Who robs the Americans? A Marxist critique of Trumpism

US President Donald Trump claims that he is fighting for and defending the working class, but in reality, Trump is one of their greatest enemies, says Malaysian academic Lee Pei May.

US President Donald Trump has continuously asserted that other countries have “pillaged and looted” the US for decades, causing massive losses for American taxpayers. He claims that jobs have been stolen from Americans, and as a result, he is determined to have America reclaim its status as a manufacturing powerhouse. Is his claim true that the US has been taken advantage of by other countries, particularly those that have run the most significant trade surpluses with the US? The simple answer is no. In reality, Trump’s understanding of the international trading system is fundamentally flawed. If Marx were here today, he would have happily lectured Trump on how international trade and capitalism truly work.

What Trump fails to recognise or mention is that the US is the largest services exporter, exporting over US$900 billion in 2022 alone. In fact, the US has been running a large surplus with China for years...

Manufacturing jobs did not shift away from the US due to other countries taking American jobs. Instead, this trend followed the logic of capital, in which capital flows to places that enable the maximum accumulation of profits. While the US emerged as a manufacturing powerhouse following World War II, globalisation and rising costs in the US caused American firms to begin moving their production abroad.

This transition was accelerated in the 1980s, during the triumph of neoliberalism, when leaders from both the US and the UK strongly favoured and pushed for liberal capitalism. Margaret Thatcher was known as one of the key defenders of neoliberalism, arguing that there is no alternative. This transition coincided with China’s policy of reform and opening up. As a result, foreign capital began to establish a foothold there as well. Other developing countries, with lower labour costs, also started to receive a massive influx of foreign direct investment. Does this shift signify that the US economy has become less competitive and is going downhill? No, in fact, the exact opposite is true.

According to Walt Rostow, a proponent of modernisation theory, as countries embark on their modernisation path, they will inevitably pass through five stages of linear economic development: traditional society, preconditions for take off, take off, drive to maturity, and finally, the age of high mass consumption. The final stage is the most desirable, whereby countries have achieved a modernised status and transformed into a service-based economy with high levels of consumption.

The fact that the US is running a trade deficit in goods with most countries is highly expected of a consumer-based society. What Trump fails to recognise or mention is that the US is the largest services exporter, exporting over US$900 billion in 2022 alone. In fact, the US has been running a large surplus with China for years in terms of trade services, ranging from consulting fees to financial services and many more. According to estimates by Nomura, China’s imports of US services have skyrocketed over the last 20 years, reaching over ten times their previous level.

Trump’s tariff policies and policy flip-flops may have ruined the appeal of US assets as a safe haven.

High level of debt in the US

Another concern frequently raised by Donald Trump is the high level of debt that America faces. He wishes to use tariffs as a means to raise revenue and asserts that other countries have been engaging in unfair trade practices, resulting in an unequal playing field for the US.

Theoretically, countries with higher levels of debt are considered to have potentially unsustainable economies. However, unlike other countries, the US enjoys what is known as exorbitant privilege status. The US position as a global hegemon, particularly after the end of the Cold War, with the dollar serving as the global reserve and primary trading currency, places the nation in a distinct position.

In other words, the trust that people and countries have in the American system and institutions has allowed the US to sustain its economy through continuous borrowing. Currently, the US’s national debt exceeds US$36 trillion, and technically speaking, it can still be supported by the sale of US treasuries. Even during major crises, such as the 2008 global financial crisis and 9/11, people continued to purchase US treasuries as they are widely regarded as risk-free, safe assets. However, Trump’s tariff policies and policy flip-flops may have ruined the appeal of US assets as a safe haven.

The US isolationist policy could even accelerate the de-dollarisation process currently being pursued by some regions and countries. In fact, there has been concrete efforts by BRICS to de-dollarise through the establishment of their own financial institution, New Development Bank (NDB), that lends in local currencies and also some members floated the idea of launching its BRICS currency. There is also an increasing use of the RMB in energy transactions that were traditionally conducted using the petrodollar.

While this high level of debt is considered a serious concern by some, as it may pose several risks for the US, it is worth examining why the US is running on such high debt. According to the Watson Institute for International and Public Affairs, one of the major reasons for the US’s growing national debt is its involvement in several major wars post 9/11, which were funded substantially through borrowing. Not only does the US have to pay for the debt and its interests, but there are also other indirect costs associated with these wars that have been shouldered by the Americans, such as paying for the welfare of veterans returning from abroad.

