Trump’s tough stance on China: Spillover effects on Cambodia

Cambodia, seen as a country that helps China re-route its exports to the US, fears being caught in Trump 2.0 trade reprisals, says Cambodian researcher Sokvy Rim.

Cambodia’s relations with the US have seen peaks and valleys. But they reached their lowest point when Donald Trump was president: the US halted aid to Cambodia citing democracy concerns in 2018 and Cambodia’s Generalised System of Preferences (GSP) status lapsed in 2020. Now, Trump’s return to the White House and his hard stance against China could put Cambodia in a more difficult situation.

During Trump’s first term as president from 2017 to 2021, the US waged a trade war against China, imposing trade tariffs, sanctions on some Chinese companies and export restrictions on advanced technology equipment. Amid these actions, US pressure on China was also felt in Cambodia. In September 2020, the US imposed sanctions on Chinese state-owned Union Development Group Co., Ltd. for its project in Dara Sakor. It accused the company of violating Cambodian laws, abusing human rights and destroying the ecology in the special economic zone. The sanctions also extended to Kun Kim, a senior Cambodian general, based on alleged accusations of bribery over Chinese investment in Dara Sakor.

Continuing under the Biden administration, in 2021, the US also sanctioned two senior Cambodian government officials, Chau Phirun and Tea Vinh, who were accused of taking bribes in relation to the Ream Naval Base project. In the same year, the US also imposed an arms embargo on Cambodia, citing growing Chinese military influence in Cambodia.

Some of China’s controversial projects might get the US’s attention. One of them is the Funan Techo Canal...

Cambodia a proxy target for China

As Chinese influence in Cambodia grows stronger than ever before, with Cambodia supporting China’s regional and global agenda, the Trump administration in its second term would hardly be able to ignore Cambodia. Some of China’s controversial projects might get the US’s attention. One of them is the Funan Techo Canal, hailed by Cambodian leaders and the Cambodian People’s Party (CPP) as the kingdom’s mega project. The Trump administration might not view this project favourably as it could enhance Beijing’s influence in Cambodia and the whole Southeast Asian region.

On the economic front, higher US tariffs on Chinese goods could have a spillover effect on Cambodia. Trump has threatened to impose a 60% tariff on Chinese exporting goods and a blanket tariff of 10% to 20% on all countries. The aim is to protect the US economy, as Trump believes that the economic development of China and other countries come at the expense of the US economy.

... around 90% of garment factories in Cambodia belong to Chinese investors or companies, and the garment products are mainly exported to the US.

The US is probably going to impose tariffs on Chinese goods manufactured in third countries. Cambodia may be affected as many Chinese companies have actually moved their operations to Cambodia, giving the country’s economy a lift.

