, it has further stimulated the expansion of Chinese enterprises overseas.

The power of the home market

On the other hand, boosting domestic consumption demand has also been necessary to mitigate external shocks. In the face of the declining foreign demand, many foreign trade enterprises in China have actively adapted to the domestic market demand, improved the layout of dealers in key domestic regions, and accelerated the expansion of domestic channels.

China’s huge domestic market thus provides a buffer space for many foreign trade enterprises. The Chinese authorities’ recent commitment to supporting foreign trade enterprises to “export to domestic sales” has also helped foreign trade enterprises to turn tariff pressure into a driving force for the deep cultivation of the domestic market, to a certain extent.

China’s domestic market gives Beijing leverage, in the sense that domestic firms in China can reduce their dependence on foreign markets for sales if the Chinese market starts buying more. According to the IMF (International Monetary Fund) data, China’s GDP grew from US$396.5 billion in 1990 to US$18.2 trillion in 2024. Its per capita GDP also rose from US$346 in 1990 to US$12,970 in 2024 based on current market prices. China has a huge market of 1.4 billion people, of which about 400 million are middle class. This provides sufficient potential and space for China’s economy to bring long-term development through the expansion of domestic demand and consumption growth.

Reducing China’s economic growth and Chinese firms’ dependence on foreign trade, and increasing the share of domestic investment and consumption in GDP are the more sustainable economic development models that the Chinese authorities have been aspiring to achieve.

External pressures like the China-US trade war bring both challenges and opportunities. The China-US trade war can help force China to accelerate its domestic economic restructuring and industrial upgrading to allow for more domestic consumption. This includes shifting its reliance on foreign trade markets to domestic sales or diversifying trade markets.

... the expansion of domestic demand requires the establishment of a large and unified domestic market.

Structural shift also needed in China

Nevertheless, the success of the two-pronged strategy adopted by many Chinese firms remains uncertain, at least in the short term.

Regarding export market diversification, both developed and developing countries are concerned about the rerouting of exports by Chinese firms, and the influx of Chinese-made goods originally intended for the American market. This influx of cheap Chinese products could crush many local industries in European countries and emerging market economies.

Many countries could push back against imports from China amid the escalating trade war between the US and China. Some countries, including Brazil, Turkey, Thailand and Indonesia, have already taken defensive trade measures to protect local industries by curbing imports from China. Against this backdrop, it will be difficult for Chinese manufacturers to further diversify their export market and expand access to the European Union or emerging countries.

In shifting their focus to China’s domestic market, Chinese enterprises are facing many challenges and difficulties. On one hand, the export products of Chinese enterprises do not necessarily meet the needs of domestic consumers. On the other, it is tough to expand domestic consumption due to the impact of China’s economic downturn and rising unemployment, especially on youths.

Although the Chinese authorities acknowledge the urgent need to rebalance the Chinese economy towards a domestic consumption-driven one, the state policy measures that have been announced and implemented so far have had limited impact, creating a dilemma for China. For example, the Chinese authorities’ trade-in programme to promote the trade-in of consumer goods has boosted demand in sectors such as household appliances. However, China’s overall retail sales remain quite weak.

According to China’s National Bureau of Statistics, China’s total retail sales of consumer goods grew by 4.6% from January to March 2025, compared to a higher figure of 4.7% in the same period last year. Despite the various stimulus policies introduced by the Chinese government to boost domestic consumption, the index was weaker than expected.

Many Chinese households do not consume enough because they feel insecure about their economic situation if they marry, fall sick, or retire. Unless the Chinese authorities engage in drastic domestic reform, it will be difficult to unleash the spending power of Chinese consumers. The Chinese government needs to implement decisive, long-overdue reforms in state-owned enterprises, the household registration system, healthcare, and pensions. These measures will increase the income of the population and boost their spending confidence.

Rebalancing the Chinese economy by reducing dependence on exports and relying more on domestic consumption is the true panacea for China.

In addition, the expansion of domestic demand requires the establishment of a large and unified domestic market. This, in turn, requires breaking down various barriers of regional protectionism, reducing the cost of cross-regional circulation of products, and realising the effective circulation of goods, capital and personnel. These are structural barriers, rather than superficial ones.

Rebalancing the Chinese economy by reducing dependence on exports and relying more on domestic consumption is the true panacea for China. The escalation of the trade war might just give the Chinese leadership the motivation to take more bold actions to push for critical domestic reform.

There is no time to be wasted. The clock is ticking.

![[Big read] When the Arctic opens, what happens to Singapore?](https://cassette.sphdigital.com.sg/image/thinkchina/da65edebca34645c711c55e83e9877109b3c53847ebb1305573974651df1d13a)

![[Video] George Yeo: America’s deep pain — and why China won’t colonise](https://cassette.sphdigital.com.sg/image/thinkchina/15083e45d96c12390bdea6af2daf19fd9fcd875aa44a0f92796f34e3dad561cc)