No China backlash, so far: The Philippines' new 'assertive transparency' policy in the South China Sea

The Philippines' "assertive transparency" in the South China Sea has so far not generated negative economic repercussions for the country. Does this demonstrate the limits of China's grey zone coercion?

The Philippines stood out in recent months as an emerging example of how a smaller, weaker country could stand up against a larger, stronger power in the South China Sea (SCS). The Marcos Jr administration has projected newfound assertiveness not seen in the aftermath of the 2012 Scarborough Shoal incident.

The Philippines has started to vocally speak out against Chinese transgressions in its exclusive economic zone (EEZ), bolster its longstanding alliance with the US, and cultivate closer security partnerships with friendly players outside the SCS, such as Australia, India and Japan, and pushed on with its defence posture shift from an internal to external orientation.

Coined as "assertive transparency", this policy innovation revolves around strengthening national resilience, building international support and imposing reputational costs on China. The last aspect is particularly noteworthy - especially one that has not been observed before in Southeast Asia: the open publicising of maritime incidents with China and calling out Chinese aggression or intimidation, starting from China's laser pointing episode this February. Manila's new "name and shame" strategy does appear to have put Beijing on the back foot, perhaps due to the element of surprise more than anything else.

Chinese may yet tighten economic valve

Except for activities around the Second Thomas Shoal, according to the Philippine Coast Guard, its Chinese counterpart has exhibited less aggressive behaviour since its actions were thus "exposed". In August, the Chinese fired a water cannon at the Filipinos during the latter's rotation and resupply (RoRe) mission to Second Thomas Shoal, resulting in a further spike in tensions.

... some of the potential big China industrial investors who were keen to invest in the country after Marcos Jr's state visit to Beijing in January 2023 became "jittery" or paused their inquiries with the PCCI following the Second Thomas Shoal flare-up. - Sergio R. Ortiz-Luis Jr, President, Philippine Exporters Confederation, Inc.

Some have warned about potentially negative consequences of the Philippines' new SCS policy, particularly on the economic front in the form of Chinese foreign investments being pulled out. For example, Sergio R. Ortiz-Luis Jr, president of the Philippine Exporters Confederation, Inc. (Philexport), who is concurrently honorary chairman of the Philippine Chamber of Commerce and Industry (PCCI), revealed that some of the potential big China industrial investors who were keen to invest in the country after Marcos Jr's state visit to Beijing in January 2023 became "jittery" or paused their inquiries with the PCCI following the Second Thomas Shoal flare-up.

After all, the weaponisation of trade and investments is not new in Beijing's modern statecraft. As China remains a major trade partner of the Philippines, one could justifiably assume that Beijing might seek to tighten the economic pressure valve on Manila in retaliation. This is especially salient as foreign trade and investments constitute a "soft underbelly" for the Philippines' economic recovery and developmental trajectory.

So far, however, there are no indications of coercive economic reprisals from China since the start of the Philippines' publicising of China's aggressive behaviour in the SCS in February. Trade and investment data published by the Philippine Statistics Authority reveal that until September, there was in fact a sharp rise in Philippine trade with China.