Chinese manufacturing in Cambodia could face headwinds

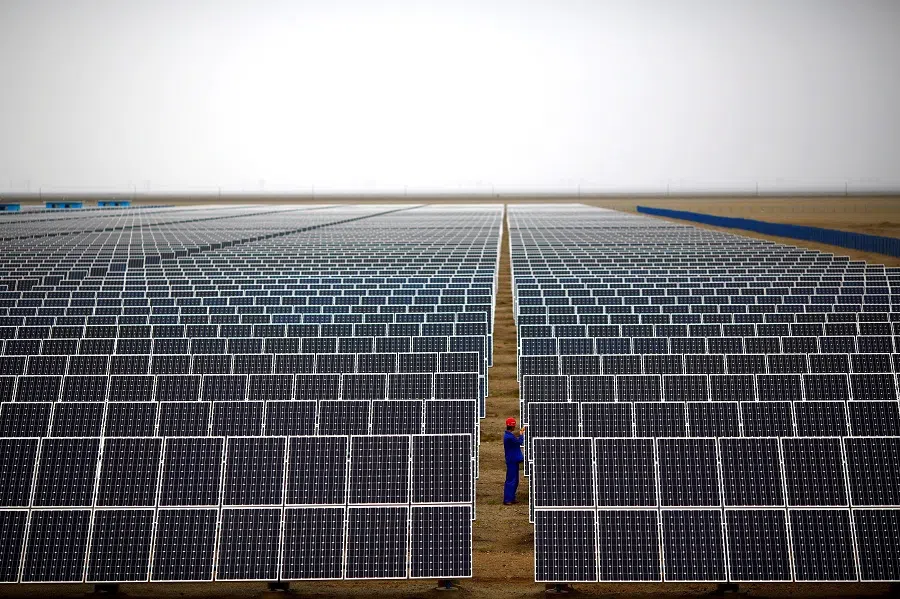

Most of the garment and textile factories in Cambodia are owned or invested in by Chinese companies, which enables the latter to export their products to the US with little barriers. Some Chinese-specific goods such as textiles, travel goods, semiconductors, solar panels and electric vehicles are exported to the US with high tariffs.

According to the Cambodia Garment Manufacturing Industry Research Report 2023-2032 report, around 90% of garment factories in Cambodia belong to Chinese investors or companies, and the garment products are mainly exported to the US. In the first eight months of 2024, Cambodia’s goods exports to the US including garments, footwear and travel goods reached US$9.2 billion, representing an increase of 22.8% from the previous year.

Chinese investment in Cambodia also extends to solar panels and the electronic industry. Cambodia’s solar panel exports to the US increased dramatically in 2023 after the US extended Trump-era high tariffs on Chinese solar panel exports. Similar to the garment industry, solar panels in Cambodia are mainly manufactured by Chinese companies. Between 2022 and 2023, Cambodia imported more than 90% of solar panels from China.

Some analyses have it that Chinese investors tried to re-route their exports to the US via Cambodia after the Biden administration announced tariff exemptions on Southeast Asian solar panels (from Cambodia, Malaysia, Thailand, and Vietnam) in 2022. More Chinese investors were enticed to invest in Cambodia’s solar panel industry. In 2022, China’s L-Q New Energy Co Ltd’s started investing around US$84 million in manufacturing solar panels in Cambodia for export, mainly to the US.

Trump’s hard stance against China will have implications on Cambodia, a country that depends on China for investment and the US for export.

Reprisals from the US

However, these same manufacturers who seized these opportunities may now be struggling to cope with new challenges. Trump might not take kindly to Chinese companies re-routing their products to Southeast Asia in order to avoid tariffs. In late November, the Department of Commerce announced a new round of preliminary anti-dumping duties of up to 271.2% on solar cells and modules from the four Southeast Asian countries — Cambodia, Malaysia, Thailand and Vietnam, targeting Chinese photovoltaic companies in these countries.

These are what Trump refers to as unfair trade deals, and is the main motivation for him to impose high tariffs on Chinese exports. It is conceivable that Trump might feel the need to pressure Chinese manufacturing companies in Cambodia by imposing more tariffs on Chinese-made products in Cambodia bound for the US.

If this happens, Cambodia’s main exporting industries such as garment products and solar panels, of which the US is the largest market, are likely to be affected by Trump’s policy. The garment and textile industry alone is one of the main pillars of Cambodia’s economic development. It constitutes 40% of Cambodia’s total exports and employs around 80% of Cambodia’s workforce.

Trump’s hard stance against China will have implications on Cambodia, a country that depends on China for investment and the US for export. Cambodia’s excessive dependence on China also makes it very hard for Cambodia to adjust its foreign policy amid the upcoming US-China trade war.

The Cambodian government is probably anticipating what US foreign policy will look like under the Trump administration and is preparing for what is to come. This can be seen from the return of former Foreign Minister Prak Sokhonn to the foreign ministry portfolio. He is seen as one who is skillful and has leverage to steer Cambodia’s foreign policy through a period of intense rivalry between two powerful countries.

![[Big read] Paying for pleasure: Chinese women indulge in handsome male hosts](https://cassette.sphdigital.com.sg/image/thinkchina/c2cf352c4d2ed7e9531e3525a2bd965a52dc4e85ccc026bc16515baab02389ab)

![[Big read] How UOB’s Wee Ee Cheong masters the long game](https://cassette.sphdigital.com.sg/image/thinkchina/1da0b19a41e4358790304b9f3e83f9596de84096a490ca05b36f58134ae9e8f1)