How China saw through America’s bottom line in the trade war

Borrowing Mao’s logic of protracted struggle, China has shifted from defence to stalemate — countering US pressure with rare earth leverage and strategic patience — and in the process, uncovering the limits of America’s economic coercion. Commentator Deng Yuwen examines this subtle shift in power balance.

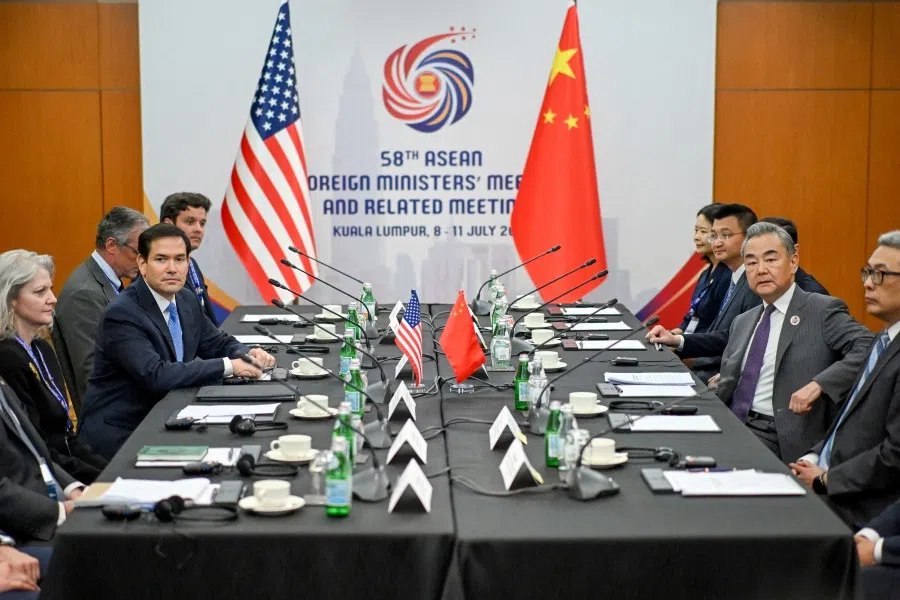

I have argued that in the US–China competition, America may soon be left with only one decisive advantage: finance. The latest Kuala Lumpur talks confirm this trend. Following the leaders’ meeting in South Korea, Beijing released the results, which effectively reset the trade and technology confrontation to its April status. In short, both sides fought for nothing

Interpretations of this outcome vary. Ironically, many Chinese-language social media commentators believe the US won and China lost, while mainstream American media argue the opposite — that Washington lost and Beijing won. In my view, if one must assign winners, China won — not by a landslide, but meaningfully. It was not a small win, nor a decisive one, but a moderate-degree win.

A moderate win for China

On the surface, the result looks like a draw. But on specific issues such as soybeans and the 10% reduction in fentanyl-related tariffs, as well as the suspension of port fees on each other’s vessels, China stands to gain more.

Over the past two years, China shifted large soybean purchases to Brazil, pushing up Brazilian prices. By resuming purchases from the US, China can depress Brazilian soybean prices. Reducing the US fentanyl tariff by 10% effectively lowers the average tariff on all Chinese exports, since it applies broadly, enabling China to increase export volumes. Suspending mutual port fees benefits China more: as a major exporter, it has more vessels at sea, lowering costs, reducing transit time, and minimising risk exposure.

These are modest, tactical gains. My characterisation of this as a moderate win is based instead on the strategic balance between the two countries.

In his seminal essay On Protracted War published 70 years ago, Mao Zedong divided China’s War of Resistance against Japan into three stages: strategic defence, strategic stalemate, and strategic counteroffensive.

In his seminal essay On Protracted War published 70 years ago, Mao Zedong divided China’s War of Resistance against Japan into three stages: strategic defence, strategic stalemate, and strategic counteroffensive. Borrowing that analytical framework, China has passed the most difficult phase of strategic defence in its competition with the US. It has now entered a phase of strategic stalemate.

China matching the US

The signals are clear: in April, Beijing responded to Trump’s tariff escalation with symmetrical counter-tariffs. By October, China acted proactively, imposing what the public has dubbed “nuclear-level” rare-earth export controls in response to Washington’s technology restrictions. Leveraging rare earths and soybeans, Beijing compelled the US to retreat from its latest pressure campaign.

This is strategically significant. It suggests that competition has reached a point of near parity — even though the US remains stronger overall, the gap is no longer overwhelming. In that context, Beijing’s position in this round can indeed be called a mid-sized win.

Following Mao’s logic, the stage after stalemate would be a strategic counteroffensive. Whether China will reach that stage remains uncertain...

