China and the US enter a strategic stalemate as chips and rare earths chokehold is released

Once on the defence, China is now engaging the US in a more balanced struggle of offence and defence, compelling Washington to make greater concessions, says Lianhe Zaobao correspondent Yu Zeyuan.

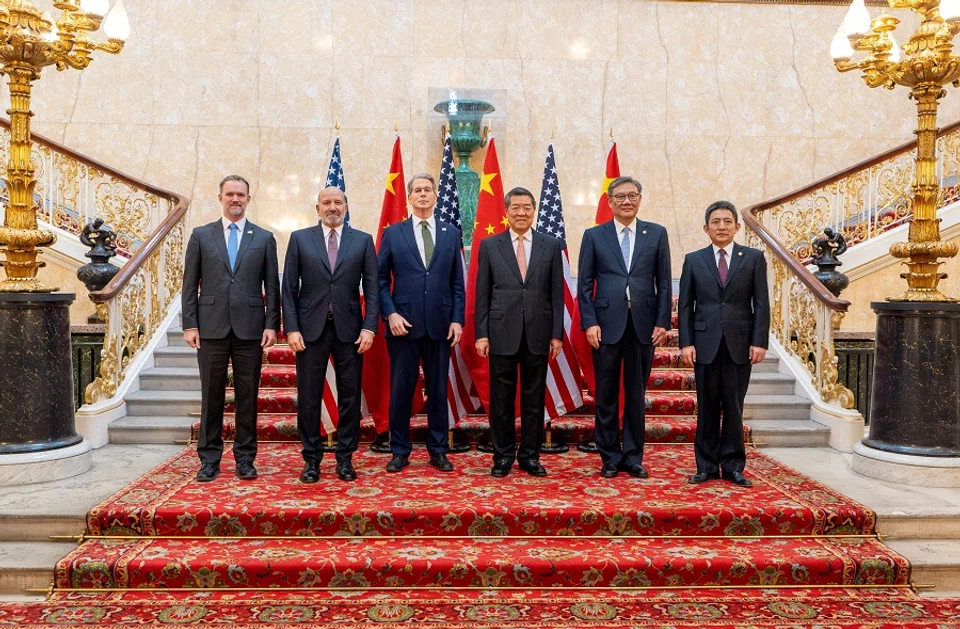

On 10 June in London, the China and US trade negotiation teams agreed on a framework to implement the consensus formed by the two countries’ leaders during their phone call. Indeed, there is hope for a reprieve to the intense China-US tariff and export restriction faceoff.

Continued countermeasures after Geneva talks

Li Chenggang, China’s international trade representative, stated that the progress achieved at the London talks was beneficial to enhancing trust between the two countries, advancing the healthy and stable development of China-US economic ties, as well as providing positive energy to the global economic development.

US Commerce Secretary Howard Lutnick also told the media that both sides have reached a framework to implement the Geneva consensus, adding that once approved by US President Donald Trump, they would strive to implement it. (NB: President Trump has said on social media that “our deal with China is done” and “we are getting a total of 55% tariffs, China is getting 10%”.)

After Trump triggered a global tariff war on 2 April, China was pegged as a major target for the US. Both sides have not backed down on the tariff issues and escalated the situation by tussling with each other in the trade domain, using restrictions on chips or rare earth sales to counter one another. Given the intensity of this China-US confrontation, external observers believed that an agreement or even a consensus between both sides were off the table.

However, the speed and extent to which an agreement was reached exceeded expectations. On 12 May, China and the US released a joint statement after the Geneva trade talks, not only significantly reducing the tariffs imposed by both sides since early April, but also establishing a China-US trade consultation mechanism to continue economic and trade discussions.

Unlike the Geneva talks, which focused on tariffs, the London discussions focused on trade issues, in particular the export restrictions imposed by each side.

Yet even after the Geneva talks, the US believed that China was not actively implementing the agreements, and released guidelines for export controls on artificial intelligence (AI) chips and halted sales of electronic design automation (EDA) software to China. There were even threats to revoke Chinese student visas. On the other side, China continued its countermeasures by restricting the sale of rare earths to the US, among other moves.

China’s chokehold on the US

On 5 June, the leaders of China and the US shared their first call since Trump’s second term in the White House. Trump described the call as a positive conclusion for both countries, while Chinese President Xi Jinping invited Trump to visit China, which signalled a positive atmosphere during the call.

The trade negotiations in London between the China and US teams were the next step in engagement following the Geneva agreement and the phone call between the two leaders. Unlike the Geneva talks, which focused on tariffs, the London discussions focused on trade issues, in particular the export restrictions imposed by each side.

Specifically, China asked for the US to ease its export controls on advanced chips and semiconductor design software to China, while the US requested that China loosen its restrictions on rare earth exports to the US. Recently, Kevin Hassett, director of the US National Economic Council, said that he hoped China could restore its rare earth supply to the US to the level before early April. In return, the US would consider lifting recent restrictions on the sale of EDA software, nuclear power products and jet engines to China.

... the past few years have shown that the “chokehold” effect of these tactics is weakening, as China has grown increasingly capable of independently developing alternatives in the chip sector.

Clearly, the export ban on advanced chips and related equipment remains the US’s main tool to exert pressure on China. However, the past few years have shown that the “chokehold” effect of these tactics is weakening, as China has grown increasingly capable of independently developing alternatives in the chip sector.

Huawei founder Ren Zhengfei recently told the media that while China’s single chip still lags one generation behind that of the US, it can still achieve practical conditions through cluster computing. China also faces no bottleneck in software.

But while the US’s ability to “choke” China weakens, China has found the US’s vulnerability in rare earths. China’s rare earth restrictions have not only affected US military products, a wide range of civilian products such as automobiles have also suffered. Some American factories have even said that they would move production to China, completely at odds with Trump’s original intent of bringing manufacturing back to the US.

By restricting rare earth exports, China successfully gave the US a taste of what it means to be on the receiving end of a supply-chain chokehold.

US strength eroding

Since Trump launched the US-China trade war in 2018 during his first term, bilateral relations gradually entered an era of comprehensive strategic rivalry. Up until January this year, when Trump began his second term, China was basically in a defensive posture. This phase was characterised by the US exerting continuous pressure on China across various fronts — trade, politics, security and ideology — while China found itself overstretched and relatively passive.

However, following the tariff and export control war between China and the US in April this year, China significantly shifted its approach from a primarily defensive strategy to assertively countering US moves. By restricting rare earth exports, China successfully gave the US a taste of what it means to be on the receiving end of a supply-chain chokehold.

As China’s dual circulation strategy of boosting both domestic and international economic flows begins to bear fruit, and as it continues to advance in high-tech fields such as AI, aerospace and semiconductors, the US has fewer effective tools to inflict economic or technological pain on China.

... the US’s traditional image of strength and leadership is starting to erode, further weakening its ability to rally allies in efforts to pressure China.

Essentially, China has begun to emerge from its previously disadvantageous defensive position — at least when it comes to the economy and technology. It is now engaging the US in a more balanced struggle of offence and defence, compelling Washington to make greater concessions.

Coupled with Trump’s unpredictable and often unreliable domestic and foreign policies, the US’s traditional image of strength and leadership is starting to erode, further weakening its ability to rally allies in efforts to pressure China. The US-China rivalry is now entering a phase of strategic stalemate.

This article was first published in Lianhe Zaobao as “中美博弈进入战略相持阶段”.