To make matters worse, Trump and Congressional Republicans are now proposing further tax cuts, which would mean less revenue for the government and less investment in its people.

Are tariffs the best way to raise revenue?

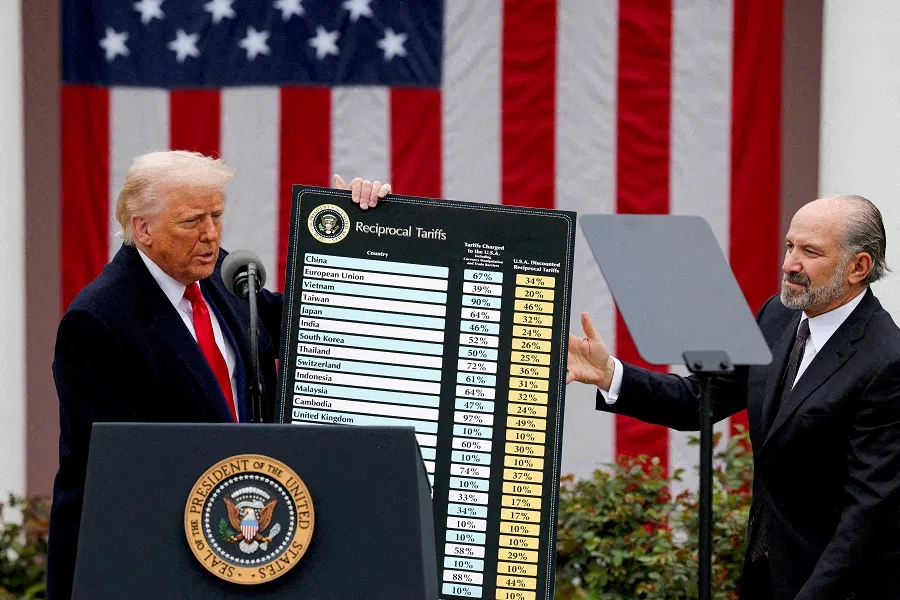

It is not an exaggeration to say that Trump adores tariffs, as he often says that “tariff” is the most beautiful word in the English language. He (wishfully) believes that tariffs are going to make the US rich again. However, the pause on reciprocal tariffs on almost all countries, and subsequently, the recent deal struck between the US and China to mutually slash tariffs, have proven that this policy cannot make the US rich. So, what could be some other better ways for Trump to achieve his stated goal?

According to a report by the Institute on Taxation and Economic Policy, published in March of this year, Tesla was not required to pay any federal income tax in 2024. But in that particular year, Tesla reported earnings of US$2.3 billion in the US alone. Over the past three years, Tesla has paid very little in terms of taxes (much lower than it should have paid). The Fair Tax Foundation investigations suggest that the “Silicon Six” big American tech companies have avoided US$278 billion in US corporate taxes over the last decade. The reason that these big corporations are paying less taxes is due to the many special tax breaks and loopholes that have allowed them to legally avoid taxes. The IMF reported that US multinationals have been shifting their corporate profit into tax havens, and today, the percentage stands at roughly 25-30%.

To make matters worse, Trump and Congressional Republicans are now proposing further tax cuts, which would mean less revenue for the government and less investment in its people. These new tax breaks would allow corporations to pay less than citizens, which only exacerbates inequality. Therefore, the US must raise revenues by taxing those who are most able to pay in order to make up for its budget deficit. The report argues that other methods, such as spending cuts, would not address the budget deficit issue. This problem can only be addressed by implementing a progressive tax system in which the rich pay more.

As discussed above, tariffs are certainly not a good way to raise revenue, as the immediate effect of rising prices would be felt more harshly by lower-income groups. Therefore, the question of who is robbing the Americans is clear now: it is the capitalist class who enjoy the constant backing of the state. Marx explained in his writings that the capitalist state would use all sorts of instruments to ensure the continuation of capitalism and to protect the interests of the capitalist class. Indeed, the proposed tax cuts by the Trump administration exemplify this exact philosophy. President Trump claims that he is fighting for and defending the working class, but in reality, Trump is one of their greatest enemies.

![[Video] George Yeo: America’s deep pain — and why China won’t colonise](https://cassette.sphdigital.com.sg/image/thinkchina/15083e45d96c12390bdea6af2daf19fd9fcd875aa44a0f92796f34e3dad561cc)

![[Big read] When the Arctic opens, what happens to Singapore?](https://cassette.sphdigital.com.sg/image/thinkchina/da65edebca34645c711c55e83e9877109b3c53847ebb1305573974651df1d13a)