Following Mao’s logic, the stage after stalemate would be a strategic counteroffensive. Whether China will reach that stage remains uncertain, due to unpredictable factors on both sides, including the quality of strategic decisions.

The stalemate phase will last for years, marked by persistent entanglement. In its early stages, the US will find that winning against China is extremely difficult — or perhaps impossible. This outcome is shaped by strategic choices, leverage structures, interest constraints, and domestic political variables on both sides.

US failure to consider China’s capabilities

First, consider the shift in strategic perception. For years, Washington’s core calculation has been that preventing China’s technological and economic rise requires structural containment. Beijing’s corresponding assessment has been that breaking through US containment requires developing counter-pressure capabilities and strategic autonomy. These two paths collided, producing the current confrontation.

Yet, even after the US withdrew its threatened 150% tariff escalation and repeatedly delayed existing hikes, Washington failed to reassess China’s growing capabilities. American policymakers continued to assume they held far greater leverage and that China remained reactive — an entrenched habit of political thinking, where they assumed further pressure and tighter tech controls would compel Chinese concessions. The Kuala Lumpur talks showed this expectation was misplaced, as China moved first and played its trump card: rare earths.

The leverage rare earths give China over the US’s strategic industrial supply chain is self-evident. For two years, the US has been promoting supply-chain “re-industrialisation”, yet its vulnerability in raw-material processing remains severe. In rare-earth processing, separation, and high-purity refinement, the US cannot achieve independence within five years. Washington knew China had this leverage, but did not expect Beijing to actually deploy it.

That misjudgement reflects a flaw in US strategy. Resources are an absolute power tool; technology controls are a relative power. For the first time in the US–China rivalry, the leverage has reversed.

That misjudgement reflects a flaw in US strategy. Resources are an absolute power tool; technology controls are a relative power. For the first time in the US–China rivalry, the leverage has reversed. China does not need daily restrictions — just keeping approval power and usage scrutiny in place is enough to create long-term deterrence. The US failed to grasp this before Kuala Lumpur.

If rare earths strike at America’s industrial nerves, soybeans hit America’s electoral nerves. Like rare earths, soybeans are a tangible Chinese lever. Agricultural swing states are central to US elections, especially for Republicans. China is America’s largest soybean buyer. The US cannot easily find an equivalent buyer; China can diversify. Washington can subsidise farmers, but not indefinitely. When China cuts purchases, farm anger shifts toward Washington, making soybeans a rhythmic strategic weapon, as China can decide whether to buy, how much to buy, and when to buy. The weapon is timing, not tonnage.

Meanwhile, America’s tech-containment tools are entering diminishing-return territory. The latest 50% penetrative export-control rule was introduced because earlier restrictions saw declining effectiveness as China made gains in chips and semiconductors. But pushing controls further brings greater self-harm.

Silicon Valley, chipmakers, defence contractors, and Wall Street do not share uniform interests. As a transactional president, Trump is not driven by ideology but by leverage and electoral calculus. He cannot push tech war to an irreversible point; doing so would cost US tech firms the China market and accelerate China’s domestic tech base, while the US would lose its bargaining chip.

US constraints

Furthermore, domestic US political constraints already shape its China policy. While both parties agree on confronting China, fiscal strain, industrial anxiety, political division, and election imperatives prevent Washington from abandoning trade or escalating tech sanctions without internal blowback. Trump particularly values tangible transactional outcomes, which influences negotiations.

Washington can no longer “win” negotiations through psychological intimidation and coercive posturing. It must now offer real concessions to secure stability.

Thus, under these constraints, the US cannot be guaranteed victory in talks with China. This does not mean America is weak — its comprehensive power remains greater. However, it now faces a China that no longer accepts asymmetric pressure.

The US can no longer dictate terms unilaterally; China has built a symmetrical counter-pressure structure and is willing to use it. That dynamic is just beginning, but it marks a turning point: Washington can no longer “win” negotiations through psychological intimidation and coercive posturing. It must now offer real concessions to secure stability.

In other words, the Kuala Lumpur talks and the leaders’ meeting confirmed a crucial truth for China: the US bottom line is lower than its rhetoric suggests. Beijing now understands what Washington fears most and what it cannot afford to bear. That strategic information is more valuable than any written agreement.

US–China rivalry will remain intense, and the path ahead is not smooth. But in this round, China was not passive. The negotiations were not about avoiding risk; they were about controlling tempo, forcing the opponent to step back first, and compelling the US to start calculating costs.

![[Big read] When the Arctic opens, what happens to Singapore?](https://cassette.sphdigital.com.sg/image/thinkchina/da65edebca34645c711c55e83e9877109b3c53847ebb1305573974651df1d13a)