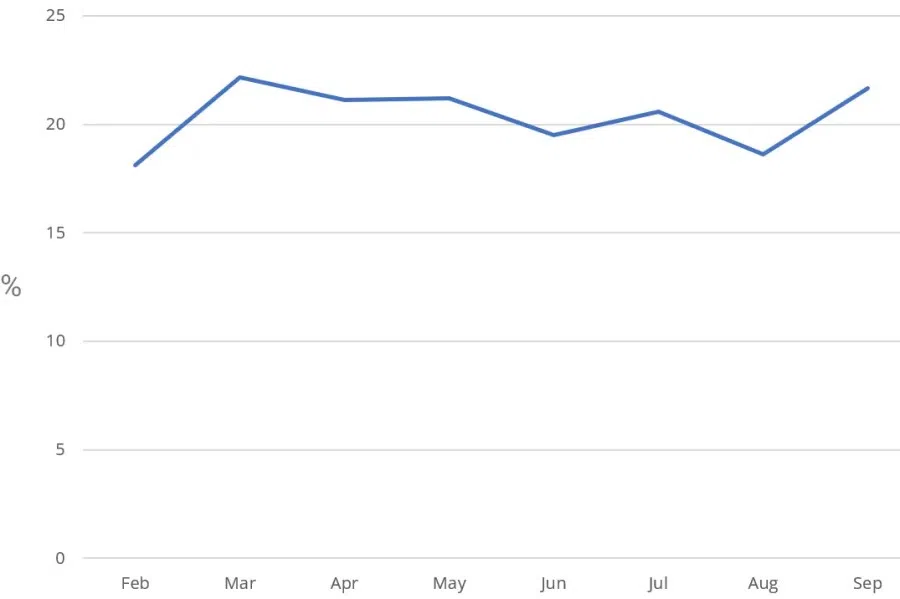

Despite the August 2023 water cannon incident at the Second Thomas Shoal, mentioned above, Philippine trade with China from August to September did not appear to have been affected - in fact, it rebounded from below to above 20% of total trade between February and September 2023 (Figure 1).

... even in the wake of the SCS flare-ups since early 2023, Chinese investments picked up from 0.07% in the first quarter to 0.38% in the second, spiking at 6.76% in the third.

What about Chinese investments in the Philippines? This has been one of the more contentious aspects of the bilateral relationship, largely because most of Beijing's investment pledges did not materialise during the previous Duterte administration. Given the importance of infrastructure investments to Philippine economic growth, this would be another area where Beijing could seek to dial up pressure on Manila over the SCS issue.

Since 2021, most plausibly influenced by the Covid-19 pandemic, China's share of total approved foreign investments in the Philippines has hovered below 5%. Interestingly, even in the wake of the SCS flare-ups since early 2023, Chinese investments picked up from 0.07% in the first quarter to 0.38% in the second, spiking at 6.76% in the third.

Figure 1: Chinese Trade (as Percentage of the Philippines' Total Trade), February to September 2023

The SCS flare-ups have not had any discernible negative impact on Chinese investor interest in the Philippines, especially in renewable energy and critical minerals. In April, while tensions brewed in the SCS, the Philippine government revealed that a Chinese company was already "actively seeking partners" for nickel processing in the Philippines.

Possible limits to China's grey zone coercion

In the same month, Dajin Heavy Industry, the world's largest manufacturer of wind turbine towers and structural products for offshore wind power projects, expressed interest in building manufacturing plants in the Philippines. In October, the Philippines secured a combined total of US$4 billion worth of investments from a pair of Chinese equipment makers in the renewable energy industry. Finally, the Department of Foreign Affairs clarified that the Philippines remains in China's Belt and Road Initiative, adding that infrastructure projects funded with Chinese official aid are still being implemented.

... if China desires to uphold its image as a proponent of common development in the global south and a strong supporter of economic integration, weaponising trade and investment against the Philippines may be foolhardy.

The question is to what extent China is willing to weaponise trade and investment to retaliate against the Philippines' pushback in the SCS, if at all?

Saddled with its own economic woes, China probably does not want to cast itself as an increasingly less reliable and therefore unattractive trade and investment partner. Moreover, if China desires to uphold its image as a proponent of common development in the global south and a strong supporter of economic integration, weaponising trade and investment against the Philippines may be foolhardy.

So far, the Philippines' pushback against China's grey zone actions in the SCS can be deemed generally successful. Assertive transparency ought not to be the approach exclusively executed by Manila but can perhaps be more broadly adopted by other Southeast Asian claimants. That the Philippines has not experienced any major negative economic impact since the SCS flare-ups early this year demonstrates the limits of China's grey zone coercion.

![[Big read] When the Arctic opens, what happens to Singapore?](https://cassette.sphdigital.com.sg/image/thinkchina/da65edebca34645c711c55e83e9877109b3c53847ebb1305573974651df1d13a)