Why Singapore sovereign fund sued Chinese EV-maker Nio

In a first, Singaporean sovereign wealth fund GIC Pte Ltd has sued Chinese EV company Nio Inc. for alleged securities fraud in an attempt to recover investment losses.

(By Caixin journalists Yue Yue and Qing Na)

Singaporean sovereign wealth fund GIC Pte. Ltd. is suing Chinese electric-vehicle (EV) maker Nio Inc. and executives for alleged securities fraud, in a bid to recover “tremendous” investment losses.

GIC filed a complaint with the New York Southern District Court in late August, accusing Nio, along with its CEO Li Bin and Chief Financial Officer Feng Wei, of violating securities law, alleging that they used a battery rental joint venture (JV) to inflate the automaker’s revenue.

This is the first known instance of a sovereign wealth fund suing a US-listed Chinese company.

The case drew broader attention after Caixin’s Chinese-language report on 15 October circulated among investors. Nio’s Singapore- and Hong Kong-listed shares plunged around 9% on 16 October.

Battery rental controversy

At the core of the dispute is Wuhan Weineng Battery Asset Co., a battery rental JV launched in 2020. The concept: Nio customers would buy a car without a battery for a lower price and lease one from Weineng, which also appealed to drivers because it meant they could easily upgrade battery packs as the technology improved.

In a 2022 report, US short seller Grizzly Research LLC claimed Nio had used “accounting games”, allowing it to immediately recognise revenue from its battery sales to Weineng...

Nio first sold batteries to the JV, which then collected subscription payments from users through the “battery-as-a-service” business.

In a 2022 report, US short seller Grizzly Research LLC claimed Nio had used “accounting games”, allowing it to immediately recognise revenue from its battery sales to Weineng, referring to it as an “unconsolidated related party subsidiary,” which should have been recognised over several years under a subscription system.

Grizzly Research also suggested that Nio oversupplied batteries to Weineng to exaggerate its revenue. Nio denied the accusations, saying they were “unsupported speculations and misleading conclusions and interpretations.”

Shortly after the report was released, investors launched a class action lawsuit against the automaker.

In its complaint, GIC called Weineng a “purposefully created” vehicle to help Nio manipulate its financials and shore up funding. Almost immediately after the JV was created in August 2020, Nio’s revenue surged. In the fourth quarter of that year, the company generated 6.6 billion RMB (US$926 million) in revenue, more than doubling year-on-year, according to the complaint, which cites Nio’s financial reports.

GIC argued this approach had the intent or effect of “misleading” investors, pointing out that if revenue from Weineng was recognised over time in a compliant manner, Nio’s revenue for the same period would have been substantially lower.

GIC argued that Nio had a “disproportionately” larger economic interest in Weineng, suggesting Nio’s actual control over the latter reached 55%...

The sovereign fund claimed that Nio’s 19.8% stake in the JV was carefully designed — a “hairsbreadth” below the 20% threshold. The threshold could lead to Nio being deemed to have effective sway over decisions, and therefore subject to consolidation under US generally accepted accounting principles, which would have prevented Nio from accelerating revenue through Weineng, according to the fund.

GIC argued that Nio had a “disproportionately” larger economic interest in Weineng, suggesting Nio’s actual control over the latter reached 55% during the period when GIC held the company’s American depositary shares (ADSs), US-traded certificates for foreign shares.

“Nio… controlled Weineng as Weineng’s only revenue stream,” GIC stated, viewing Weineng as a “mere facet” of Nio’s business.

The case has been suspended as of early October, as the court is awaiting a ruling in the earlier class action case.

Nio’s losses

Since 2018, when it went public in New York, Nio’s accumulated losses had reached nearly 120 billion RMB by June this year, according to Caixin’s analysis of its reports.

During that period, Nio’s stock price was “artificially inflated” due to “misleading” statements and omissions, GIC said in the complaint.

GIC purchased a total of about 54.5 million Nio ADSs between August 2020 and July 2022, according to its complaint.

During that period, Nio’s stock price was “artificially inflated” due to “misleading” statements and omissions, GIC said in the complaint. “When the market learned the truth about Nio’s accounting shenanigans, Nio’s securities plunged in value,” causing GIC to suffer tremendous losses, it said.

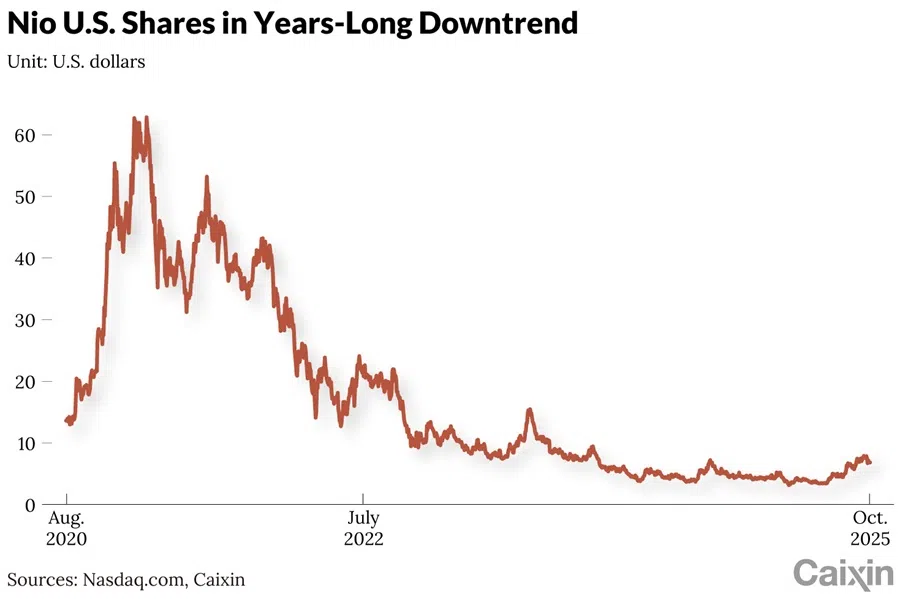

Nio has seen its US-listed shares plunge from its peak of around US$60 in 2021 to below US$7 Wednesday.

The fund did not specify how much it is seeking in damages in the complaint, but based on stock price movements over the period, its potential losses are estimated at between US$500 million and more than US$2 billion.

Ding Yi contributed to this story.

This article was first published by Caixin Global as “In Depth: Why Singapore Sovereign Fund Sued Chinese EV-Maker Nio”. Caixin Global is one of the most respected sources for macroeconomic, financial and business news and information about China.